By David Hargreaves

The country's economists have been both upgrading their economic growth forecasts - and downgrading their expectations of inflation.

At the same time, there's another caution from the Reserve Bank that falling inflation expectations might lead to further rethinking of interest rate levels.

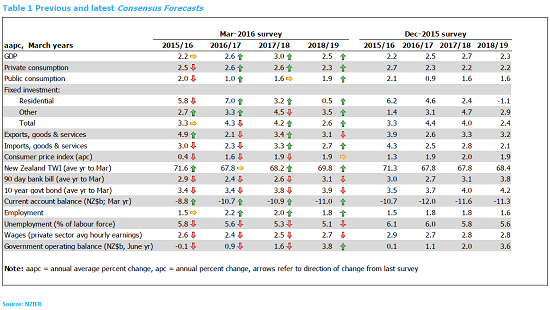

The latest NZIER Consensus Forecasts show that on average economists now see GDP pushing up to 2.6% for the year to March 2017, rising to 3% in the March 2018 year and easing back to 2.5% in 2019. This compares with forecasts in December of 2.5%, 2.7% and 2.3% for the same periods.

But at the same time, the economists picks for inflation have dropped sharply. In December they were picking an annual inflation rate of 1.3% for the March 2016 year - but now they are picking just 0.4%. The average prediction for the March 2017 year has also fallen significantly to 1.6% from 1.9% - but the picks for subsequent years are largely unchanged.

In deciding last week to drop the Official Cash Rate to a new record low of 2.25% from 2.5% the Reserve Bank talked extensively about recent sharp falls in market expectations of future inflation.

And in an RBNZ March Bulletin article that would have been prepared ahead of the OCR decision, authors Michelle Lewis, Adam Richardson and RBNZ Assistant Governor and Head of Economics John McDermott look closely at recent inflation expectation trends.

"There has been a material decline in inflation expectations recently, which risks becoming embedded in future wage and price decisions," McDermott said.

"This is one factor contributing to the current need for low interest rate settings. Low interest rate settings will help offset the dampening impact low inflation expectations will have on today’s wage and price setting behaviour. They will also help ensure inflation expectations remain well anchored.

"If the recent material decline in a broad range of inflation expectations measures continues, the Bank would need to reconsider the outlook for interest rates."

BNZ senior economist Doug Steel said BNZ economists had argued that the RBNZ "may be backing itself into a corner" with its approach on falling inflation expectations. "Today’s release exemplifies this."

Steel said it could only be assumed from the McDermott comments that the RBNZ would ponder cutting its cash rate even further than the 2.0% low already assumed in its latest MPS.

"If, and that’s a big if, the RBNZ remains consistent with this statement, then a cash rate below 2.0% starts to look almost certain. With headline inflation likely to remain low then it’s almost certain that inflation expectations fall further and in so doing triggering the reconsideration the RBNZ suggests.

"We have a 2.0% low in our cash rate track at the moment. But 1.5% is certainly not out of the question based on this rationale. It all feels very mechanistic. Sharp swings in the likes of the price of oil drive headline inflation outcomes and, in turn, contemporaneous measures of inflation expectations, which then influence OCR decisions. While there is a great deal of thinking and modelling in the middle here, such things as the price of oil still look to have a great bearing on actual OCR decisions."

NZIER senior economist Christina Leung, commenting on the latest consensus forecast said although inflation forecasts have been revised lower, all forecasters expect inflation to be back within the Reserve Bank’s 1-3% inflation target band by early 2017.

"There is increased uncertainty about near-term inflation, with the weakest forecast being for annual inflation to remain at a low of 0.1% in March 2016."

She said forecasters had already revised down expectations for interest rates through to 2019, before the RBNZ's OCR move last Thursday.

"The survey was taken before the RBNZ surprised markets with a 25bp OCR cut at its March Monetary Policy Statement, and signalled further easing is likely. The consensus is for 90-day interest rates to average 2.4% for the year to March 2017, before lifting to 3.1% in 2019. Although expectations for interest rates for the next year are relatively narrow, there remains a large degree of uncertainty over what interest rates will be in 2019."

Leung said recent developments pointed to an improvement in economic activity, and the consensus was that this would flow through to stronger growth in the subsequent years.

"In particular, expectations for household spending and residential construction have been revised up markedly beyond 2016. Strong migration-led population growth has boosted demand across many sectors, and lifted housing demand.

"The labour market outlook is also more favourable, with expectations of stronger employment growth and a lower unemployment rate. The unemployment rate is now expected to ease to 5.1% by 2019. However, wage growth is expected to be more subdued, in line with the weaker inflation outlook."

3 Comments

"There has been a material decline in inflation expectations recently, which risks becoming embedded in future wage and price decisions," McDermott said.

"This is one factor contributing to the current need for low interest rate settings. Low interest rate settings will help offset the dampening impact low inflation expectations will have on today’s wage and price setting behaviour. They will also help ensure inflation expectations remain well anchored.

Any proof to counteract the Japanese experience?

....the precipitous drop in JGB yields of late already suggests how NIRP is already failing. Read more

BNZ senior economist Doug Steel said BNZ economists had argued that the RBNZ "may be backing itself into a corner" with its approach on falling inflation expectations. "Today’s release exemplifies this."

Backing itself is crediting the RBNZ with more control than performance would suggest .......

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.