By Amanda Morrall

Is the continuation of interest-free students loans after graduation and three-year repayment holidays for OEs sending a generation of students the wrong message or else inviting the more financially savvy among them to "game the system''?

The Savings Working Group, in its report on the country's national savings woes, argues yes and calls for the reintroduction of interest on student loans as a way to discourage systemic abuses.

Despite tweaks and proposed reforms to the student loan system, including a provision to forgive 10% of outstanding debt for those who make voluntary payments of NZ$500 or more above compulsory repayment obligations, "financially savvy people are gaming the system," the SWG writes.

The SWG does not detail the range of alleged financial exploits taking place save one; the pragmatic deferral of no-interest loans, flanked by strategic savings that aim to take full advantage of a bonus debt forgiveness plan when sufficient savings are accrued.

Education Minister Steven Joyce, in interviews regarding the impending changes to be announced in the May 19 Budget, has already indicated that graduates who remain in New Zealand will be spared - for now.

Instead, Government has indicated that it will be going after student loan delinquents domiciled in Australia and the United Kingdom. (For more see this article by Gregor Whyte writing for Critic magazine.)

Student loan debt, which has spiraled to a staggering NZ$11 billion, makes up 6% of GDP.

Inland Revenue estimates that NZ$2.2 billion in outstanding student debt belongs to as many 89,000 individuals working overseas. Of that 35,000 are estimated to behind in their repayments.

Joyce warned last month that Government will soon be going after OE debt dodgers more aggressively as together this cohort group is responsible for 55% of overdue debt.

In an interview with Business Desk's Pattrick Smellie, Joyce said Government was aiming to reduce its loses from 45 cents per dollar to 40 cents. (See full article here).

"We're writing off about 45 cents on the dollar for every student loan because of the interest-free policy. That's down from about 48c. We want to get it down to 43c in this Budget and then I'd love to see it down below 40c.''

As another means of reducing student loan costs, Government is looking at restrictions on loans for students over the age of 55 and for trainee pilots.

Default rates among mature students are among the highest (around 70%) because of their reduced capacity to earn an income. A scarcity of aviation jobs also meant that Government was swallowing a huge portion of the NZ$30 million a year allocated for pilot training programmes.

Cracking down

In addition to Government's excess repayment bonus, where borrowers who make voluntary repayments of more than NZ$500 or more in a year receive a 10% discount on their outstanding balance, it has also introduced annual fee charges on loans held by Inland Revenue. Effective, March 31 2012, it will begin charging $40 a year for the 2011/12 tax year.

There is also legislation in the works that would allow Government the ability to recall the entire loan balance for those who repeatedly ignore requests for repayment.

The Savings Working Group, in its report from last year, insisted a more effective incentive for students to repay debt would be to start charging interest upon graduation.

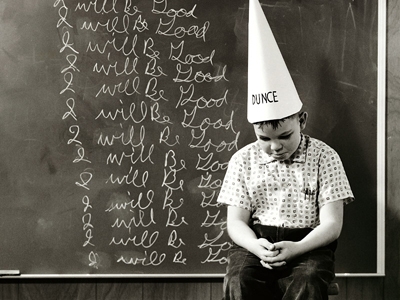

It said the current system "encourages young people to think it's fine to have a large debt - other than a mortgage.

"Anecdotal evidence suggests this can lead to a blase attitude to debt with former students unconcerned if they run up large credit card bills. Such an attitude could lead to a lifelong habit of being in high-interest debt rather than saving.''

As a result, the SWG said it encouraged Government to consider charging low-interest on student loans after graduation so young people could learn debt management skills whilst repaying those loans.''

KiwiSaver provider Fidelity Life, has suggested Government consider allowing member access to their accumulated funds for the express purpose of repaying loans, as an alternative to cutting KiwiSaver incentives and bonuses. (See Business Day story detailing that suggestion here.)

22 Comments

Education is supposed to be an investment in a country's future. I still don't get why NZ insists on having young people borrow when by definition they don't have the means to service a loan yet. It doesn't make any sense to me. When we set people up to take on debt so early it's no wonder they don't think twice about borrowing more later in life.

So sure, the govt doesn't have the means to fund everything but what about changing the system a bit? Eg, instead of admitting pretty much anyone in any uni course, why not have tough entry criteria/exams throughout the duration of a degree? Those who are not motivated wouldn't bother and the others could benefit of lower or no fees. Similarly, why not make the disciplines that are likely to bring the most benefits to NZ more attractive to young people, eg higher funding for medicine, engineering etc? Or limit the number of spaces available based on the real world reality (ie dependant on the actual number of graduates required in any discipline to help decrease the number of those who end up on the dole once they have a degree). All these things are done elsewhere, and with success I might add.

My father is a truck driver and my mother a clerk at a local hospital. Without a student load I would never have been able to get through university in the 1990s.

And here's a news flash: even the 1990's the rich kids were still getting student loans and playing share markets, even though the loans had interest rates well above the floating rate.

For the majority of us, however, that money went on food, fees and rent. Perhaps the occasional pint, but very occassionally.

Think about, which demographic in society needs the student loans and which sector will be punished by the interest? The government means tests student allowances, why don't they just do the same with student loans? Any argument against one must stand for the other...

It was a rort from the start carpetbagger....in the begining a university got govt loot and you needed to pass to get in....so them with the cloth caps were welcome and could go for nix...indeed they could win loot if they was bright...Then some idiot said let's make the buggers pay fat fees and the fat fees will pay for the uni system etc and that will discourage the waste and put an end to the boozing student days...which were fun, believe me!.....and they would have to borrow heaps and pay interest on the heaps and that would make the buggers work harder etc etc. This bright idea was soon seen by the university bosses as a great way to bloat their salaries cos all they had to do was enrol enrol and enrol...stuff entry exams....the more bums on seats the more dosh for them....and this in time brought academic courses in weaving flax and training dogs to bark...all very important stuff....finally ending in every sodding occupation requiring a masters degree in something....yes even the spin doctors who stuff the Beehive have to have a degree in BS.....some have a BBS others who borrowed more got an MBS....I'm told there are even some doctors in the House....no bloody good if you stub your toe though.

It's another hocus pocus financial bubble industry that we're in global lock (goose?) step with. This might help clarify the mechanism......

http://www.zerohedge.com/article/nia-why-americas-college-bubble-next-b…

Good link Noprogram. Here's another questioning the college bubble.

http://www.guardian.co.uk/commentisfree/2011/apr/25/students-degrees-su…

Here's an excerpt:

Like an addict back on the smack, the country is hooked on hope once more, but this time the bubble is in higher education rather than housing. The latest figures for university applications – out on Tuesday – are likely to be at record levels, with applications set to top last year's high of 688,310. Demand is rising among students aged 19-21, suggesting that many rejected in previous years are applying again.

The provocative idea that rising fees are feeding an overvaluation of the investment – a bubble waiting to pop – has been floated in the US byPeter Thiel, the venture capitalist whose backing for Facebook made the social network happen. His description of education as a "classic bubble" makes uncomfortable reading as universities here rush to charge £9,000. A bubble, Thiel says, must be overpriced and there must be an intense belief in it.

That belief has enabled both the University of East London andCambridge to charge the same fee next year, despite the fact that a recent university guide ranked the former fifth from bottom for graduate job prospects while Cambridge was third from the top. That could be the makings of a new sub-prime crisis – cheap money being pumped into paying for an overpriced asset. And in this case it's government money that is paying tuition fees upfront. The challenge for one of the record numbers applying for a university place is how to avoid ending up with a degree that offers poor value for money.

Start with this question – is it worth getting a degree at all?

good piece

and if you extend the bubble thinking in terms of "easy credit" we have that here with interest free student loans...

I've long thought the uni system here is a joke. You wouldn't believe the poor quality of some of the grads I've watched over these past few years. Most of them can barely string a sentence together let alone put forward convincing and logical arguments. University education has been commodified and in my opinion, apart from perhaps the most elite degrees (eg. medicine) has lost all meaning and value.

Spot on. Uni degrees used to be looked up to. Now it's a dime a dozen. We're subsidising with taxpayer $ free loans to get rubbish output. And it causes "degree creep" - i.e. need a Masters or PhD just to get looked at by an employer where you previously needed a Bx (which is now meaningless as you imply since even the illiterate get awarded those now).

I'd support interest free loans if the criteria for entry was academically challenging. When I went to Uni it was a 'B' bursary minimum (or wait around till you were 'old' - 21 I think). Even that was generous as some of the 'B's were bloody average. About time we stopped the tyre kickers from getting in... that'd cut the costs of the system and also increase the value of the bit of paper that true quality graduates would get in the end.

It called qualification inflation. The main problem is the quality of academics in many disciplines in New Zealand is low.

When I wanted to pursue a specific discipline, I had the good fortune that family connections were was able to assess the quality of the departments at the respective universities here.

What we discovered was no one was gaining employment when graduating from all these departments across our universities, they identified only one head of department who was internationally recognised, connected and a good teacher. Get him as your supervisor you set otherwise your chance of sucess was practically nil. So I went and knocked on his door.

What a waste of resources all these are other departments represent.

In terms of tertiary education, I'd say yes, we are oversupplied. The competition for students is ridiculous - bums on seats mentality - and the National government looked as if they were on the right track in terms of not funding stduents numbers which exceed enrolment budgets/allowances. But they need to go a step (and likely a big step) further. The emphasis has to be on quality, not quantity higher education. And given our resource constrained future - a great deal of emphasis should be put on extramural / effective distance education.

The student loan system is an intoduction for many on how to rort. My kids wonder why the heck they have to borrow, when their mates who are the children of wealthier farm owning and business owning, trust operating parents don' t need to borrow at all - they are all getting student allowance instead - meaning they don't have to pay anything back!!!!!

Why the frekin heck is this demeeed acceptable???

When did the Govt last run an analysis on parents of kids getting student allowance to see if they were hitting the target groups (ie the poor)?

Answer. NEVER. Because if they did it would be embarrasing. Its not the poor getting the student allowance, but the educated rorters!!!

The same one's who winge about dole bludgers!!!!

The esteemed Nick Smith who has a degree in geotechnology pushed for the Turitea wind farm and it's literally right on the Wellington Fault line. GNS Science is predicting a possible 9 on the Richter Scale earthquake to slam the lower and central North Island. The economic cost will be the last nail in the NZ economic coffin. So much for higher education, eh!

Links are here. http://www.palmerston-north.info

Carpetperson - um, windfarms are a way of storing fossil energy, and dissipating it over a long period - some of it when the fossil won't be availabe.

My solar panels are the same thing - if you actually count (properly) the fossil energy that went into making them, it never comes back in energy gotten out of them. What they do, is store it, and give you ownership of it, long after the aromatics have gone off in the liquid form, stored physically.

Tidal is not all it's cracked up to be - big logistics with high voltages interfacing with salt water, and it quickly reduces the total flows it purports to use. Which in turn, reduces the outgoing phase.

Micro hydro is the best of them - it's constant, 24/7. Thus:

http://gbweekly.co.nz/2011/3/23/pupu-hydro-society-turns-30

No human activity has zero impact, but pelton systems don't require full dams, and only remove the water for a (steep, preferably) short distance.

Thanks for the reply, Steven, at least this time there were no ad homs. Did you follow the links and actually read them?

Meridian, for example, is having huge maintenance issues with Westwind and doesn't want them in the public domain prior to being put on the auction block after the election. Investors don't want non performing assets.

Wind farms have a minor role to play in the energy mix but they have no place inside a city.

I have one question of you. Recently I saw you post that you are on PAYE. Do you have an incredibly tolerant boss? Where in fact do you work or was that claim by you just a cover.You are on the net almost around the clock it seems.

One last thing. When you end your posts with the faux "regards" you are actually saying something else altogether.

And the evidence for your assertions, Rastus, is, or is that just your socioeconomic and political belief doing the talking?

I remember a student who had a student loan of ~$80,000 after he had finished his PhD. This was back in the days when student loans were still charged market interest rates from the moment the loan was drawn down. He lived at home in affluent Howick with his parents and didn’t drive a car. He didn’t qualify for student allowances because of his parent’s income.

He used to draw down money to buy expensive European designer clothes, to have the latest electronic gadgets and to travel overseas. While he was doing this he was paid a tax free scholarship that was just shy of the average wage. At least for a few years after graduating he did work in NZ and would have made some payments back from his wages. But now he has moved to the UK with his wife (who had a similar sized student loan) and family. The family also received WFF in NZ, while she also got numerous lucrative Iwi grants paid for by the Govt. to study at Uni, as she was 1/10th of 1/5th of 1/3rd Maori.

Based on my familiarity with their moral compass, I would imagine that their contribution to now paying back their student loan in NZ would be 0%.

Their sense of entitlement, 100%. Their sense of obligation to pay back what they owe, 0%.

As you can see this issue is not always about equality of opportunity, it’s also about personal responsibility.

And the BS has got to stop New Zealand.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.