Today's Top 10 is a guest post from Kirdan Lees who is Principal Economist at the New Zealand Institute of Economic Research.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz. And if you're interested in contributing the occasional Top 10 yourself, contact gareth.vaughan@interest.co.nz.

See all previous Top 10s here.

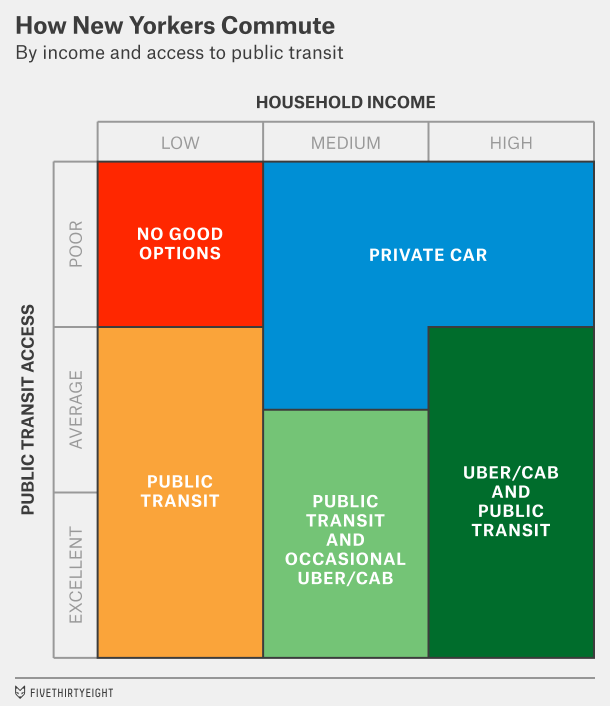

1. Public Transport and Uber – new best friends.

No way that how to get Auckland going is going to be over anytime soon. Nate Silver’s take, over at FiveThirtyEight, is that cars are useful not so much for the commute to and from work, but for the increasing number of shopping trips, trips to visit family and other journeys that are just not that well suited to some PT setups in the US. He argues that an Uber-PT union could prove super friendly to both transport options.

If Uber is to achieve its goal of becoming cost-competitive with car ownership, it may have an unlikely ally: public transit. A combination of (mostly) public transit along with some Uber rides can be affordable for a wider range of customers than Uber alone.

2. Transport policy today not really a need for speed.

Robert Puentes at the Brookings Institute has a useful post from a while back now that argues that urban transport policy is not so much about movement of vehicles but more the accessibility an urban transport system can provide for people.

For decades, urban transportation policy and practitioners favored a model of analysis that prioritized “mobility”—that is, increasing the speed for moving vehicles, and the time that is saved as a result. While this may make sense on an intuitive level, it is a problematic measure today.

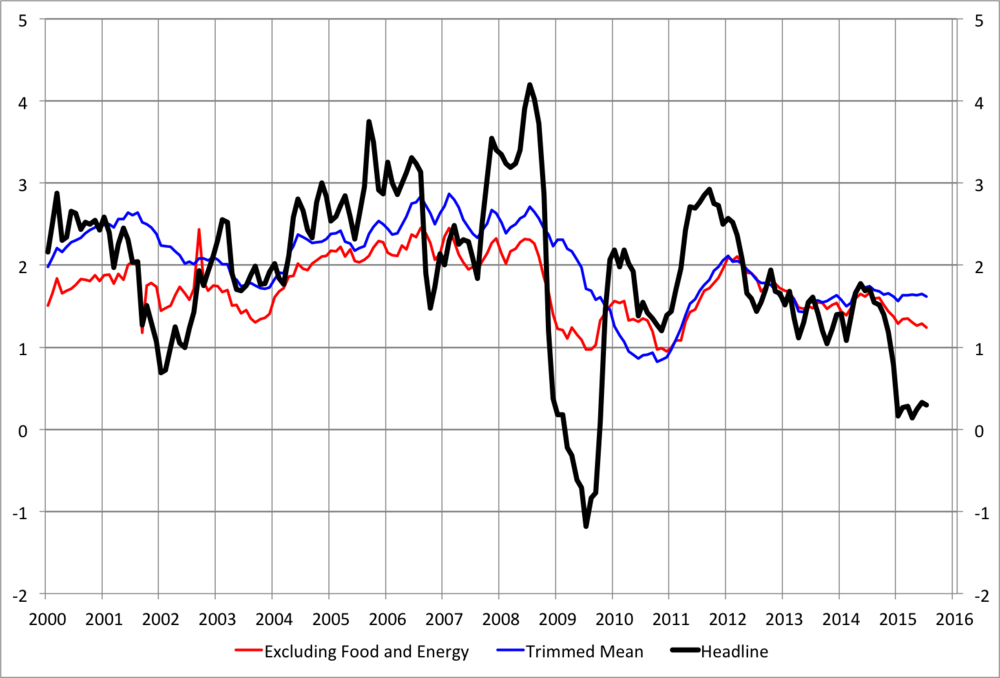

3. Message to self – inflation forecasting is hard and just got a whole bunch harder.

Stephen Cecchetti knows a heap about inflation. He used to head up the Monetary and Economic Department at the BIS in Basel and was the Director of Research at the Federal Reserve Bank of New York back in the late 1990s. His first job was counting cows for Goldman Sachs so he’d be right at home in New Zealand.

Along with a co-author he’s scribed a long and technical piece in his regular blog that shows just how hard it is to forecast inflation and that it’s got even harder in recent years. The heart of the problem is how to tell if trend inflation has shifted down a gear or if the low headline numbers (see the figure) are transitory and likely to return to more normal rates. Either way Cecchetti argues it’s not the timing of the Fed’s first move that matters it’s how hard and fast the rate rises. The earlier the Fed starts the slower the rate rises will come.

Figure 1: Headline inflation in the US is very, very low right now

Our bottom line is that the models we have simply aren’t very good at forecasting inflation – at least not to the precision we would need to distinguish a change of trend inflation of one-half of one percentage point over the next two years. And, what was challenging a decade ago has gotten more difficult since then. (For a very careful and technical analysis, see here.)

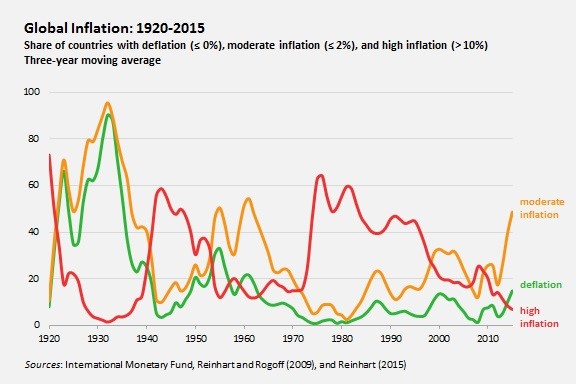

4. All over the world getting inflation down looks easier and easier.

While on inflation, Carmen Reinhart has her views on the takeaways from this year’s Jackson Hole meeting on inflation dynamics run by the Federal Reserve at the end of every August. Reinhart points out that the share of the world’s countries experiencing high inflation has declined markedly over the past decade and argues the Federal Reserve needs to look beyond domestic conditions to get a better steer on inflation.

At the end of the day, the US Federal Reserve will base its interest-rate decisions primarily on domestic considerations. While there is more than the usual degree of uncertainty regarding the magnitude of America’s output gap since the financial crisis, there is comparatively less ambiguity now that domestic inflation is subdued. The rest of the world shares that benign inflation environment.

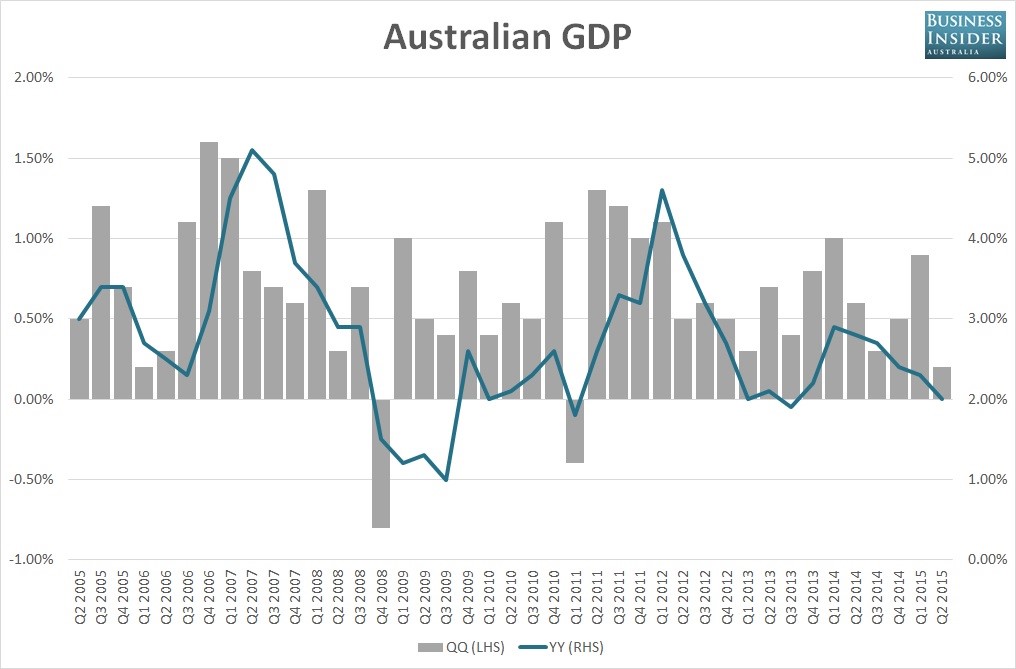

5. Australia’s economy tanks – well since March at least.

Much angst has hit the macro blogs over last week’s read on the Australian economy. You need to go back a few quarters now but GDP growth seemed relentless and the outlook for the government books seemed to suggest surplus after surplus. Business Insider has a nice plot of the recent outturn – a paltry 0.2 boosted by government spending. But before the schadenfreude maxes off the charts, worth bearing in mind that’s the same rate of growth New Zealand posted back in March.

Australian June quarter GDP is out, and it’s big a miss. The economy grew 0.2% in the three months to June, missing expectations for an increase of 0.5%. It was the lowest quarterly increase since the March quarter of 2011.

6. Time to cut or is nominal GDP targeting completely bonkers?

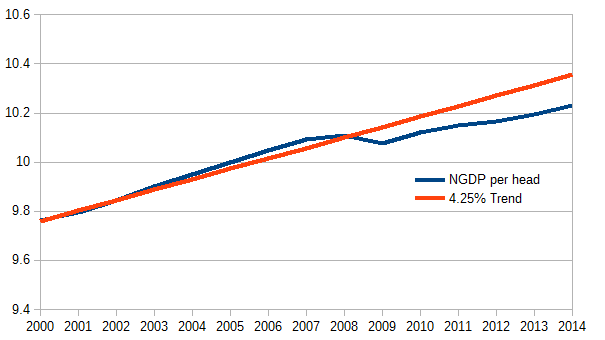

Simon Wren-Lewis is one of the better regular macro bloggers going around particularly when it comes to the big picture questions on whether we’ve got the right economic frameworks. His latest post takes a look at what nominal GDP targeting would have to say about the latest moves in the UK to try and get some interest rate rises happening. His preferred nominal GDP target – a growth rate of 4.25% per capita – would mean keeping rates really, really low for a very long period of time. Either raising rates right now is silly or nominal GDP targeting is bonkers.

Figure 2: Simon Wren-Lewis says UK Nominal GDP is way below target

If the Bank of England had adopted a NGDP target, as many have recommended, the MPC would be tearing their collective hair out right now trying to stimulate the economy. There would be zero talk of interest rate increases. So there seem to be just two possibilities. Either NGDP targeting is nuts, or monetary policy has slowly gone off the rails by focusing on CPI inflation alone.

7. Arresting bad behaviour at the school gate.

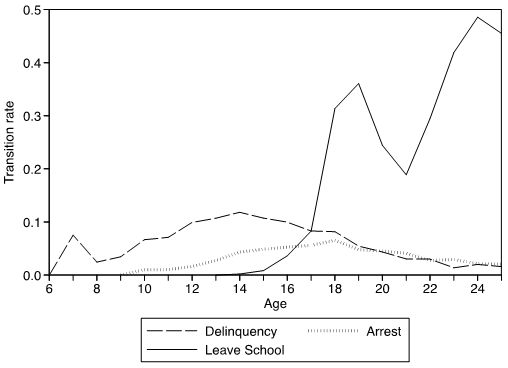

Much is being made in Wellington policy circles of the investment approach to social welfare and the provision of social services. So this note at voxeu that uses US data to show that delinquency has just as profound an impact on leaving school at an early age as arrest, could be useful for setting where resources are spent in New Zealand.

Figure 3: Transition rates for first delinquency, arrest and school-leaving by age

…we show that there are a large group of delinquents who avoid arrest, but whose reduced level of educational attainment is as important as that of the group that have been arrested. As a result, to focus interventions solely on those who come to the attention of the criminal justice system would miss a large part of the vulnerable population.

8. Let’s hope Treasury goes “viral” on Superannuation.

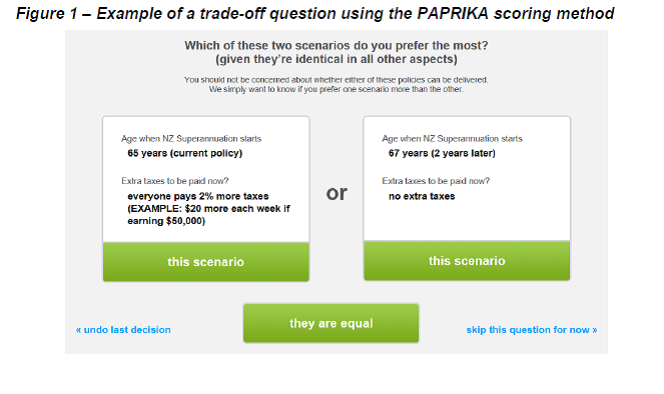

Treasury just released a tranche of 5 working papers that cover a myriad of topics including living standards, how to think about the uncertainty that surrounds the long-run fiscal outlook, labour supply and superannuation policy. Each of the papers contains some great insights so it’s a shame we get hit with the papers in one go. They could also benefit with a two page cut-to-the-chase treatment like the Productivity Commission do with their inquiry reports.

One paper that looks intriguing and practical in equal measure is work by Joey Au and Andrew Coleman at Treasury with help from Trudy Sullivan at the University of Otago. They look at how much you can reveal what people might prefer in Superannuation policy – or indeed other government policies – by simply asking a range of questions (see the figure below for an example). That’s helpful when it comes to set policy by making it easy to identify policies that have some winners and very few losers rather than the fraught policies that make some better off at the expense of others. The authors are keen to see others pick-up their methods.

…the policy of raising the age of eligibility by two years maximises well-being for the fewest number of people and lowers it for the largest number…Obviously, the decisions to change these policies are political. Nonetheless, just as economic models that show how income is redistributed by different policies…surveys that provide quantitative information about the distribution of preferences also can provide useful information to policymakers.

As the survey is web-based, it can be ‘rolled-out'… to let the general public do the survey at nearly zero additional cost, simply by posting the link on a public website, such as that operated by the Commission for Financial Capability, and letting the survey go “viral”.

9. Global growth dependent on improving female labour force participation.

With much to angst about on the global growth outlook, one big question is just where the growth is going to come from. Christine Lagarde is suggesting much could be done to lift female participation.

As the global economy risks falling deeper into a long-term malaise, where can policy makers turn to boost growth aside from central bank cash injections? International Monetary Fund Managing Director Christine Lagarde is pushing policy makers to get women into the world’s labor force.

“Women’s empowerment is not just a fundamentally moral cause, it is also an absolute economic no-brainer,” Ms. Lagarde said in a keynote speech at the W-20, an ancillary conference launched by the Group of 20 largest economies aimed at boosting gender parity in the global workforce.

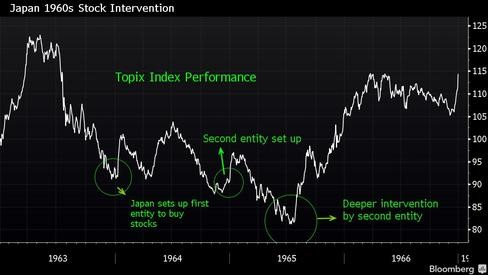

10. Is China today the Japan of the 1990s or the 1960s?

It’s tough to understand the Chinese economy at the best of times. The structure of the economy is much different to Western economies and policymakers have a completely different set of tools and political issues to grapple with. So it’s all the more useful to try and learn from the experience of other countries.

Many see parallels between the current slowdown in China and Japan in the early 1990s. If true that would hurt our own prospects but Paul Sheard, chief global economist at ratings company Standard & Poor's, thinks the correct parallel is Japan in the 1960s – a much more positive story for global growth.

China’s economic slowdown and market crash often evoke comparisons with Japan’s bust in the 1990s, a period that saw the world’s second-largest economy of the time tip into prolonged stagnation. Japan’s run-up eventually ended in a hard landing that the country is still recovering from. The argument says China could end up suffering a similar fate. Yet a more apt parallel may instead be its neighbor’s experience of the 1960s.

11 Comments

Or maybe 20+ years of high interest rates, super-control of inflation, and using interest rates to knock the stuffing out of the economy at the first sign of growth, has semi-killed the poor patient. Why bother to grow and expand when that will be punished with higher interest rates?

We have swung from one prime enemy; inflation, to a new enemy, deflation.

Perhaps modern societies cannot bear the natural cycles of prosperity and famine, so try to smooth it out with monetary policy. Except that ain't working no more.

So why not? well as a long term trend energy is no longer for ever cheap. If you accept that to grow GDP 4% you need 2.5% more energy and you have no more energy then you cannot grow. Indeed when energy starts to decline GDP is going to shrink. The noise on top of the long term trend is the boom and bust cycles...with the busts getting bigger and lasting longer.

#3

This isn’t really much of a surprise given the circular nature of those models, always assuming monetarism works because monetarism is assumed to work, but in this context it is quite more damning.

http://www.alhambrapartners.com/2015/08/25/when-the-fomc-completely-los…

The experts know it all

Stephen Cecchetti knows a heap about inflation. He used to head up the Monetary and Economic Department at the BIS in Basel and was the Director of Research at the Federal Reserve Bank of New York back in the late 1990s. His first job was counting cows for Goldman Sachs so he’d be right at home in New Zealand.

Well not that long ago the experts were telling everyone to fix their mortgages because interest rates were going up.

People with those sorts of qualifications are the last people to listen to for advice.

Re #1 and Auckland gridlock. Len Brown, buy 1000 new buses. Make fares inverse to traffic congestion. So, bus fares are really really cheap (or free/koha) during morning and evening rush hours. As the traffic clears up, fares can rise. This is the opposite of Uber and would fit together very well with Uber. No new roads or rail required, just an efficient use of infrastructure that is already there. Have our roads filled with buses during rush hours when most people are going the same direction and same place (in or out of the city). The rest of the time, have our existing roads full of cars going many directions to many places.

Nice, new buses are the key. Buses can be moved around to suit demand (unlike roads or rail tracks)

Dedicated bus lanes during rush hours. Let cars with three or more people use them as well? Use computer algorithms connected to digital signs to control access to express lanes. As conditions change, access can be adjusted. It is a simple logistics exercise, not rocket surgery. How is it possible that a problem so simple and straight forward has got us tied up in knots?

Auckland's traffic problems could be solved in six months for a relatively small amount of money.

The Auckland City Council needs, AT LEAST, $400,000,000 extra (more than it gets now), every single year, for the next 30 years, for transport infrastructure.

http://www.aucklandcouncil.govt.nz/SiteCollectionDocuments/aboutcouncil…

Or, it could buy a couple of ship loads of buses and some fancy digital signage and be done with it?

Predict inflation? and yet it seems the Keynesian and Minsky schools of economics and their followers have been quite reasonable predictors. Unlike say Peter Shiff following the Austrian school. Personally when I have a theory on a problem and its not holding true I abandon it and look for a better theory and test that.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.