Summary of key points: -

- RBNZ surprise no.1 – reintroduction of OCR projections

- RBNZ surprise no. 2 – “heroic” GDP growth forecasts

- New Zealand completely off the radar of international investors

- US “taper talk” progressively increasing

RBNZ surprise no.1 – reintroduction of OCR projections

The master artist of “surprises”, the RBNZ Governor Adrian Orr, was true to form last week with two major surprises in his Monetary Policy Statement.

Yet again, the financial markets were taken by total surprise with the reintroduction of forward OCR interest rate projections in this statement, as it was widely expected that the RBNZ would continue with the existing practice since the Covid shock 15 months ago, of no guidance at all on the future track of the OCR. In the statement’s forecast tables was the OCR interest rate lifting to 0.50% by September 2022 and 1.30% by September 2023.

The foreign exchange market’s reaction to the surprise was again swift, the NZD/USD rate shoved immediately higher from 0.7240 to a high of 0.7320 on Wednesday 26th May. There was no expectation in the markets beforehand that the RBNZ would signal an unwinding of their super loose monetary settings as early as this. The RBNZ Governor likes to deliver the unexpected and make a splash and he achieved that result last Wednesday. However, as with all the other monetary policy announcement surprises over the last three years, the NZ dollar FX market reaction is never long-lasting and within a few days the exchange rate was back to where it was before the RBNZ statement.

The impact on the NZ dollar from this latest statement was exactly the same, with no follow-through buying above 0.7300 in offshore FX markets on the night of Wednesday 26th May. The Kiwi dollar has retreated back to 0.7250 since, following the Australian dollar which lost ground against the USD for a variety of reasons last week.

Consistent with previous Monetary Policy Statements, the Governor was in the media the next day, essentially walking back any inferences that the new OCR track higher was cast in stone and reminding the markets that there is an equal probability that the RBNZ could reduce the OCR, as there was to increase it. As always, it all depends on whether the economy actually performs to near the RBNZ forecasts that the OCR track is based on.

Actual economic performance may turn out completely different to the current RBNZ prognosis and they are forced to change their forecasts. The published projections of the OCR increasing to 1.30% by September 2023 are really just an output of the RBNZ circular economic model from which they always forecast annual inflation to be close to their mid-point of 2.00%.

Given their GDP growth forecasts and stable TWI exchange rate assumption, the OCR projection is where monetary policy conditions need to be to deliver the stable 2.00% annual inflation result. In other words, do not read too much into the OCR interest rate projections higher unless you have total confidence that RBNZ GDP growth forecasts will be 100% accurate.

RBNZ surprise no. 2 – “heroic” GDP growth forecasts

The GDP growth forecasts for the next 18 months contained within the statement were the second surprise. Six quarterly GDP increases in a row averaging +0.90% for each quarter from June 2021 through to September 2022 appears somewhat “heroic” in the face of zero immigration inflows, labour shortages, a slowing housing market, east coast drought reducing agriculture production, a potential new brain drain outflow of young people to Australia and flat business investment.

The RBNZ statement failed to address these potential risks and restrictions for the economy over the next 18 months. The NZ economy has had periods in recent history where consistent quarterly increases near to 1.00% each over an 18 month timeframe have been achieved. Two periods were rapid economic expansion following a recession (1993-1995 and 2001-2003). The third boom time was in 2014/2015 when both dairy prices and house prices were rising strongly. Looking 18 months ahead from today, the greater likelihood is that both those prices are in for a consolidation phase or small corrections downwards as opposed to roaring even higher to produce the consistently high GDP growth.

Strong periods of GDP expansion in the NZ economy are always associated with increasing business investment levels. The RBNZ are forecasting higher business investment levels over coming years. However, the evidence on the ground around the corporate board tables of New Zealand currently is that there is still a reluctance to commit to big debt-funded expansion projects, given global uncertainties (supply chain disruptions lasting a lot longer) and a left-leaning Government prone to draconian anti-business economic policy shifts.

New Zealand completely off the radar of international investors

The conclusion is that monetary policy changes in New Zealand are unlikely to influence the NZD/USD direction over the next 12 months as it seems more likely that the timing of OCR increases are pushed out as it become evident that the RBNZ GDP growth forecasts are too optimistic. The chances of independent NZ dollar strength on its own accord over the coming period are very low indeed.

It is very instructive as to the amount of offshore speculative trader/investor interest in the Kiwi dollar at this time when the rapid increase in whole milk powder dairy commodity prices in March to near US$4,400/MT failed to attract any NZ dollar buyers. Historically, the Kiwi would have followed dairy prices higher as the offshore punters see our economy as one large dairy farm.

The offshore players are now totally absent from the NZD FX market; therefore NZD/USD direction will continue to be 100% driven by the USD side of the currency pair. Offshore investors have been reducing their NZ asset weightings in both equities and bonds over recent months. Such decisions reflect future NZD gains will be harder to achieve from here to what we have seen over the last 15 months, as well as less confidence in the NZ economy from the sharp left turn in Government policies (discussed in last week’s column).

US “taper talk” progressively increasing

January, February and March saw the USD dollar appreciate against the major currencies as the FX markets anticipated stronger economic data forcing the Federal Reserve to consider how and when they would unwind monetary stimulus. April and May saw a reversal in the USD’s fortunes (hence the NZD/USD return to 0.7200/0.7300 from below 0.7000) as the FX markets started to reflect several Federal Reserve member’s views that the monetary stimulus would need to remain in place for a considerable time yet. Inconsistent US economic data through April and May reinforced that view. The US dollar direction over coming weeks/months will be determined by whether the US economic data being released consistently prints higher than prior forecasts (USD positive) or comes out weaker (USD negative).

The first lead-indicator will be the May Nonfarm Payrolls jobs numbers on Friday 4th June. An increase well above the 650,000 consensus forecast and an upward revision in the April 266,000 number will send the US dollar higher (potentially below $1.2000 against the Euro). The weekly jobless claims figures confirm the massive “return to work” trend occurring across the US. Last Friday’s PCE price index for inflation over the month of April at +0.60% was above prior forecasts. The weight of positive economic data will continue to force more Fed members to adjust their viewpoint on when and how monetary stimulus is unwound (tapering bond purchases).

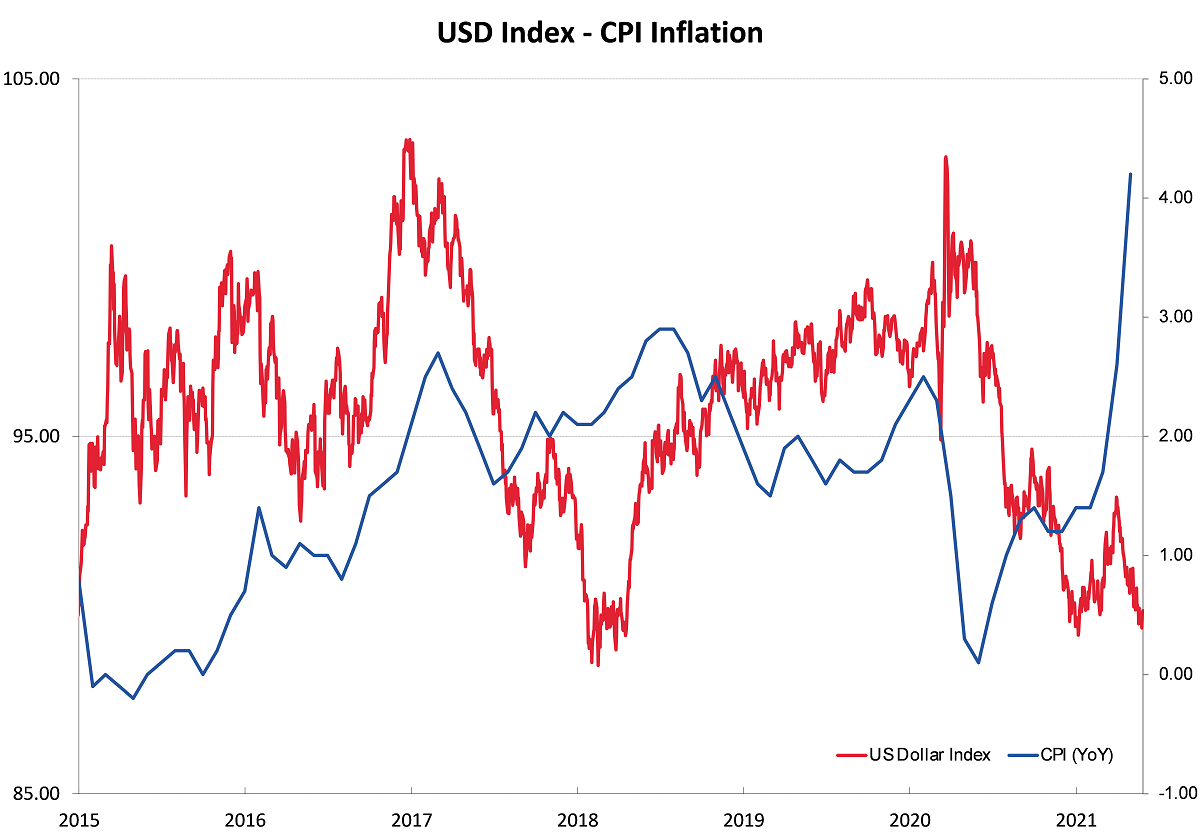

Sharply higher inflation in the US, where evidence is mounting that it could be more permanent than temporary, suggests a stronger US dollar value this year, not a weaker one (refer chart below).

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

5 Comments

"evidence on the ground around the corporate board tables of New Zealand currently is that there is still a reluctance to commit to big debt-funded expansion projects, given global uncertainties (supply chain disruptions lasting a lot longer) and a left-leaning Government prone to draconian anti-business economic policy shifts."

Prudent businesses do not invest in unstable political environments... look at the oil and gas announcements a few years ago, leaving us destined to import all of our fossil fuels. Not to mention importing coal rather than mining it our selves.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.