By Rodney Dickens

A number of the bank economists are calling for an early start to OCR hikes and for significant hikes over the next couple of years.

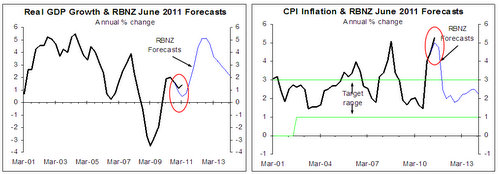

Calls for a hike before the 26 November general election intensified following Stats NZ announcing on 7 July that GDP growth in the March quarter was stronger than the RBNZ had been expecting (left chart below) and on 18 July that June quarter CPI inflation was higher than the RBNZ had expected (right chart below).

See the gaps between the thick/black lines and the thin/blue lines in the charts contained within the red oval shapes.

The fact that CPI inflation is well above the RBNZ’s 1-3% medium term target range would seem to justify OCR hikes.

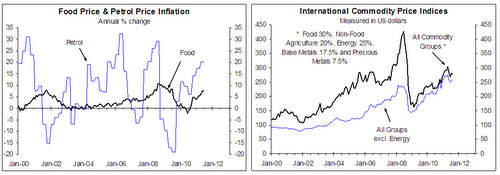

However, as discussed below, the RBNZ is supposed to focus on the medium-term inflation outlook, not the historical level of inflation that has been driven by both one-off factors that won’t be repeated and surging food and energy prices that are more likely to fall than rise in the future.

In terms of economic growth, annual GDP growth in the March quarter was only 1.4%, which is way too low to be concerned about it driving core or underlying inflation higher.

If we annualise the 0.85% increase in GDP in the March quarter it weighs in at 3.4%, which is above the historical average and sustainable rate, but there were some major industry factors that contributed to the stronger than expected number that are unlikely to be repeated.

More importantly, there is a moderate amount of spare capacity in the economy (e.g. the 6.5% unemployment rate is above the sustainable or desired level).

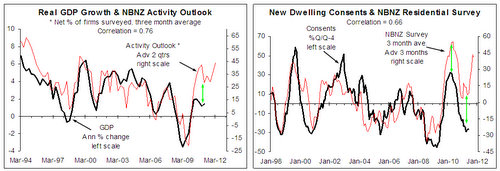

This means the RBNZ should be happy to see a moderate period of above average economic growth before it needs to rein it in. Some bank economists are using components of the NBNZ survey and a composite indicator made up of those components to argue that economic growth will soon hit 5%, meaning the RBNZ should start leaning against it now.

The left chart shows that the NBNZ activity outlook survey, which used to be a good leading indicator of annual GDP growth, went AWOL in early 2010 (i.e. well before the 4 September earthquake). The right chart shows that the NBNZ survey of residential builders’ expectations has been greatly overstating near-term growth prospects for residential building consents since early 2010. Calls for early OCR hikes based on these components of the NBNZ survey are nonsense and should be disregarded.

Labour market should be the key medium term inflation outlook

In a modern economy the heart of inflation is the labour, so rather than focus overly on the likes of food and petrol prices that can have a major short-term impact on inflation, the key consideration for the medium term inflation outlook should be the labour market.

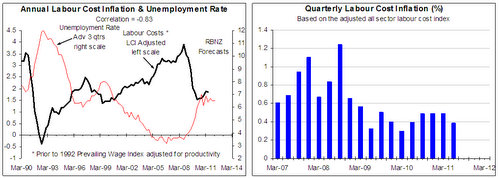

Stats NZ announced on 2 August that annual inflation in the most important measure of labour cost inflation nudged fractionally lower in the June quarter (black line, left chart). This is a measure of labour cost inflation that is designed to only pick up the bad or inflationary component of labour cost increases, which excludes the good component of labour cost increases associated with productivity growth. This means it is the most important measure of underlying inflation in the economy and reflecting this it is the only labour cost inflation measure that the RBNZ forecasts.

The unemployment rate tells us about the balance between demand and supply in the labour market and reflecting this useful roll the left chart shows a strong inverse relationship between the unemployment rate (right scale) and annual labour cost inflation (left scale). The best fit in the chart is with the unemployment rate line advanced or shifted to the right by three quarters. A change in the unemployment rate represents a change in bargaining power between employers and employees and it takes around three quarters for a change in bargaining power to filter through to labour cost inflation.

With the unemployment rate having largely drifted sideways over the last three quarters it implies that this critical measure of annual labour cost inflation should largely drift sideways for the next three quarters at least. The right chart shows the quarterly % changes in this measure of labour costs. If the quarterly increases were becoming larger there would be a reason for concern, but the increase in the June quarter announced by Stats NZ on 2 August was slightly smaller than the quarterly increases in the previous three quarters.

At the moment there is little reason to panic about medium term inflation prospects. Obviously, if economic growth was about to accelerate to 5% the unemployment rate would fall significantly and roughly three quarters after that labour cost inflation would increase. However, only the dubious leading indicators that have gone AWOL, like those shown at the bottom of the previous page, are suggesting that economic growth is about to accelerate strongly.

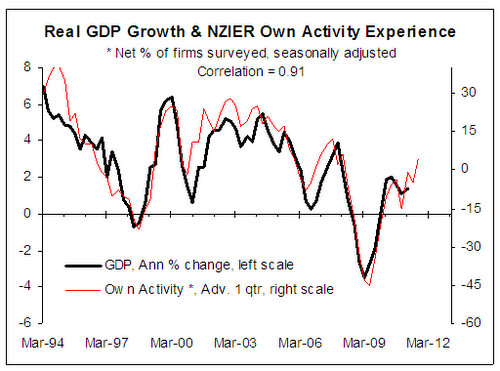

The NZIER survey of firms’ experienced activity, which leads annual GDP growth by one quarter, is still on the job and predicts a much more moderate acceleration in GDP growth in the June and September quarters (See chart below). Sound judgements about the OCR should be made on the basis of this sort of indicator rather than based on some of the components of the NBNZ survey that have been massively overstating near term economic growth/industry prospects. Just as labour costs are the heart of inflation, consumer spending is the heart of economic growth in a modern economy.

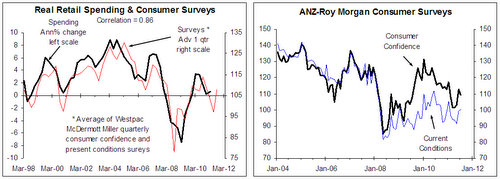

The Westpac McDermott Miller quarterly consumer surveys point to only moderate near-term prospects for annual growth in the volume of retail spending (left chart below). Supporting this expectation, the ANZ Roy Morgan monthly consumer surveys that tell us most about near-term prospects for consumer spending also remain at moderate rather than high levels (right chart below). In general the indicators that have not gone AWOL are pointing to moderate to average near-term economic growth prospects, which is not the sort of growth that will result in a significant fall in the unemployment rate or need for concern that medium term inflation prospects are at risk of getting out of control any time soon.

When we assess medium term inflation prospects there is neither a smoking gun nor an imminent risk of a gun going off. There is enough spare capacity in the economy for the RBNZ to allow a brief to moderate period of above average economic growth before it needs to start hiking the OCR. Short-term inflation prospects are different. For the next couple of quarters annual inflation will remain well above the top of the RBNZ’s 1-3% medium term range because of the 1 October 2010 increase in GST, higher energy costs because of the Emissions Trading Scheme, some increases in excise duty, and food and petrol prices having spiked.

But this is largely history.

The left chart below shows surges in annual food and petrol price inflation over the last year, but it also shows that spikes in inflation are generally followed by either much lower annual increases or especially in the case of petrol falling prices. When I look forward rather than backwards I focus on the fact that international commodity prices in general are starting to fall (right chart below).

Dairy product prices in the Fonterra auctions have in general been falling for a while. The ASB/CBA weekly NZ commodity price index has already fallen 13% from the peak level in March in NZD terms, while the ANZ monthly NZ commodity index has fallen 11% from the peak level when measured in NZD terms.

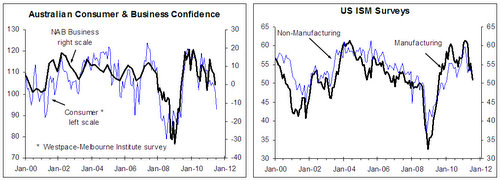

These falls partly reflect the rise in the NZD, but the NZD measures are the ones that matter locally, both in terms of incomes for primary exporters and in terms of the outlook for primary product prices in the supermarket. The fall in international commodity prices fits with signs that international economic growth is in the early stages of what could prove to be a significant slowdown. The left chart below shows recent sharp falls in two key Australian leading indicators, while the right chart below shows the same for two US benchmark leading indicators.

No need for Bollard to panic

If Governor Bollard does what he is supposed to do and makes OCR decisions based on the future rather than historical movements in food, petrol and consumer prices, I see no reason for him to panic about hiking the OCR, but instead good reasons for him to be circumspect. If needed I am happy to buy the governor a set of earmuffs so he can’t hear the barking from the bank economists who want him to hike early based on dubious leading indicators of economic growth and/or equally dubious assessments of inflation prospects.

A balanced assessment of the OCR The reconstruction work in Canterbury will have a significant impact on economic growth over the next couple of years, with implications for inflation. However, the continued large quakes in Christchurch in February, April, May and June have materially delayed the reconstruction work and it now looks likely that significant rebuilding activity will not start until next year.

This means time is on Governor Bollard’s side while he waits to see how material the unfolding slowdown in international economic growth will turn out to be and how much it might push export prices down. Again, of critical importance should be the fact that there is spare capacity in the economy so the governor can allow at least a moderate period of above average economic growth before he starts to lean against it.

The governor has called the 0.5% cut in the OCR in March an “insurance” cut (i.e. a proactive cut just in case things turn out nasty, but which should be reversed once the threat has passed). He delivered similar insurance cuts in 2003 when the source of concern was negative international developments. The 2003 insurance cuts proved to be misplaced while the governor was much too slow to reverse them, which ultimately necessitated much larger hikes in the OCR than would have been needed if he hadn’t delivered the cuts in 2003.

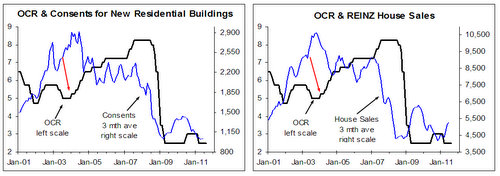

This experience might well be weighing on the governor’s mind, but the charts below show that the current situation is dramatically different to that which existed in 2003 and 2004. The left chart above shows that Governor Bollard didn’t start hiking the OCR in January 2004 until after the number of consents for new dwellings was already well above historical average levels. The right chart above shows that he waited until after existing house sales had already boomed before hiking in 2004. The left chart below shows that annual GDP growth had been running above the average or sustainable rate for a number of quarters before he hiked in 2004.

The right chart below shows that he let the unemployment rate get well below average before he hiked in 2004. To his credit Governor Bollard is trying to be proactive now (i.e. reverse the 0.5% cut in the OCR in March before he has over stimulated the economy), but in my assessment there is no need for urgency. My assessment is supported by the four charts above that show no smoking gun (i.e. an unemployment rate of 6.5% currently versus under 4% in 2004; consents for new dwellings at 1,000 per month now versus well over 2,000 per month in 2004; house sales at under 5,500 per month now versus over 8,000 per month in 2004; and annual economic growth at only 1.4% now versus 4-5% in 2004).

And the clouds are gathering on the horizon in the international economy. The lack of need for urgency is in part because the 0.5% cut in the OCR in March should not be called an “insurance” cut. Yes, it was delivered after the horrific 22 February Christchurch earthquake, which is largely why is had been defined as an “insurance” cut (i.e. insurance against the fallout from the 22 February earthquake and subsequent large quakes having a significant negative impact on the economy).

But the March cut was justified because economic growth was stagnating well before the first earthquake on 4 September and it should have been delivered much earlier. In our August 2010 monthly economic report we argued that token OCR cuts were justified because the economy was stuffed. When the RBNZ delivered the first of two 0.25% OCR hikes in mid 2010 economic growth had already come to an almost standstill (i.e. 0.23% growth in the 2010 June quarter).

The 0.5% cut in the OCR in March 2011 is better viewed as the reversal of the two 0.25% hikes in mid 2010 than as insurance cut associated with the subsequent earthquakes. This puts a very different perspective on the need to reverse the March cut.

*Rodney Dickens is the managing director and chief research officer of Strategic Risk Analysis Limited.

11 Comments

No need, real life will give us all the experience we deserve....

regards

PS Rodney is talking the next 6 months and not the next 6 years....so in the context of Bollard not panicking he is correct in this article. Core inflation is still <2% and prices are coming off commodities....so the CPI should drop back similar to America...

I also recently (today) pasted a piece from GBH's favourite banker's, GS on the same thing....we are seeing if anything dis-inflation to 1.25% they think....I agree.

regards

Agree there is no urgency and its still looking rough....though I think a rise this year (September) so ppl take Dr Bollard "seriously" seems probable and later seems to close to the election to my mind. I wouldnt raise it myself but then Im such a negative person....hahahaha....this time next year maybe.....

regards

This just out from ASB:

"This week’s events will be dominated by reaction to Standard & Poors’ (S&P) downgrade of the US long-term sovereign credit rating from AAA to AA+. The other ratings agencies, Moodys and Fitch, had somewhat reluctantly confirmed the US AAA rating after the recent debt deal was reached.

S&P downgraded the US’s sovereign credit rating because it fell short of what it calculated was necessary to stabilise the government’s medium-term debt dynamics. But the increasingly fractured state of US politics was another key reason. Many watching the US debt ceiling saga would probably perceive children in a sandpit as having a better chance of sharing their toys than the US houses of government have of coming to a sensible fiscal compromise.

So what does the rating downgrade mean? While a downgrade from S&P seemed probable, the decision is in some sense a step into the unknown. The US AAA rating dates from 1917 (from Moody’s) and 1941 (from S&P).

The initial impact on the NZD and AUD is somewhat ambiguous. Global sharemarkets are likely to fall sharply today (US S&P futures are down over 2% at time of writing). Since the NZD tends to be aligned with global financial market sentiment, downward pressure on the NZD may well be the initial outcome over Monday. It will take 24 hours for global time-zones to open up for trading on Monday morning. Participants should prepare for at least 72 hours of volatility, because it will take a few days for the full implications of the loss of the US’s AAA sovereign rating to be digested. By the end of the week, the decline in the USD could well lead to a higher NZD. The medium-term impact is likely to be a slightly weaker USD than otherwise, reinforcing the upward structural shift in NZD/USD.

At this stage we continue to expect the RBNZ will in September take back March’s insurance 50bp OCR cut. However, the risks have grown over the past week that the RBNZ will delay that hike. How the global financial risks evolve over the next month will be a key influence on whether the RBNZ hikes in September, with a hike contingent on receding global financial risks.

To a large extent the US downgrade is a sideshow to the main source of debt concern, which is in Europe. Italy has been under the gun as markets focus on its high level of debt and relative inaction. The Italian Government has now pledged to get its (relatively modest) budget deficit back into balance by 2013, a year earlier than originally planned. That is a small step to alleviating investor concern. But Europe’s politicians – usually reluctant to act – would best serve their constituents if they acted decisively sooner rather than later."

http://theautomaticearth.blogspot.com/2009/07/july-5-2009-unbearable-mi…

Just why we shoudl fear deflation and dismiss inflation.....for sure hyper-inflation.

regards

Well that magic 'V' word finally gets some exposure, lot of credit for that alone.

Another phrase in there I like "inter-disciplinarian".

But this is a nice summary that some of your detractors really display a distinct lack of understanding:

In fact, building an appreciation of the bigger picture requires a broad view. In order to understand the scope of our predicament, it is necessary to understand finance, but also energy (net energy, EROEI, receding horizons etc), ecological carrying capacity and population, collective psychology and herding behaviour (see Prechter), diminishing marginal returns to socio-economic complexity (see Tainter), catabolic collapse (see Greer), positive feedback loops, adaptive ecological cycles (see Holling), pollution and pathogens, game theory,real politik, risk dynamics, reality versus perception as socioeconomic drivers etc, etc

" unnecessary pain"...really!...

I think the pain is necessary...call it tough government...call it what you bloody want but don't tell me people will change the way they use money without it.

Too many in NZ think credit based living is ok...you can't blame them since successive idiot govts and compliant RBNZ bosses and parasitic banks and greedy retailers, have together pushed credit as a good thing.

And here we have inflation above the easy 'who gives a shite' range thought to be ok for a modern economy..

How seriously sick must this economy get before the likes of Rodney Dickens wake up to the need for tough government?

"but in my assessment there is no need for urgency. My assessment is supported by the four charts above that show no smoking gun".......doh

Oh right...make credit cheaper or the economy will suffer!.....

Bernanke has made it free to his mates in the banks and what good did it do?

Maybe the next step in this drive for greater idiocy is to pay people to borrow..and charge people who save..would that improve business Mortgagebelt?

And with the Kiwi$ falling like a stone, expect import prices to shoot up even with oil prices dropping. Note that oil is increasingly in short supply...so any sign of growth across the world markets will mean...yes you guessed it....bloody high oil prices and that means some serious imported inflation.

QED, when you discourage saving by running a debasement policy and lie about inflation and expect people to get by on less income..what you get are riots and burning and destruction.

London is but a summer event that will become common in major cities throughout the western shite economies.

The proper road to a better future is to discourage debt and encourage investment by holding the value of saving high and the cost of debt higher even if in the short term it means recession level activity...somebody needs to tell Bollard.

Commodity prices are falling and so is the $NZD, so in NZD terms our imported goods remain pretty much fixed. So I don't see any "imported inflation" unless the Kiwi dollar fell faster than commodity prices.

In a credit based economy savers will always suffer. That is simply the way it is. The fiat currency system has made it this way.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.