By David Hargreaves

So, we can take it as a given that the Reserve Bank's loan to value ratio (LVR) restrictions will celebrate their fifth birthday later this year - and right now it's difficult to see them ever being removed in their entirety.

If there had been a genuine appetite on the part of the RBNZ to say farewell to the - let's face it, supposedly temporary - LVR rules then it might have been imagined the central bank would at least signpost the possibility of following up on January's slight loosening of the rules.

Instead, the latest Financial Stability Report and ensuing media conference on Wednesday appeared to highlight a central bank that's happy with the job the rules have done and unwilling to part with them in the near term, if at all.

The LVRs, lest we should forget, were created in 2013 and officially brought into usage as of October 1 that year.

The initial iteration was through a 'speed limit', allowing just 10% of new lending by banks to be for house purchases with deposits of less than 20%.

This was followed by an ill-starred Auckland-centric move in 2015 that saw the general 'speed limit' of 10% retained in the largest city and with the additional impost of a 30% deposit rule for Auckland property investors. Outside of Auckland the general 'speed limit' was lifted to 15%.

There was virtually no impact on the Auckland market - while the loosening of the rules outside of Auckland poured petrol on the housing markets elsewhere, very probably assisted by 'Auckland' investor money looking for easier targets.

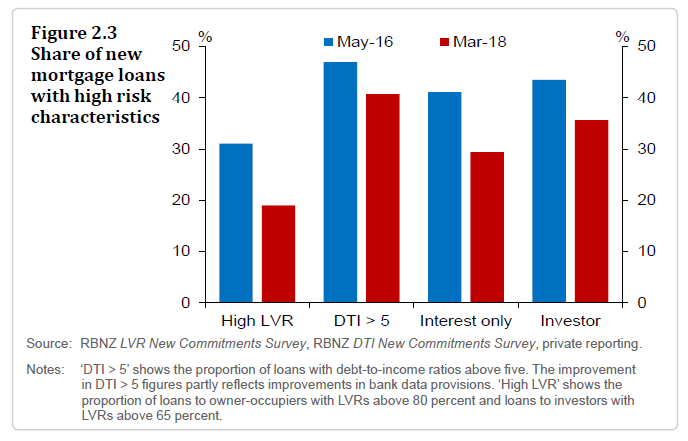

So, then there was 2016 in what I still think was at the time a kind of panicky last resort - but which has seemingly done the trick. This was the blanket introduction of a 40% deposit rule for investors right round the country, while the general owner-occupier 'speed limit' was put back to 10%.

In relaxing the rules from January 1 the RBNZ has shifted the investor deposit limit down to 35% and relaxed the general speed limit to 15%.

Being the naturally cautious body that it is, the RBNZ was always likely to want to give itself more than six months of observing how things are going after the relaxation of the rules before deciding whether to go the well again.

And it is true that the RBNZ likes to keep things close to its collective chest.

Notwithstanding that though, the language in both the latest Financial Stability Report document and at the media conference suggested that the RBNZ feels it's holding a reasonable hand of cards at the moment and it's not prepared to lay that hand on the table.

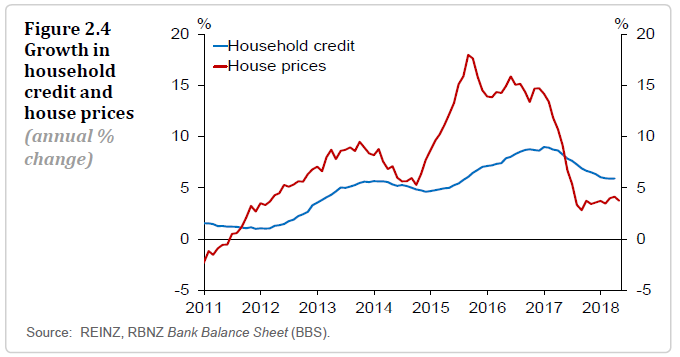

It's instructive to look at what's happened both to the housing market and borrowing patterns through the three evolutions of the LVRs. After the first implementation in 2013, the general speed limit, the housing market did cool. But, and it's a very big but, during the same period the RBNZ hiked interest rates four times in the belief that inflation was just around the corner. It wasn't and the hikes were reversed - but there can be no question they will have contributed to the cooling of the housing market in that 2013-14 period.

So, then to 2015 and the Auckland-centric move. Basically Auckland investors said 'is that all you've got?' and carried on, while elsewhere the loosening of the rules seemed to act as a definite spur to people to start climbing in boots and all, with the result that what had largely till then been an Auckland-led boom became more country-wide.

And then there was the 2016 move, tightening up the general speed limit and bringing in the heavy artillery against the investors nationwide. Call it desperation, call it what you will. But it worked. In fairness again though this did coincide with a squeeze on bank funding and a move to a far more cautious lending strategy on their parts.

The really interesting thing about the 2016 move though is that if the whole market had been clobbered then it could be imagined that the RBNZ would be under huge pressure to lift the LVR restrictions totally.

The real focal point or, if you will, leverage in all this has been provided by the first home buyers. They are the public face of a distorted housing market. The victims. As people most likely to be wanting to borrow more than 80% of the cost of a house these were the people always most likely to be affected by a blanket 'speed limit' on high LVR lending. And so that seemed to be the case from 2013 onwards.

Unfortunately the RBNZ's excellent new mortgage lending by borrower type figures didn't appear till mid-2014 - so, it becomes anecdotal how the mortgage market share broke down before then. What we can say is that the monthly figures in 2014 showed the FHBs making up slightly less than 10% of new mortgage lending. Investors at that time were making up just under 30% of the total - but this soon moved to in excess of 30%. In Auckland it was higher.

By mid-2016, the FHBs, possibly helped by the relation of the overall LVR speed limit outside of Auckland, had lifter their overall share of borrowing to around 11%. But the investors were storming. They were up to about 35%.

So out came the RBNZ blunderbuss. By the end of last year the FHBs were up to a 15% share of overall lending, while investors' share had shrivelled to under 21%

What happened following the January relaxation of the LVR rules was therefore always going to be very important.

The latest available figures are for April. These show that the FHB's share has risen to a new high of over 16%, while the investor figures have recovered a bit too - at about 23.5%.

Now, anybody worth their salt will tell you percentages alone can be a bit meaningless. The most meaningful detail in all this is the fact that the actual amounts borrowed by FHBs have stayed remarkably consistent month-by-month even as the amounts borrowed by investors have fallen by hundreds of millions. In April 2016 prior to announcement of the third instalment of LVRs, the FHBs borrowed $789 million. In April this year they borrowed $868 million.

Contrast this with the investor grouping, which in April 2016 accounted for $2.182 billion worth of new mortgage borrowing, but in April this year totalled just $1.264 billion.

This is hugely significant because the FHBs are politically loaded. They've been used as the justification by various vested interest parties as to why the LVRs should be removed.

The fact is though - whether this was by design, or as I suspect an accident - the 2016 changes to the LVRs have tilted the balance back somewhat toward the FHBs and where they were previously being outbid by grey-haired baby boomers they now have a fighting chance again.

As I say, this is all hugely political. The idea of the future of the country being locked out of homes is a very bad look for anybody interested in winning a general election.

So, there would be satisfaction all round at the moment, firstly though the fact that the housing market has gone quiet but secondly and most definitely that the FHBs are in there and managing to get homes.

Why would anybody want to change that?

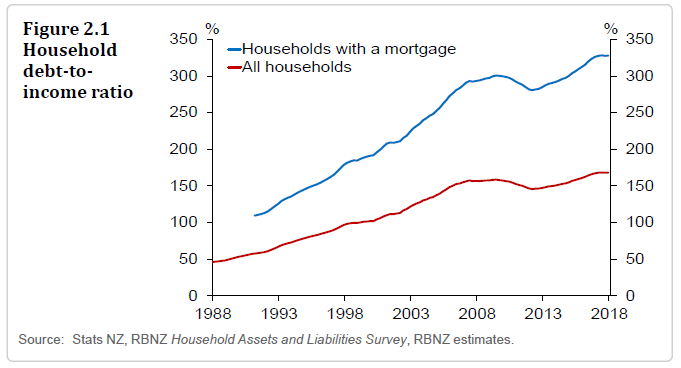

The Reserve Bank reiterated the point it has made previously that only about 8% of NZ households have investment properties - but they account for 40% of housing debt.

I think there is room for argument as to whether investors really are a bigger risk to financial stability in a serious housing downturn - but the RBNZ certainly believes that.

Therefore there is every reason to believe it would be keen to see the indebtedness of investors drop.

That's why I can't see any chance at all that the RBNZ will want to let the higher deposit limit on investors go at the moment. I think that is going to be in place for a very long time and I can't see it being reduced any further from the current 35% level.

As for the general overall speed limit of 15%, well, the key point (and sorry to hammer this) is the fact that the FHBs are now managing. Why therefore loosen it further?

RBNZ Governor Adrian Orr said the central bank would wait "at least" till the next Financial Stability Report in November before addressing possible further relaxation in the LVR rules.

Personally, I think there's no chance at all there will be relaxation in those rules this year.

And really, with a housing market currently in check but not going wildly backwards, I see no compelling reason for the RBNZ to loosen the rules any further.

The other big point to consider is that the RBNZ is still very keen to get some sort of debt-to-income or debt servicing instrument added to its repertoire of 'macro-prudential tools' (of which the LVR measures are one).

The previous National-led Government pushed back against such a measure and the new Government has shown no appetite for it either.

To me, it's logic to have a DTI of some description available. I think the RBNZ will keep working away on this one.

Is there a potential some way down the track for a bit of a trade-off? 'We get our DTI and you get a further reduction in LVR restrictions?'

It's got to be at least a possibility, surely. Why then would the RBNZ give up the current state of the LVRs without perhaps some sort of trade off occurring?

Either way, whether the LVRs are relaxed further or not (and as I say, don't hold your breath for this year), I now think they will never be completely retired.

Indeed, outgoing Acting RBNZ Governor Grant Spencer alluded to such an idea in his final major speech before retiring from the role in March, suggesting that tools such as LVRs could either be switched 'on' or 'off' but would remain established within banks’ reporting and compliance systems.

The LVRs are here for good and I wouldn't bet against the RBNZ getting its DTIs too - eventually.

17 Comments

Bring on DTis. Reckon 5x should be a good number, and follow Aussie lead on interest only (i.e. no more interest only bubble lending). All this on top of loss fencing and overseas speculator ban . Good to see Center Left trying to protect the average kiwi from debt enslavement, and getting into what they were voted in to do.

Get on with the asset reset for the benefit of all Kiwis (the many) bar Bank profits and speculators (the few).

I think DTI of 8 - 9 is acceptable:

Rent cost $550pw. Mortgage + Rate + mandatory insurance on $600k house (similar house in similar area as rent) is $550 pw (4.3% interest). It is about 50% of average family income (75k income) and this is mean that mortgage was taken with DTI about 8-9x (assuming ~20% deposit)

Ok, so, we can say we are renting with DTI 8, why would we restrict owning on DTI 8x ? People are paying this amount of money for rent anyway.

Oh, risks.. You say if you cannot afford to rent a house - your family moves to renovated garage/sleep-out for (guess how much?) not cheaper than $350 pw! So, you saved $200 on rent. If you stay in own house and board tenant into 1 room for $200pw - you saved same. And you can put interest only repayment - another $80pw pay cut. At the end both you and tenant are living in a house, not in garage.

I believe DTI restriction should not be harder than converted (as above formula) to rent. And it is now about 8.

p.s. 75k is roughly average family income. $600k house is about price I have seen several of my colleges (FHB) are now buying/just bought in Auckland (super city location). $550pw rent is what they payed for rent and some payed $350 for garage to save that extra $200pw for deposit the first home.

Amazing how FHB's have been the largest sector buying houses in the last 5 years as reported over the last few days while the media talk up how hard it is for them ?? Lots of BS great to see lots of FHB's just getting on with their lives and ignoring all the possible excuses why they could fail. DTI's are very unlikely to happen when LVR's seem to be so effective. Great comment from ZS below -

'The factor you are not considering is Globalism. A million dollar home in Auckland may be a shitbox from your perspective as a privileged Kiwi but from a global perspective it is heaven on Earth.

It's not just a home though but everything that surrounds it. An English speaking, British heritage system, high trust, low corruption, low violence, low unemployment, high tolerance, diverse, high prosperity community, in a mild climate, connected to the rest of the world by cheap air travel. '

There are loads of people doing very nicely today young and old the clock is never going to get resent AM the sooner people understand the world as it is today rather than try to control and reset it the better the country will be. We need to be more self directed and responsible rather than looking for someone to save us like the COL, they will appear to be doing good but will make no difference except run up more debt as they always do.

That is good, but you've got to realize that by bringing house prices down, you will cause serious pain to the average Kiwi you're trying to help. Aka major unemployment, maybe a decade or more for the economy to restructure (if there is the intensive discipline and will from both the private and political sectors, a complete retooling of skills and industry in the economy, most likely bank defaults occurring, very likely you see failures. All those things as well as others, are very associated with housing busts, which is very very different from improving affordability.

The best way to make homes more affordable, is not to bring prices down (that actually makes them very un-affordable because people don't have jobs at that point), but to raise the real incomes of the average man, and I'm not talking about increasing the minimum wage. To do that we need an intense drive on education and skill increases, and would actually need to dramatically raise productivity levels, this should be public priority number one, period.

The truth is housing is the heart of the economy, and it fits with who we are as a species, we have this weird tendency to want to produce offspring, which is reflected in every economy being totally focused on building nests (homes) to do just that, it's not rocket science.

The other thing about 'debt enslavement' is that we are a very young nation compared to most. Think about the huge wealth and real economic value accumulated over centuries in say Japan, or Europe, very large populations, with huge history and therefore real wealth behind them. We are young! We don't have that history, and that is absolutely OK, everyone starts somewhere, money is loaned from those who have to those who do not, that might seem like enslavement, but I look at that as a major opportunity for the country, its not the debt, its what we do with it that counts. The world would loan us everything they had if they saw we were really using it productively, but that's a choice we have yet to make and commit to, there are only hard choices.

That's really my take on it all, I guess that's what comment sections are for.

Well said lalaland - hat is good, but you've got to realize that by bringing house prices down, you will cause serious pain to the average Kiwi you're trying to help. Aka major unemployment, maybe a decade or more for the economy to restructure (if there is the intensive discipline and will from both the private and political sectors, a complete retooling of skills and industry in the economy, most likely bank defaults occurring, very likely you see failures. All those things as well as others, are very associated with housing busts, which is very very different from improving affordability.

There's room for people like you in politic's -sensible !

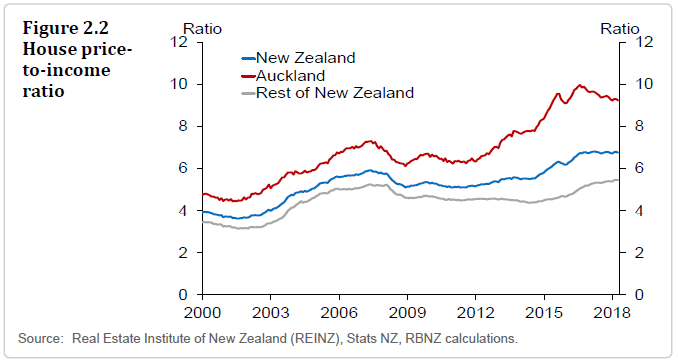

Continuing to pour people into Auckland will continue to lock FHBs out of the market unless they have parental help. So potential home buyers are driven out of Auckland.

Maybe this is the strategy - turn more and more people into renters, then a corporate buyout of housing.

So a $250,000 repayment mortgage at 5% costs the same as a $350,000 interest only loan at 5%. No wonder the first home buyers have had to borrow so much to compete with 30% of the loans in the market being interest only. (and probably negatively geared as well). Who wrote the rules to this game? Someone who didn't have any kids of their own?

A mortgage is a leverage tool. I wouldn't be buying in Auckland unless I could put 50% down as margin-calls can come when you least expect. If I had half a million sitting around though, Auckland wouldn't even be on my radar.

Housing sentiment in winter is interesting .. I'd imagine in the past, renters suffering in cold, poorly maintained rental properties would be encouraged towards home ownership. However, now that house prices have reached such heights, home ownership doesn't equate to higher living standards.

In such a low wage economy, houses averaging a million dollars should be of a standard where they are something to behold - which in Auckland they're not. People are largely free to decide the risk they'll take on and property maybe continue to increase in value. I just think it's strange FHB are increasing their market share in Auckland.

The factor you are not considering is Globalism. A million dollar home in Auckland may be a shitbox from your perspective as a privileged Kiwi but from a global perspective it is heaven on Earth.

It's not just a home though but everything that surrounds it. An English speaking, British heritage system, high trust, low corruption, low violence, low unemployment, high tolerance, diverse, high prosperity community, in a mild climate, connected to the rest of the world by cheap air travel.

As such a million dollars is extraordinarily good value. It is why all similar places on Earth have appreciated massively. Even Hobart and for similar reasons Reykjavík.

@ Zachary Smith

A million dollars is a huge amount of money, unless you expect to never pay it off. Take the housing bubbles out (Sydney, NY, California, Melbourne, Toronto, Vancouver, parts of South Korea, etc) and even with currency conversions, Auckland houses are 'shit boxes' compared to the rest of the OECD.

Saying Auckland is safe is a contentious claim. NZ has one of the highest incarceration rates, homeless rates and child abuse rates. The wages in NZ noway justify the house prices compared to our OECD counterparts .. social issues in NZ are growing at an alarming speed and by all accounts traffic in Auckland is a bad joke.

I could go on all day but to be frank, your arguments are weak, full of holes and smack of propaganda, Zachary Smith. Normally your comments are very insightful, don't know what is happening with you today.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.