By Alex Tarrant

Markets were abuzz this morning following comments from the International Monetary Fund that it wanted a giant chunk of extra money because it thinks there will be demand for US$1 trillion of bail-out loans from sovereign nations (most of them developed economies) over the next couple of years.

It wants another US$500-600 billion, which would boost its available resources to about US$1 trillion, to help deal with the latest round of the financial crisis stemming from the eurozone sovereign debt crisis.

As New Zealand is a stakeholder in the IMF (a small one, but a stakeholder nonetheless), it is worth asking whether we will be called on to provide even more of our scarce dosh to the IMF as it comes cap-in-hand once again in a bid to save the world's financial system.

What we're signed up for

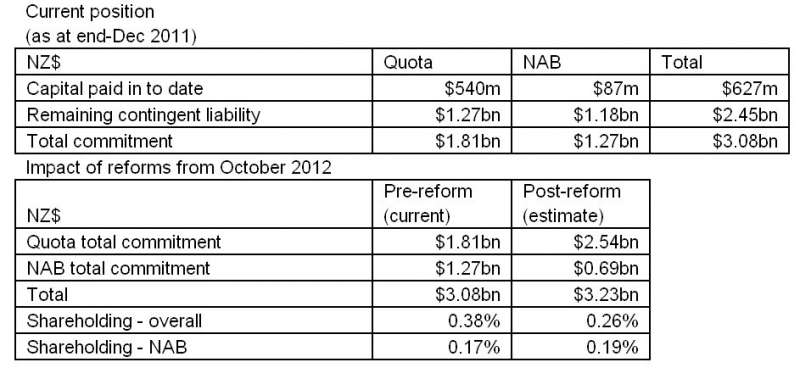

As a member of the IMF (we have been since 1961) we've paid up in cash more than half a billion dollars to them over the years - about NZ$540 million - as part of our NZ$1.81 billion quota commitment with the Fund.

That NZ$540 million is called our 'reserve tranche position' with the Fund - hard cash we've actually sent into its coffers. The rest of the quota - NZ$1.27 billion - represents promisory notes the IMF can call upon if it wants them.

Generally, a country's reserve tranche position - 'paid in capital' - with the IMF represents about 25% of its overall quota. Ours at the moment represents just over 29%.

On top of our quota we've also agreed to lend the IMF up to NZ$1.3 billion through a credit line called the New Arrangements to Borrow (NAB) facility. This US$550 billion line of credit from 40 countries was expanded tenfold from a piddly US$50 billion as we signed up in April 2010.

The NAB facility was only supposed to be called upon once the IMF had exhausted all other resources available to it. Seeing as we're contributing funds through the NAB, one would assume we'd paid up in those promisory quota notes, but that's not the case.

Political squabbling over quotas, mainly in the US, meant the IMF decided to access funds through the NAB facility instead of its quota facility, meaning New Zealand has been called upon to lend NZ$87 million to help with IMF assistance to Portugal and St Kitts & Nevis since April last year. See our earlier article.

Any new IMF financial assistance packages announced between now and March could trigger more lending from us under the NAB, as it is opened for windows of six months, the latest window opened at the start of October 2011.

We're already set to give them more hard cash with a quota increase

Even before this morning's call for another US$500-600 billion, the IMF was set to double the amount of funding it receives through quotas, while scaling back the NAB credit line.

Figures provided to interest.co.nz by the Finance Minister's office last year show New Zealand's quota with the IMF is estimated to rise 40% in October this year to NZ$2.54 billion. At the same time, our NAB commitments should fall 46% to NZ$0.69 billion. Our overall commitments (quota + NAB) would rise slightly to NZ$3.23 billion from NZ$3.08 billion.

Seeing as our quota is set to increase, the amount needed to be paid in as our reserve tranche position would also increase, meaning a cash payment from the government to the Fund will be in order. Given a reserve tranche position is generally 25% of a nation's full quota, we'd be required to have paid in NZ$635 million to the fund to satisfy this (currently we've paid NZ$540 million).

That's an extra hundred million in cash needed to satisfy this quota increase when it's expected to come into force in October, having first passed through our Parliament.

Please Sir, may I have even more?

Now the IMF is saying it may ask its members for even more.

It currently has about US$385 billion available to it and wants to get that up to about US$1 trillion.

This report in the Irish Times says the extra US$500-600 billion is likely to be sourced through ad hoc loans rather than voluntary contributions.

Political football

So who's going to pay?

The British government is coming under increasing pressure to not give the IMF any more cash, and a number of Conservative party MPs voted against their party on a European Union initiative to boost the IMF's coffers by 200 billion euro last year. The government still managed to squeeze through legislation for their 30 billion euro contribution, and it's expected Labour might sign up this time, but it's certainly not a given.

Meanwhile, the Americans aren't at all keen to give any more money to the IMF, and some Republican lawmakers are even trying to unwind a US$100 billion commitment made in 2009.

The US Treasury went as far to say: “The IMF cannot substitute for a robust euro area firewall. We have told our international partners that we have no intention to seek additional resources for the IMF.”

Emerging market economies, including Brazil and India, may support the big boost, but only if European nations agree to take a leading role in boosting the IMF's coffers first.

The general wish from the IMF seems to be the eurozone bails out the eurozone, but as were currently seeing, we're all pitching in.

The latest desire for capital from the IMF may never eventuate, given political tensions are so tight. But there's certainly a possibility that over the next couple of years the IMF might just come knocking on our door once again.

17 Comments

Wolly - stop the worrying !

It's all going to be borrowed from a bigger sucker - just tipping another bucket into the debt vortex.

While the music plays everyone will be happy.

Ignorance can hide a lot of sins for a very long time.

"At particular times a great deal of stupid people have a great dea of stupid money and there is speculation and there is panic " Walter Bagehot 1860’s

"You can fool some of the people all of the time and those are the ones you have to concentrate on " George W. Bush

Fool me once shame on me, fool me twice............ GW Bush.

..... oh yes , that's a worthy cause , to save the Eurozone , and to bail out the feckless Greeks and Italians ...... yup , money well spent .....

Ummmm , sorry Africa , sorry starving kiddies in Asia ...... but there's nothing left over to gift to you .... the IMF came knocking , and we've already given ........

Good overview here on Reuters on who may stump up.

http://www.reuters.com/article/2012/01/19/us-imf-resources-idUSTRE80H0VU20120119

(Reuters) - Two years after it requested $500 billion to fight off a global slump, the International Monetary Fund's call for a further $600 billion to limit the fallout from Europe's debt crisis prompted supportive words from Brussels on Thursday but no stampede in the rest of the world to commit the cash.

Sorry Alex, I should have wrapped my question in sarcastic tags. Yes, I knew she was with the UN, but thought that maybe I'd missed an announcement she'd moved over to the IMF recently. GBH, yes, it's ridiculous when you hear and read the stories about the tax dodging going on in Greece and Italy that the enablers will just keep on taking from others to sustain those behaviours.

Maybe do some research Hamish, it will stop you looking so ignorant!

Itallians have an inherrant distrust of banks, which is a wise position. They now have an ex Goldman Sachs General , unelected in charge, just like the ECB, and Greece, why is that you think Hamish!

Hi LloydM1, I read the article you linked. It was kind of interesting. A couple of sentences stood out towards the end of the piece,

"When rates are low, as they were when many contracts were agreed, local authorities using a variable rate could find their costs shrinking. However, when rates rose, officials would find themselves owing more money.

Milan has argued, as have many other local administrations, that the contracts were murky, carried hidden costs and banks had failed to explain them.

However, a source close to the issue said Milan could not argue that it was ignorant about derivatives since the 2005 swap replaced a contract that had been renegotiated repeatedly."

Wow, when rates go up then so does the costs, and, read the contract to understand all the costs in there. Did I miss anything?

And all I can find at the moment on an update from your May 2010 piece is the following;

Is there any more to this?

"An outright default would be seen as a sign politicians had lost control of the single currency, and markets would immediately take aim at other weak countries such as Italy, Spain and Portugal."

http://www.telegraph.co.uk/finance/financialcrisis/9029612/What-happens-if-Greece-defaults.html

Are you ready...last Domino almost in place..how will it go?....like 500 very frightened cats released from the back of a truck and three sheep dogs and one bloke waiting to muster them into an orderly line to await slaughter......get the picture...

GREECE

Have you got that right?

Our nation is lending money to Greece!

I sincerely hope you are joking.

It is a basket case.

The Greek expression is something like "egg armoto".

The support the Greek electorate showed for the likes of the psira KKE, and at the other end of the spectrum, for an outfit that thinks that the Papadopoulos regime of 1967 - 1974 is what Greece needs; they are Kolok Benass.

I have littered this treatise with some Greek words that Hellenophiles would call offensive. My lexicon is so limited that I must resort to those sorts of words to describe the situation.

Greeks have for so many years voted for politicians that promise them the earth, all of which is to be delivered to them on dough borrowed from hard working Krauts. Let the bastards stew in their own juice. Now the Greeks are complaining how hard they were done by the Krauts the last time they were invaded in 1941. But keep in mind that the Greeks who collaborated with those invaders back then, were rewarded with the baubles of office after the Marshall Plan propped up the Greek regime during the ruthless civil war of 1946 - 49. Keep in mind that the history of 400 years of Turkish occupation of their homeland will live with Greeks for many more centuries. As such they will suck up to anybody that promises them salvation. But that Turkish occupation was a long time ago. Like, Ali Pasha was driven from Ioannina in just 1913. Now is the time for the world to tell the Greeks to come into the 21st century. Get your act together and don't come bludging to New Zealand.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.