This Top 5 comes from interest.co.nz's Gareth Vaughan.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz. And if you're interested in contributing the occasional Top 5 yourself, contact gareth.vaughan@interest.co.nz.

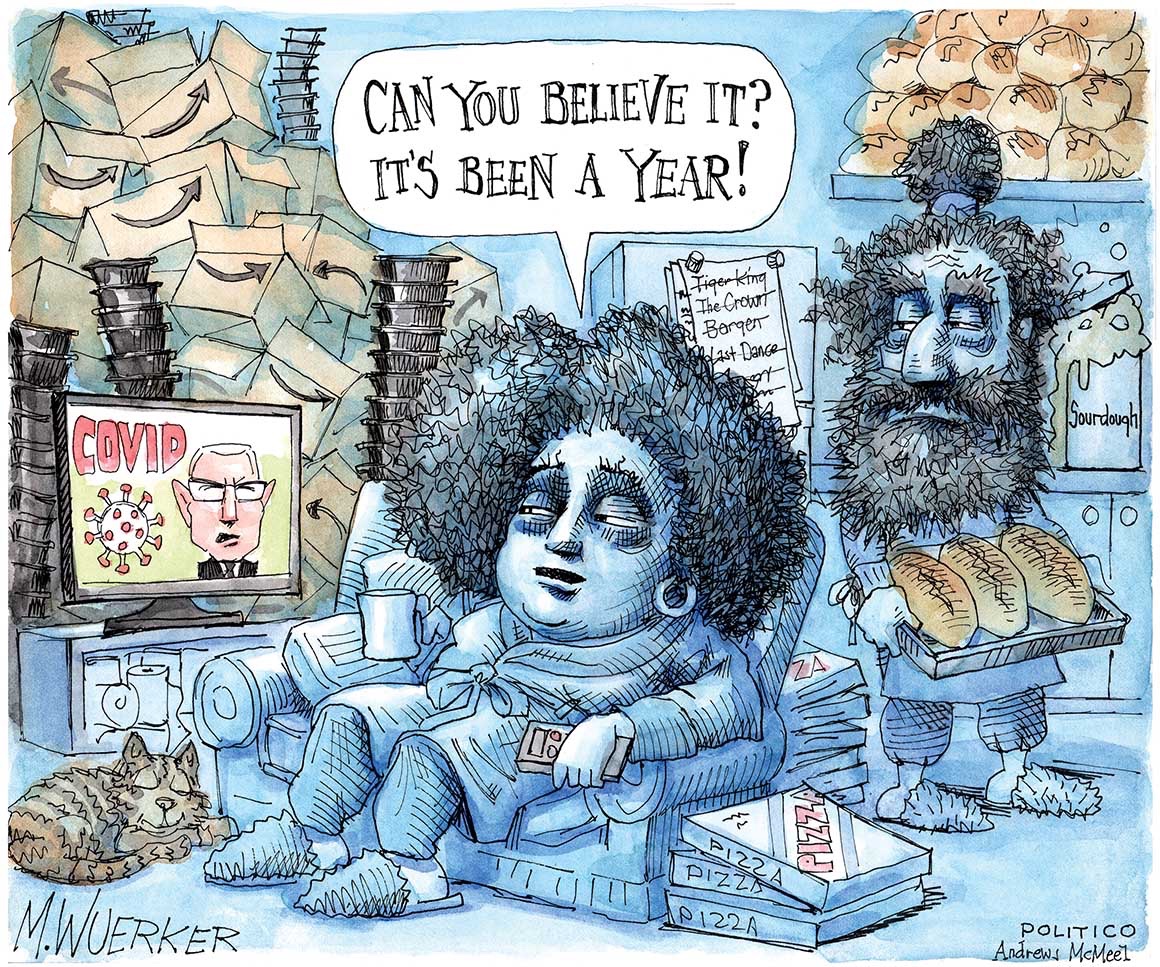

Cartoon: Matt Wuerker, Politico.

1) 'Negative interest rate policies have worked.'

In a recent blog post from the International Monetary Fund (IMF), authors Luis Brandao-Marques and Gaston Gelos argue negative interest rate policies, implemented in a range of countries, have worked.

Remember that just a few short months ago the Reserve Bank of New Zealand (RBNZ) was making serious noises about taking the Official Cash Rate (OCR) negative. And in last month's Monetary Policy Statement the RBNZ said the banking system is operationally ready for negative interest rates, with its Monetary Policy Committee prepared to lower the OCR from 0.25% to provide additional stimulus if required.

Negative interest rate policies have proven their ability to stimulate inflation and output by roughly as much as comparable conventional interest rate cuts or other unconventional monetary policies. For example, some estimate that negative interest rate policies were up to 90 percent as effective as conventional monetary policy. They also led to lower money-market rates, long-term yields, and bank rates.

Deposit rates for corporate deposits have dropped more than those on retail deposits—because it is costlier for companies than for individuals to switch into cash. Bank lending volumes have generally increased. And since neither banks nor their customers have markedly shifted to cash, interest rates can probably become even more negative before that happens.

Brandao-Marques and Gelos come across as pretty gung-ho about negative interest rates. I imagine a few savers in countries where they've been applied may disagree...

In sum, the evidence so far indicates negative interest rate policies have succeeded in easing financial conditions without raising significant financial stability concerns. Thus, central banks that adopted negative rates may be able to cut them further. And those non-adopting central banks should not rule out adding a similar policy to their toolkit—even if they may be unlikely to use it.

2) The case for financial transactions taxes.

In a submission to the New York State Assembly, the Tax Justice Network argues the case for financial transactions taxes (FTT).

An FTT does what it says on the tin. States apply a tiny tax rate (for example, 0.1 percent) on the value of financial transactions such as the sale of shares or derivatives. Well designed FTTs have three main benefits: first, they raise significant tax revenue, delivering a welcome transfer of wealth from rich to poor; second, perhaps more importantly, they curb excessive and harmful high frequency financial speculation (which makes up around half of all US stock market trading now) while leaving normal trading and investment intact; third, they boost transparency, giving tax authorities better oversight of financial activities.

The submission is in response to a bill promoted by Assemblyman Phil Steck that effectively looks to turn back the clock.

The form of FTT in play is the Stock Transfer Tax [STT], a tax on share dealing that has been on the books in New York state since a Republican governor introduced it in 1905 – and still is. The tax was progressive and highly effective, raising around $80 billion (in 2020 dollars) until 1979 when the New York Mayor and state governor caved into Wall Street pressure and phased in a 100 percent annual “rebate”, which unfortunately also remains in effect. So the tax is in effect levied – then kicked straight back to Wall Street. According to detailed calculations by co-author James Henry, who is helping Steck organise the fight, New York state has lost $344.2 billion in lost STT revenues since 1979 when they started phasing in the rebate (figure is in 2020 dollars: original data sources are here and here.)

“The whole public sector has been starved,” said Steck.

His bill is clear and simple: it removes the rebate. If enacted, it would levy a tax of five cents on every share trade valued over $20 – so for the median Nasdaq share traded, worth $48, this would amount to an insignificant 0.1 percent tax. It behaves like a progressive sales tax, vastly lower than the eight percent tax New York residents pay on retail items.

The STT would be painless and easy to implement – and, of course, would prove immensely popular. Steck’s bill currently has 54 sponsors in the New York assembly – and it only needs 60-65 to get accepted.

The submission notes the expected push back from Wall Street and the European banking sector describing this as "versions of the same threats and spurious arguments we have seen, time and again, around the world, whenever anyone wants to tax financial capital." The submission counters five claims from the banking lobby, starting with the one below.

Claim 1: that this is a ‘tax on working families’ The idea here is that financial institutions will simply pass the cost of the tax onto end investors – such as pension funds.

The exact opposite is true, for several reasons. First, we must distinguish between investors holding shares for the long-term – like pension funds – and high-frequency traders [HFT]. The former has legitimate needs, while the latter provides no useful service to the economy: their business is to use super-fast computers to flip shares milliseconds ahead of their competitors, to gain a trading edge over their counterparties, which include pension funds. This is pure wealth extraction from others. The 0.1 percent average STT hardly touches the ‘good’ investors, because it is levied only once per trade – while it would hammer the HFT predators (which are effectively levying a private tax on all share owners every time they use their supercomputers to trade against them.)

— Robin Wigglesworth (@RobinWigg) March 9, 2021

3) Exporters battle shipping container shortage.

We've heard a lot over recent months about global supply chain problems, notably import delays and high freight costs. Locally this has been highlighted by delayed imports through the Ports of Auckland.

Here Bloomberg looks at what Asian countries are doing to try and alleviate a shipping container shortage jeopardizing their overseas trading.

Government-owned Indian Railways has moved empty boxes to inland depots like Delhi from seaports for free. South Korea has deployed an extra nine vessels on the Trans-Pacific route to help local manufacturers while China’s state-owned shipyard, Cosco Shipping Heavy Industry, has converted at least one freshly built paper-and-pulp carrier to transport the containers.

It's not just major exporters such as China and South Korea taking action.

The UTLC Eurasian Rail Alliance reduced tariffs last April for transporting empty containers via its Europe-China link. The company jointly formed by the state railways of Russia, Kazakhstan and Belarus said that this would help “avert the shortage of containers for loading in China.”

Ultimately, mass vaccination is touted as the circuit breaker.

Government role is limited and market forces will ultimately determine how things pan out, said Ajay Sahai, director general at the Federation of Indian Export Organisations.

“The best thing governments can do is ensure rapid and effective vaccination of their populations so that landside logistics labor capacity and productivity can be restored to pre-pandemic levels,” said Heaney. “That will do a lot to improve the circulation of containers.”

New Zealand has been running an MIQ scheme the same scale as Australia (both countries been allowing around 2000 arrivals a week), despite the latter having five times the population.

— Matt Nippert (@MattNippert) March 11, 2021

4) Niall Ferguson's inflation concerns.

Historian Niall Ferguson is worried about inflation. In this Bloomberg article he compares where the world's at now with events from the past. Whilst acknowledging he has mistakenly worried about inflation before, Ferguson sees similar concerns today to where the world was at in the 1970s. He notes economist Milton Friedman's famous comments in 1970 that; “Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

Ferguson also ascribes significant weight to concerns raised by former US Treasury secretary and Harvard University President Lawrence Summers of President Joe Biden's US$1.9 trillion fiscal stimulus. Whilst suggesting the US Federal Reserve may not fear inflation, Ferguson himself does.

In Charles Dickens’s “Great Expectations,” the orphan Pip comes into a fortune from an anonymous benefactor and embarks on the life of a gentleman — hence his great expectations. Only later does it become clear that the money comes from a dubious source and it ends up being lost altogether: “My great expectations had all dissolved, like our own marsh mists before the sun.”

It may ultimately be that our great expectations of inflation will dissolve in a similar way, vindicating [Federal Reserve Chairman Jerome] Powell and making fools of aged economists and bond vigilantes alike. But the resemblances between our situation and the one Milton Friedman described in 1970 are striking — even if it is not quite true that inflation is always and everywhere a monetary phenomenon.

I did not watch the Harry & Meghan interview.

— ian bremmer (@ianbremmer) March 9, 2021

The Royals are a tourist mechanism in the UK. We have that in the US. It’s called Disneyland. I don’t watch interviews with Mickey Mouse, either.@gzeromedia | World #In60Seconds: https://t.co/ViXtYr3v43 pic.twitter.com/AlrGRDOKTJ

5) COVID-19, global trade & inflation.

Andy Haldane, the Bank of England's Chief Economist who is also a member of its Monetary Policy Committee, has also been talking about inflation. In a recent speech Haldane suggests COVID-19's negative impact on global trade, on top of a pre-existing push-back on globalisation, may add inflationary impetus to the global economy. An interesting theory, but once COVID-19's no longer dominating our lives and with Donald Trump no longer in the White House, will the globalisation agenda gather new steam?

A second supply-side effect working in the same direction is globalisation. The world witnessed many decades of under-interrupted growth in world trade and global value chains after the Second World War, much of it associated with the rising role of China in the world economy.19 On average since 1983, global trade volumes have risen by around 5½ % per year, roughly double the rate of growth of the world economy.

The Covid crisis has decisively broken those trends. Global trade volumes collapsed by around 15% at the peak of the Covid crisis, compared to a fall in global activity of around 9% (Chart 16). The crisis saw the fracturing of some global value chains, in part as a result of countries prioritising domestic over international supply of some goods and services.

With global trade barriers tending to rise over recent years, and with Covid having provided a further impetus towards localisation, it seems unlikely globalisation will remain as powerful a disinflationary force in the future as it has been in recent decades. And it is certainly possible trends in globalisation could even go into reverse in the period ahead, adding inflationary impetus.20

12 Comments

Well if the RBNZ uses negative interest rates, the government will need to do something like this:

https://www.newshub.co.nz/home/money/2021/03/western-sydney-property-li…

For every 100 windfalls gained by the property magic beans, there has to be the 1 or 2 hard luck stories. This might be one of them. However, look at the corruption and largesse that happens in Sydney constantly and is perpetuated by the way in which the whole economy is structured around the property complex. It stretches right to the top of Aussie's political structure and is pervasive.

Anyway, when I was a student in Japan, we had a kindly Japanese man take a group of foreign students out for dinner and drinks at a Japanese pub 1x per month. He would pay for everything. The guy came from farming stock and his family's land was appropriated in the 60s to build a train station for many of the new suburbs that sprung up around Japan's main cities. The family's livelihood was gone but the govt compensation ensured that they would never have to work again in their lives with more money than most could ever imagine.

"Ferguson sees similar concerns today to where the world was at in the 1970s."

Have you had a good look at the economic and social systems of 1970 and those of today, Niall?

Have you had a look at the size of the Global Population increase since 1970? And what do you think all those extra bodies are going to do for work - to provide for their welling - when jobs are disappearing faster than at any time since 1970 with technology and outsourcing?

1970 isn't the yardstick, Niall - 1890 is, when social support mechanisms and central banks, as we know them today, were non-existent. That's what's coming as Governments run out of the capacity to provide for their under utilised/ageing populations and leave them to fend for themselves.

Not going to happen?!

It already is. Ask any of our young who are trying to find a job or house themselves.

The crux of inflation is this: are the mass of pop facing higher costs increases than they get in wage increases, in a given period. If so, you have a dropping disposable income. Which means, in absence of more printing, that you get a recession. Inflation as measured is not accurate, as most serious commentators acknowledge. CB want inflation to erode debt and now more than ever. At same time they want low interest rates, so attempt to jaw bone down bond market. This little trick worked 2009-19 but no longer. No more cuts available and bond holders always lose money in coming scenario, so they want higher premium on their risk. Good luck CB, in fighting the elephant in the room

In lieu of increasing wages, we get easier credit access. Which kind of works -- see current house prices -- but it certainly means that pile of debt isn't going anywhere. It seems that the lesson CBs have learned from '08 is 'liquidity, liquidity at all costs!' Which is essentially the Japanese approach, right?-- You have so much liquidity that no one ever has to go broke, so you avoid a crash. The result in Japan has been kinda sorta tolerable in real terms -- but they went into it *after* a collapse in asset prices, not before.

It all reminds me of the classic Clark and Dawes sketch: "You only have to service the debt"

https://www.youtube.com/watch?v=DyaitC91hEM

Which is essentially the Japanese approach, right?-- You have so much liquidity that no one ever has to go broke, so you avoid a crash

Incorrect. In Japan, many companies and h'holds went broke after the bubble. The Japanese banks have much liquidity but h'holds and firms have been paying down debt and not borrowing. It's completely different to NZ and Australia where the private sector gouges on debt and people spend like drunken sailors. The stories of Japanese arrogance during their bubble are plentiful. And I think that's much like the arrogance in countries like NZ and Australia who think their bubbles are impregnable. Reality is that even at the peak of its bubble, Japanese h'hold debt to GDP was never as high that of NZ. Many lived within their means. The same cannot be said for NZ.

RE:1) 'Negative interest rate policies have worked.'

Hard to take that claim seriously - Japan's experience says otherwise.

Negative interest-rates are all that fit a post-peak society. Ask the Romans....

Financial transaction taxes are not taxing the real, but are stopping the unreal buying the real. Except that the Govt can now buy the real, using the unreal. What is needed, is spending and taxation related to the real. And we've hell-and-gone from that, and away-ing further by the day.

I think we're looking at inflation, a collapse, and then deflation (if the system holds intact enough).

Inflation in the 1970's was caused by the post war baby boom growing up wanting houses, schools and everything else. There was a lot of demand and available resources to satisfy that demand were stretched. There were unions and people were getting good wages so could afford to pay for the building required but capacity did not expand in a timely enough fashion to provide what was demanded.

You can expand the money supply if you want but if you don't expand the capacity of the economy to produce at the same time then you get more money chasing the same amount of products.

I don't think it is the same today. There is an income divide that means that a large proportion of the population don't get the same sort of wages as people in the 1970's so can't afford to buy a house without a large amount of credit. There is the same bureaucratic stupidity and penny pinching as there has always been in NZ so the same constraints in building houses and infrastructure apply regardless of the increase in demand. Today's demand is more of a pent up temporary phenomenon than a consistent increase in the average income earners buying power.

NZ was more of an internal economy in the 1970's with import substitution industry and tariffs. Covid is generating a small amount of cost associated with the free flow of imports being disrupted in today's world but I imagine that this will be reversed once the borders reopen.

I would say that inflationary tendencies are for 5 to 10 years ahead. Except for what is going to happen with the Biden stimulus.

No-one is talking about how the $1.9 trillion to be put into the US economy shortly is going to affect NZ. How is the US deficit spending going to be financed? Where are all the stimulus cheques going to be spent? Does New Zealand have a plan for what is going to happen. Hahaha just joking, of course we don't have a plan.

I have been watching the recent upwards movement of the bitcoin chart and it looks to me like at least some of the money is going to be spent gambling on crypto and shares. Will there be another wave of liquidity washing around the globe? Is the our Reserve Bank governor going to be blamed again for something that he has no control over?

Someone recently made the comment that a lot of people are saving for a deposit or have bought a house and re paying off the mortgage so fewer people are spending on other (consumption) items. So my reading of this is that money that has gone into the speculative economy is starving the consumer based economy of sales and income.

I'd like to make the point that when the next wave of liquidity arrives on these shores the govt could divert some of this funding into the real economy. The Reserve Bank will face a choice of expanding our own money supply to compensate for other nations expanding their monetary supplies or seeing the dollar rise and NZ industry slowly disintegrate a la Whakatane Board Mills.

There is an alternative. Money could be spend on New Zealand's crumbling infrastructure. Bonds could be issued by the Reserve Bank for this purpose rather than this money being pushed onto trading banks balances. It doesn't have to be the same dumbo response as the last time. Part of the money that last time went into the speculative economy could be spend on releasing constraints to future growth and productivity instead.

From a theoretical point of view I have no problem with negative interest rates, but context is all important and the playing field is incredibly distorted:

a) there is no comprehensive wealth, capital, capital gains or land tax in NZ

b) there is a very large shortage of housing – “The national median house price rose $50,000 in February, Auckland median up by $100,000 for the month, the REINZ says” (all with zero immigration)

c) RBNZ risk weightings favour housing over business loans & recourse mortgages are allowed further distorting the playing field.

d) there has been no increase in capital requirements with lowered interests rates & RBNZ delayed the stricter requirements

e) housing is a consumer requirement. It is not in the CPI and the imputed rent does not sufficiently reflect house price increases

f) the RNBZ lifted LVR requirements at exactly the wrong time & has been incredibly slow reimposing them

NZ cannot have low interest rates (we have just blown the biggest housing bubble ever), let alone negative rates without levelling the playing field first.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.