GDP growth forecast will probably be lowered

The Bank will have been reassured by the continued health of the labour market. In fact, the Bank’s forecast that the unemployment rate would average 5.0% in the fourth quarter was spot on. Job vacancies, the Bank’s favourite leading indicator of labour market conditions, climbed to a fresh recordhigh relative to the size of the labour force in November, which lends some support to the Bank’s view that the unemployment rate will continue to decline.

And even though inflation slowed a little further in the fourth quarter, the Bank will be able to cast the blame on falling petrol prices. Indeed, the 1.75% average of trimmed mean and weighted median inflation was exactly in line with the Bank’s forecast.

However, jobs growth has continued to slow and the number of full-time positions fell in both November and December. Combined with the recent weakening in the employment surveys, that’s a sign that the labour market is losing steam.

What’s more, developments in economic activity have been disappointing. For a start, the Q3 national accounts data released a day after the Bank’s December meeting showed that GDP expanded by just 0.3% q/q in the third quarter. That means that the economy probably expanded by no more than 3% last year rather than the 3.5% the Bank was forecasting in its latest Statement on Monetary Policy. And the continued deterioration in business confidence suggests that the Bank’s forecast of a 3% rise in GDP this year looks increasingly optimistic. We suspect it will lower its GDP growth forecast for 2019 from 3.25% to 3.0%.

That said, GDP growth of 3.0% would still be above the economy’s sustainable rate of 2.75% and would imply that spare capacity will continue to diminish. As such, we expect the Bank to retain the key phrase that higher interest rates are likely to be appropriate at some point.

Bank is underestimating threat from housing

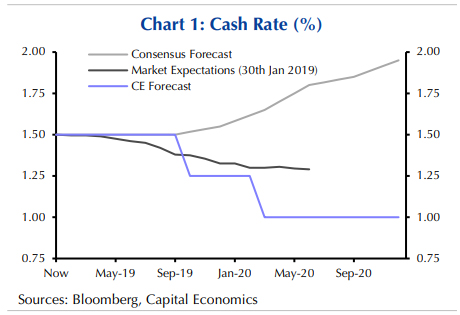

The analyst consensus agrees with the RBA’s view that the next move in rates will be up, though not before the first half of next year. By contrast, the financial markets are now pricing in about an 75% chance that the RBA will cut interest rates by the end of this year. (See Chart 1.)

We believe that the Bank continues to underestimate the threat from the weaker housing market. House prices fell the most since the current downturn started in December and our sales-to-newlistings ratio suggests they will keep falling at a rapid pace in the first half of this year. We’ve lowered our forecast for the peak-to-trough fall in house prices from 12% to 15%. A fall of this magnitude would be nearly twice as large as the one in 1982/1983 which currently holds the record for the most severe downturn in Australia’s modern history.

Admittedly, the Bank already said in December that it expects dwellings investment to be close to its peak. But the further 9.1% m/m fall in building approvals in November suggests that it will fall by more than the Bank was anticipating. What’s more, we think that the slump in house prices will encourage consumers to live within rather than above their means, so consumption growth may slow from 2.6% in 2018 to 2.0%.

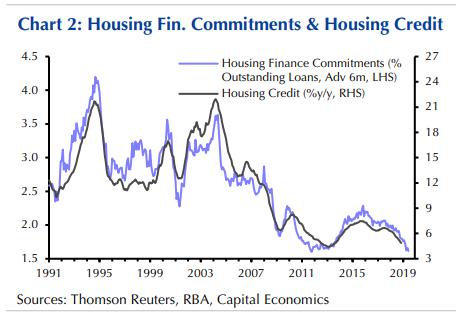

Finally, the threat from the Royal Commission is hanging over the banking sector. Labor will probably win the federal election that needs to be held by May and Shadow Treasurer Chris Bowen indicated that a Labor government would adopt its recommendations unless there were “very, very, very good reasons” not to do so. There are already signs that banks have started to tighten lending conditions. The share of firms that are reporting difficulties accessing finance has been creeping up in the NAB survey. And the continued decline in housing finance commitments suggests that housing credit growth will soon revisit its 2013 lows. (See Chart 2.)

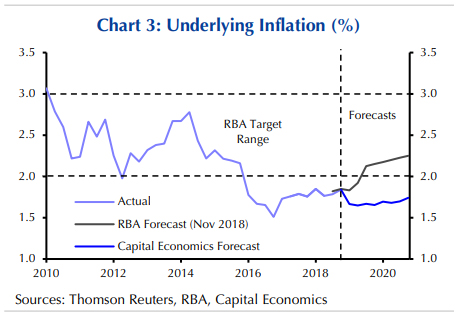

Our forecast is that GDP growth will slow to 2% this year and remain there in 2020. That would be well below the potential rate and suggests that spare capacity should widen again. Indeed, we now expect the unemployment rate to rise to 5.5% by the end of next year. A renewed slackening of the labour market would nip the fledgling recovery in wage growth in the bud. So while the Bank expects underlying inflation to rise above 2% by the end of this year, we think that it will remain below the lower end of the Bank’s 2-3%% target range for another two years. (See Chart 3.)

We now expect the Bank to lower interest rates to 1.25% by the end of the year and follow up with an additional 25bp cut in the first half of next year.

That’s consistent with the lessons from other advanced countries that experienced housing downturns. We’ve identified 58 housing downturns in 18 advanced economies since 1980, including the ones in Australia that started in 1994, 2008 and 2010. When housing was expensive as it was in Australia at the end of the boom in 2017, house prices fell by nearly 14% from their peak – broadly in line with our forecast of a 15% decline for Australia’s house prices. Central banks loosened policy at some point in the three years after the start of housing downturns in 49 of the 58 cases (85% of the time). When they didn’t, it was either because interest rates were already near the zero lower bound or central banks were managing fixed exchange rate regimes.

The consensus is that the Australian dollar will rebound from US$0.72 now to around US$0.75 by the end of the year. By contrast, we believe that it will continue to weaken. While the financial markets are already pricing in looser policy, we think that the exchange rate would still weaken a little further once the consensus shifts towards rate cuts. We also believe that the prices of Australia’s key commodity exports, iron ore and thermal coal, may fall by around 25% and 10% this year, respectively. Finally, we believe that stock markets will continue to sell off this year. All told, we’ve lowered our year-end forecast for the Australian dollar from US$0.65 to $0.60.

Marcel Thieliant is the Senior Australia & New Zealand Economist at Capital Economics, based in Singapore. This article is re-posted with permission of the Capital Economics Australia & New Zealand Service. For more information or to request a trial contact alexander.klimov@capitaleconomics.com or call +61 2 9083 6809

16 Comments

"Reserve Bank governor Philip Lowe retreats from his tightening bias and declares "the probabilities appear to be more evenly balanced" between an interest rate hike and an interest rate cut."

The RBA, followed by the RBNZ, is going to lower interest rates. They have no choice; there's nothing left they can do, and doing so IS NOT GOOD, regardless of what any debt holder may think

Mortgages will still be assessed on a much higher multiple than wherever the new rates are; at 7% rather than at the market of 3% ( or wherever); credit is going to be harder and harder to come by, and that won't stop what's coming - much lower asset prices.

All lower rates are going to do is imprison property holders in situ, but allow them to keep paying off the mortgage. There is no long term upside from this. Only a VERY long downside.

We are more stable politically and we don't have millions of fish dying in a river but we also aren't wonderful politically and are our rivers aren't anything to crow about. Royal commision wise, we're operating with the same underlying system and will face similar issues, we're just delayed and will face most of these issues in due course.

Most Australians would swap PM's in a heartbeat. Australia is burdened with a boorish culture and deeply partisan politics. Compromise is virtually unheard of. Gay marriage tells you all you need to know about our respective cultures and the ability to adapt and evolve. Most commentators here find it difficult to praise NZ.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.