National's policy to sell up to 49% stakes in four State Owned Enterprises is about getting money out of bank accounts to help build the economy, Finance Minister Bill English says.

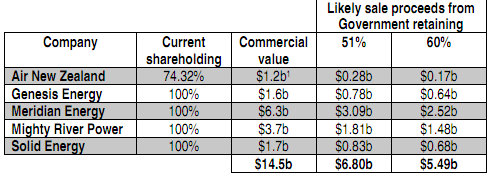

Speaking on Tuesday on Bloomberg TV, English said the government was looking to sell shares in Mighty River Power, Genesis Energy, Meridian Energy and Solid Energy. They had been reasonably well run for a number of years, although the government believed that with market disciplines they would be better run and get better access to capital, English said.

“Once the new government is formed, we’ll make decisions pretty much straight away about that [the sales process], and we would expect over the next 12-18 months to have a number of significant floats with a strong emphasis on domestic ownership," English said.

“Particularly [for] our households, who are increasing their savings rates and will be looking for better investment opportunities than our finance companies, which collapsed over the last 4-5 years," he said.

The sale process would get some money “out of bank accounts and helping build the economy.”

Mighty River or Genesis first to go

English's comments follow comments from Prime Minister John Key yesterday, who said either Mighty River Power or Genesis Energy should be first on the block, although not before the latter part of 2012. See yesterday's article here.

27 Comments

With all due respect Mr English my money is just about to be sent overseas....sorry too little too late, you had your 3 years to deflate the residential property bubble but your buddies at the banks twisted your arm to keep the bubble inflated.....anyway just watch all the big players from overseas rush in and monopolise purchasing of above shares....

Europe's shrinking money supply flashes slump warning All key measures of the money supply in the eurozone contracted in October with drastic falls across parts of southern Europe, raising the risk of severe recession over coming months.

The three main gauges – M1, M2, and M3 – have each begun to decline in absolute terms after slowing sharply over the Autumn.

The broad M3 measure tracked closely by the European Central Bank as an early warning indicator shrank last month by €59bn to €9.78 trillion, a sign that Europe's long-feared credit squeeze is underway as banks retrench to meet tougher capital requirements.

http://www.telegraph.co.uk/finance/financialcrisis/8921720/Europes-shri…

comments

Precisely. What happened was the the S-Europeans and the Germans created together a massive economic bubble, somewhat similar to but smaller than the Chi-American bubble economy.

To put it simply CA deficits can't exist without corresponding CA surpluses, and the other way around. If the CA deficits were unworkable in the long run, that held equally true about the German CA surplus over the years - with the S-Europeans.

The Southern Europeans were quite willing partners in crime - had it appeared insatiable appetite for German good purchased

for German loans.

Naturally all bubble burst - and once this inherently destructive dynamic had begun last decade the Euro was heading for trouble, as sure as the sun rises each day.

-----------------

However it appears that Germans find it inconvenient recognize their part in this debacle, how they benefited - how more jobs existed in Germany during the years of the bubble than else would have been the case, the false additional GDP growth they experienced.

No, their narrative is that the Southerners were profligate, and that they shall pay up - neatly absolving Germans from needing to refunding their own banks, if they can make it work out.

Naturally the Southerners are increasingly growing to detest Germans over what to them seems quite unjust treatment, while the way Germans are talking about them grates even further.

This issue is really creating a divide in Europe, and it's that anger which is feeding up on itself, that shall destroy the EU - if event follow their course meaning the Southerners become bankrupt and helluva lot worse off for years to come.

Then they'll really hate Germany all over again. And I guess Germans will react to that hate, and detest the Southerners all that harder for it.

So growing tensions in the future between South and the North.

----------------------

I've noted that the countries are getting into trouble more or less in the order of who has the greatest CA deficit on the average the last few years.

The outrageous thing about this is the Maori wanting to buy the public assets, first of all the taxpayer gives the money to the Maori in so called treaty settlements then Iwi buy the assets that already belong to the people of NZ. Its madness. The income from the assetts goes to the Maori and then they invest it over seas. None of the money ever trickles down to the ordinary day to day Maori, they still live in poverty.

In the mean time the money received from the sale of the assets gets frittered away by the Govt in charge and the taxpayer misses out all round.

We must have a referendum before any asset or part of is sold!!

John Key does not have a mandate to sell anything just because he got elected as PM. He just got elected because there was no other reasonable alternative.

.. ummmm , on my ballot sheet it didn't say " elect John Key , 'cos there are no reasonable alternatives " ...... there really were alotta reasonable alternatives ....

So the Maori tribes are gonna get stakes in some of the SOE's , huh ? .. beats spending all that Pakeha wampum on ciggies & DB , doesn't it ..... Well done Mr Solomon , and Ngai Tahu , excellent use of your munny , sir .

.big " V " .... the shrieking , screaming wails from the defeated left are so pitiful , .. and so very funny .

It's called " democracy " , toots . Suck it up ! ..... we did , for 9 years , when Helen & Michael ran roughshod over the electorate , foisting upon us a mighty lot of stuff that was not in their pre-election manifesto . At least JK told you what he was planning to do , before you voted .

He would argue that he does have a mandate by winning the election when this was a stated key (no pun intended) policy platform.

The number of people who voted National but also say they oppose the asset sales astounds me. I don't know what the hell these people were thinking.

I get annoyed by how the "state assets" are lumped together. I don't mind if they sell down their stake in Air NZ, but the electricity co's is another matter altogether.

The electricity market is already disfunctional (see the "undesirable trading situation" from earlier this year) and with Bill's so called "market disciplines" it will get a lot worse.

The only thing this will grow is the bonuses of a few I-Bankers who broker the deals.

I suppose they considered something else worse......fear of a Labour crazy spree spending maybe.....I cant think of anything else.....I know it worried me....

Agree on Air NZ, its dead, sell it before it dawns on private investors the airline industry is toast, of course Pollies are always slower still.

The "undesirable trading situation" was nothng more than a bunch of whinners declining to pay for a fixed rate....they knew full well the possible cost spike...they chose not to purchase, they should pay up IMHO.

regards

ironic isn't it that:

Cullen ran surpluses during the 9 years

English has run deficiets during his 3 years

Government debt flat under Cullen

Government debt Increased dramatically under Blinglish

Cullen lambasted for not dropping taxes during the surplus years

English drops taxes during the deficiet years

Labour propose to push up the age of eligibility for Superannuation

National propose to leave it as is.

And the perception is that National are better money managers...

My view, with Cullen gone, is that both National & Labour would be running deficiets. The size would differ... But people have short memories...

"The sale process would get some money “out of bank accounts and helping build the economy.”

What utter nonsense. We run a multi billion dollar current account deficit. Is Blinglish not aware of that? So, if money on term deposit is used to buy these existing assets, the banks will need to source funding from offshore to replace their Kiwi depositors funds.

The MOF is making up stuff to try and justify the stupid plan to flog off our irreplaceable assets.

Look past the smoke KD....buy the shares.....keep them.....if we all do this....they stay NZ owned ....if Labour had pushed this as policy and encouraged supporters to buy the shares...they might today be govt....

As for the banks...you can count on a run on funds at one of them...that's going to be the consequence of the OBR madness and the serious lack of RB control.

I think this is a wise move. The banks are not safe and that can only get worse. The OBR is a sign that one or more of them is expected to fail and bollard knows this....talks with English and Key about this prospect gave us the OBR set to be in place soon.

Those with deposits in bank accounts are being hung out to dry by Bollard...on the back of home spun BS that the OBR will make banks behave...what a crock.

Owning the shares across these power companies and not just in one of them, will give you a good but not spectacular return that remains pretty steady...who cares if the value of the shares rises or falls...just don't sell in a fall.

Selling the shares will be easy when you need some capital to pay your dentist for a filling.

As far as the OBR BS....Gareth is right on the money....Bollard needs to start behaving like the FSA boss and end the farce...the bank bosses are out of control...LVR levels are back to 100% near enough..no control at all...

"The OBR is a sign that one or more of them is expected to fail and bollard knows this"

Anybody who has looked at the current situation, compared us and OZ to Ireland, looked at the slow speed train wreck that is the EU must realise there is a real risk. I mean its laughable when we get a poll in here saying a EU depression....does anyone really think it can be contained? I dont see how. In some ways its worse as our big 4 NZ branches are somewhat exposed to OZ at the same time. So Dr Bollard insisted that the NZ banks retain autonomy for IT capability, ie they run NZ bank accounts from NZ and we get the OBR which is a safety valve for us the voter...

The OBR isnt to make banks behave, its to make them stand by themselves...ironically the OBR will probably cause a S&P/Moodys downgrade for them....

The shares will be overpriced even in a stable market. When the EU implodes, shares across the globe will be the first to tank......50% losses easily.....they will take decades to recover......and once the share market has collapsed so the housing market will follow......Me, Im keeping my cash for now.....some years from now yes sure buy back in.....this is the ultimate in dead cat bounces....fools rush in....IMHO.

Dr Bollard cant control the LVR.....get the Pollies to put legislation into place taht he can then use.

regards

The values will fluctuate...we know that....as for the LVRs....Bollard could slam a lid on at 75% and make it stick if he and English wanted to....they don't....and the reason is because the banks have got them by the short ones....the bubble is now the hammer bashing the economy and feeding the banks fat profits....

What has to happen, before we see the banks shoved back into the box and the lid nailed shut for ever. This economy has to be dragged kicking and screaming back from credit dependency....it's that simple.

The OBR will cause the failure because others like me will move capital away from all of the banks. The shares will vary in value but they are not subject to the threat of the 'fractional farce'

But, but, but, the power companies will be free to expaaand. Their management, free from bureaucratic constraint can build geo-thermal/hydro/wind powered capacity in Nicaragua and other such places that can't build them for themselves! The management will be able to expand their empire and borrow vast sums to invest in wonderful investments so they look very clever and obviously deserve obscene salaries based on their projected future returns. Share prices will expode upwards in anticipation of the wealth that will be created.

I apologise for being a tad cynical but there is a danger that unfettered management will do stupid things and over expand without regard for the shareholders who will eventually suffer. The relationship between shareholders as owners and management as skilled labour doesn't seem to have been resolved in these behemoths. Or has it, I really cannot tell?

That's a good point Roger, will the power companies follow the traditional NZ corporate path of expanding overseas and getting their clocks cleaned? When was the last time a New Zealand corporate successfully expanded into Australia or anywhere else for that matter?

So about 2015 or so we will be "forced" to sell the remaining 51%.... Then we'll see them eviscarated just like any other NZX stock, energy prices double to give a "worthwhile" return......and once they are gutted they will get loaded with crippling debt and the privite equity will run with the cash.....like duh.

regards

In a well managed economy the govt would be issuing the orders to the reserve bank, instead we have the banks directing Bollard.

The OBR is an idea born out of poor thinking. Capital flight is certain. As it gathers pace, one of the banks will approach the cliffedge and scream out "HELP" to protect the fat salaries of those who ruined the bank....and the next morning ma and pa Kiwi wake up to not being able to access their capital...their savings...while also being told they are likely to lose some of their capital...because the stupid useless gutless RBNZ, together with the dopes in the Beehive were too fatheaded to understand they had to control bank behaviour because the bank bosses had no intention of doing so.

Morning one and bank one goes down....what happens on that day?.....the run on the rest of the banks...why?....because those who are slow to act will wake up on day two to find they are losers.

Bollard......English.....stop this buggerising around.....start doing what you should have started 3 years ago....The banks have been out of control for nearly three decades....they now own the economy...they are dictating monetary policy...and the pair of you know it.

We live in a social environment malarkey...we do not have pure capitalism...the RB has always been operating under govt direction...the problems developed because the directions were too sloppy, too open to abuse. Where was the rigid LVR model...why were banks allowed and indeed encouraged to lend up to and over 100% of valuations already riding a bubble....WHY?

More to the point, the OBR game is govt policy wrapped up in RB tissue paper to look independent of govt....it is nothing of the sort.

Take a walk back in time...somewhere back there bank managers not only knew the risks credit creation posed but they lived by a code not to expose the bank to risk. So where did it change malarkey...At the point where fatheads in govt recognised the potential to pork the market with credit to make sure they won an election....there was from that point on a govt promise to bail out any bank at any time.

Right now today....Bollard is doing exactly that....he is porking the market with a near zirp.....go figure.

His behaviour, at the direction of English...is a clear indication that this whole sorry economy runs on credit and nothing else.......Nothing Else...got it..

You mean "In a well managed economy the reserve bank would be issuing the orders to the member banks, instead we have the banks directing Bollard", but this state has been in place for at least the last 30 years. You certainly couldn't claim that Greenspan was in charge in the US. He was barely qualified to dribble, let alone run the FED.

Good to see you have gotten past your blame the government fettish, because this idea helps keep the eyes off the troublesome banks.

Out of banks and into economy?? Does he always shoot at the hip? Before he said the money was going to be used to pay of the national debt, now it is to pay for schools, hospitals, etc... That money will be fritered away and the friendly media will cover it up. Watching New Zealand is like watching the USA falling all over again. I can only hope the opposition will not let English and Key get away with it and National be voted out in 2014

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.