This week's Top 5 comes from interest.co.nz's own Gareth Vaughan.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz. And if you're interested in contributing the occasional Top 5 yourself, contact gareth.vaughan@interest.co.nz.

1) A COVID-19 economic policy tool: retrospective insurance.

In my interview with economist Arthur Grimes this week he mentioned Alistair Milne, Professor of Financial Economics at Loughborough University, and his idea of retrospective insurance to protect businesses from bankruptcy as the world battles COVID-19.

Milne says retrospective insurance would be "surprisingly inexpensive" at a net additional cost of 2% of GDP, and could guide the allocation of public resources to "ensure no business goes under as a result of the pandemic and all who merit protection get support."

His key point is that, in order to limit the long term economic impact of the pandemic, viable businesses need to be protected from bankruptcy. Milne proposes setting a guaranteed level of support based on loss of revenue for businesses, non-profit organisations and the self-employed. Milne sees a need to correct a market failure being the absence of widespread business interruption pandemic insurance.

It is the absence of such pandemic protection that is leading to the transmission from households to firms illustrated in Figure 3 and which threatens to cause substantial and long lasting systemic structural damage, from layoffs and from the failure of healthy companies. Therefore, the overall role of government in response to this crisis is to step in and provide this insurance which has not been provided by the market.

This means that, government should now be basing their promise of support by asking the following “what if?” question. Suppose business had taken out appropriate business interruption insurance, what compensation would they require in order to ensure to avoid financial distress or being forced out of business altogether, until the impact of the disaster has receded? Similarly, suppose an individual loses income as a result of business interruption, what compensation would they require in order to maintain themselves without the threat of losing their home or their credit standing and be able to resume their livelihood once the impact of the disaster has receded?

This ‘retrospective insurance’ is a complement to, and not a substitute for, the measures of support for individuals and businesses already taken so far. All these measures are appropriate and welcome. The point of announcing retrospective insurance is to provide a framework of compensation that includes all these measures and to build confidence by setting a clear and forward looking basis for assessing the totality of public financial support so that, as the pandemic unfolds, businesses and individuals will receive.This will give them as much certainty as possible about the support they will be given. Where the payments they have already obtained fall short of that offered retrospective insurance then they can expect to get more. Where the payments exceed, then they are lucky it will not be clawed back.

Milne argues the concept of retrospective insurance shares costs appropriately between the public purse and the affected businesses. Generous compensation is provided whenever revenue decline exceeds a minimum trigger level, which is assumed to be a 10% annual revenue decline, which a well-run business should be able to absorb in the course of normal business operations without financial distress, he says.

The payout can then be based on the ratio of wages, rent and profit to revenue as recorded in the most recent annual financial statements for each firm or self-employed worker. The payout assumed is 100% of rent, 80% of wage payments and 50% of profits.

In table 2 below Milne presents an illustrative calculation of retrospective insurance for the airline group IAG.

The required data is that in the first two columns of numbers, the figures for revenue, wages, EBUITDA (profit before interest, taxes and dividends) and rent, all taken from the IAG annual report. The annual report does not distinguish rent payments from other property costs so these are assumed to be zero.

The first two rows are the assumptions about revenue loss for 2020 (assumed to be 75%, since even if they commence flying again after six months passenger numbers will remain low) and for the deductible before any retrospective insurance is payable.

The middle two columns show the calculations of eligible projected decline in wages, EBITDA and rent, under the assumption that these fall direct proportion to the decline in revenues. The total decline in revenues is 75%×25506=19130. The excess, over and above the 10% revenue loss trigger is 65%×25506=16579. The projected eligible decline in wages is then 19.5%×16579=3225 and in EBITDA 12.9%×16579=3507.

The final two columns show the calculated retrospective insurance payout. This is simply the appropriate ratio (80% for wages, 50% for profits, 100% for rent) applied to the projected eligible decline in the components of value added. The total compensation of €4334mn compared to a 2019 value added of 10358

2) Coronavirus crisis a good time to tackle tax evasion properly.

With governments around the world borrowing huge sums of money to tackle the pandemic and its economic fallout, Scilla Alecci of the International Consortium of Investigative Journalists has highlighted how useful taxes governments could be getting from multinationals and big corporates, but aren't, would be in bolstering their coffers. Instead, billions of potential revenue is being funnelled to tax havens. Perhaps now is finally the time when some serious and effective global co-ordination to tackle these tax dodgers will occur?

Gabriel Zucman, an economist at the University of California, Berkeley, said if there was one lesson we could take from the current economic crisis, it was: “Shoring up our public services starts with fighting tax avoidance and tax evasion more aggressively.”

When countries like Luxembourg offer “tailored tax deals to multinational companies, when the British Virgin Islands enables money launderers to create anonymous companies for a penny, and Switzerland keeps the wealth of corrupt elites out of sight in its coffers,” Zucman said, “they all steal the revenue of foreign nations.”

Developing countries are particularly vulnerable to such a system, with yearly tax losses estimated at around $200 billion, a figure roughly equivalent to the amount the United Nations predicts they will lose due to the coronavirus pandemic.

But it's not just so-called developing countries that could benefit.

Take for example, Italy, which has the world’s highest number of COVID-19-related deaths [since overtaken by the US] and recently announced a $28 billion plan to rescue the virus-hit economy. The country has a 30% evasion rate and, in 2016, it lost $118.5 billion to tax dodging and underreporting, according to the latest government estimates.

“The taxes that are evaded have to be compensated for by higher taxes on the law-abiding,” Zucman told ICIJ via email “or else they translate into less public goods and services for the rest of us — such as less access to health care.”

3) Stranded in paradise, an eternal honeymoon in the Maldives.

David Zweig of The New York Times has this tale of a honeymooning South African couple getting trapped in the Maldives as their homeland shut its airports and the Maldives also enforced a lockdown. Thus the honeymoon turned out to be much longer than the six days planned by Olivia and Raul De Freitas, a teacher and a butcher.

By Sunday, they were the only guests at their resort, the Cinnamon Velifushi Maldives, which normally is at capacity this time of year, catering to some 180 guests. (“Room rates start at $750 a night,” its website still says.) The resort comprises the entirety of its speck of an island. There is nowhere to go. The couple reign like benign yet captive sovereigns over their islet. The days are long and lazy. They sleep in, snorkel, lounge by the pool, repeat.

The resort’s full staff are at hand, because of the presence of the two guests. Government regulations won’t allow any Maldivians to leave resorts until after they undergo a quarantine that follows their last guests’ departure. Accustomed to the flow of a bustling workday, and the engagement with a full house of guests, most of the staff, having grown listless and lonely, dote on the couple ceaselessly. Their “room boy” checks on them five times a day. The dining crew made them an elaborate candlelit dinner on the beach. Every night performers still put on a show for them in the resort’s restaurant: Two lone audience members in a grand dining hall.

At breakfast, nine waiters loiter by their table. Hostesses, bussers and assorted chefs circulate conspicuously, like commoners near a celebrity. The couple has a designated server, but others still come by to chat during meals, topping off water glasses after each sip, offering drinks even though brimming cocktail glasses stand in full view, perspiring. The diving instructor pleads with them to go snorkeling whenever they pass him by.

The downside of the much longer than expected stay at a five-star resort was they still had to pay.

Though the couple has been paying a generously discounted rate, the bill grows ever larger. Each day that ticks by is a chip taken out of their savings that had been set aside for a house down payment.

Olivia and Raul have now made it back to South Africa, to a government quarantine facility, after 21 days in the Maldives, Insider reports.

"We came back with a private charter that was self-funded by the 40-plus South African and Mauritian tourists that were stranded in the Maldives," they said.

That private charter cost $104,000, which was divided among the passengers.

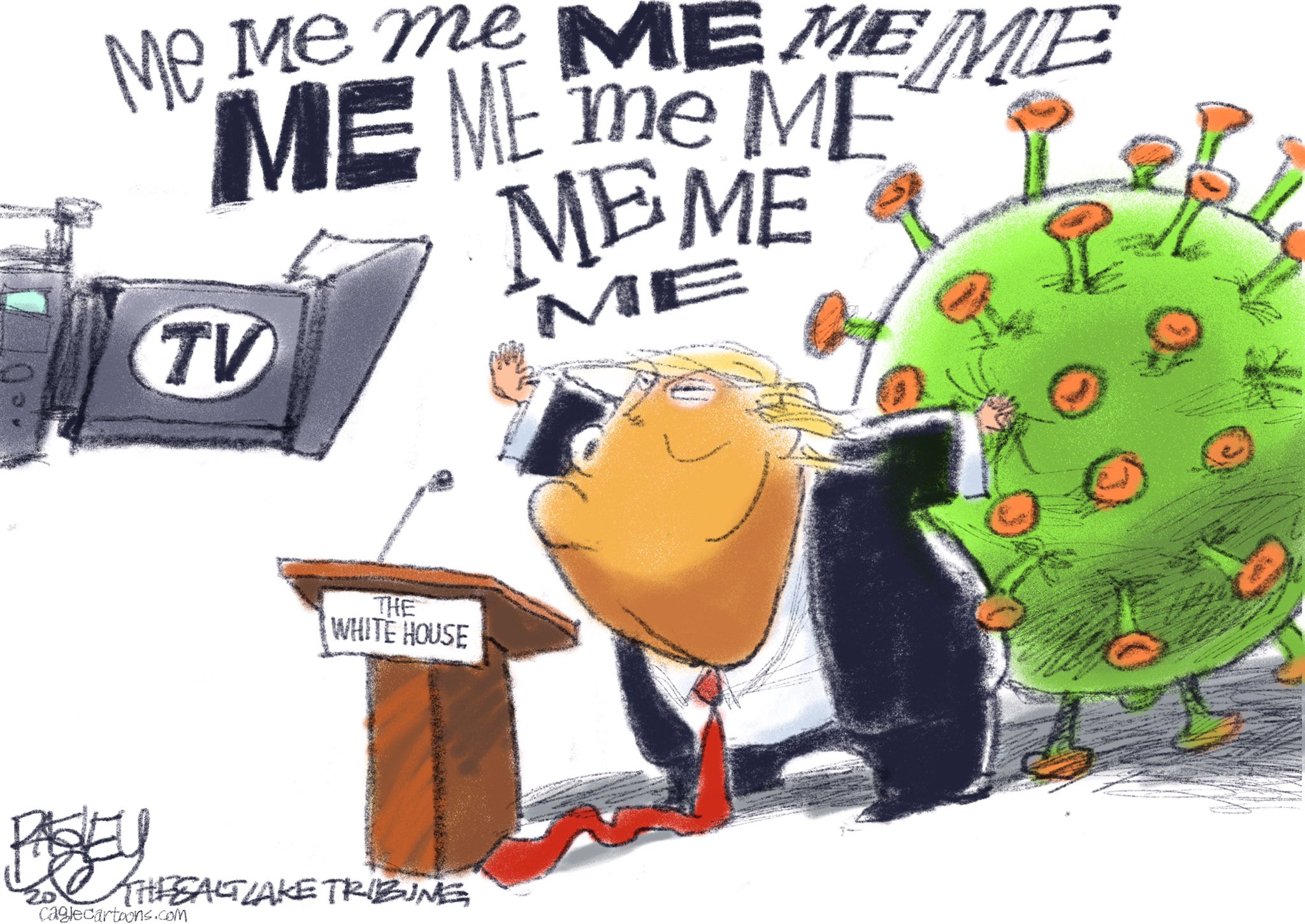

Cartoon by Pat Bagley of The Salt Lake Tribune.

4) The drugs and vaccines that might end the coronavirus pandemic.

Bloomberg reports that more than 200 different programmes have been launched to develop vaccines and therapeutics to combat COVID-19, and those behind them are in a global race to find and test the products. Bloomberg details antivirals, vaccines and indirect therapies being worked on. Bloomberg's tracker will add new ones as they start or advance in trials, gain significant backing or show promise.

Almost all of these programs are in the early stages, meaning that the gold standard of data ― clinical trials with "blinded" placebo and therapy groups ― is still hard to come by. With loosened rules and a desire to get a treatment to market quickly, it's important to cast a skeptical eye on too-good-to-be-true data.

Britain is one of the country's hardest hit by COVID-19 so far. Even their prime minister and the heir to the throne have caught it, with PM Boris Johnson ending up in intensive care. This harrowing account in The Guardian from junior doctor Rosie Hughes of her battles to save patients and catching the virus herself, is a stark reminder that we have been lucky in New Zealand so far. Let's hope that continues.

I have cared for patients from admission until death and I have held their hands when they have been too breathless to speak. I have fought hard for a patient to be considered for ventilation despite knowing that they didn’t meet the criteria. I stayed with them after my shift had ended, gowned and gloved, and watched them take their last breaths, knowing that a few months ago they might have stood a chance. I ring families to tell them that their loved one who came into hospital for something totally unrelated now has coronavirus and will not survive.

I then apologise and tell them that they won’t be able to visit because of the infection control risk. On one occasion I failed to hold back my tears while I was on the phone and hoped that my voice didn’t tremble enough for them to hear.

This week we have received constant emails from our trust about our lack of personal protective equipment (PPE) and so we have little choice but to care for the patients at our own risk using just surgical masks and plastic aprons because we have now run out of gowns too.

Hughes, 25, says she has been working in the National Health Service at a major metropolitan hospital for just over eight months. She is certainly experiencing a baptism of fire.

Testing positive for the same virus that has killed so many of my patients is obviously a daunting prospect but it felt inevitable given the lack of safe PPE. In a way, I was relieved that the wait was over and it had finally hit.

It’s not surprising that I am finding it difficult to relax at home in the knowledge that I am infected with the same virus that I have written down countless times as the “primary cause of death” on the death certificates of my patients. Many of them were young, many of them did not have underlying health conditions.

Did they give it to me? Or did I give it to them? I’ll never know, but I stay up at night wondering.

VIDEO: New Yorkers sing Frank Sinatra's "New York, New York", as an ode to the city's essential workers amid the coronavirus pandemic pic.twitter.com/J60k8vwQoM

— AFP news agency (@AFP) April 17, 2020

46 Comments

You should be leaving Arthur Grimes in the history books. He belongs under the heading 'those who believed in ever-more global tulips, for ever and ever, amen.

And he comes out poorly in this: https://www.rnz.co.nz/programmes/two-cents-worth/story/2018710893/the-e…

They mis-headed the item though; there was only one heavyweight. I look forward to a Raworth interview; she's now being asked to re-configure places like Amsterdam https://www.kateraworth.com/2020/04/08/amsterdam-city-doughnut/

Well of course I think it's silly.

It thinks money solves issues, and this late in the game it is sad to see folk thinking like that. There isn't the insurance capability to bail out the collectin of forward bets, and hasn't been for a decade, in my opiion. You have to assume an ever-growing world for that. too.

T'aint there.

Insurance to save.....bigger context now many countries have woken up to China's intention to fish in troubled waters. NZ government has to rise and be prepare to face short term pain, which on surface is Rock Star Economy - for long term gain, real economy and also not to be dependent to one country so much that it start dictating your Politics and Ploicies along with economy.

Corona Virus can be a good time to reset NZ economy and policy. Many countries cannot avoid Trap of Loan sharks but NZ can though will be hard as many in NZ have been enchanted by glitters aand glamour of overseas money from....

https://www.dailymail.co.uk/news/article-8165687/Australian-government-…

https://m.economictimes.com/news/economy/foreign-trade/keeping-a-check-…

https://www.bloomberg.com › articles : Germany Eyes Tough Rules on Foreign Investment Amid China Worry - Bloomberg - Bloomberg.com

https://tfipost.com/2020/04/we-cannot-let-china-destroy-us-spain-italy-…

https://www.ft.com/content/e14f24c7-e47a-4c22-8cf3-f629da62b0a7

Can Labour led government do it ???

Richard try telling this to people (Now in majority) who sold their $700000 house to 1.1 million or million dollar house to 1.7 million and made unimaginable profit that is hard for any average Kiwi to see in their lifetime by doing decent jobs. This is how to throw money and gain entry to rule.

Many experts do know that China has so much money that they can buy tiny NZ not once but number of time and are also aware of their strategy to gain entry and dominate but if each individual or agencies are making unheard profit for now, who cares and now this ponzi has to keep continue or NZ will go backward.

Like a drug, now once hooked, hard to let go.

So now, this money/ ponzi is need of NZ and no power can afford to disrupt it. Gave too much time to National - 9 years to damage it.

Now hard but yes if any opportunity is now or we are, if not already their colony.

Trademe property listings: GJ Gardner have thrown ALOT of properties onto the market this last couple of days (scroll down on link). But who will buy in this market?

https://www.trademe.co.nz/browse/categoryattributesearchresults.aspx?se…

Number 2 will include evasion/ avoidance by all the cruise ships that visit(ed) NZ and Australia. All registered in Flags of Convenience countries.

When (if) they start up again I hope we get our share. Australia in particular has definitely taken a financial hit from their actions.

New Zealand has been waiting and waiting and waiting for the OECD and G20 to establish a set of rules to neutralise BEPS tax erosion. New Zealand (and Australia) have been waiting for 10 years that I'm aware of. The biennial response is "we are waiting" America is never going to agree because the biggest evaders are US multi-nationals

Easy to forget when Trump came to power US multi-nationals held $4 trillion of untaxed profits sitting in off-shore jurisdictions. Trump offered them a low flat tax to bring those profits on-shore to boost local production and local jobs. History tells us those companies used the funds to do share buy-backs instead

Meanwhile nothing happens. NZ has to go it alone

This is stale news. The MSM are never going to foam at the mouth over it now

A unilateral statement that we intend taxing all earnings made by foreign companies in NZ as if they were based here would do. So if we are 1% of Google's market we intend to tax 1% of their earnings or whatever their NZ subsidiary declares.as profit - whichever is the highest. NZ has what may be a very short period of being admired overseas - if we say we will do it then most EU countries (not ireland) will do the same and the more Trump complains the more popular it will be. Get our fair share of earnings made by Facebook, Amazon, Uber, Google, AirBnB, etc.

Yep, as demonstrated by The 15 arrests in Hong Kong this weekend.

https://www.bbc.com/news/amp/world-asia-china-52338493

DW news

https://youtu.be/KQ_MDhMtvqM

Singapore or Hong Kong’s economic model is largely about arbitraging the inefficiencies, or loopholes, in their larger neighbours. To some extent, money laundering is the core business. It doesn’t take a genius to come up with this economic model. How hard could it be? You just need a powerful friend for protection. Singapore has the United States. China just lets Hong Kong get away with it. It believes that what’s in Hong Kong stays in China anyway. And some powerful vested interests need Hong Kong to get their ill-gotten wealth out. Link

"To some extent, money laundering is the core business."

Correct, and NZ since 2012/3 has followed that model. The direct effect has been inflation of land prices and thus residential, commercial property prices through allowing opaque Chinese money to flood into the country.

There is a perception of local wealth due to the asset value inflation whilst the effects of pricing out the younger generations from the property market and the resultant leverage employed by those who have bought has been largely ignored.

Should also mention No 6 : NEGATIVE INTEREST RATE

https://voxeu.org/article/negative-interest-rate-policy-post-covid-19-w…

Markets no longer believe that QE in the US can bring expected inflation to target, much less create very high inflation. Of course, markets learned this long ago in the case of Japan, where long-term inflation expectations have been stuck below half a percent through very aggressive QE programs and even, one might argue, de facto helicopter money. Given the steady downward drift in global real interest rates, the difficulties in raising expected inflation, the ineffectiveness of quasi-fiscal instruments at the zero bound, and ultimately the importance to central bank independence of having an instrument of unilateral control, create a strong imperative for proactively preparing now for a negative interest rate world that is perhaps inevitable.

For which discernible purpose?

Japan has had negative interest rates for savers at the front end of the curve for a protracted period of time. And yet it remains ill equipped with unsatisfactory infrastructure investment to deal with COVID -19.

China tightens its Grip on the UN narrative..Check out the handover ceremony picture in the first link. Why is the UN handing over medical supplies to China? Obviously made in China and being returned to China after the UN has paid a pretty sum. You cant make this stuff up!!

https://www.undp.org/content/undp/en/home/coronavirus.html

"Since its emergence in Asia late last year, the virus has spread to every continent except Antarctica"

Correction for the UN.

"Since its emergence in CHINA late last year, the virus has spread to every continent except Antarctica"

https://unctad.org/en/pages/newsdetails.aspx?OriginalVersionID=2315

"With two-thirds of the world’s population living in developing countries (excluding China) facing unprecedented economic damage from the COVID-19 crisis, the UN is calling for a US$2.5 trillion package for these countries to turn expressions of international solidarity into meaningful global action."

No body knows how well the disbursement of this amount of money will be handled the the UN. Take a look the salaries and allowances the UN ivory towers team are on? No NZ for some reason but Australia is 100k+

https://www.un.org/Depts/OHRM/salaries_allowances/salaries/gsumoja.htm

I vote the UN all take a pay cut of 25% across the board.

Blame game is on for now but real agression will come after the corona virus issue is contained. Bad the virus get worse will its after effect...

https://www.thesun.co.uk/news/11428731/china-ahead-of-us-coronavirus-de…

Hard Talking and Responsibilities with many head rolling cannot be ruled out. Hopefully Truth prevails.

Already ground preparation is on... https://www.rnz.co.nz/news/world/414586/trump-threatens-consequences-if…

Being election year President Trump will have to go all out

I think before we get serious about tax evasion, we need to get serious about open ended massive deficit spending by governments who have lost all fear of debt. It's obscene and the huge taxes needed from it will be handicapping recovery into the next decade and next generation.

So many questions: our wage subsidy and similar packages were necessitated by level 4 lockdown (and will be exacerbated by level 3 which makes such little difference): did we need to do that? [I'm not interested in the arguments for and against, I'm totally over that on Twitter; but level 4 in the strict way it's been done is not a given as shown by the farming sector which has safely remained open, as with going to the supermarket]. Then that package was so profligate by being totally untargeted: every business can keep 12 weeks worth of wage subsidy, even if for 8 weeks out of that 12 they are trading normally; no requirement to pay back: that's nuts. Also, okay bring it down for workers (although the big companies, Harvey Norman, Warehouse, et al, should have had rainy day funds to get them through a couple of months (they better get punished in their valuations if that does not now become a priority after this); but personally I think there should have been the requirement for business owners: self employed, shareholder employees, etc to at least live on their savings for one month (or there should have been an asset test put on this). .... It was supposed to be absolute emergency package, but we have such a free-luncher mentality in society now learned from untrammeled welfare statism it really has all the hallmarks of a lolly scramble by some. .... And all of this before I even get onto how the trap was set for depression from this by 80 years (the last 12 on steroids) of lose monetary policy out of central banks that found it so easy to loosen, but never to tighten and normalise, to the point price discovery has been destroyed, and we went into this crisis with no room in monetary policy at all. If good comes from this, disband the RBNZ and get back to a free market.

I have some thoughts on the decision making criteria for coming out of lockdown. Check it out here.

https://medium.com/@brendon_harre/has-new-zealand-made-the-public-healt…

Went to collect the mail , and I have just read the "personal " invitation by Auckland Airport ( in which my wife and I own some legacy shares from a shares-for-dividend scheme nearly 15 years ago ) to purchase shares up to $50,000 at what would be regarded as a really keen price ............six months ago ($4.66/ share )

We will NOT be participating .

Quite apart from making it clear there will be no dividends for the foreseeable future , I did a fair value investigation

Fair value is $1,55 or thereabouts.

Unless you Bono or Elton John looking through rose -tinted glasses , this share offer is not a winner .

I personally hold no optimism for Auckland Airport in the short-to medium term , and cannot see any sane person with the gumption to stick their head above ramparts for this offer .

Basically Auckland Airport want to retire interest - bearing debt ( they use the euphemism " shoring -up" their balance sheet ) and replace it shareholder funds at zero obligatory cost .

Their shareholding is is also problematic with nearly 60% of shareholders being the general public and only 24% being institutional investors and 18% being Government ( ACC, NZ Super, Auckland Council ) , and I reckon the Government will pass this over . The Super needs cashflow , as does ACC and Auckland Council has other fish to fry like building roads and train sets .

Lastly , there is no depth on the Board of Directors , the average being in the job for less than 24 months

New Zealand's critical weakness has always been the gutlessness of Kiwis.

For every NZer willing to have a go at something new or different, there are at least a thousand others who will sneer and smirk and mock them, while smugly explaining why their idea is stupid and won't work and how they will fail and everyone will laugh at them and it'll be so embarrassing, you knoooOOOWWW?

Risk is almost as bad as embarrassment, and Kiwis will die to avoid either. This is why NZ has always been such a powerhouse at absolutely nothing at all and is likely to lead the world in doing nothing for the foreseeable future.

CTE, spinal injuries and Jobs for the boys (Robinson, Foster et al ) will see rugby become an awful memory in 10 years. The thuggish Shag getting a knighthood was simply an indictment on NZ society.

Farming, don't expect any relaxation from the pressure groups. The virus will be something the world will overcome at some pt but I dont expect the climate issues will ever be defeated.

“I have written down countless times as the “primary cause of death” on the death certificates of my patients. Many of them were young,“

Yet only 1% of the UKs COVID deaths are under 40yo. She must have seen a lot of deaths to have seen “many” young!

None of these stories seem to align with the stats.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.