By Gareth Vaughan

KiwiSaver funds held by banks aren't included among the unsecured liabilities to be "pre-positioned" for the Reserve Bank's Open Bank Resolution (OBR) policy meaning, if a bank got in trouble and had the OBR policy applied to it, the KiwiSaver money would remain frozen in full at the behest of the bank's statutory manager.

A Reserve Bank consultation document sets out the Reserve Bank’s policy on pre-positioning requirements for its incoming OBR policy, which is designed to provide a potential alternative to a liquidation or full taxpayer bailout in the event of a bank failure.

The consultation paper notes that as OBR requirements are largely focused on outcomes, banks can come up with "bespoke technical design solutions" for their individual OBR functionality, so long as the Reserve Bank approves these.

"This recognises that banks have different operating systems, and this in turn affects how outstanding account balances are calculated, which is dependent on their IT configuration, process cycles and specific product features. An example is the treatment of term deposits. Banks have varying product features and interest accrual cycles and hence, are given the flexibility in choosing which design approach would suit their situation," the Reserve Bank says.

"Early repayment of term deposits is not expected to be allowed by the statutory manager."

Banks won't be required to build capability to calculate interest on the frozen portion of customers' funds. The statutory manager will decide whether interest should be paid on frozen funds and at what rate. The theory is that customers regain access to parts or all of their frozen funds over time depending on the resolution of the bank’s financial problems.

The Reserve Bank says term deposit accounts, although not transactional in nature, are required to be pre-positioned for OBR because they're usually held by individuals and entities who also engage in transactional banking. Pre-positioned customer accounts will have unfrozen funds made accessible or available to account holders from 9 am on the business day following the appointment of a statutory manager, with the exception of term deposits which will be accessible at maturity.

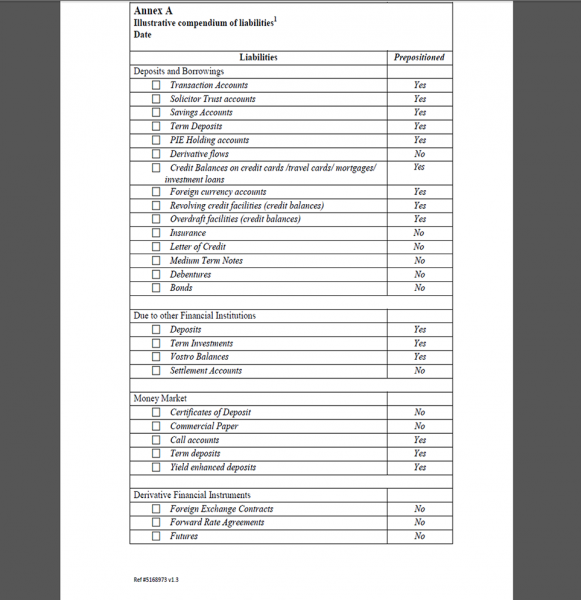

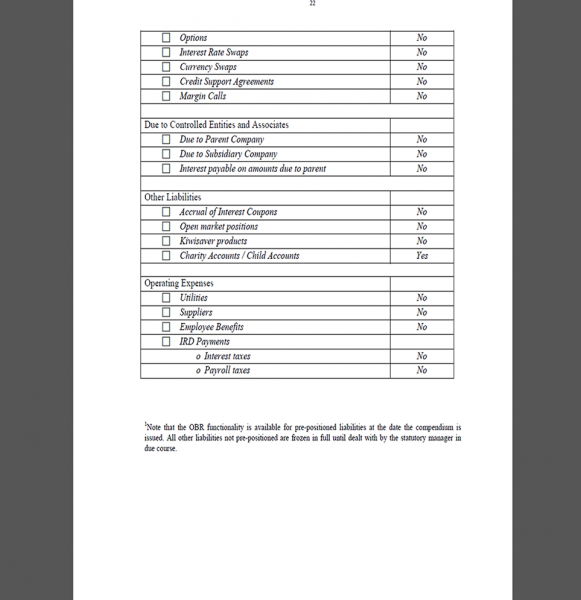

The list below shows which unsecured liabilities will, and which won't, have to be pre-positioned for OBR. The Reserve Bank says unsecured liabilities that don't have to be pre-positioned generally involve more sophisticated creditors or counter parties who can "better manage temporary illiquidity." Liabilities that aren't pre-positioned remain inaccessible or frozen in full until the statutory manager is "in a position to release" the unfrozen portion of these liabilities at a later date.

All locally incorporated registered banks with retail deposits in excess of NZ$1 billion dollars, which covers banks ranging from ANZ, the country's biggest bank, to newcomers the Co-operative Bank and Heartland Bank, must be ready for the OBR policy from June 30. This means having their IT, payments, resource and process functionality in place.

The OBR policy has come under fire, especially from the Green Party, following news of haircuts of up to 60% on Cypriot bank deposits as part of a bailout of that country's failed banking system. The Reserve Bank’s head of prudential supervision, Toby Fiennes, defended the OBR policy in a speech last week. And the central bank has previously said OBR could save taxpayers' more than NZ$1 billion whether there's a bank failure or not. It estimates pre-positioning is costing the banking industry an initial investment of NZ$20 million, plus a net cost of NZ$1 million per annum for ongoing maintenance.

Fiennes laid out the OBR policy thus;

When a bank is in trouble and we think it is unlikely to be able to meet its obligations in full and/or on time, it will be placed into statutory management. The statutory manager will legally freeze the bank’s liabilities.

Customer liability accounts must be pre-positioned for OBR. Pre-positioned customer liability accounts will have unfrozen funds made accessible or available to account holders from 9 am the business day following the appointment of a statutory manager (except for term deposits which will be accessible at maturity).The basic idea is to release transaction accounts to the bank’s customers as swiftly as possible so they can carry on making and receiving payments.

Instead of their accounts being frozen for a lengthy period as they would under a conventional liquidation, a proportion would be unfrozen and released for the start of the next business day (with a government guarantee to prevent further runs on the bank). Non-transaction accounts would be released, also in the same proportion, in line with their maturity. The frozen funds would be released in whole or in part as resources are available.

The Reserve Bank's consultation paper includes the diagram below of the OBR process

This article was first published in our email for paid subscribers. See here for more details and to subscribe.

26 Comments

Can the RBNZ categorically confirm that "rollover risk" money lent by foreign wholesale institutions to our banks will be frozen? Remember BNZ lends out 162% of deposits according to Moodys - so there must be a large element of foreign fast money exposure.

Of course it won't because in most instances the money lent is a foreign currency borrowed by our local bank in a foreign country (primarily USD), the proceeds of which are currency swapped for NZD to credit the local NZ bank.

So what is the law surrounding the local obligations of the statutory manager in respect of these NZD swap liabilities under taken by a failed bank.?

Are the bank's NZD liabilities booked against a swap counterparty not subject to the freeze and paid back ahead of the frozen and increasingly wiped out funding of unsecured creditors?

Immediate answers appreciated.

The deposit creation process is at the heart of the banking system servicing the public and stimulating economic growth. The modern banking instruments of securitisation, hedging, leveraging, derivatives and so on turned this process on its head. They enabled banks to lend more out than they took in deposits. According to Morgan Stanley Research, in 2007 UK banks loan-deposit ratio was 137%. In other words the banks were lending out on average £137.00 for every £100 paid in as a deposit. Another conservative estimate shows that this indicator for major UK banks was at least 174%. For others like Northern Rock it was a massive 322%. [For more details, refer to Table A.] Banks were “borrowing on the international markets” and lending money they did not have but assuming to have in the future. Likewise, “international markets” were doing exactly the same. At first sight it might not seem so much different than deposit creation. Deposit creation is lending money by the banks they do not have on the assumption that they will get enough back in sufficient time in the future from borrowers.

On closer examination there is a remarkable difference. With every cycle of the 86.5% loan-deposit ratio every £1 deposited is reduced becoming less than £0.50 after 5 cycles and less than 1 penny after 32. With a loan-deposit ratio of 137% — lending £137 for every £100 — not to mention 174% or indeed 322%, the story is drastically the opposite. Imagine a banker gets the first £1 deposit in the first week of a new year and lends it out. Imagine that twice every week in that year the amount lent out comes back to him as a deposit and he sustains such deposit creation process with a ratio of 137% twice every week for the year. This is a perfectly plausible scenario on the current electronic financial markets. By the following New Year’s Eve, the final amount he finally lends out from the original £1 is over £165 trillion (165 with 12 zeros, or over 16 times the amount governments have so far injected into economy). The total amount lent out in a year by a banker is over £447 trillion. Significantly with a loan-deposit ratio 100% or above no reserve is created.

http://gregpytel.blogspot.com/2009/04/largest-heist-in-history.html

Stuff's Chalkie seems to agree that in lieu of substantially more information than is available to depositors under the current RBNZ regulatory/prudential bank management regime they must withdraw from the exposure of overzealous lending polices apparentl;y being undertaken and highlighted by the rating agencies. Read article

Chalkie reckons the lesson here is that the best protection for investors is high-ranking security and information on which to judge the quality of a lender's loans. Bank depositors don't have that, which makes it hard for them to closely scrutinise bank management as the Reserve Bank expects.

The upshot, Chalkie reckons, is that we are still some way short of policies to protect the economy from bank craziness. But at least we're talking about it.

With global central bankers “printing” desperately, the collapse in gold stocks and sinking commodities prices were not supposed to happen. Is it evidence of imminent deflation? How could that be, with the Fed and Bank of Japan combining for about $170bn of monthly “money printing.” Are they not doing enough? How is deflation possible with China’s “total social financing” expanding an incredible $1 Trillion during the first quarter? How is deflation a serious risk in the face of ultra-loose financial conditions in the U.S. and basically near-free “money” available round the globe?

Well, deflation is not really the issue. Instead, so-called “deflation” can be viewed as the typical consequence of bursting asset and Credit Bubbles. And going all the way back to the early nineties, the Fed has misunderstood and misdiagnosed the problem. It is a popular pastime to criticize the Germans for their inflation fixation. Well, history will identify a much more dangerous fixation on deflation that spread from the U.S. to much of the world.

http://www.prudentbear.com/2013/04/things-have-gone-too-far.html#.UW3MPbXryTO

Stephen, if the BNZ lends %162 of deposits, then is it a fair assumption, that in an OBR event the depositors would most likely get ZERO?

As Greg Pytel points out, it is noithing more than a pryamid scheme, although no doubt a very profitable one in the good times. One that would make Albainians proud.

More from Pytel

The loan-deposit ratio below 100% that traditionally served as a very strict self-regulating mechanism of money supply stimulating the economy becomes a killer above 100%. The banking system becomes a classic example of a massive pyramid scheme. But as with every pyramid scheme, as long as people and institutions are happy not to demand cash withdrawals from the banks it is sustainable. Any bank can always print an impressive account statement or issue a new deposit certificate. The problem is whether the cash is there.

Loan-deposit ratio above 100% is like (untreated) AIDS. As it progresses it weakens the immune system of economy that safeguards against adverse events: natural disasters, wars, etc or sometimes unpredictable mood swings of market players. The current crisis was triggered by the collapse of subprime mortgage market (effectively overvaluation of assets). This time the system, for years having had been weakened by loan-deposit ratio above 100%, also collapsed altogether. It was a giant pyramid and it was bound to crumble anyway (for whatever direct cause). It was like a human suffering from AIDS whose death was not caused by AIDS directly, but by pneumonia, flu, infection, etc. However it is AIDS that made the curable illnesses lethal.

Stephen, if the BNZ lends %162 of deposits, then is it a fair assumption, that in an OBR event the depositors would most likely get ZERO?

andrewj, it would seem you are right because it has been confirmed to me that the foreign wholesale borrowing portion (62%) is exempt from the tentacles of OBR - in effect those foreigner lenders get their money back before the process of deciding the haircuts local unsecured creditors, depositors included, are expected to incur when a local bank is deemed to have failed.

There is absolutely no incentive for the local NZ subsidiaries of the Australian owned banks to consider prudent lending practices, which may lead to a lower profit growth, when the risk remains a NZ domestic only issue. Foreign borrowing will continue to explode with the full knowledge that the RBNZ is indifferent to the outcome.

The nonsense noted in Brian Fallow's article in today's NZ Herald is laughable.

There is an air of unreality about the Reserve Bank's discussion of its plans for Open Bank Resolution - or how the authorities might handle a bank failure - and the issue with which it is inevitably entangled, whether we should have deposit insurance.

The Reserve Bank's head of prudential supervision, Toby Fiennes, in a speech to the Institute of Directors last week, said that if the authorities fostered expectations that a failed bank would receive a government bailout, the incentive for its management, shareholders or depositors to minimise the risks of failure was much reduced.

Deputy Governor Grant Spencer in an op-ed late last year said OBR would strengthen the incentives for creditors - which in the bank's lexicon seems to include depositors - to closely scrutinise bank management, something that would be eroded if it was assumed the Government would bail out a failing bank.

In similar vein the Finance Minister, Bill English, explaining two years ago why the Government does not favour compulsory deposit insurance, said it blunted incentives for both financial institutions and depositors to monitor and manage risks properly, as well as being difficult to price.

The argument is that a safety net for depositors creates "moral hazard" by undermining their sense of the trade-off between risk and reward in interest rates, nudging the banks towards riskier lending.

It would seem the RBNZ has declared a 24/7 open ended hunting season in respect of NZ unsecured bank creditors, but not on the obviously ever expanding foreign lender.

Mai Chen gets to the core of the problem in her article entitled: Alarming signs of state incompetence or have the servants been captured in the most lucrative way.

Stephen H - thanks for link to Mai Chen article. Good to see her writing on the public servants issue. I believe the incidents that she has written about are only the tip of the iceberg.

I meet with a large number of people from private enterprise and all very unhappy with the system. Many people have been on the receiving end of some dispicable behaviour and some have got into financial strife trying to fight a hideous system of public servants.

Public servants have to be the most incompetent people around. They are irrational and show no conscience. There is a hideous culture that permeates every public service building I have entered it exudes arrogance and power without intelligence. PS cannot follow the legislation that they are governed by. They seem to have an inability to know right from wrong.

Andrew - it is quite difficult to get a response out of the RBNZ.

It annoys me that a part of their job is financial stability which you would assume entails keeping the pressures on the Banks to get their loan to deposit ratios in order. Instead they are passing the buck of financial stability onto local depositors via the OBR. What is it with bureaucrats that they are so damn incompetent?

Well granite is what the institutional crowd would have you think cause its massive.

As with any profile, dig down a bit and one finds it all "schist for miles". And as we all know derived from nothing but mud and clay.

Not something you build/construct much on...

Henry - from AJ's link above. It's certainly mud and clay!

“One series of offshore trusts associated with Northern Rock were called Granite (presumably a witty pun on the Rock bank). Granite holds approximately 40% of Northern Rock's assets, around £40bn. Yesterday, the Treasury minister told the house that "Granite is and has always been a separate legal entity".

Let's look at that: Northern Rock does not own Granite, that's true. It is however, wholly responsible for it: it's officially "on" its balance sheet in its accounts. But it is legally "off" its balance sheet when it comes to getting hold of its assets as the basis for the security of the sums owed the Treasury.

Granite is based in Jersey, an offshore tax haven where Northern Rock's best assets sit outside the reach of taxpayers. So the bill to nationalise Northern Rock will, in fact, be nationalising only dodgy debt, which will increase the burden on the taxpayer and put at risk the jobs of Northern Rock workers. The sad truth is that by failing to regulate the financial sector adequately, the government has been hoist by its own neoliberal petard. The participants in this tax dodge will be allowed to walk away with millions, when workers may lose their jobs and the taxpayer risk billions."

Andrewj - thanks for posting link. It is going to be an interesting ride as the levers continue to be pulled. Pyramid selling is legal if you know the right people and none of the bankers will end up in jail. The OBR looks like shop-lifting is also getting the thumbs up.

http://www.interest.co.nz/bonds/62807/new-zealand-banking-system-has-hi…

So, I guess interest.co.nz supports the RBNZ's off the record embargo in respect of the OBR briefing as reported on Seven Sharp tonight.

It's hard to accept "Helping you make financial decisions" when the website seems to acquiesce to RBNZ demands to condone a policy of "constructive ambiguity" - the fourth estate is no longer the countervailing force the population should expect - is this soft NZ fascism in the development stage as determined by taxpayer dependents?.

I saw that item as well.

I take it there is to be some kind of announcement tomorrow.

Perhaps a decision has been made on a 'minimus'?

Or maybe some bank is is defaulting tomorrow?

Or maybe zerohedge was onto something?

Embargo can only mean - there is something we're going to learn about tomorrow.

Stephen, the briefing was in Wellington and I didn't go. But my understanding is there was no "embargo" as such. More it was an off the record briefing by Reserve Bank officials about the OBR.

Here's what the invitation said:

"The Reserve Bank invites journalists to an off-the-record media briefing on Open Bank Resolution (OBR).

OBR is a long-standing Reserve Bank policy aimed at allowing a distressed bank to be kept open for business, while placing the cost of a bank failure primarily on the bank’s shareholders and creditors, rather than the taxpayer.

So that OBR could be available as an option in the rare event of a bank failure, the Bank last year asked all locally-incorporated banks with retail deposits of over $1 billion to pre-position their IT systems. This will enable OBR to be a feasible option in the Government’s failure resolution toolkit. Other banks can opt-in to the policy if they choose to.

The media briefing will be strictly off-the-record. The Bank’s Deputy Governor Grant Spencer and Head of Prudential Supervision Toby Fiennes will give a short presentation explaining the background to the policy, how it would function, and how it fits in with developments in this area internationally. There will then be an opportunity to ask questions.

The briefing will be held at 9am on Tuesday 16 April 2013 at the Reserve Bank, 2 The Terrace, Wellington."

Stephen, the briefing was in Wellington and I didn't go

Gareth, thank you for clarifying your situation - Bernard and Brian Fallow were clearly seen leaving the RBNZ on the Seven Sharp film footage. - not that I really understand Bernard's current relationship to interest.co's publishing policy.

That long blue arrow between 'Accounts Frozen' and 'Unfreeze portion of customer accounts" does seem awfully long. Longer infact than the rest of the other arrows. Have fun trading houses and running farms for capital gains folks, don't think I will bother hanging around to fund any more of it.

I dont have a lot of that stuff one calls savings, but I am with you Moa Man. I think I might operate my life through OD from now on. Oops thats right I do that anyway.

My brain is working overtime with exactly what they are panicking about though. Clearly they are doing this for a reason. So what may that be. Ummm

1 Foot and mouth...now we are bringing in so much palm kernal, and apparently it is infested with biological bits that shouldnt be there ie dead monkeys, and birds. We are also about to embark on importing uncooked pork.........hmmm a pork or pk recipe for disaster methinks. That would root the banks pretty quick.

2 Birdflu??? Sars kinda hit my bank account in a big way, no one wanted to eat out, nek minit the schedule went thru the floor. Could this be a black swan that gets to fly or flu?

3 Fukushima, come on people.... get with it, those giant swimming pools are leaking like no tomorrow. Oops thats right there will be no tomorrow if thos fuel rods go up... But really Tokyo is hotter than is good for ones health, there is no putting the genie back in the bottle, 45 million people need to move house. Could this be a problem. Nope. I dont think so, cos no one seems to understand the science of a wild plutonium atom, let alone a bankster.

4 Europes Banks...I have no idea, really no idea. Clearly there is a problem. But will it also root our banks........pass.

5+ Ideas please....

Fingers crossed OBR and Kiwisaver - nothing new there then - value can go down as well as up.

"KiwiSaver money would remain frozen in full at the behest of the bank's statutory manager."

or...

Some of your bank managed Kiwisaver retirement funds may or may not be there after the statutory manager has sorted the problem from assets available...whenever that may be.

About to transfer overseas pension funds into Kiwisaver? Might be worth a raincheck on any guarantees lost.

No 7 Earthquake. I see there is another 6.8 around Papua NG. If we got the overdue biggie in wgton, could that see a bank tip.

No 8 vulcanism. Auckland is the obvious and I think I read somewhere this week Rangitoto was going off for hundreds of years nonstop. The banksters wouldnt like that

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.