Wishful thinking, as we all know, is the death knoll for many investors. Getting carried away by emotion has rarely, if ever, been a recipe for accumulating vast riches.

It seems that a lot of people have missed that distinction between wishful thinking and reality lately - and I fear it’s going to hurt them badly.

After Donald Trump won in November, some Americans didn’t just hope for the best; they thought it was here.

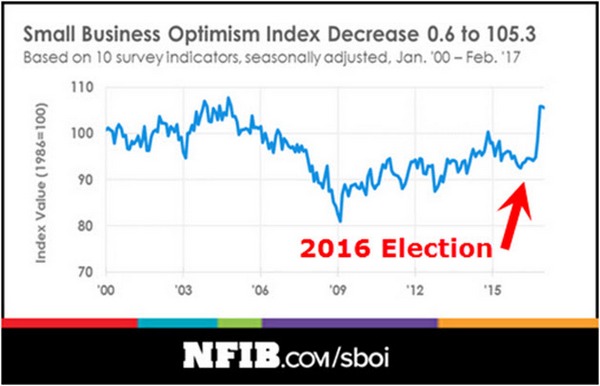

The euphoria is visible in the Small Business Optimism Index, which is published by the National Federation of Independent Business.

Confidence spiked higher following the election because surely, people thought, an all-Republican White House and Congress would waste no time ushering in business-friendly policy changes.

While that was a reasonable conclusion, now it looks like small-business owners may have let their political excitement affect their common sense.

The jury isn’t in yet on how massive the changes are going to be. And the NFIB index hasn’t pulled back much, so respondents seem to be patient so far.

You could say the same for investors. Stock benchmarks rose after the election, particularly in regulated sectors like banking and energy, because investors believed policy changes would lead to higher earnings.

I was less confident, and said so in my December Yield Shark letter.

Can Trump and the Republican-controlled Congress do anything to justify this kind of shift? I don’t think so. Yes, we’ll get some tax cuts and deregulation. They might trim government spending here and there. But they can’t possibly do as much as some people expect for 2017.

The Senate will spend weeks, possibly months confirming Trump’s cabinet appointees and a Supreme Court justice. The House will have to come up with the “replace” side of its “repeal and replace Obamacare” pledge.

Add in Democratic delay tactics and heavy lobbying from opposing interest groups, as well as resistant state and local officials and court challenges, and I see little chance that Trump will deliver all or even most of his agenda as fast as people expect.

So, I think stock bulls should curb their enthusiasm - otherwise, they will get a rude awakening at some point next year.

I’m still convinced that’s true - and the “rude awakening” may be even closer now.

Coiled spring?

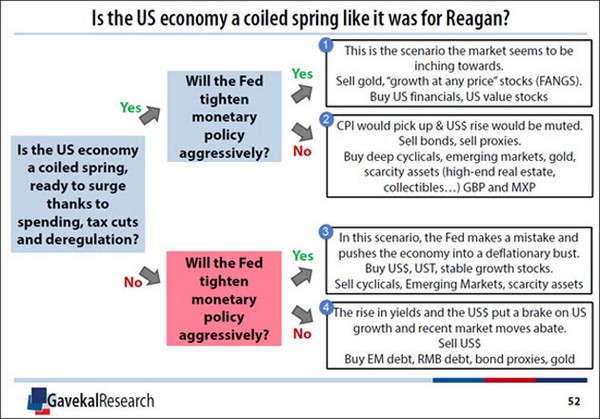

In that same issue, I showed Yield Shark subscribers the following decision tree from one of Louis Gave’s epic Gavekal Research presentations. It’s four months old now, but still a good analytical guide:

Answering two questions leads you to one of four scenarios, each with a different investment strategy.

·Does the US economy have pent-up growth potential that a Trump presidency can unlock?

·Will the Fed tighten monetary policy aggressively?

Let’s think about these in order.

If the US economy is a coiled spring ready to surge, it has a strange way of showing it. Even the most optimistic projections show real GDP growth for 2017 will be little better than last year’s disappointing 1.6%.

I think our economy is the opposite of a coiled spring.

It’s been stretched past its limits by debt. Aside from insane federal, state and local government debt, we owe trillions more in credit card, auto, student loan, and mortgage loans. That stands in the way of any meaningful expansion.

But let’s suppose for the sake of argument the economy really wants to grow, and all it needs is a little nudge from the government. Are those policy changes right around the corner? I don’t think so.

Gridlock galore

The Trump administration’s first 100 days are running out, and we have yet to see any major legislation pass.

The Obamacare repeal/replace plan is still on the table but not doing well. The GOP is divided at least three ways. Compromises that would bring more conservatives aboard repel the moderates—and vice versa.

Furthermore, the healthcare reform bill wasn’t just healthcare. It would have eliminated the Obamacare taxes on higher-income Americans… and its Medicaid cuts were going to offset lower corporate tax rates in other legislation. Now that’s much harder.

Scratch healthcare and tax reform off the list.

Bank deregulation? That’s going nowhere. We hear talk about amending the Dodd-Frank Act, but nothing concrete is happening.

Worse, the Trump administration still hasn’t gained control of key regulatory agencies. As of now, the Securities and Exchange Commission (SEC) only has two commissioners. One is a Democrat. The Commodity Futures Trading Commission (CFTC) is similarly split.

New chairs for both agencies are pending in the Senate. But even after they’re confirmed, the Democratic commissioners can stop any reforms cold simply by boycotting the meetings, thereby preventing a quorum.

That would be easy to fix, though: the president could simply nominate more commissioners and then outvote the Democrats.

I don’t know why he hasn’t. Maybe he has other priorities. Maybe no one wants those jobs (I sure wouldn’t). The Federal Reserve Board has no nominees for its three open slots either.

Banks can’t count on much administrative relief until the president gets his people in control of the regulatory agencies - and that’s nowhere on the radar right now.

Infrastructure stimulus? It’s bogged down in a debate how to pay for it. Last week, Trump told the New York Times he would consider borrowing “much more” than $300 billion for infrastructure projects.

You can imagine how GOP deficit hawks loved that idea. It won’t mesh well with their desire to cut tax rates without adding more debt.

Trump has talked about making deals with Democrats if he can’t get enough Republican votes to pass his bills. But Democrats have little reason to cooperate. Their base voters are energized against Trump and won’t stand for it.

Bottom line:

·Congress has no majority favoring any of the changes that made investors and business owners so optimistic after the election.

·The Trump White House has a lot to do and is still trying to get organized.

Instead of a unified Republican government, we have near-total gridlock.

I think the answer to our first question, “Does the US economy have pent-up growth potential that a Trump presidency can unlock?” is clearly “no.” Scratch Louis Gave’s scenarios 1 and 2 off the list.

As for the Fed…

The Fed tightens the screws

The policy-setting Federal Open Market Committee (FOMC) spent last year building up its nerve for more rate hikes. It gave us one in December and another in March, and more are coming.

The Fed is clearly on a tightening path, but is it “aggressively” so? That’s not as clear.

We saw in the March dot plots that even the most hawkish FOMC member thinks the longer-term federal funds rate will only rise to 3.75%. Other estimates came in at 3% or lower. That’s “tight” only compared to years of near-zero rates.

Of course, 3% rates might feel tight to a generation of Millennial traders who have never seen anything like it before.

But that’s not all.

The March FOMC minutes, released last week, showed the Fed is seriously considering how it will unload its bloated bond portfolio. They could start letting assets roll off without replacement later this year, which could have more impact than rate hikes.

Looking back at the decision tree, I think the No/Yes path is the most likely. The economy isn’t ready to surge, but the Fed will tighten policy anyway. Not a good combination, but I’m in the minority.

Most investors still have their bets on Yes/Yes. Some are starting to get nervous. Given events in Washington, they should be.

Cold reality

I am sorry to be the bearer of bad news, but here’s reality as I see it.

·There will be no tax cuts this year.

·Banks won’t get much regulatory relief.

·Obamacare will likely collapse with no replacement ready.

·Any infrastructure stimulus is way off in the future.

·The Fed is tightening because it thinks an economy that grew only 1.6% last year is overheating.

It doesn’t matter if we’d like this to happen. It is what’s coming, in my opinion.

I haven’t even mentioned other flash points: a potential government shutdown after April 28, more military action overseas, or trade conflicts with China and other countries.

I also haven’t mentioned the assorted Russia-related investigations. Whatever happened in the election, the fallout is distracting both the White House and Congress.

I’ve thought about what could possibly change all this for the better. Nothing comes to mind.

Recent reports suggest Trump wants to shake up his White House team. That may help, but he’s already lost of lot of time and political capital.

Gridlock vs. euphoria

To me, this situation feels like a slow-motion train wreck where all you can do is watch.

Much depends on the first quarter earnings reports that start flowing this week. Good results from high-profile companies might buy a little more time. Unexpectedly bad results from big names could put on the brakes.

Washington’s monumental gridlock is on a collision course with investors’ blind euphoria. We’re all on one train or the other. Hold on tight.

See you at the top.

*Patrick Watson is senior economic analyst at Mauldin Economics. This article is from a regular Mauldin Economics series called Connecting the Dots. It first appeared here and is used by interest.co.nz with permission.

20 Comments

Trump is incompetent, mind isn't on the job and his intellect is low versus the demands placed on him so I have low expectations. His actions. Thus far in office can give no one any confidence...what if anything has he achieved. So depending on the quality of those around him is how far their economy will progress. Expect little and you won't be disappointed.

I would just like to take this moment to present an observation from the ranks of the Alt-Right. It would be fair to say that confusion and anger reigns. It would appear that Trump has done a 180 on key assumed election promises. The two most important ones being, working with Russia to defeat ISIS and no more wars in the Middle East. Currently it would appear that the US has greatly emboldened the ISIS movement and is practically acting as its air support. At the same time the US is unnecessarily aggravating the Russians who I would think are not to be messed around with.

The astonishment and disappointment is palpable. A few still hold out hope that events are largely theatrical or there is some deep master plan at play however there is a deep sense of surrealness as all major Western powers now appear to have lost their minds.

It certainly is a bit of a worry Zach. I don't know if you read 'The Slog' by John Ward but think you might enjoy:

The key short-term factor for me has to be a US President weakened by implacable domestic opposition to his presidency per se, and thus left with little alternative but to regain some ground by foreign policy action. Donald try to change system, nasty élite ensure Donald reviled; Donald bomb people, good boy Donald, now you’re cookin’ on gas.

But the ramifications of this in terms of freedoms in both the US, UK and the EU are very bad indeed. The neocon bubble-dwellers are in the ascendancy. As so often happens in history, this is the overture to their demise. But such will not be achieved without violence, false Gods, and a different relationship between the community and the State…. with no guarantee at all that it will be any better than the one we have now.

Thanks David George I will bookmark that blog as I love that sort of stuff.

My communications with a small sampling of people on the ground in Texas who are not Alt-Right reveal that they are largely happy with the Trump administration so far. They didn't expect the coming of a great leader so weren't as disappointed as the meme warriors, in fact this is exactly what they expected, maybe better than expected. Tenders for building the wall which will really be a glorified fence are proceeding apace apparently. Bombs dropping anywhere on the ME don't seem to be a concern and it is generally recognized that diplomatic dialogue with the North Koreans is a pointless exercise. Xi and Trump may have come to an "understanding". They largely look at things through the lens of what is best for America rather than the West as a whole.

Laughable Zachary

Any New Yorker could've informed you long ago Trump is a bombastic fool. His renovation architect on Mad A Lago hasn't ever been paid nor have thousands of others. Trump has been involved in over 3500 law suits !

Everyone in NYC knows his pathetic story

Sadly last roll of the dice working class gave him the votes to win in the undemocratic electoral college.

He's only good for crutch molesting

Is this true Zachary, has the glow from the golden wig finally faded and you now recognize what a self indulgent buffoon, that Mr Trump is??

The chances are that he will probably end up bankrupting American and probably take the most of the Western world with him if he's left in power. The most he can hope for is to motivate (Scare) the rest of the world to buy arms from the US to bolster their economy. Why do you think he's been pushing to build up the US military, it's not to protect the West, it's all about trying to make money.

He's a Con Artist that's all. I would suggest taking a look at some of Bill Maher (New Rules) extracts for some cutting reality as light entertainment. He explores the similarities between President Trump and a snake oil salesman. It's also very funny. I would post the full link but it might offend some delicate ears, so you'll have to google it: New Rule: Trump and the Long Con | Real Time with Bill Maher (HBO)

Yes it is true CJ099 although I actually believe the situation is worse than Trump simply being a self indulgent buffoon. Who knows what the truth is or what is actually going on? Politicians seem to always go back on their promises and when a promise is not to go to war with Russia that is pretty serious. The whole point of electing Trump was to put the final nail in the coffin of the Neocon warmongers who have wrecked havoc with millions of people's lives and who now seem to be back in force. Interesting times ahead but ,yes, I am done with Trump. It is pretty obvious now that he is not to be trusted. I think he just worked the crowds and altered his pitch as the crowd increased its enthusiasm so the apparent policy he was promoting didn't really exist. He came across as a humorous and a cool guy but look at him now, giving us Sunday school sermons while committing war crimes and betraying his friends.

ZS - how is Donald Trump going to war with Russia?

Why are you so upset that an American politican is going back on his word? If you're so upset about that - why aren't you disgusted with what National have done the last 3 terms here in NZ?

And that you say Trump is a self indulgent buffoon - have you read your comments on this site the last few years? All I can think of is a pot, kettle and the colour black.

US National Security Adviser Herbert McMaster thinks that the relations between the United States and Russia have reached the lowest point.

Ultimately I believe in looking after my own interests. I wasn't as emotionally invested in NZ politics. I didn't vote National. Trump talked about a movement which caught my attention.

I was quoting CJ099 about Trump being a buffoon. Not sure why you need to take it so seriously. I am actually quite enjoying what's going on. The big lesson here is that electoral politics is a big con everywhere.

I trust that you are going to get down on bended knee and make a heartfelt apology to those among us who were able to see Trump for what he really is BEFORE the election. You argued black and blue how he was going to be the shining knight on the white steed, when in fact he turned out to be exactly what those of us with a basic understanding of human nature predicted he would.

It is such foolishness as yours that got the idiot into power.

More to the point, why aren't you attacking Trump still?

No bended knee from me, got to move on. I'm following Max Stirner now:

https://en.wikipedia.org/wiki/Max_Stirner

Supporting any social movement is supporting statism!

OR:

Clintonian foreign policy, the aims of George Soros, the crypto-Imperial European Union and the objectives of NATO are all things that, by and large, most Anglo-Saxon Leftlibs sign up to. All of this twisted futurology desires a New World Order that has little to do with individual freedom, and everything to do with Stalinist élite socialism.

This isn’t something they’ve been forced into: it’s a goal they actively espouse. The citizen enslaved by centralised nationalism is to be transmuted into squashed clay. As a bloke who wants the diametric opposite of that, I cannot but be opposed to those who yearn for it.

You will get what you want. The trouble is centralisation requires resources, something the world is on the back side of in terms of the supply curve. Forget the conspiracy of the one world order, if it exists it was formed my men not smart enough to understand resources.

Nice link thank you, I didn't know about Hitler being bugged.

Thank you Macadder, no clay pipe involved. I have removed the link in deference to David Chaston who has given me a tune up for posting it or similar and won't be doing so again. I read all sorts of stuff including the Guardian on a daily basis (PC as it gets with a real pro earth bent) and have linked to them in the past. I truly feel one should seek out a range of thoughts and knowledge without fear nor favour, perhaps even more so if they challenge deeply held personnel beliefs.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.