Today's Top 10 is a guest post from Selena Eaqub, an economist and co-author of Generation Rent - rethinking New Zealand's priorities. She has previously worked for Goldman Sachs JBWere, the Reserve Bank and Statistics New Zealand.

As always, we welcome your additions in the comment stream below or via email to david.chaston@interest.co.nz. And if you're interested in contributing the occasional Top 10 yourself, contact gareth.vaughan@interest.co.nz.

See all previous Top 10s here.

1) RBNZ acts while government flails.

The Reserve Bank is looking at measures to rein in the Auckland housing market. As reported by Radio New Zealand:

Reserve Bank governor Graeme Wheeler openly concedes that puts the health of the financial system at risk.

But he's not giving up yet.

Speaking at the Finance and Expenditure Select Committee today, he told Labour Party finance spokesperson Grant Robertson that the central bank was exploring further measures to tighten the credit noose for investors.

"In Auckland, investors account for 46% of the transactions, for the rest of the country it's around 40 [percent] or a bit more, so it's very significant," Mr Wheeler said.

"It's providing a lot of impetus in the market. So that's one area we're looking at around the LVR [loan to value ratios] around investor activity [though] we're still doing the analysis."

Measures to introduce loan limits based on income levels - called debt to income ratios - are also in the pipeline.

However, the Reserve Bank can’t solve the housing crisis alone. The Government needs to step in and fix some of the fundamental issues, such as supply.

The Government has shifted the focus away from them and on to the Reserve Bank, Auckland Council, and other factors like “changing social norms towards having families later and more people wanting to rent” as reported by Interest.co.nz. The latter doesn’t stack up – most age groups have seen falls in home ownership. Renters are also unhappy relative to homeowners.

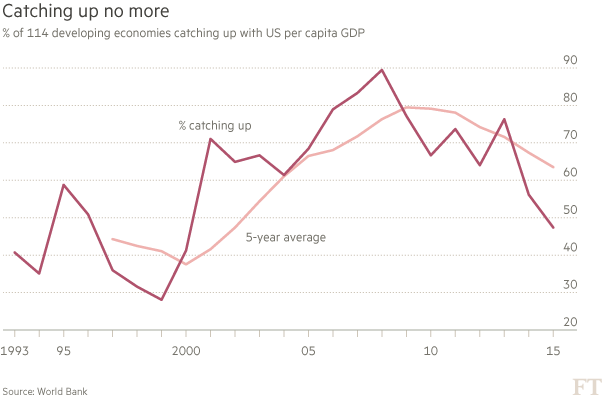

2) EM miracle slowing.

Optimism for emerging markets is fading due to depressed commodity prices. The BricsPost reports that:

The drastic drop in commodity prices, including oil prices that are 70% lower now than the same period two years ago, has set back efforts by emerging markets to regain the momentum they once had just five years ago.

The World Bank’s report, Global Economic Prospects: Divergences and Risks, says the worst hit are countries which have relied on oil exports as a major source of income.

The Financial times reports that it is the high commodity exporting countries that have suffered the most. The significant reduction in global inequality between countries is slowing.

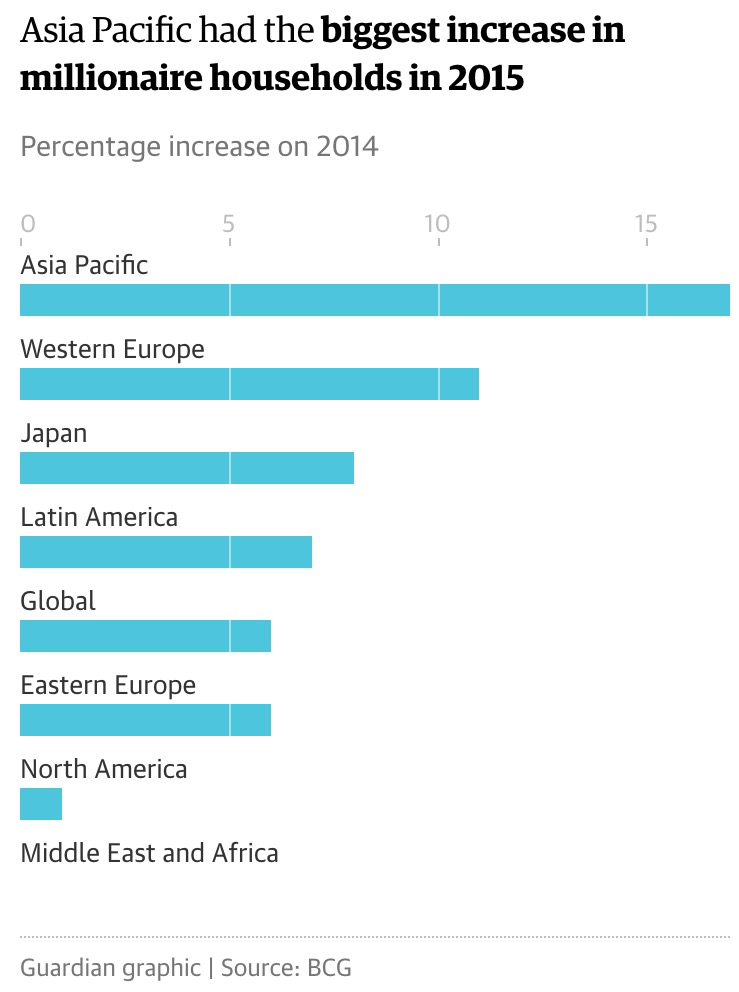

3) Richest getting richer.

Global private wealth rose 5.2%, with strong growth in the number of millionaires in China and India. The results are from the BCG annual wealth report. The Asia Pacific is expected to surpass Western Europe as the second wealthiest region.

In a reflection of the global shift in economic power, the Asia-Pacific region, excluding Japan, experienced the strongest rate of growth in private wealth, although it remained behind North America and western Europe in total wealth.

Asia-Pacific was the only region to post double-digit growth, up 13% at $37tn, with China “the principal growth motor”, BCG said, despite slowing economic growth in the region and increasing market volatility.

“China and India have strong GDP growth and that has fuelled a lot of wealth creation,” said Anna Zakrzewski, one of the report’s authors.

4) UBI’s time hasn’t come yet.

Universal basic incomes are in fashion. The idea is that the Government pays everyone the same amount of income. This is utopian. Switzerland recently had a referendum to introduce a basic income but this was overwhelmingly rejected, suggesting the time has not yet come for the idea.

The idea of universal basic income is it allows people to have more choices that they otherwise wouldn’t have like have start a business. However, it is quite an expensive exercise and will lift taxes too much. It is likely to create disincentives for working.

The Economist notes:

Setting up a basic income would be no easy matter. To pay every adult and child an income of about $10,000 per year, a country as rich as America would need to raise the share of GDP collected in tax by nearly 10 percentage points and cannibalise most non-health social-spending programmes.

More generous programmes would require bigger tax increases still. There would be benefits. Poorer workers (and people who work for no income, like stay-at-home mums) would get a big boost to their incomes.

Many people might use the payment to invest time and money in education or training. Entrepreneurship would become less risky.

A more robust safety net would give workers more bargaining power with employers, and force firms to work harder to retain workers (and to make productivity-boosting investments). Yet there would also be big downsides. Many people might choose not to work at all; social tensions might rise.

The availability of a basic income would almost certainly harden attitudes towards immigration.

5) Competing into inequality.

This report by London School of Economics asks the question about how inequality became politically and culturally attractive. It is because we are focusing on competition. Competition has become a virtue in contemporary culture. The problem is that competition is at odds with equity:

Competitiveness is an interesting concept, and an interesting principle on which to base social and economic institutions. When we view situations as ‘competitions’, we are assuming that participants have some vaguely equal opportunity at the outset. But we are also assuming that they are striving for maximum inequality at the conclusion. To demand ‘competitiveness’ is to demand that people prove themselves relative to one other.

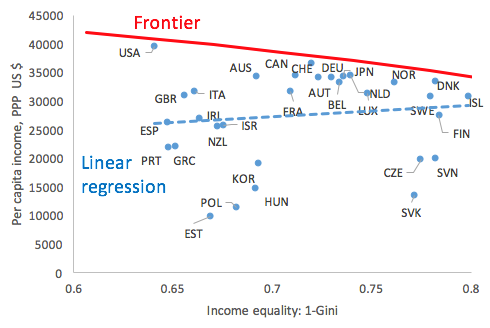

6) Fairness and growth possible.

This study has looked into countries in the OECD and has found that some countries can improve economic performance and equality.

Mainstream thinking posits that if an economy becomes more efficient it becomes less equal. There is a tradeoff. But this is not the case for every country.

Such findings seem to run counter to standard reasoning in economic textbooks pointing to a trade-off between economic performance and income equality (or efficiency and equity in the economics jargon). Okun (1975) dubbed this the “big trade-off” and explained it by the metaphor of the leaky bucket: "The money must be carried from the rich to the poor in a leaky bucket. Some of it will simply disappear in transit, so the poor will not receive all the money that is taken from the rich”

Countries at the frontier will find it hard to grow without sacrificing equity or economic performance. But for those countries that are not at the frontier, like New Zealand, it is possible to have increases in both economic performance and reduction in inequality.

7) Brexit a coin toss.

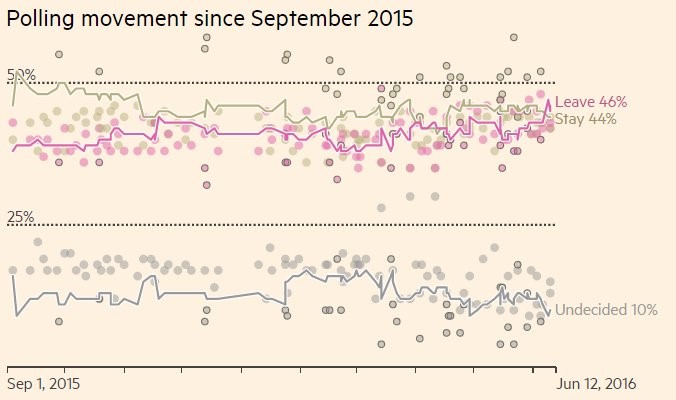

In a week, we find out if the United Kingdom will remain or leave the European Union (EU). Different polls have been showing different results. In this poll reported by the FT, it is very close with ‘leave’ in the lead.

The UK leaving the European Union is worrying because they trade and interact heavily with the rest of Europe. If they leave, they will have to renegotiate trade conditions – which is something that the ‘leave’ camp has not worked on in enough detail. The uncertainty is likely to cause fragility in world financial markets, including New Zealand’s. A recession in United Kingdom has been predicted by the British Treasury.

Source: Financial times

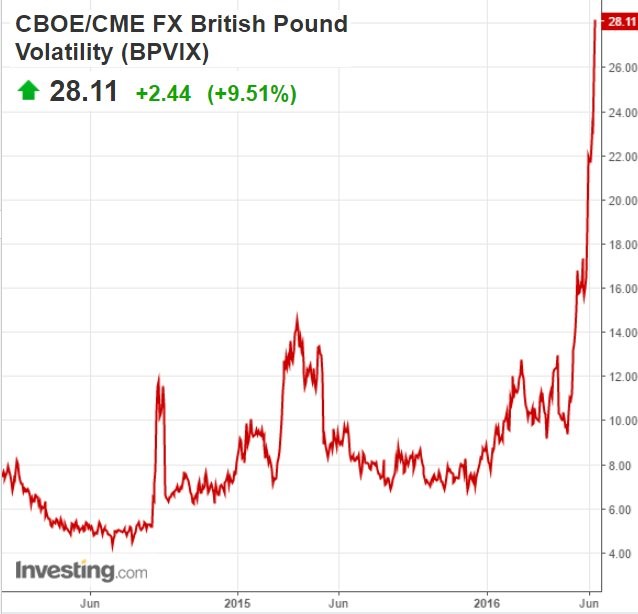

8) Pound panic on brexit.

The uncertainty around Brexit and different poll results have caused volatility for the British pound.

The pound has fallen sharply, reflecting that “the bears are in town”, as reported by the BBC. Investors are worried about a the impact of a possible Brexit on the economy. Financial market volatility is contagious - Asia and New Zealand financial markets have fallen in anticipation of the result

Source: Sober Look

9) No, robots won't take all the jobs.

Almost half of jobs in the United States are reportedly at risk of being taken over by robots. But a report by London School of Economics found that it is much lower – closer to 9%. This is because previous reports have assessed whether an entire occupation will be taken over by robots, but it makes more sense to look at occupations in detail:

Rather than assessing the risk that a whole occupation will be replaced by smart-machines the OECD authors instead take a more granular look at the underlying bundle of tasks that make up different jobs, considering how automatable each of them are. The point being that even within occupations that appear ripe for technological upheaval — say, bookkeeping or retail sales — there is much non-routine work that will prove very hard to mechanise in the near future.

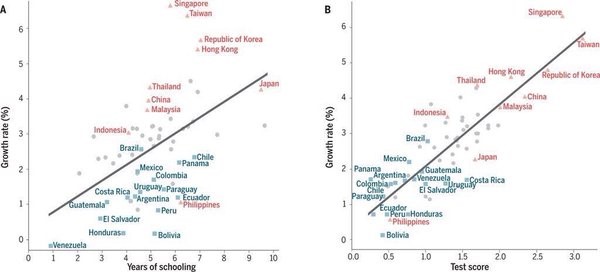

10) Quality key for education.

Quality and quantity are important for economic growth according to Science Magazine. They found correlations between the growth rates of a country with years of schooling, and test score.

The way to do this is to improve teacher quality. The Economist found that it is about improving the skills of the teacher, not other factors.

Forget smart uniforms and small classes. The secret to stellar grades and thriving students is teachers. One American study found that in a single year’s teaching the top 10% of teachers impart three times as much learning to their pupils as the worst 10% do. Another suggests that, if black pupils were taught by the best quarter of teachers, the gap between their achievement and that of white pupils would disappear…

Teacher-training institutions need to be more rigorous—rather as a century ago medical schools raised the calibre of doctors by introducing systematic curriculums and providing clinical experience. It is essential that teacher-training colleges start to collect and publish data on how their graduates perform in the classroom. Courses that produce teachers who go on to do little or nothing to improve their pupils’ learning should not receive subsidies or see their graduates become teachers. They would then have to improve to survive.

28 Comments

Say no to Sugar Hit Political Policies, and yes to Nation Building Policies and Standards.

http://www.radionz.co.nz/audio/player/201804400

Housing booms and dairy busts - what are the vulnerabilities in New Zealand's economy and what role has the government played in setting policy? Nine to Noon speaks to Kerry McDonald, former Chief Economist at the Comalco Group who's written a thinkpiece critical of the government's current approach and director of the NZIE and Kim Campbell, the Auckland Chair of the Employers and Manufacturers Association.

otherwise its a race to the bottom.

driverless cars are already here in a watered down fashion. tesla is the leader

https://www.youtube.com/watch?v=0A92HRD6szk

By 'watered down' you mean 'basically not at all'. Tesla's autopilot requires the driver keeps their hands on the wheel, and is basically a collection of driver aids (lane keeping assist, adaptive cruise control, auto stop). It's not a 'driverless car' in any real sense.

Driverless cars are coming - Google is the leader - but it'll be a few years yet.

Watch all of the changes due in the next 5 years. Some of the changes I can't talk about because they are being implemented now but you don't seem to have noticed the changes that are already here.

Have you used a self-checkout at the supermarket?

Driverless vehicles are still getting a lot of polish before release (they really do need a lot of work) but they will be everywhere in a short time. The first generation iPhone was released less than a decade ago and now smart phones are everywhere. The same will happen with our roads, wait until the first cars are road legal (not the Tesla version that requires you have have you hands on the wheel).

It will take some time for a complete fleet change. Kiwis do tend to hold onto their cars for a long time, and you are right the cars coming out now last a lot longer. Even with driverless cars the existing stock of cars will be on the road for a long time so it could be a good 30 years before we find it unusual to see one of today's cars on the road.

Cars have gotten more affordable over time as well as the reliability and lifetime increase. It has been bad for profitability for car manufacturers which is why they have their own finances companies to make up the difference. Some are suggesting cars will become a service rather than something you own, but we will see what actually happens.

In the very near future the whole car world will change.

With driverless cars and Uber the big car firms will get left behind so they are buying in to the new system.

The new system will be private cars off the road and big motor companies will supply large corporate taxi companies.

If you need to go anywhere you will have to call a driverless car owned by an Uber type company who get their driverless cars from someone like Google

Goodby private cars - and in the not to distant future

Why Car Makers Are Hailing a Ride Uber-Style

http://www.wsj.com/articles/why-car-makers-are-hailing-a-ride-uber-styl…

Saftey advantages of car sharing becoming apparent also. "Using a unique panel of over 150 cities and counties from 2010 through 2013, we investigate whether the introduction of the ride-sharing service, Uber, is associated with changes in fatal vehicle crashes and crime. We find that Uber’s entry lowers the rate of DUIs and fatal accidents. For most specifications, we also find declines in arrests for assault and disorderly conduct. . For most specifications, we also find declines in arrests for assault and disorderly conduct. Conversely, we observe an increase in vehicle thefts."

"Hertz announced its earnings last week and cut its revenue expectations for the year, saying that the rental car market is suffering from excess capacity. And by “excess industry capacity” it might as well have said “Uber,” “Lyft,” or any other on-demand car service, though Uber is eating up everyone else in its market."

https://skift.com/2016/04/18/skift-survey-more-evidence-of-uber-becomin…

Hoteliers might be struggling though - I'll bet check in is faster than usual.

We constantly talk about the number of jobs being lost to Robots. But why are economists not looking at the other big source of job losses?

Businesses passing the work onto the shopper

Examples are

Serve yourself at the supermarket - That's not a robot - That's me you are talking about.

Go and buy some furniture from the warehouse and you take it home and assemble it yourself - Thats not a robot doing the assemble - That's me.

And so on

Hers another example of doing the talk -

"Minister for Primary Industries Nathan Guy says he had "strong words" with his Italian counterpart after seeds imported from Italy led to a potentially costly outbreak of velvetleaf."

http://www.odt.co.nz/news/farming/386255/govt-mulling-options-after-vel…

I am sure the Italian will be well cowed.

Driverless cars are fine; until it rains.

Google labs employees are paid to fail... they go in every day trying to kill their projects and get bonuses if they do..

The google car was supposed to hand control back to the driver if it got too hard... this ultimately failed when they actually asked the users... BUT the project was relaunched for FULL autonomy...

Now the engineers, even at that time, admitted there were times that it was too hard...

So; they work fine on "easy" roads in fine weather...

Its a LONG until you really have a truly autonomous car.. you are more likely to have autonomous drones that take you places as its probably easier to navigate in the sky... depending on the weather again of course...

For a Universal Basic Income i would rather see the government introduce a special digital currency. Let us call this currency a WINZbit.

These WINZbit’s would have very limited use in that they could only be used for essentials/

Essentials being Food, Clothing, Shelter, Medical, Transport, Electricity and so on.

They could not be used for luxury items. To purchase luxury items you would have to work and earn NZ dollars. This takes away the dis-incentive to work.

Landlords and businesses who would accumulate quantities of WINZbit’s could exchange them with the government for NZ dollars or to pay their taxes.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.