By Bernard Hickey

Sometimes you just have to sit in a ringside seat at a big fight to really understand what it's like.

Hearing and seeing the thwack of a knockout punch at the same time as you see the sweat fly is always better than watching it on television or reading a newspaper report.

Luckily for New Zealand, Reserve Bank Governor Graeme Wheeler is now our banking regulator and he had a ringside seat when a housing crash in America almost knocked out the global financial system.

Mr Wheeler was the Head of Operations at the World Bank in Washington from 2006 to 2010 so he no doubt saw the sweat fly in those dark months in late 2008 and 2009 when by many accounts the global financial system was brought to the brink of collapse.

Only massive intervention by the US Federal Reserve staved off an electronic run on its banking system in late September 2008 that would have emptied America's coffers within hours.

Mr Wheeler would have been around when central bankers, politicians and bureaucrats in Washington burned the midnight oil to save the system.

He would have seen up close and personal how home owners' fortunes were wiped out and bank capital was gutted because they borrowed too much and never believed house prices could fall.

He would have seen the furrowed brows, felt the sweaty palms and seen the stress in the eyes of his fellow central bankers when they were bailing out that system.

This explains his determination to avoid the same thing happening here and why he pushed ahead this week with a 'speed limit' on high Loan to Value Ratio (LVR) loans.

He has had to fight against the surprisingly public and heavy political pressure from Prime Minister John Key and the squeals of outrage from bankers, first home buyers and their fellow travellers.

He has also had to overcome a decades-old internal culture at the Reserve Bank that is reflexively against telling bankers how much and to who they should lend.

When Mr Wheeler arrived at the Reserve Bank in September last year he inherited a central bank reluctant to impose so-called macro-prudential controls such as a speed limit on high LVR lending.

Departing Governor Alan Bollard told me as much in an exit interview where he talked about his memories of lending controls during the Muldoon era of the 1970s. Bollard's Reserve Bank, which is still largely led by those with searing memories of those controls, was against reimposing such limits.

It even publicly considered them in 2006 and 2007 during the tail end of the last housing boom, but agreed with those in the banking industry and in politics that such controls would create "distortions."

I say bravo to Mr Wheeler for sticking with his instincts forged during the crisis of 2008 and 2009.

It should not be forgotten that the Reserve Bank here also had to make more than NZ$7 billion emergency loans to our own 'Too Big To Fail' banks between October 2008 and April 2009 as house prices fell more than 10%.

He has had to fight hard and right from the start.

Unfortunately for him, he arrived just as the banks were pushing hard down on the accelerator of mortgage lending. Mr Wheeler's term began on September 26, just a month before ANZ integrated National and unleashed an almighty dash for market share in the Auckland mortgage market as others tried to poach National customers unsettled by the integration of brands and computer systems.

ANZ and ASB went at it hammer and tong for months, offering free televisions, thousands of dollars of 'cash-backs' and waiving low equity premiums to first home buyers and others wanting high LVR loans.

By November 7 when Mr Wheeler held his first press conference it was becoming clear this surge of lending was the spark that could set alight an Auckland real estate fire that was smoldering with the fuel of capital inflows, migration and a lack of supply.

He sensed it, but five weeks into the job he wasn't willing to slam on the speed limits without more evidence of a housing boom.

"Even if we had the ability to use that instrument at this point in time, it's not something we would seek to be exercising...at the current time," he said on November 7 when releasing the bank's Financial Stability Report. But even as he was speaking, lending and house prices were taking off in New Zealand's most crowded and auctioned city.

Auckland's house price index rose 16.6% in the six months after that November 7 news conference. (Here's the section of that news conference where Wheeler and his deputy Grant Spencer answer my questions about the high LVR lending that was taking off). Here's my November 7 article criticising the bank for a lack of action then.

He has moved six months too late, but it's better late than never and he should be congratulated by politicians and bankers, rather than badgered at and harped at.

I'm glad our banking regulator has seen up close and personal what a housing bust would do to our banks.

That experience was crucial in over-coming the complacency and objections of bankers, politicians, and home buyers who believe in their bones (still) that house prices in New Zealand can never fall.

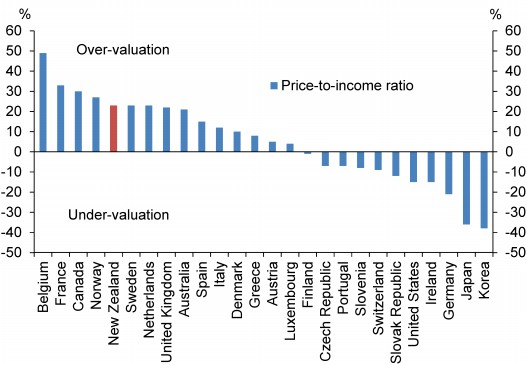

Anyone with any doubts should read Mr Wheeler's excellent speech this week in which he showed how New Zealand's house prices were more over-valued than America's, Britain's, Australia's and Ireland's.

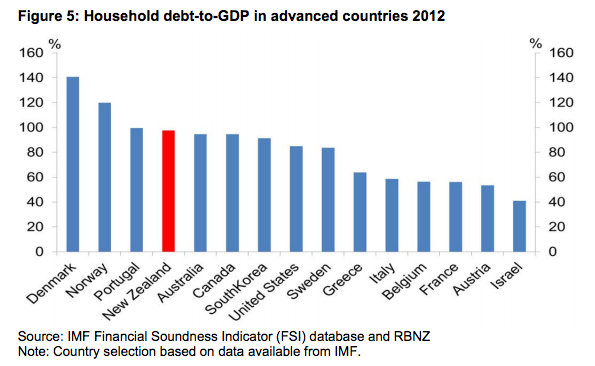

He also showed how our household debt is now higher relative to our GDP than America's, Australia's and Greece's.

That heavy thwack of a housing bust hitting our economy is something no one ever wants to see up close and personal, but I'm glad our Reserve Bank Governor has.

Here's his speech from last week. It's well worth a read.

-----------------------------------------------------------------------------

A shorter version of this has appeared in the Herald on Sunday. This full version is used here with permission.

(Updated with November 7 video, charts, link to speech)

31 Comments

He also showed how our household debt is now higher relative to our GDP than America's, Australia's and Greece's.

That heavy thwack of a housing bust hitting our economy is something no one ever wants to see up close and personal, but I'm glad our Reserve Bank Governor has.

Nonetheless, the thwack of peonage resonates incessantly across our not so fair land.

In Auckland it is very doubtful that Wheelers LVR change will have any impact. In provincial towns and smaller cities ie Palmerston North, Nelson, Hamilton etc the impact could be quite crippling, with a significant price drop.

In Auckland the low level of new house construction, net migration gain which is rapidly turning more and more positive and a reluctance for people to live in the earthquake cities will all counter the LVR change. On the rental side those who have a less than 20% deposit will be trapped as renters and rents will increase, which in turn makes it easier for investors with plenty of equity over a portfolio of properties to buy even more real estate.

Initially ie over the next 10 weeks there will be a house price surge in Auckland as those with less then 20% deposit and particularly those with only 5% or 10% compete amongst each other for all the entry level properties. They cannot save another 10% that quickly especially as their rent and other costs of living increase.

Those with wealthy parents and the surge of Asian migrants will not be at all affected by the LVR change.

There is no prospect of 39,000 new homes being built in the Auckland region over the next 3 years. We simply lack the trained workforce to achieve this, property development capital is diifficult to obtain and 15% GST and monopoly building product supply companies will keep new house construction at a very low level.

Wheeler has got it wrong.

I disagree this will have little or no impact in Auckland. I agree that other factors will balance out its impact though. All it might mean is prices don't go up much, if at all, in the next year, rather than shooting up possibly another 5-10%. It's better than nothing.

Not that I pay bank eoncomists much attention, but both Dominic Stephens at Westpac, and Steven Topliss at BNZ, think it will drop house prices in at least the short term.

By itself, its obviously not enough.

About 3-4 years ago I was calling for LVR limits to dampen demand, and big planning changes ot boots supply. FINALLY, the LVR limits have been introduced, And very slowly the govt seem to be moving in the right direction with planning reform, although it's all taken far too long.

As someone from a smaller city, why would you suggest that a significant price drop is a crippling effect? surely that opens the door for more people otherwise "trapped as renters" as you put it. only people to suffer will be councils, people highly leveraged, and banks. Seems all positive.

Midget - lets say you live in a small town or city with an average price of $250,000 and you have a deposit of $25,000 and under the new LVR rules you struggle to get a mortgage. You need to save another $25,000 after tax (probably not easy on a small town wage) or house prices need to halve to $125,000 - now that is simply not going to happen!

Completely disagree.

Small town? You simply get a welcome home loan and buy an above average 300k property that would be worth over $1 million in auckland. And they get $5k from govt and add their kiwisavers..

High LVR requirements impact high price regions such as Auck far more.

For 485k a welcome home loan first home buyer in auckland gets free $5k also (here only 10% of deposit as opposed to the small town first home buyer who gets 17% of his 30k deposit paid for).. But you are stuck with a well below average house in auckland.

Unofficially the lvr has already been in place with banks at least 4-6 weeks. Banks have already been applying it.

… and of course with recent interest rate increases the sudden surge may not happen as in theory it would have already been happening.

If I was buying a house (which I am) , I would hold off and wait to see what happens.

Now hidden issue is the Nz dollar has just become more expensive (due to the lvr) that may counter the other immigration driven side of the coin. Ie double whammy

I don’t know, but I hope the tide has turned.

Of course it's going to have an impact. The Auckland property market dropped 10% after the banks started tightening up after the GFC. Once they started loosening up again 18 months ago prices started rising again. There are close to 5000 rental properties available in Auckland and close to 9000 for sale. Incidentally one of the properties up for rent for $580 per week sold a month or so ago for nearly $900,000. That is out of whack to me. There are plenty of rentals available so I don't think the housing supply is as marked as people are suggesting. About 3 months ago the 3 year fixed term was about 5.75% and now it's up to 6.5%. Median house prices have stayed the same for months now. We are looking at buying too and will be holding off till after October.

Personally I can't see there will be any marked difference between buying now or after October however if buying for long haul it's always a good time to buy so the saying goes so if you find something you like for a fair price....Quite agree though, the apparent lack of housing does not exist unless you have your mind set on living city fringe which has become more and more desirable...There is plenty of modest housing (sub 400K) in good school zones (decile 6-8) in West Auckland if you know where to look.

I assure you not, there is a place, if you go there you shall be amazed, the neighbours are lovely, the houses neat and proud, no main road or pylons, in fact views of the Waitakere foot hills you could have, your kids will go to the same schools to those kids who's parents have spent double or triple what you have paid for your modest yet noble abode. Simply take yourself to Shetland Street, Glen Eden, Auckland, then look to purchase on this or the few streets that run off this street and you to will have unlocked this secret place of the West.

Yeah.... No! Maybe last year! Nothing decent under 470k there now... schools are good though!

This one? CV 290k, asking 440k... http://www.trademe.co.nz/property/residential-property-for-sale/auction…

This one on the railway tracks - wanting 439k... http://www.trademe.co.nz/property/residential-property-for-sale/auction… cv 305k

You've missed mulitple sales on Kotinga Ave for less than 400K in the last couple of months! One was private and think the end number was about 350K. They did not sell at lightning speed either. There may not be anything there right now at that price but they are coming up. Just keep to the Konini side of Glengarry for some fantastic deals.

Its out of whack, its a gross yield of 3.35% not taking into account any capital gains.

Banks are offering 3.75%<->4.10% gross yield month to month for doing nothing other than getting your statement from letterbox – no risk.

A house price fundamentally must be the value of rent income – and its future capital value (less any maintenance issues) must also be a function of “income returned over life time of asset”.

I think people are missing this piece of the logic, anything you pay over this magic number is “good will”

At the moment the house I rent is valued 725k I pay rent of 31k per year which means 4.3% gross return to owner. She gets to pay for the oven, dishwasher and carpets wear and tear. Its good being able to say garage door broken – please fix – in a way its all subsidized all by the tax payer – which is what I find the most funny aspect of it. (she gets to claim a rebate against her profit at roughly 33 cents for every dollar).

And because its such a weird world she is borrowing from me as I have 900k sitting in the bank earning interesting at 4.10% - which in a roundabout way she is borrowing from the bank at roughly 5%.

It's far too early to be saying My Wheeler got it wrong, we will only find this out over time. Let's remember there's still plenty of scope for own home buyers to purchase with less than 20% deposit and to support this as an example if you said the ANZ Bank wrote 1000 new mortgages this month 100 of these could be on a sub 20% deposit, that still quite a lot. The likelihood is that the banks will however choose the safest business to write over 80% LVR now and this may mean many of these highly leveraged and cash flow poor investors who have been buying multiple rental properties at 90% or 95% LVR will now be frozen out of the market which in my opinion is the whole intention of the speed limit. First (and upgraders) home buyers seeking properties for own occupation have been competing with these frenzied investors in the lower to middle end of the market and it's certainly sparked a fire in Aucklands real estate. Having said that there has been a certain amount of market correction since post 2007 and a small degree of overseas investor activity in the city fringe suburbs but consider how these have been lagging behind in terms of relativity since years gone by where no white collar worker would consider living in the likes of Ponsonby or Westmere. So those with less than 20% deposit can absolutely still look at buying their first home and should not be put off by people who lack quality information.

Yes Bernard I too was moved to reflect on my critique of Wheeler's performance Sept to March, preferring to think the mould and any poured into it were bereft of teeth , spine, stomach.......clay men.

While your piece is encouraging in regard to Wheeler looking to stamp his style of Goverorship, I'm not yet about to shout him a champion from the rooftops ....or indeed pronounce him the bubble popper extraodinaire.......as it's going to take a lot more than the threat of a big prick to rein in wild south Bankers.

To impose regulation is one thing Bernard to enforce it is another altogether.....As, and when the time comes for the Governor to make an example of those in breech (through whatever instrument), we shall see if his official position has been restored to be seen as truly independent.....potent.... respected in law to act in the wider interests of New Zealanders guarding them sometimes even from themselves.

Oh P.S. come on Bernard you never been to a fight in your life...unless it was Cameron or Tua and their both a coupla bums on the big stage. ...

"floats like a butterfly - stings like a bee"

jab, jab, tap, tap

right cross - missed

jab, jab, tap, tap

left hook - missed

uppercut - where did he go

right jab, left jab, tap, tap

haymaker - bugger - missed again

KAPOW !!!! thud !!!! splat !!! Zzzzzzzzzzz - huh? wha' happened?

Sometimes amendments, tweaking and fiddling are not the answer. A big overhaul is needed.

Here is the housing part of my solution

Step 1

.Allow ratepayers to sue councillors and council employee directly for failing to provide for the needs of their community.

The following simultaneous actions take place.

Step 2

Abolish all benefits such as DPB, accommodation allowance, working for families, sickness, unemployment, pensions and so on. Also make all State houses market rents.

Step 3

Every New Zealand citizen/permanent resident shall receive a 'Big Kahunda' as follows

Those aged seventeen years shall receive $100 per week.

Those aged eighteen years shall receive $150 per week.

Those aged nineteen years shall receive $250 per week.

Those aged twenty years and older shall receive $300 per week.

Disabled persons and caregivers eligible for free State housing and free electricity and water. On top of 'Big Kahunda'.

Single and unemployed parents shall have a separate bank account for their children.

This account is to provide for the child’s necessities for a healthy lifestyle and can only be used for that purpose.

One parent shall accept guardianship over this bank account.

One quarter of each parents 'Big Kahunda' goes directly into this account for a single child.

One half of each parents 'Big Kahunda' goes directly into this account if they have more than one child.

The government will top these accounts up as required.

Where a child is suffering because the account is not being use wisely then another family member is sought to take over this account. If no suitable family member can be found then it passes onto a friend and failing that onto a welfare agency.

This account is for the children, and so must be rigidly enforced to make sure it is not abused.

There should be no more children going to school hungry or in their bare feet.

Step 4

All residential property to pay a tax as follows.

10% tax on total value of property

Less deductions for family residence as follows.

$2,000 per square metre up to a maximum of 200 square metres per property. Apartments, cross leases etc. dealt with elsewhere.

This deduction is reducible as follows.

For each year since the family residence was built the deduction is reducible by $1,000

Here are some examples of taxes to pay

example a)

A couple with a 150 square metre home 30 years old and valued at $400,000 would be liable as follows

Value of property = $400,000

10% tax on $400,000 = $40,000

Deduction for family residence

150 square metre home @ $2,000 per square metre = $300,000

less 30 years at $1,000 per year = $30,000

Therefore value of family home to be deducted from total value = $270,000

$400,000 less home of $270,000 = $130,000

10% tax to pay on $130,000 = $13,000

The couple receive a 'Big Kahunda' of 2x $15,600 = $31,200

$31,200 less property tax to pay of $13,000 = $18,200

So this couple receive $18,000 from the government ($9,100 each)

example b)

A couple with a 200 square metre home 20 years old and valued at $1,000,000 would be liable as follows

Value of property = $1,000,000

10% tax on $1,000,000 = $100,000

Deduction for family residence

200 square metre home @ $2,000 per square metre = $400,000

less 20 years at $1,000 per year = $20,000

Therefore value of family home to be deducted from total value = $380,000

$1.000,000 less home of $380,000 = $620,000

10% tax to pay on $620,000 = $62,000

The couple receive a 'Big Kahunda' of 2x $15,600 = $31,200

$31,200 less property tax to pay of $62,000 = $30,800

So this couple would have a tax bill of $30,800 to the government ($15,400 each)

Not covered here are abolition of PAYE and other tax changes. Nor have i covered other property taxes such as Commercial, Industrial Rural.

*/

Just a thought, but could the LVR restrictions be needed to slow and protect the housing market outside the big cities?

People moving away from Christchurch after the earthquake were a great help to the real estate market of a number of towns. As Christchurch gets closer to being rebuilt it may become attractive for former residents to move back causing problems for the real-estate market in other parts of the country?

Sorry, Bernard. I think you are dead wrong on this and time will prove me right. Let me explain:

"It should not be forgotten that the Reserve Bank here also had to make more than NZ$7 billion emergency loans to our own 'Too Big To Fail' banks between October 2008 and April 2009 as house prices fell more than 10%."

And.....that money came via the US FED in the form of a SINGLE 'credit default swap' . Here is that specific deal highlighted by US senator Alan Grayson to Ben Bernanke. It was $9 billion USD by the way

http://www.youtube.com/watch?v=BORjkIcIcwQFirst homebuyers have not been proven to be the actual problem in this for a VERY LONG TIME. I believe they are being exploited as yet another scapegoat by the RBNZ's own attempt to save face with respect to it's blatant disregard to main street banks recklessness .The banks are the ones making the SAME risky loans that were made prior to 2008.

The RBNZ have now not only screwed over all bank depositors, as they have done now for years by keeping the OCR artificially low and fudging the CPI, but are now willingly forcing an entire generation into a DIRE rental situation with potential crisis.

What's now to stop rental prices after October from doubling over night? Tripling? What's to stop current first home savers just giving up and pulling their current bank deposits out on mass in protest? Taking their ever more worthless cash to even riskier lenders not controlled by the RBNZ?

This is going to go pear shaped..........BIG TIME

What's now to stop rental prices after October from doubling over night? Tripling?

ummm, how about people's ability to actually pay rents that are double or triple?

But yeah, I think rents will rise.

Who knows where this is all going to lead.

It's a frickin joke, a laughable situation of political incompetence by NZ's central and local governance over the past 10 years, of both left and right persuasion

What will happen after 1 October?

Will it? .. Won't it?

One simple test of that will be the make-up of the attendees at auction rooms

It can be expected one group will begin to diminish - not immediately - pre-approvals

As the tide recedes it will expose for all to see who remains

Hopefully we will get some quality feed back from some of the common taters here

Social engineering takes on a whole new angle.

If bank lending is causing financial instability then why would you not ensure that the banks who are causing the percieved problems hold a percentage of their profits annually rather than distribute all profits back to shareholders? Is this just too simple that people cannot understand?

Instead the RBNZ is enforcing people who are saving for the roof over their head to prop up the merry-go-round and actually leveraging off these people. The first part of the leverage is from their savings and the second part of the leverage is from the work they do as an individual i.e their employment from which they earn.

If you look at equity as the ownership without debt of an asset then surely the individual who earns is the equity if they are free to own themselves. Social engineering has ensured that the individual is owned by the State to use as the State sees fit.

Journalists like Mr Hickey who defend Socialism and it's self-given right to ownership over an individuals life have screwed the common people of owning and controlling their own life and destiny.

Bernard , I must disagree, New Zealand's (Auckland ) housing shortage is the complete antethesis of the rampant oversupply and runaway reckless lending to all-comers in the US prior to the GFC .

There is emperical evidence of thousands of empty houses in the US to this day, this is not the case here .

Auckland has a real shortage of houses , with young families doubling up , or cramped into converted garages and un-insulated out-houses.

Wheeler is really only looking to protect the Banks from themselves , and it will have little impact on the market , which I believe has a long way to run yet .

The LTVR deposit is his buffer , like an insurance policy for the banks , in case it comes back down with a pop .

My view is that Wheeler will leave this market to sort itself out, and after insisting on the deposit , he will do little else .

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.