By Alex Tarrant

They say two things in life are certain: Death and taxes.

I'd add a third, use by politicians (and journalists - ha) of selective numbers to support their arguments.

The numbers that have been debated the most in Parliament over the last few years must be the effects of the government's tax changes.

They're either negative, neutral, broadly neutral (a fudge for initially negative, then turning positive), or just straight positive.

And our politicians have been able to use the numbers in different ways to support all of the above.

Wednesday in Parliament it was no different.

Prime Minister John Key was being quizzed by Green Party co-leader Russel Norman about the claimed neutrality of the government's tax changes.

Norman was claiming the changes had cost the government NZ$1 billion in the first nine months of being implemented, which was a much larger cut in the tax take than forecast. The Prime Minister on the other hand, was pumping the increased revenue the changes would bring in, although not in the first few years of the package, saying the government's deficit would be NZ$1.5 billion larger this year had the government not made the changes it did.

Norman's changes

The changes Norman was trying to get at were those included in the 2010 tax switch, which saw the government cut income and company taxes, raise GST, eliminate the ability to claim depreciation on buildings with a usable life over 50 years, and a couple of extra fiddles around the edges.

At the time the package was announced, we were told by Finance Minister bill English the changes would be "broadly neutral" which, as indicated above, is a fudge for "initially negative, then hopefully turning positive."

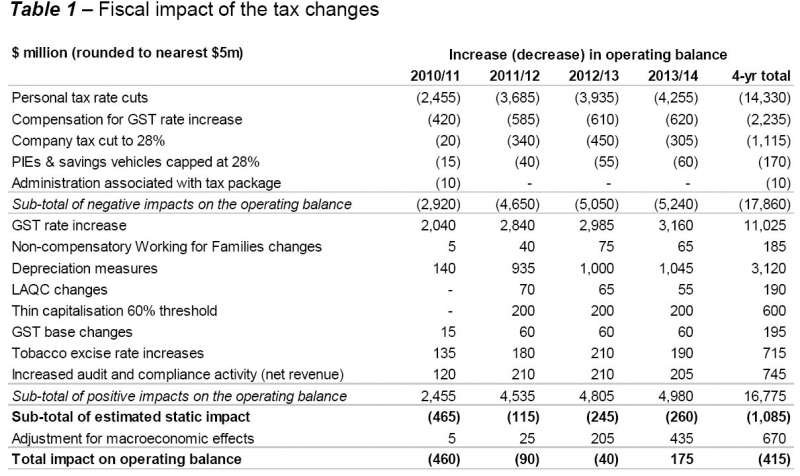

A helpful table from Budget 2010 shows the changes and the effects of the package:

As you can see, the total impact on the government's operating balance was expected by Treasury to be an increase of NZ$415 million over four years. Deficits in the first three years of the package would be replaced by more revenue in the fourth year, and from that point we'd be away laughing.

However, Treasury got there by including some pretty helpful "macroeconomic effects," without which would have seen the package cost NZ$1.085 billion, with the static impact on the rise.

In Parliament on Wednesday, when asked about the costs of the government's tax package, Key noted the NZ$415 million figure for the first four years of the package.

“But from the fourth year and forever after, the package is strongly positive,” Key told the House.

Key then changed tack and began talking not just about the 2010 tax switch, but all of the tax changes the government had made since coming into office.

When it came to comments on the neutrality of the "tax package," you see, it would be better to talk about all the government’s moves, not just one part of it, the House was told.

“These tax changes, including the 2010 Budget changes, were slightly fiscally negative in '08’ and 2009/10, but fiscally positive from 2010/11 onwards," he said.

“In the short-term, yes, they are fiscally neutral. In the medium to longer term, they’re actually fiscally positive. They reduce government deficits and reduce government debt, compared to the situation we inherited on coming into office.”

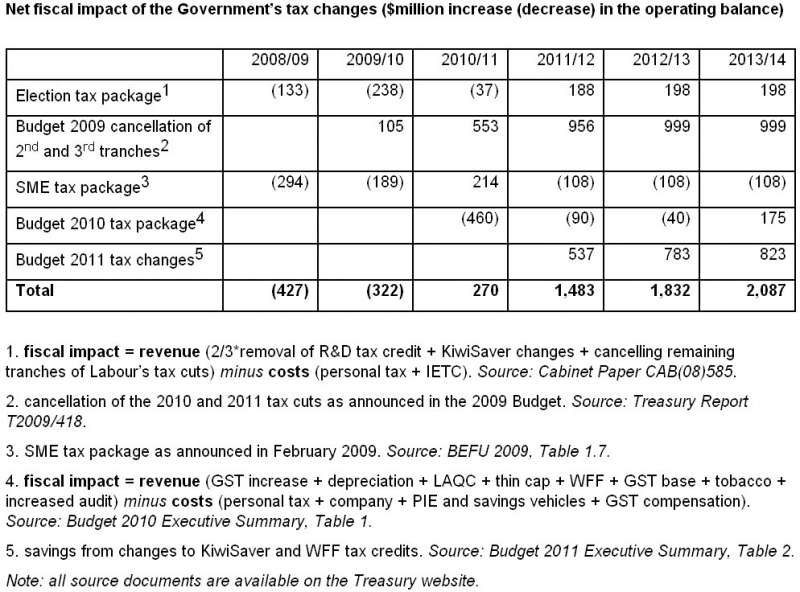

The Finance Minister's office provided another helpful table to let everyone know what Key was talking about:

“A cost of NZ$427 million in 2008/09, the following year costs of NZ$322 million, and then positive NZ$270 million, positive NZ$1.4 billion, positive NZ$1.83 billion, and by 2013/14 positive NZ$2 billion," Key explained.

“A remarkable achievement,” he said.

Norman takes different tack

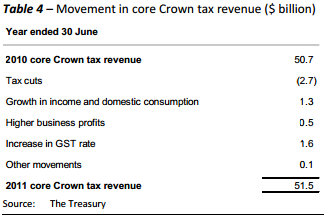

Not put off by the figures, Norman took a different tack, asking the Prime Minister about table 4 in the government's 2010/11 financial statements "which showed that his government’s 2010 tax cut package has in practice cost about NZ$1 billion in just the first nine months."

Key, however, wanted to stick with his table, reminding the house again about the positive parts of the government's changes

“For 2010/11 for instance, a net gain of NZ$270 million. By 2013/14, positive NZ$2 billion. So if people want to vote for the Green Party and have these reversed, they’ll have to fund NZ$2 billion a year of extra debt, on top of about the NZ$10 billion they want to spend on other things,” he said.

The Budget deficit would be NZ$1.5 billion worse this year if the government had not made any of the changes it did. Next year’s deficit would be NZ$1.8 billion worse, and the year after would be NZ$2.1 billion worse.

“So our changes are reducing [the] deficit, and reducing the amount the government needs to borrow. No wonder the IMF was praising this government’s economic leadership in the paper this week,” Key said.

But Norman too knew how to stick to his figures when presented with different ones from the opposing side, bringing the Prime Minister back to his table showing the NZ$1 billion hole created in just nine months.

Struggling to find a NZ$1 billion hole due to the 2010 tax switch from that table?

NZ$2.7 billion lost from the tax cuts, minus NZ$1.6 billion from the hike in GST, gives about a NZ$1 billion hole.

Simple really.

As simple as saying those tax changes were fiscally neutral. Or positive.

Perhaps it's best to stick with the initial fudge of broadly neutral. That covers all bases.

15 Comments

What you are discribing has a name: corruption

Plain and simple these people are liars, traitors, dis-honorable and deceitful and the "asleep at the wheel" majority of NZ continue to vote thinking they still have some form of representation via some form of 'alleged' democracy.

Sad all round. What will it take? Total economic oblivion? Yes......I believe so

Russel Norman presents his argument here.

http://blog.greens.org.nz/2012/04/05/how-to-crash-the-budget/

It is John Key who is spinning the numbers and not answering the question; all so he doesn't have to acknowledge the lie that the 2010 tax cuts were (broadly) fiscally neutral.

He must have to replace his burnt trousers lots of times each week -- does the taxpayer pay for them I wonder.

Andrewo - in the current economic climate some policies of “The Greens” make far more sense long term then any other of any other NZparties. So Andrew, explain why should they not be able to put a sensible budget together ?

E.g. do you believe as your Steven Joyce reckons building more roads and casinos are productive ?

....... they'll make tofu and bean sprouts exempt from GST ........ it will all be worth the initial shock to your digestive tract , to absorb the Greens diet .......

Fuel excise to jump 250 % ........

........ subsidised mud for rebuilding the nation's housing stock into environmentally approved cob huts and caves .......

100 to 1000 % tariffs on all imports ........( books on the cultivation of natural narcotics and magic mushrooms will be exempted ) ......

Bill English $42,723

Road Transport Forum ($5000) and $37,723 from a raffle.

i think raffel is a fair reflection on the way he runs things generally, albeit with fixed outcomes.

Pita Sharples $55,000

Included Fletcher Construction ($20,000), Mainfreight chair Bruce Plested ($25,000), CEO of Richina Group Richard Yan ($10,000).

Well no rocket science required here....keeps the Nats hands clean of dirty money to buy confidence and supply.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.