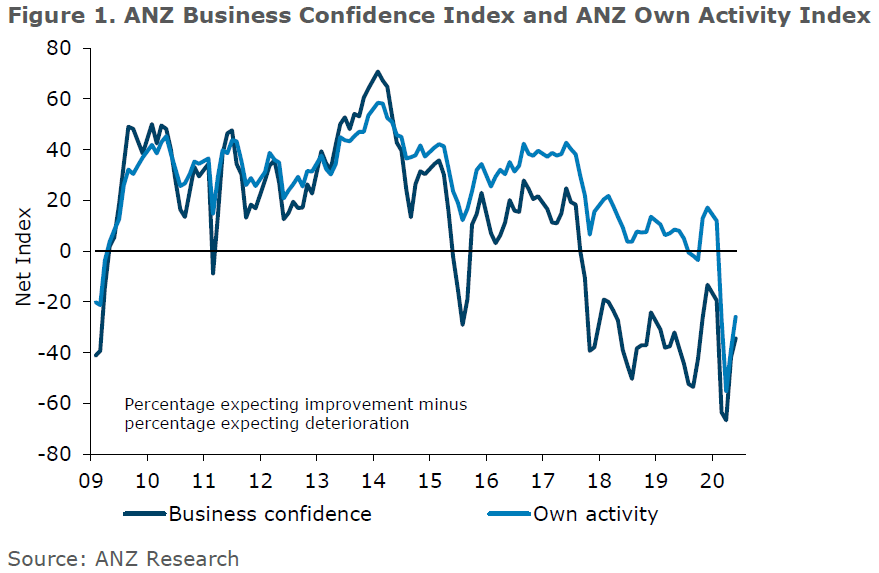

Business confidence levels are continuing to improve - but only to levels consistent with the view that the recession is "just starting", according to the ANZ Business Outlook Survey for June.

ANZ chief economist Sharon Zollner said New Zealand was the envy of the world, with no social distancing measures imposed upon us and restaurants, bars, sporting events, all able to carry on as normal.

"But the fact remains, New Zealand with a closed border is a significantly smaller economy, at least in the near term, and the recession is just starting to make itself felt," she said.

"It is encouraging to see a bounce in sentiment in the retail sector, and this tallies with anecdotes we are hearing about households rushing out to spend the involuntary savings accumulated during lockdown, as well as the money that had been squirreled away, earmarked for an overseas holiday.

"But these sources of spending are not particularly sustainable. Our consumer confidence survey suggests wariness on the part of households about what the future may bring, and accordingly, a desire to prune discretionary spending. The bizarreness of the lockdown experience means we must be very careful about making any inferences from current spending trends about what consumer behaviour may look like six months down the track."

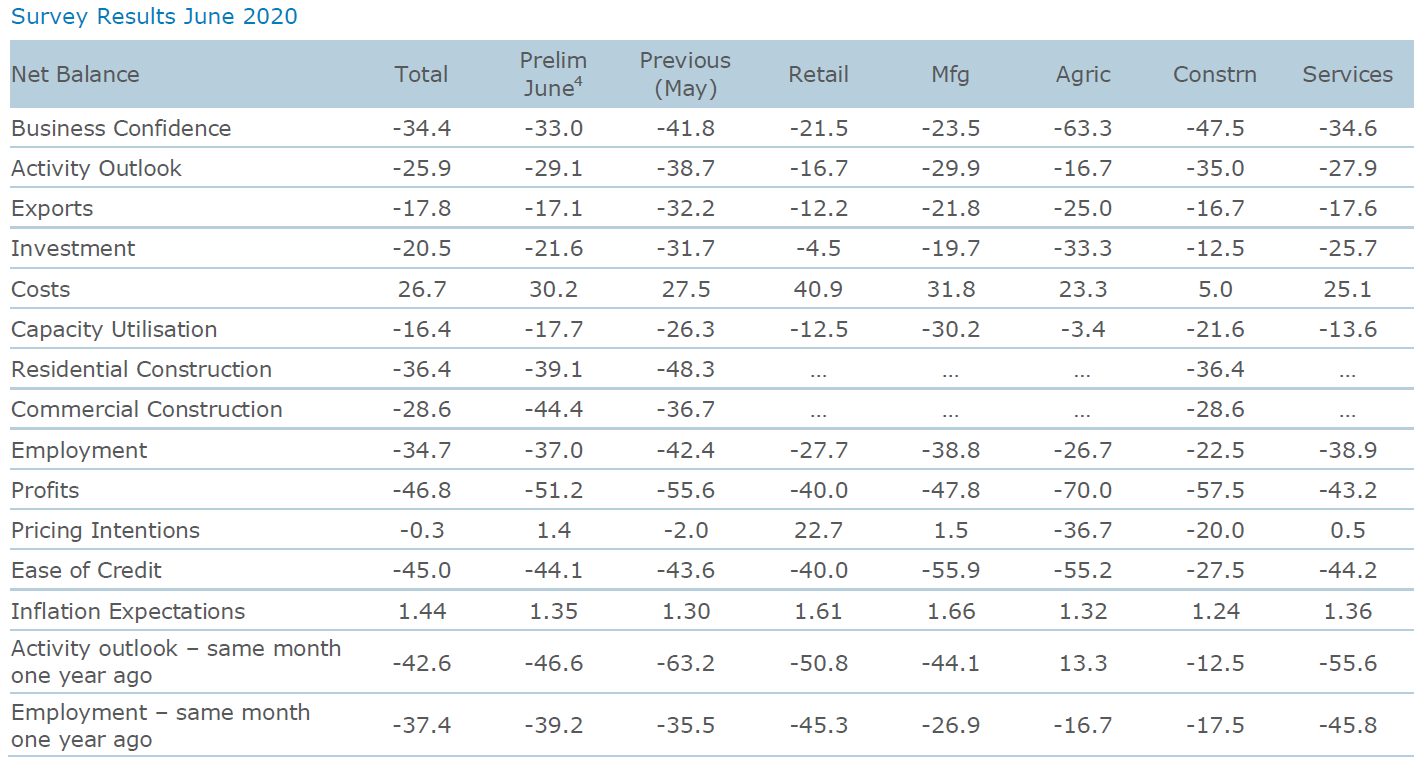

Zollner said in the latest survey headline business confidence stabilised over June, similar to the preliminary results released earlier in the month and read at -34%. She said a net 26% of firms expected weaker activity for their own business, a further 3 point improvement, "approaching levels typically seen in a recession". Retail sector expected activity "bounced a lot".

Nearly half of respondents sid they intended to lay off staff, and a similar proportion said they already have fewer staff than a year ago (some of these will be the same firms).

Zollner said there were some clear broad themes:

·On the activity side, particular hotspots of weakness are employment, profitability, and exports.

·Cost pressures and pricing intentions are continuing to ease across the board, but particularly in the construction sector.

·Investment intentions are recovering more quickly than employment intentions are.

·The manufacturing and services sectors are particularly subdued relative to where they usually sit; retail and construction less so. Retail and agriculture are considerably less worried about the outlook than they were last month.

·The services sector is extremely negative regarding employment intentions, relative to historical experience.

·The agriculture sector is not particularly worried about activity levels relative to normal, but remains very concerned about profits and credit availability. The sector’s employment intentions also deteriorated more than most over the month, even though they report being extremely busy in terms of capacity utilisation.

·The manufacturing sector is increasingly concerned about credit availability.

“The outlook for the labour market is of particular concern at the moment, with the pressures from the loss of international tourism particularly pronounced for people-centric industries of tourism, hospitality and retail," Zollner said.

24 Comments

Citizens of HK should be rephrased to citizens of HK who get paid by the US/UK spy agencies to deliberately create chaos in Hong Kong and string anti-China sentiment.

After the national security law being passed, there would be no more such thuggish domestic terrorism, as they will be thrown into jail for breaking the law.

I've just got back from a weekend in QT. Here are a few sobering facts for you to digest.

~ the car rental place is doing 5 or 6 rentals a day vs 60 / 70 per day equivalent last year

~ staff are expecting 75% of employees to be given notice within two weeks so that notice is worked over the wage subsidy period

~ the school holiday period is expected to be 90% down on last year

~ airbnb rentals that were 900 pw are now 300 pw.

~ our car rental was NZD80 for 4 days

~ the vineyards in Marlborough are mainly writing off 2020, several simply wont be opening this year.

I'm not sure where ANZ are getting their data but its WAY off point.

Agree Agree Agree, maybe they got bonuses and thought the rest of NZ is on it's way back. The industry I am in is very very nervous that by October things be well and truly heading down the drain unless the government can act on the promises, but going off KB we doubt it, there is a lot of pain to come.

Glitzy

Good anecdotal information.

Looking at a week in Christchurch later next month to use credit from Level 3 cancelled trip.

Airfares the same, accommodation at same place about 30% cheaper, and four day car rental car total $4 cheaper.

So yes, reasonably competitive prices.

However, looking at three weeks in Queenstown region around Christmas time.

Airfares about what we would usually pay - may be slightly down (have booked) compared to past years.

Considered a campervan - a reasonable 2 berth livable one (i.e. not a Wicked one!) about $4,000 or close to $200 per day for 22 days.

Basic cheapest rental car (not embarrassed as no one knows me down there) with $0 excess about $50 per day which was very much on the high side of usual (usually look to about $30/day).

Motel accommodation also seemed a bit on the higher side - getting up to Glenorchy for a few 1 to 2 day tramps and basic motel or lodge accommodation around $180 which seemed consistent with other places around. Mt Cook - again for one day tramps - is also very expensive for what it is.

Currently holding off confirming as a few things on my plate.

Also looking at another kayaking trip in the Sounds - ferry with car great but AirBnB expensive and Nelson Lakes etc also not down on usual values.

I thought after all these years as an independent traveler I thought I was pretty efficient at booking - but maybe not.

Maybe you can become a booking agent!

Yes, I think anyone who expects New Zealanders to even begin to pick up the slack in tourism spending is kidding themselves. There's a massive excess of supply and we will hunt around for the best rates until we get the cost down to say $150 a day or $250 per family if its possible. We don't want to pay for a tour guide or visit locations in a dense group and all the local attractions for overseas groups we went to while at school. I guess North Islanders vising Queenstown could spend a bit to pack in some more after paying Air NZ flights but that's it.

Its a high risk bet on a vaccine by the end of the year for a lot these business to try to stay open.

Agree. How can their be V shape fecovery as predicted by some experts if Travel and Tourism is dead, Hospitality is dead, International student / education is dead, Immigration is down (Returning Kiwis - yeas but not as many and donit spend as much).

All this bound to have domino affect and if unemployement level goes more tban 10% will be very bad and every additional percentage will be disaster.

If we can keep selling overpriced kiwi shed housing to each-other for ever increasing prices, we can simply live off of mortgage equity withdrawals.

.. bugger, we've already been doing that for the last decade. Any other ideas? Share market bubble anyone - I get $5 for sharesies referrals?

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.