By Bernard Hickey

Watching the Reserve Bank grapple with the housing market over the last two years has been like watching someone blowing up a long, thin party balloon and then trying to twist and fold it into one of those perfect balloon sausage dogs.

But that someone is doing it behind his back with the help of a mirror, and for the first time.

Each time the bank blows up the balloon and twists it in a certain direction the air squirts to another part of the balloon, the rubber squeaks and then the balloon veers off in a completely different direction.

I have tried to blow up many of these balloon sausage dogs in my years of catering for kids parties and I've never got it right first time. I've blown up and burst a few. I've folded them into countless cats, snakes and rabbits -- almost never the perfect sausage dog. The ears and the tail are the hardest bits.

The Reserve Bank's decision this week to give up on its two years of opposing regional restrictions on Loan to Value Ratios (LVRs) and to target rental property investors in Auckland is a welcome sign that it's getting closer to the perfect balloon sausage dog. But it's taken a fair few iterations and it's not quite there yet with the perfect ears and tail.

The bank's first attempt in 2013 was deliberately simple with as few interventions as possible because the Reserve Bank was reluctant to delve too deeply into the business of telling banks how much to lend and to whom. It was a very simple sausage balloon.

All residential property loans in all parts of New Zealand were treated the same. The banks were limited to no more than 10% of new loans having an LVR of more than 80%. First home buyers, rental investors, new builders, Southlanders and Aucklanders alike were treated the same. For a long time the bank argued that first home buyers did not lose out too much to investors and that it was almost as worried about house prices in the rest of New Zealand as it was about Auckland.

The first change in balloon folding technique came in December 2013 with an exemption for high LVR mortgages for new homes after a righteous howl of protest from new home builders. This addressed the first unintended consequence of the policy, which was to potentially restrict new supply in a market screaming out for new supply.

Then as 2014 progressed came the extension of the LVRs beyond the 'temporary' period initially talked about when it was introduced in October 2013. That was because the initial impact on house price inflation was bigger than expected and the time bought to delay sustained interest rate hikes kept extending out into the never never as inflation died a death. Also, the feared arrival of non-banks from Australia to get around the rules never happened.

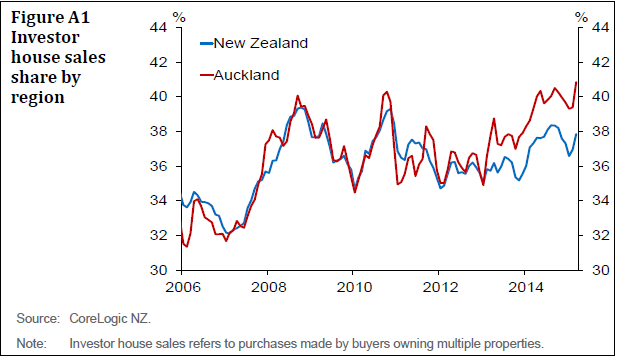

The folding technique evolved again last year when the bank started talking about asking banks to hold more capital against mortgages to landlords with more than five properties. By early this year that had twisted to become a plan to hold more capital against all loans to landlords. This arose as it became clearer that investors had more equity to play with than first home buyers as prices kept rising quickly, particularly in Auckland. This was the second unintended consequence. Young home buyers hoping to get onto their first rung were leapt over by those with plenty of equity 'air' in their balloons who were already on to the fifth or sixth rung.

This week's pirouette and somersault to limit Auckland property investors to no loan with an LVR above 70% and to increase the 10% speed limit on high LVR loans outside of Auckland to 15% was the biggest shift yet. This was quite the capitulation after two years of insisting that regional LVRs were not possible or needed. Rightly, the Reserve Bank has also exempted new builds from the restrictions on Auckland landlords. There may yet be more twists and turns in the policy with a consultation document due later this month to talk about thorny issues such as when a holiday home is an investment property and how LVRs are 'shuffled' between mortgages for a number of properties owned by the same landlord.

To be fair to the Reserve Bank, plenty has changed over that two years to make it harder to blow up and fold the perfect balloon sausage dog. The re-election of the Government last year, which removed the immediate prospect of foreign buyer restrictions or a Capital Gains Tax, pumped a whole lot more air into the Auckland landlord balloon. Net migration has been a permanent air pump on full blast for more than a year. The potential for yet more hot air to be blown in to Auckland's balloon if the bank itself cuts the Official Cash Rate later this year was the final puff.

The Reserve Bank should be congratulated for its excellent new balloon folding technique after a couple of years of practice.

But it could do with some help to suck some of the air out of the market. It hinted as much this week when it said it would welcome better data on foreign buying of properties and last month called on the Government to reduce the tax incentives for properties. The Government has refused to help turn off these demand side 'pumps' into the market.

That's a pity. It's hard to fold the perfect balloon sausage dog when the balloon is getting bigger and tighter and more stretched by the day. The Government could help by first collecting the data on foreign buying and then adopting Australian-style restrictions or stamp duties on non-residents buying existing property. That would let some air out of the balloon.

------------------------------

A version of this article has also been published in the Herald on Sunday. It is here with permission.

21 Comments

I see the Australian Financial Review addresses the same problem this morning. "The federal budget could be a game-changer for the property market as cuts in retirement benefits; "It might be a rush for the door," says Martin North, principal of Digital Finance Analytics, which advises banks on market trends, about the possibility of homes flooding onto the market."

RBNZ Policy =. Less first home buyers with 80% LVR, now less NZ Investors = more opportunities and more available housing stock for non-NZ resident buyers.

Will restricting NZers actually suppress house prices? Has NZImmigration been informed in the cross Government consultation? The OIO? How many Auckland houses have been financed by non-NZ/Aus banks?

Assuming NZ property investors are moderated by recent LVR restrictions, it would be conventional for the market to pause, or potentially decline.

Are non-NZ residents brave enough to purchase NZ real estate in a falling market?

I'm not convinced they are. Who would throw money into a falling market at the beginning of a correction?

Non-resident, overseas and buyers with access to offshore funds are not in the slightest concerned over where the market is heading. They simply want a resting place for their money and maybe later themselves in a place where the rule of law and human rights are upheld.

There are many more 100,000s of willing offshore buyers, or buying through NZers.

Where is this falling market? You are dreaming.

The only falling housing market is in Whangarei, Gisborne, wanganui, Palmerston N, Hastings etc. these areas are now falling/flatlining while paying the highest interest rates in the (developed) world.

...my post was made on the 'assumption' the market moderated - read it again. I never said the market is falling so I am not dreaming, I am talking hypothetically.

You say foreign buyers don't care about where the market is heading. Ok, then please explain to me why in 2014, after 4 OCR hikes, the B&T auctions rooms were only 25% full? I was at those auctions almost every Wednesday morning and there were not foreign buyers wildly purchasing. Everything was subdued. Why was that, please explain?

I've read many articles recently yet no one appears to be addressing the big question I have regarding the new LVR's.

Last time when LVR's were first introduced (i.e. 20% deposit required) there appeared to be a rush from investors and first home buyers to purchase before the restrictions were enforced. Therefore I think the initial effect was to boost the market short term.

My question is will the new LVR's at 30% create a similar short term boost to the market as investors rush to beat implementation, or will it have the desired effect and slow the market?

I suspect this time the market will slow.... but anything is possible.

Plenty of workarounds, trusts, nonbank finance as well.

It is not going to slow the number - 100,000 international students coming to live in NZ.

They all need accommodation. The Govt is desperate to increase these numbers to 120000+ so they can reduce funding to universities.

55000 immigrants as well who need housing.

Plus the 30% of Auckland housing buyers who are offshore or using offshore money then funnelling through a NZ based front buyer.

.... as Rodney Hide said on Mark Sainsbury's Radio Live show this morning , it's the expectation of further increases in Auckland house prices that keeps the balloon inflating , it's a self fulfilling balloon prophecy ...

When that expectation dissolves , it will be an overnight change in sentiment , and prices will deflate faster than a pin-prick to the party puppy balloon ...

... and there'll be just as much wailing and tears as a result , when the kiddie's realize that the party is finally over .... hee heee heeeeeeeee !!!!!!!

I agree Gummy.

Some people believe that foreign buyers will keep the balloon inflated. I have friends who are Chinese (and I do realise there are other foreign investors from other countries however Chinese buyers are a big chuck) and they said the Chinese philosophy was to buy on a 'rising market', not a falling market.

I am not convinced these foreign buyers will throw their money into deflating investments should the market start to fall.

... when the market plunges , it will take the $ Kiwi down with it , which will mitigate some of the foreign investors losses ... but they will scarper , exiting lickety-splick due to their new found expectation , that prices will keep falling ...

Which will be the right time to take a punt on buying back into the beleaguered dairy industry .... markets always moooooove in cycles .... moo-hoo !!!

Regardless of clever rules:

Will Auckland remain the main provider of jobs in NZ?

Will immigration levels keep growing/maintaining?

Will International student numbers keep growing?

Will Govt keep withdrawing funding to regional areas by underfunding their institutions?

If so, then Auckland house prices will keep growing and growing.....

Mortgagebelt seems as if you are trying to convince yourself. Sydney in the last week 60% of auctioned existing properties (not able to be purchased by foreigners) were sold to investors. Sydney's prices have surged based on principally domestic investor demand, this is what has happened in Auckland. Offshore buyers have certainly contributed, in many cases creating outlandish comparables for valuers. But the market went flat in Auckland for 3-6 months prior to the release of the new rateable valuations. The new RVs triggered the Mom and Pop investors into the markets, "look at the valuation on our property, maybe we should buy an investment property like Dave and June, they have made a killing. As our house has gone up in value, I'm sure the bank would lend us the money ". When net yields after all expenses in many suburbs are less than 2% you are in the midst of a bubble. Remember the 4 words that have cost the most money to investors throughout the ages are "THIS TIME IS DIFFERENT". "Auckland is becoming an international city", "high net immigration will continue", "international student numbers will continue growing", in fact you posit some of these this time is different points yourself. Note I'am a property investor with a significant number of properties, but can certainly see the effect these changes will have on supply and demand and subsequently prices. Though the Govt and Reserve Bank measures are simply hastening the inevitable.

Funny, as every landlord(lady) my kids have had in Melbourne & Sydney have been an offshore or sometimes onshore Asian owner. I suspect many nonresidents buy in Sydney just as they do in Auckland despite the new build only rule.

Well, I hope you're right Auckland = flat. Provinces may recover from their decline since 2009.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.