Westpac's economists have estimated New Zealand has a shortage of 10,000 houses and has forecast a 23% growth in housing construction over 2011 as developers and home buyers respond to the shortage.

They said developers and builders who were less reliant of finance would be able to buy cheaper land and keep new house costs stable.

Chief economist Brendan O'Donovan and senior economist Dominick Stephens said those arguing a shortage of finance would stop a housing construction recovery were ignoring the lessons of history and economics.

"Market economies tend to find ways of getting around obstacles, normally by throwing up new price signals," the Westpac economists said in a note republished here and attached below.

"In this case, developers who relied on cheap finance have been forced to sell land, pushing the price of undeveloped residential sections down by 15% since 2008," they said.

"Over the same period, house prices have remained unchanged. So the margin on offer for successful property development is now much wider than it was during the boom. There is a juicy profit opportunity on offer for larger firms that are less reliant on finance to get involved in residential property development. Which is precisely what we think will happen."

Here is the full Westpac comment below:

The 2008/2009 recession hammered New Zealand's residential construction industry.

The number of houses built in 2009 was half that of 2007. The recession also had the quirky side-effect of boosting annual population growth from 0.9% to 1.3%, as fewer Kiwis crossed the Tasman. The result was a housing squeeze.

The average number of people per house in New Zealand rose from 2.52 to 2.55 over 2009 - only the third episode of squeeze since reliable data began in the 1960s. The rate of house building has picked up over the first half of 2010, and building consents data suggests a further acceleration over the second half. Meanwhile, population growth is slowing because fewer foreigners are immigrating to NZ.

But even that has not been enough to ease the squeeze. By our calculations, the current rate of house building will be enough to keep the number of people per house constant through 2010, but will not be enough to bring it down. The number of people per house has been trending down for decades, as family sizes have shrunk and incomes have risen. Although the birth rate has stabilised, the downward trend in people per house has remained in place because the aging population has boosted the number of elderly living in one- and two-person households.

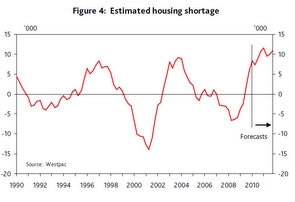

One way to consider the situation is to compare the number of people per house to its estimated trend. That suggests that New Zealand has a housing shortage of about 10,000 houses (chart above).

Historically, every time New Zealand has gotten into a housing shortage situation, the residential building industry has responded by ramping up production and eventually restoring balance. We expect this time will be no exception. We are predicting 23% growth in residential construction for 2011, and even that would only just be enough to keep up with population growth. Even more will be required in 2012 to make inroads into the housing shortage.

Those forecasting lesser increases in residential construction have a job to explain exactly where people are going to live! One idea going around is "this time is different" - difficulty obtaining finance will prevent residential construction from picking up like it has after previous recessions. That idea ignores the lessons of both history and economics.

Market economies tend to find ways of getting around obstacles, normally by throwing up new price signals.

In this case, developers who relied on cheap finance have been forced to sell land, pushing the price of undeveloped residential sections down by 15% since 2008. Over the same period, house prices have remained unchanged.

So the margin on offer for successful property development is now much wider than it was during the boom. There is a juicy profit opportunity on offer for larger firms that are less reliant on finance to get involved in residential property development. Which is precisely what we think will happen.

1 Comments

I agree with the commenters above.

House sharing within families and friends may be the flaw in the thinking.

Here's a report we did earlier this year on how people in South Auckland were choosing to live in garages and friends houses rather than buy or rent where they couldn't afford.

http://www.interest.co.nz/news/growing-housing-shortage-auckland-forcin…

Housing shortages don't necessarily mean either higher house prices or more house building. It could just mean more people per house.

I think affordability is still important, particularly as interest rates rise and incomes stagnate.

Here's more on that here.

http://www.interest.co.nz/news/home-loan-affordability-improves-slightl…

cheers

Bernard

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.