The latest ANZ Business Outlook Survey for September shows that business confidence levels are improving - though they are at levels consistent with a recession.

Additionally, businesses in Auckland are more downbeat than in the rest of the country following the recent re-emergence of Covid in Auckland and the move to Alert Level 3 there in August.

However, the overall results in the survey point to an economy that is holding up much better than the country's economists had expected at the time the Covid crisis emerged.

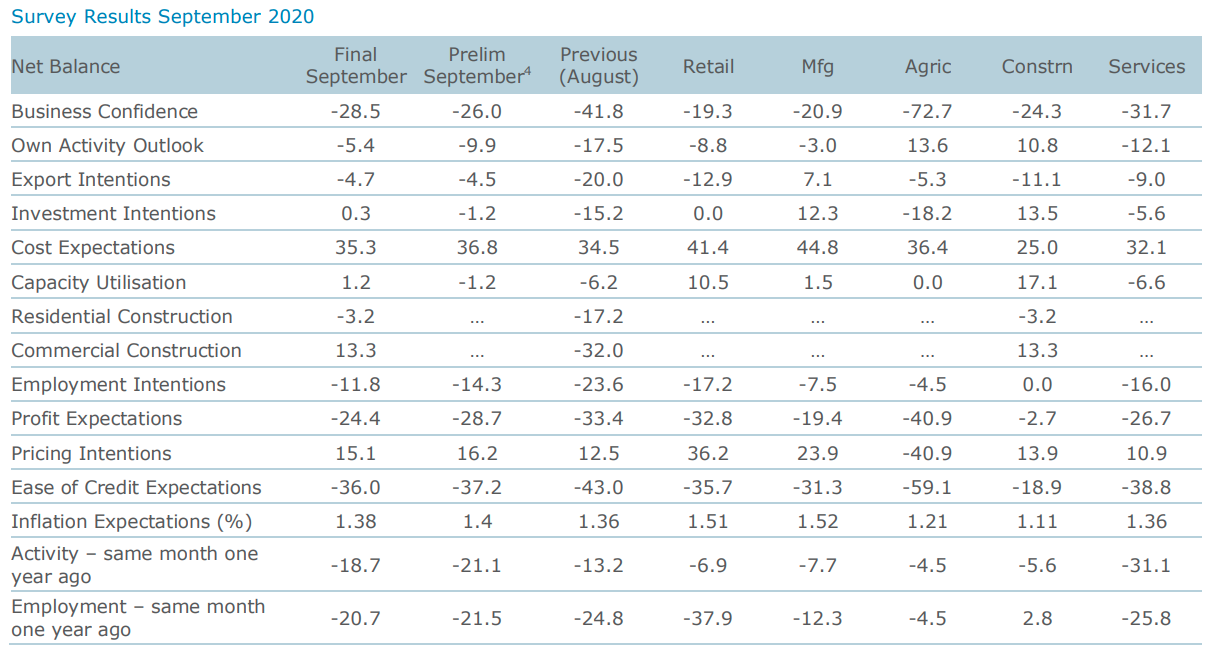

ANZ chief economist Sharon Zollner said the full-month September ANZ Business Outlook survey confirmed that activity indicators lifted since August, including firms’ own activity expectations and business confidence. "That said, the latter did dip a little as the month went on."

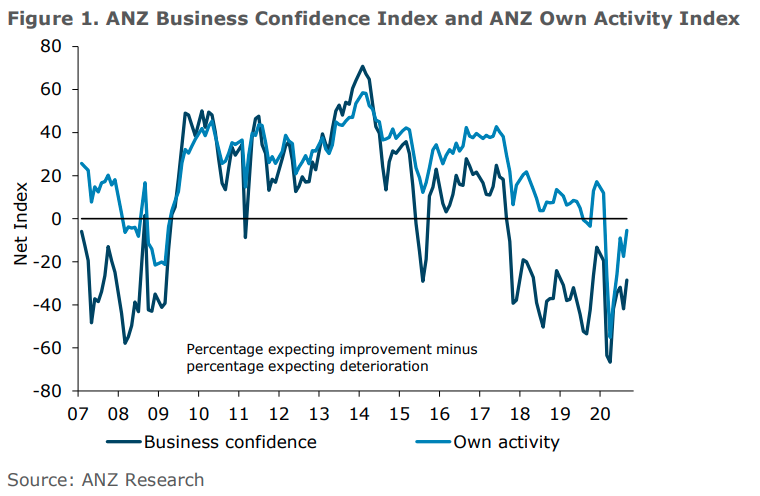

She said firms’ expectations for their own activity, with is the better economic indicator, has bounced considerably off its lows but remains negative, "which is typically only seen in recessions".

However, at a reading of -5.4% (that's the net total after subtracting the numbers expecting lower activity from those expecting higher), things could be - and have been - a lot worse, Zollner said.

"It is the highest since February, well off its spectacular low of -55.1% in April, and also higher than the lows seen in 2008/09, during New Zealand’s last serious recession.

“Across the economy, firms appear to be confident that the second outbreak of Covid-19 in the community is well under control, if this survey is anything to go by. Most activity and expectations indicators ticked up further as the September month went on, including employment and investment intentions. Headline business confidence was the exception to the rule, possibly reflecting election uncertainty."

But Auckland businesses remain "considerably more pessimistic" than the rest of the country, understandably, she said.

Looking at sectoral activity, Zollner said the services sector remains "under pressure", which she said makes sense, as this is the sector most impacted by the closed border. Retail is something of a mixed bag, but on balance is the second-least optimistic sector.

“However, improving fortunes are evident in construction and agriculture particularly," she said.

Taking a closer look at construction, Zollner said residential continues to bounce back, with now just a net 3.2% of firms expecting lower activity. Commercial construction firms’ expected activity tends to be more volatile, but has also bounced back sharply, and is now in the black with a net 13.3% of firms expecting higher activity.

Every third month the survey asks firms about their biggest problems, and what is driving their investment decisions.

Zollner said that, perhaps surprisingly given rising unemployment, firms report that finding skilled labour is still their largest problem, followed by regulation and paper work, ahead of competition and low turnover.

"There is undoubtedly a significant skills mismatch between those who have lost their jobs (in retail and services, according to this survey’s experienced employment question), and the parts of the economy with the strongest employment intentions (construction and agriculture)," Zollner said.

“It’s also interesting to see what isn’t a problem. Cashflow/debtors remain well down the problem list, encouragingly, as do access to finance, the exchange rate, and outside of agriculture, costs outside of wages."

In terms of the biggest driver of investment decisions, it is currently the economic outlook. Zollner said interest rates and credit availability "do not feature strongly".

She said that overall, New Zealand businesses "are hanging in there". They appear relatively optimistic that the re-emergence of Covid-19 in our communities will not derail things further, and key activity indicators are lifting.

“As a reality check, though, the levels of most activity indicators remain very subdued relative to pre-Covid days, and are still at levels regrettably reminiscent of 2009. There is real pain in the services and retail sectors. The full impact of the closed border is a summer story, and will be felt most acutely just as the tide of fiscal support recedes.

However, Zollner said it is not all doom and gloom out there.

"Covid-19 is on the run again, indicators are miles off their lows, sectors not heavily impacted by the closed border are relatively upbeat, the construction sector is looking up, and firms’ biggest problems – finding skilled staff, and regulation – still fall into the relatively ‘nice to have’ category.

"Many economies around the world would happily swap problems."

4 Comments

“It’s also interesting to see what isn’t a problem. Cashflow/debtors remain well down the problem list, encouragingly, as do access to finance

In terms of the biggest driver of investment decisions, it is currently the economic outlook. Zollner said interest rates and credit availability "do not feature strongly"

Someone flag all this to Orr who asserts making debt cheaper is somehow going to make investment decisions easier for the thousands of businesses who don't think they're going to last another month in the markets.

Exactly - Bad News Piles Up For ECB As Deflation In Germany Hits Five Year High

#ECB ramps up balance sheet expansion. Total assets rose by €32.4bn, most since July, to hit another ATH at €6,534.8bn. ECB balance sheet now equal to 64% of Eurozone GDP vs BoJ's 136.5%, Fed's 36.4% and BoE's 35.5%. Link

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.