By Christian Hawkesby*

Each RBNZ Governor faces the challenges of their time: Don Brash battled to get inflation down to the RBNZ’s original inflation target; while Alan Bollard navigated the economy and financial system through the GFC/Global Financial Crisis. Graeme Wheeler has faced the task of lifting inflation up to target in an environment of low global inflation – so-called ‘lowflation’.

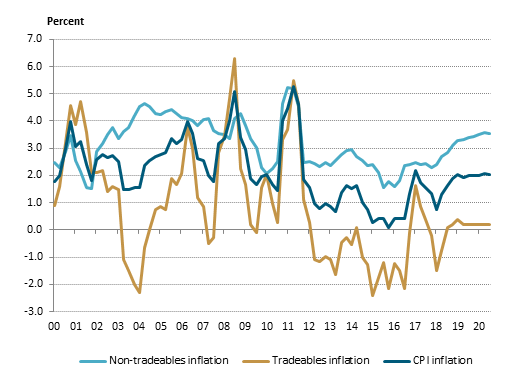

This is most clearly seen in the breakdown of annual Consumer Price Index (CPI) inflation between tradeables (influenced by global inflation, commodity prices and the exchange rate) and non-tradables inflation (influenced by domestic demand for services).

Chart 1. Tradeables and non-tradeables inflation - and RBNZ projections

However, over the past 5 years – almost the entire term of Graeme Wheeler – New Zealand has experienced a persistent deflationary force from tradeable goods. With tradeable goods dragging down overall total CPI inflation, inflation expectations have also become stuck at low levels, making the RBNZ’s job of lifting CPI inflation back comfortably and sustainably to the 2% target more challenging.

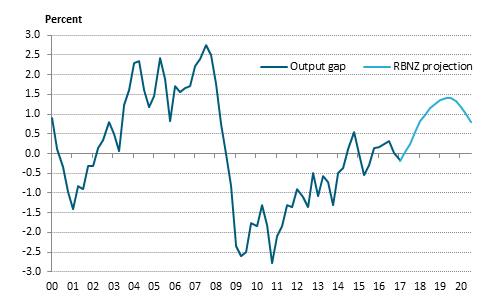

Many commentators have raised their eyebrows at the RBNZ’s 3-3.5% growth forecasts. But this is what is needed to raise non-tradeables inflation high enough to lift overall CPI inflation to target. This is evident in the RBNZ’s projections for the output gap – with GDP growth running in excess of potential growth over the projection period. In other words, the plan is to have the domestic economy running hot.

Chart 2. NZ output gap

Despite the scepticism of some economists, the RBNZ appear confident of their growth forecast.

Part of this is technical, with some catch up expected from negative surprises in Q4 and Q1. Part of the GDP growth forecast reflects strong population growth. And finally, part is fundamental, with the stimulus from National’s Working for Families package announced in the May Budget. This latter effect adds around 1% to GDP, on the assumption that after the election (if other parties formed a government instead) they would at least match the size of this fiscal stimulus.

The big question is whether the NZ economy can grow at 3-3.5% in an environment where banks are tightening credit conditions, and the NZ dollar remains elevated so that overall monetary conditions are tighter than suggested by the OCR alone. Furthermore, the current economic expansion is now 8 years old, which by historic standards is quite mature, and when economic growth often tends to moderate rather than accelerate. An implication is that, all else equal, if GDP growth is only 2% over the coming period then the RBNZ may need to cut the OCR further to generate the domestic economic growth needed to lift inflation sustainably to target.

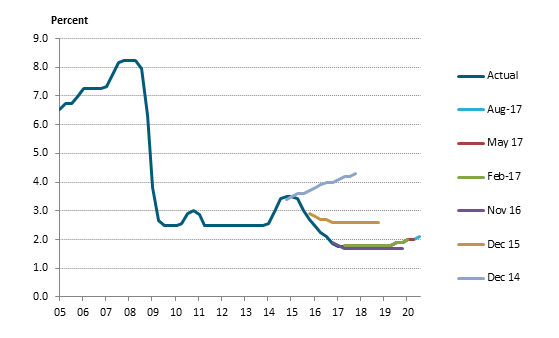

Since cutting the OCR to 1.75% in November 16, the RBNZ in Feb, May, and Aug ‘17 have illustrated a high threshold to not only change the OCR but to even signal a move in their OCR projections. The end of Graeme Wheeler’s tenure complicates the picture. But fundamentally, policy makers at the RBNZ appear to be very comfortable to wait and see if the impact of delivering 0.75% of OCR cuts through 2016 has been enough.

Chart 3. Official Cash Rate and RBNZ projections

* Christian Hawkesby is Executive Director and Head of Fixed Income and Economics at Harbour Asset Management.

6 Comments

Haven't you figured it out yet, Christian? Lower interest rates aren't going to stimulate demand! They may allow the over-indebted to remain over-indebted ( whoever they are) but demand? Nope! That came and went a couple of years back and isn't coming back for a re-run. Only.....LESS DEBT is going to create demand in the, now, longer term, and that doesn't come from lower interest rates....

Sadly, increase 'homelessness' is coming no matter what interest rates do now. The only point to be decided is:

Will it be those without a job ( higher unemployment resulting from a number of converging factors) or those that have been marooned by Negative Equity ( and have to rent their homes out, to move. Because they sure won't be allowed to sell them with NE attached)?

People all over the world have had to sell in negative equity. The banks often don't give much choice and if you are very highly leveraged then will renting out your house even cover your mortgage? Sometimes people just sell and take the loss. Some will be saddled with the debt for years to come, others will go bankrupt. If we are coming to the end of the great-debt-binge-cycle-II, the deleveraging is going to have to actually occur this time, rather than the flood of cheap credit that was the "remedy" last time. Eventually the little people will be left to pay the piper. I can't see any other way out of it.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.