Today's Top 5 is a guest post from the team at Massey University's GDP Live.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz.

And if you're interested in contributing the occasional Top 10 yourself, contact gareth.vaughan@interest.co.nz.

1. Global liquidity trap – have we reached a point where monetary policy is no longer effective?

Photo by Christine Roy on Unsplash

On the 2nd November the IMF chief economist issued a warning that the world appears to be in a global liquidity trap of persistently low interest rates and low demand.

COVID-19 has caused a global loss of demand as consumers tighten their belts and only spend on essential goods. Those in the top 1% have no need to spend more and those in the bottom 90% are so indebted they can’t spend more even if they wanted to. As a result, monetary policy may have reached the end of its effectiveness in reinflating the economy and stimulating demand. Governments will now have shoulder the majority of the burden of re-inflating the economy through cash transfers to the citizenry and investments in infrastructure, health and the environment.

Exacerbating this, advanced countries have been struggling with persistently low growth and high household debt ever since the Global Financial Crisis. And then there are heightened risks of currency wars which threatens multilateralism just at the time the world most needs it.

From the Financial Times:

“For the first time, in 60% of the global economy — including 97% of advanced economies — central banks have pushed policy interest rates below 1%. In one-fifth of the world, they are negative. With little room for further rate cuts, central banks have deployed unconventional measures.

Despite this effort, persistently low inflation — and in some cases intermittent deflation — has raised the spectre of further monetary easing to achieve negative real rates if another shock strikes. It has led to the inescapable conclusion that the world is in a global liquidity trap, where monetary policy has limited effect. We must agree on appropriate policies to climb out.”

2. Climate change is back on the agenda.

Photo by Patrick Hendry on Unsplash

With a change of President, climate change is back on the agenda in the US. However, for Joe Biden to address the issue he will need to understand what is driving the large portion of Americans who supported Donald Trump’s decision to pull out of the Paris agreement on climate change in mid-2017.

According to global think tank Carnegie Europe they are largely the lower-middle class who feel left out of the benefits of globalization yet ironically live in areas of the US which are the most negatively impacted by climate change. The fact that they can’t see that their own economic and personal safety is at risk by failure to act is an indictment on political parties on both sides of the fence.

From Carnegie Europe:

“If the US federal government is to have a chance at significant climate action over the next four years, it will need to look at what drives economic disenfranchisement. This prevents affected populations from seeing climate change as a pressing issue. In other words, the Democratic Party will need to engage in a deep repositioning of its discourse and its own priorities. It must convey the message that U.S. security is best assured through international cooperation to meet a threat of planetary scale—a threat that many Americans already experience.”

3. Why is the global economy recovering faster than expected?

All of the recent evidence suggests that the global economy – for the rich countries at least – is recovering faster than the initial dire predictions of a recession comparable to the Great Depression. Unemployment figures, house prices and equity markets have proven to be remarkably resilient. According to The Harvard Business Review this recession was different to any experienced in recent times. The differences were the nature of the recession (not a financial crisis), the strong response from monetary and fiscal policy and the fact that there was no “overhang” from the last expansion that needed to be worked off.

They sound a note of caution though. Looking at the US, so far the “easy” sectors have led the recovery with sectors that were largely unaffected by COVID (finance and housing); sectors that were impacted by lockdowns, but not social distancing that bounced back relatively quickly (vehicles and durable goods); and sectors that won’t be able to meaningfully recover until there’s a vaccine (hospitality, travel). The next stage relies on the recovery of the third sector and that is really dependent on the availability of a wide-scale vaccine.

From the Harvard Business Review:

“Many parts of the US economy have returned to pre-crisis levels of activity. Indeed, as the 3Q GDP release last Thursday highlighted, over the last three months growth has been the highest ever recorded. While this does not indicate that the US economy has returned to health or to pre-crisis levels of activity, it is testament to an extraordinarily vigorous rebound after a historically negative second quarter.

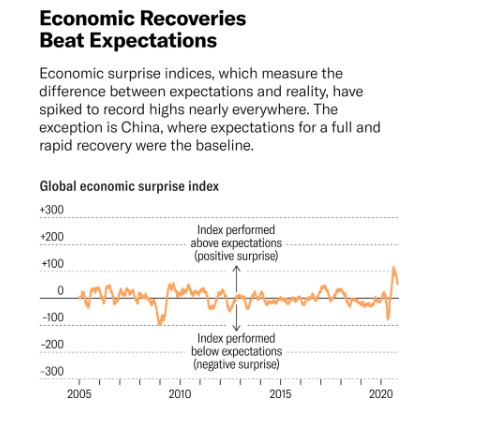

These patterns are true around the world: Economic surprise indices, which show an amalgamation of the differences between realized and expected performance, have spiked to record highs everywhere — with the exception for China, where expectations for a full recovery were the baseline.”

Source: Harvard Business Review

4. Inflation could actually be higher than we realise.

Photo by Imants Kaziļuns on Unsplash

The usual economic models for determining CPI in the early months of the pandemic may have been under reporting the true inflationary impact of a change in spending patterns. A new paper from the IMF suggests that the existing models just weren’t designed to cope with the disruptive effects of lockdowns, working from home and physical distancing, let alone the sudden reductions in income. The flux in normal spending patterns on the supply and demand side essentially rendered the old patterns obsolete overnight.

They estimate that in Canada the CPI could have been 0.23% higher than reported and in the US it may have been underweighted by 0.32%. Although it was a short-run problem, the differences between current spending patterns and the CPI weights are likely to affect the ongoing accuracy of the CPI.

The IMF reports:

“Lockdowns, working from home, and physical distancing caused people to spend larger shares of their household budgets on food and housing, while fewer people bought nonessentials, like airline tickets and clothing. And with incomes down as millions have lost their jobs, spending on nonessential items will likely remain depressed.

The consumer price index (CPI) does not reflect these abrupt changes in spending patterns because the CPI weights are not continuously updated. For example, the CPI could be pulled down by a decline in the prices of nonessentials that are no longer purchased.”

5. Maybe things are returning to the old normal after all?

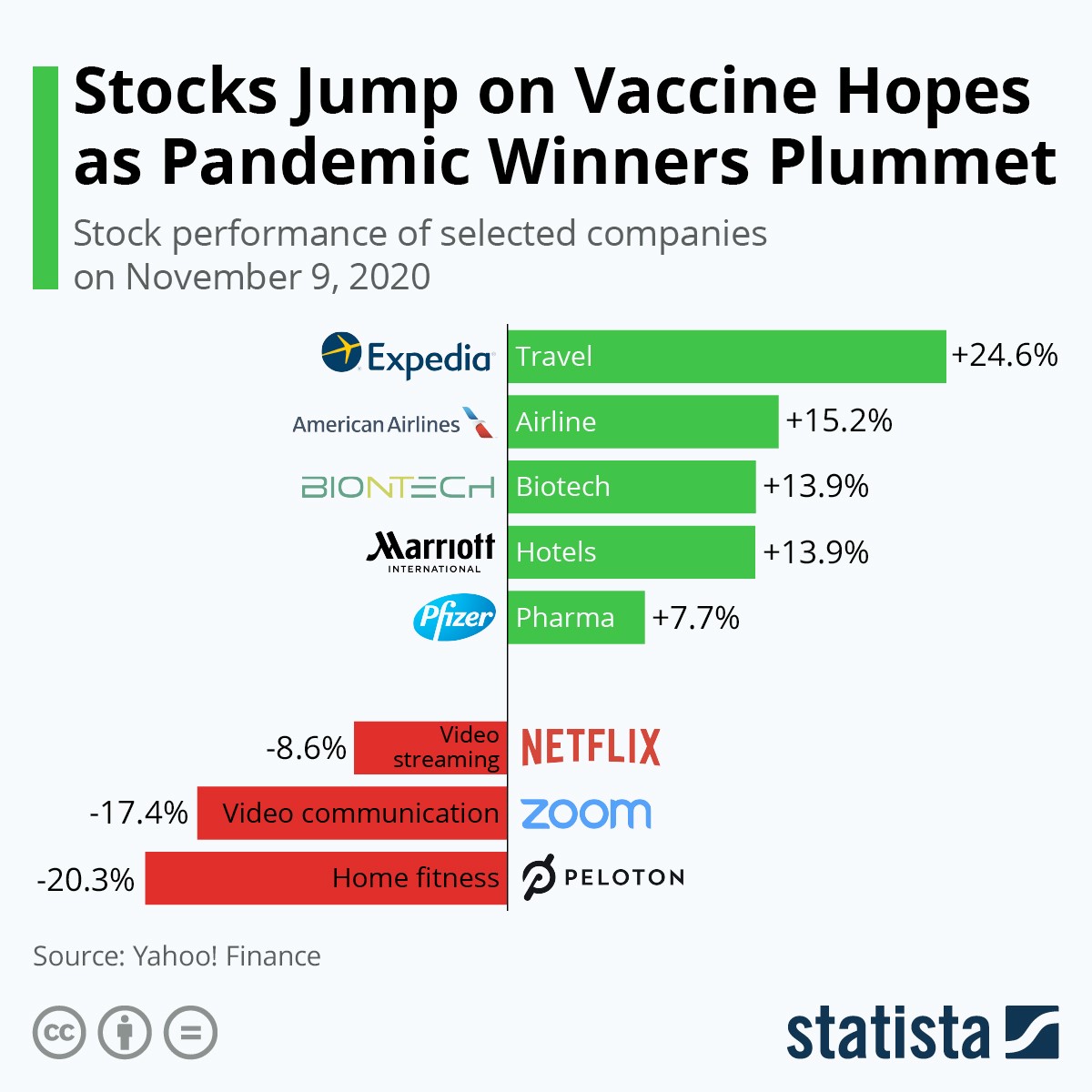

The announcements that Moderna and Pfizer and BioNTech’s vaccine candidates were highly effective against COVID-19 in trial candidates has given a boost to sharemarkets which are feeling more bullish on the travel and accommodation industry.

In a move that suggests the worst may be behind us, the “pandemic winners”, such as Zoom and Netflix also declined. The optimism may be a bit premature yet as the current vaccines have yet to complete phase 3 trials, be approved, produced and distributed. A new IPSOS survey also shows global confidence in the potential efficacy of a COVID-19 vaccine is slowly falling. Most adults in a survey of 15 countries don’t expect a vaccine to be available before mid-2021 and even then only 22% of respondents said they would get vaccinated immediately.

According to Statista:

3 Comments

If New Zealand requires government action to reflate its economy I think we're in a real pickle because neither major political party has shown any ambition in advancing major projects. Everyone is fighting for the political middle ground as society is bifricating.

"The announcements that Moderna and Pfizer and BioNTech’s vaccine candidates were highly effective against COVID-19 in trial candidates has given a boost to sharemarkets which are feeling more bullish on the travel and accommodation industry."

The marketing hype of big pharma is in full swing with Pfizer leading in the MSM in NZ in the last two or so weeks with Oxford taking a back seat until today.

Of concern is potential USA relaxing of trial standards in order to get ahead of their European counterparts. In any event the USA are generally different on many standards, not just the medical field from the Europeans. I hope the NZ MoH have sufficient insight to discern this.

The race to book vaccines ahead of the released final trials begs the question are MoH evaluating the different test trial methods. I hope so. There will be a huge quantity of data to analyse or check. Just up NZ Stats street in conjunction with the relevant medical scientists.

The growth in the"recovery".... What's the odds this is a mirage? Even once the vaccines kick in, it'll be late next year. When will borders be open and tourism, travel and business travel be back? End of next year. There's all sorts of economic scarring going to happen. We're talking about a recovery when huge numbers of furloughs and mortgage deferments haven't even ended yet. Large numbers of businesses that would usually have folded have been kept on life support through this period. What happens when support end and they finally fold? There's a lot that s yet to happen before we can think about recovery, and that's here in nz. Let alone the covid wave about to swamp the usa and European health systems. We're not even in winter yet.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.