Today's Top 10 is a guest post from Shamubeel Eaqub who is an economist, currently on a career break to be a dad. He is an occasional blogger at TVHE, author and advisory board member for Aotearoa Development Cooperative and NZ Asian Leaders.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz. And if you're interested in contributing the occasional Top 10 yourself, contact gareth.vaughan@interest.co.nz.

See all previous Top 10s here.

1. Auckland Council report on housing.

This big report from Chris Parker, Chief Economist at Auckland Council, is important. It takes a broad view of the issues making houses unaffordable, looks at the complexities and suggests a number of pragmatic solutions.

Chris Parker said to Radio NZ:

Mr Parker said a package of five policy areas could achieve the target, those include more efficient construction, more land supply and higher density housing.

There will be many competing views on this report. But the issues raised within are important and it's welcome to have a report that tries to get to some solutions. Perhaps the momentum is building for greater action. A speech by Bill English is worth reading, because it shows some seriousness among our political leaders too.

In this speech English “go[es] through a number of the reasons why the Government worries about housing, why it matters to the economy, and some of the key issues around the way that market is regulated.”

It's worth a read.

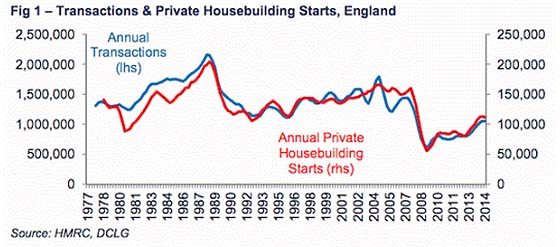

2. House building and sales.

House building follows house sales and new building. But there are normally many more house sales than houses built (because existing housing stock also turns over). In the UK, house building is typically around 10% of sales, while in NZ it is around 25%.

While this relationship is observed, it is not clear why the two are so closely linked. In the FreeExchange Blog on The Economist, they had a crack.

I am not convinced, but they reckon its because:

Housebuilders […] tend to target the price of new-build houses at the upper decile of the prices prevailing in the local property market (ie, at the top 10% of all the houses sold nearby in a given period of time). If that is true, then you would expect there (roughly) to be one house built for every ten sold.

3. Downloading house plans.

The Australian government is providing basic designs for sustainable homes, for free. Camille Bianchi writes in Domain:

those who used the plans as a concept and took them to their own architect to adapt would save at least $10,000: the average cost of the first concept and basic drawings.

Ms Andrews said in addition to savings in the design process, the ongoing cost of running a household would be minimised.

Not every element is perfect, but would something like this slowly push New Zealanders towards better quality house building?

4. Flatpack houses.

A flatpack house for $235,000? Japanese design giant Muji has moved from flogging homewares to selling homes. Madeleine Wedesweiler writes in Domain:

Muji made the move to Australia this year and now has three Australian stores: the newly opened Sydney site at the Galeries, as well as stores at Chadstone Shopping Centre and Emporium in Melbourne.

And they are not the only homewares giant moving from furniture on to bigger products. IKEA is now testing moveable walls,

but they won’t be on the market for at least three years, so it’s likely to be a very long time before the Swedish business brings out entire flat-pack houses.

Will this be part of the solution to more affordable and better quality homes?

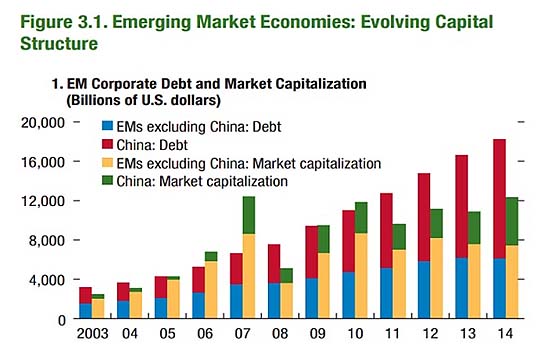

5. IMF: World set for emerging market mass default.

We have heard these warnings before, but there is a rising cacophony about risks from emerging markets. They became addicted to cheap money from the US, in USD (a cardinal sin) and now the reckoning may be at our doorstep.

A chapter in the IMF’s Financial Stability Report goes through the ins and outs. An easier to digest writeup in The Telegraph summarises:

The International Monetary Fund (IMF) has issued a double warning over higher US interest rates, which it said could trigger a wave of emerging market corporate defaults and panic in financial markets as liquidity evaporates.

The IMF said corporate debts in emerging markets ballooned to $18 trillion (£12 trillion) last year, from $4 trillion in 2004 as companies gorged themselves on cheap debt.

…the quadrupling in debt had been accompanied by weaker balance sheets, making companies more vulnerable to US rate rises. As advanced economies normalise monetary policy, emerging markets should prepare for an increase in corporate failures.

6. A global recession?

The global recovery from the GFC has been patchy, but enduring. But could we be in for another downturn? Robert Samuelson of The Washington Post investigates and suggests its only an outside possibility for now, as the emerging markets weakness is not enough to tip the US into recession.

there’s an outside possibility that a further slowdown in China could trigger a broader reaction. China’s currency, the yuan, would depreciate, making Chinese exports cheaper. To protect themselves, other countries would engage in competitive devaluations. As uncertainty increased, there would be a worldwide “pullback in risk-taking.” People and businesses would spend less. Global stock markets would sag.

What compounds the danger, he says, is that governments seem to lack the weapons to combat a new slump. Central banks (the Fed in the United States, the European Central Bank, the Bank of Japan) are already holding interest rates close to zero. There’s little enthusiasm for bigger budget deficits.

So the global economy is not flirting with a new recession — not yet, anyway. But it’s not a remote possibility either. Whatever happens will shape the election, and all the candidates are in the same boat: They can’t do much about it.

7. VW worse than Enron,

Recent revelations that VW rigged its emissions tests asks big questions. Particularly if corporations can be trusted to be good citizens. The need for oversight and supervision is high. David Bach from the Yale School of Management writes in the FT ($):

…there are reasons to believe that the fallout from this scandal will be as big as Enron, or even bigger. Most corporate scandals stem from negligence or the failure to come clean about corporate wrongdoing. Far fewer involve deliberate fraud and criminal intent.

Bach goes on to talk about the massive fraud. John Gapper in a separate piece in the FT ($) concludes:

The head of a Wall Street bank once told me the lesson he had learned from financial scandals was that ethics are absolute, not comparative. “We don’t behave as badly as our rivals” was a tempting but dangerous attitude. Many companies imperil themselves by clinging to this mantra.

Volkswagen wins the dubious honour of being the worst-behaved company in its industry, but it was a contest.

8. Will bad behaviour of carmakers make us like new technologies?

David Roberts of Vox writes:

Public discussions about electric vehicles, self-driving cars, and the future of transportation seem weirdly circumscribed to me. The value of alternative vehicles always seems to be judged against their ability to swap out for today's internal combustion engine (ICE) vehicles.

And the value, like any new technology, is likely to be what new applications they spawn, rather than improving current ways of doing things:

The enormous bulk of the potential lies not in replacing units in today's transportation system, but in generating new systems. It is the system benefits that are at once most difficult to predict and most rich with possibility.

The rest of the piece is a little sci-fi, but a useful collection of ideas on the potential uses of new technologies in transport. Worth a read.

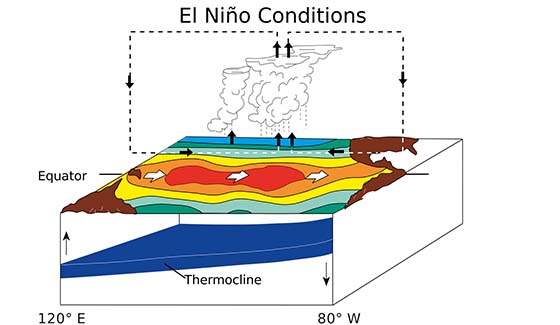

9. El Nino: Drought is coming, but how does it work?

Lots of headlines recently about the risk of drought in NZ from a strong El Nino weather pattern. But why does it happen? I found this piece by Nicholas Tyrell & Dietmar Dommenget from Monash in The Conversation a good explainer.

They write that El Nino is what happens as a result of rising sea temperatures in the Pacific. The important link is that:

global land temperature can be altered simply by changing the temperature of the tropical Pacific Ocean.

As a result:

we currently have a large, potentially record-breaking hot El Niño brewing in the Pacific Ocean, which is expected to keep growing at least through to January.

As the current El Niño combines with the background warming of climate change, we can expect land temperatures to continue to spike, potentially surpassing last year’s global record average. This warmth is likely to persist through and slightly beyond the period of the El Niño, increasing the likelihood that 2015 and 2016 will be very warm years indeed for the planet.

10. BOE: Climate change a 'huge' financial risk.

Climate change is worrying the Bank of England, particularly the risk it poses to the insurance sector. Scott Hamilton in the SMH writes:

Bank of England Governor Mark Carney said Britain's insurers face potentially "huge" exposure to shifts in climate-change policy and Group of 20 nations need to do more to combat associated financial-stability risks.

New Zealand is very reliant on global insurance markets and our coastal settlements may be at risk from rising sea levels. It could make swathes of our current buildings and infrastructure uninsurable. The 2014 ICNZ conference actually had a session on this, which you can watch above:

9 Comments

#1 - they - all the reports - and all the hypotheses never get past the report stage

The biggest problem is ... they avoid ... deny ... that inbound migration is an issue ... because you never see any modelling done or published in any of the discussions

In the real world - in the business world - where you succeed or fail .... you have to cover all bases

A quality submission to the Board would model all of the factors influencing the demand side for housing

and one of the passes through the model would be - if every other factor is controlled in a state of stasis what happens to the model if you add

(a) 10,000 migrants into Auckland

(b) 20,000 migrants into Auckland

(c) 30,000 migrants into Auckland

You see - nobody knows - and the academics doing all the reports don't want to know - because they are beholden to the supply-siders who have the microphone - and think they can beat it

Does anyone know of any modelling done on the impact on housing of various levels of migration into Auckland and or New Zealand - do they seek to rent? - or - do they seek to buy?

Just thinking out loud

You would think that a simple solution would be for all inbound PLT's, the arrivals card be made a bit larger and ask 3 more questions

(a) do you own any property in new zealand

(b) if answer to (a) is yes

- please list addresse(s)

- will you be residing at that address?

(c) if the answer to (a) is no

- please state the address where will you be staying - you must answer this question

- do you intend to rent?, or,

- do you intend to buy a property?

- if so in which city or region

How hard is that?

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.