This is a repost of an article by Kernel, an index investing platform. It is here with permission.

Opinion

Everyone wants to beat the market, be the exception, have above-average returns. But how easy and achievable is this as an outcome for an investor?

In this article, we dive into “picking winners” because there are some great companies out there that will be worth many multiples of today’s share price in 10 years’ time, so surely it is just a matter of finding them and avoiding the poor ones? Or finding someone who can do this for you. Brokers and investment advisers have acquired clients on the basis of their “ability” to beat the market for many years.

But before we get into who can actually beat the market, we wanted to weigh in on the discussions the previous article by Dean Anderson generated. So here we go:

Time in the market and suitable asset allocation

Yes, we are strong promoters of time in the market, not timing the market. Why? Because the evidence consistently proves that attempting to time the market delivers sub par results. Of course, this topic is connected to horizon and drives asset allocation, along with a number of other factors such as your own financial situation, risk tolerance and objectives. Let’s not forget that for many of us we will be living well into our 80’s and beyond, which may mean we need to rethink our asset allocations and when to move fully to capital protection in order to ensure we don’t run out of funds.

Let’s be frank – this item is completely separate to the merits of index investing and whether kiwis are scared of the sharemarket.

Index funds are disrupting the markets

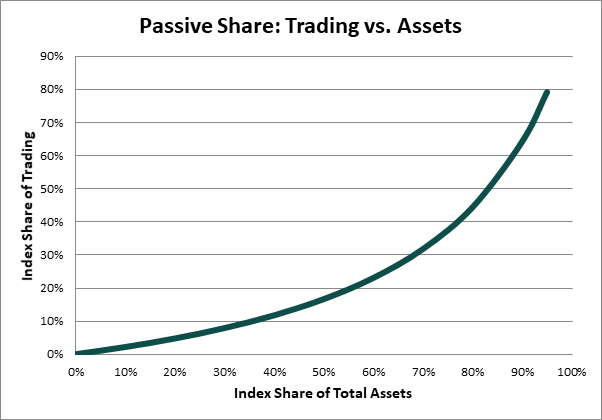

There are two points to this argument. The first is market efficiency and price discovery. As we will all agree, it is trading that sets market pricing. So, is there a risk to price discovery with index share of market ownership increasing? This can be conservatively modelled by assuming that index funds turn over 10% of their portfolio per annum and active funds turn over 50% (very conservative and recent research found to be nearer 5% and 100% respectively). The results are as follows:

Source: S&P Dow Jones Indices

Current estimated index market share of the US market is approximately 25% (worldwide, index market share is less than 5% and in New Zealand less than 3%), which would imply index share of trading is between 5-10%. For index trading share to get above 50%, the index share of assets would need to get to approximately 84%. In short – we have a long way to go before this argument has any merit.

The second point is understanding when index funds actually trade. The most actively traded security in the US is regularly the SPY ETF ($15b USD per day), however, this does not result in trading of the underlying securities.

In fact, the only time there is trading of the underlying securities is when units are created/redeemed or when an index re-balances and as most index funds track a range of market capitalisation weighted indices, there is often very limited trading to take place at an index re-balance. To be very clear, day to day, when a security falls in value the fund does not trade or re-balance the portfolio, the value of that security is simply lower as a percentage of the fund’s value.

Now on to today’s topic ...

JP Morgan Chase, the largest bank in the US and a major asset manager, looked at how difficult it was to pick individual stocks. They reviewed data from 1980 to 2014 using the stocks in the Russell 3000 (98% of the US market.) What they found was the following:

Individual companies have a high risk of going out of business

40% of companies would, at some point, suffer a “catastrophic decline.” This decline represents a 70%+ decline in value from which the stock price did not recover. Ever. This isn’t like buying the entire market where you wait it out. The company just goes out of business. 40% of companies over a 35-year time period. Of course, 60% didn’t and some of those did very, very well. So if you happen to pick stocks in the 40% or miss the best stocks in the 60% – your result will highly unlikely beat the market.

Individual stocks under-perform, on average

67% of stocks would under-perform the Russell 3000, which is seen to represent the entire US share market. By only owning one or a few stocks, your risk of missing out on those winners is quite high. See last week’s blog with our chart showing the NZ average being higher than the median. The market returns (and those of a fund tracking the index) heavily depend on the relatively few winners for their gains.

It’s caused by matters beyond the companies’ control

There are some great high-profile examples where in hindsight, management missed essential opportunities or made mistakes. But, more often, JP Morgan found in their research over 35 years, that factors completely outside management control contributed to a company’s decline. These external factors include changes in commodity prices, changes in government policy on tariffs and/or trade, unconstrained expansion by competitors and technological innovation.

Good investing is boring investing

There is a fallacy we have, because it makes sense in many aspects of life, that more effort creates better results. However, when it comes to investing, more effort just takes more time and costs more, which eats into your returns. If you’re trying to beat the market, you’re already starting on a back foot. The reality is you have a life, commitments and probably a job and family, investing is about the long term, not about guessing what tomorrow holds for our economy, the global economy or a particular company.

Leave it to the professionals – right?

If you think you can hire a professional to beat the market, you are sadly mistaken. It isn’t because these people are unintelligent. It’s because they are smart and there are many of them. Their absolute skill is worthless, when relative skill is what matters, and now they no longer have a large pool of amateur investors to take advantage of the information asymmetry.

These professional investors and managers become the market and their opinions on what market prices should be, dictate the prices at which stocks are bought and sold. They have taken all the information available, calculated the value of that information, to the point where some of them are willing to buy at a price that others are willing to sell. When buying or selling shares, who do you think is on the other side of the trade, selling you a company at a “cheap” price? You’re not trading against Nigel down the street. 90%+ of trades are institutional trades placed by professionals.

So, despite their best efforts, on average these folks under-perform the simple approach taken by a well-run, low-cost index fund that just invests in a wide range of companies in a given market.

This is not a matter of opinion. This is fact. Well-documented fact.

Fact that is documented again every year and in every market analysed by in the SPIVA survey: the Standard and Poors Index Versus Active.

In the US stock market over a 15-year period to 2018, 89% of actively managed funds under-performed.

SPIVA – S&P Dow Jones Indices

For any given asset class, that number ranges from 79% to 97%. Plus, this is after only 15 years, over your adult lifetime of 50-60 years, those numbers would be even higher.

Can’t I just pick the good funds?

Yes, there are some funds that out-performed a comparable index fund over this time period. But identifying them in advance is just as difficult as choosing the stocks that will out-perform the market in the first place. And the out-performance is usually minimal; while the under-performance is often dramatic. The evidence is no different in New Zealand or the other major markets in the world.

To make matters worse, much of the out-performance that does occur is no better than luck. The question shouldn’t be why a few people managed to beat the market, but why so few of them didn’t. Statistically speaking, random chance should have led to more out-performers than is seen in the data.

So, if the professionals, with all the resources they have, cannot do this successfully over the long-term, what chance do you really have on your own? It’s like thinking you can diagnose a patient better than a doctor with no formal medical training, no staff and no laboratory resources – in your spare time. You’re trading against professionals with far more information and resources at their fingertips.

“But I’ve picked winners before”

Now, I’m not saying you cannot beat the market ever, even in the long-term. Maybe you are a rare possessor of the skill, knowledge and discipline needed. But this skill is so rare and so valuable that if you really do have it, it makes no sense whatsoever for you to be doing anything else with your life other than picking stocks for the benefit of hundreds or even thousands of other people.

So, what should you do if you think you may have this skill? Well, the first thing to do is to prove you are right. How do you do that? You meticulously track your decisions and returns (and perhaps even have them audited by an outside firm so you can prove your rare ability to your future investors.) Be sure to include all costs including taxes and ideally the amount and value of your time. And not just the winners, the one you got really right, but also the losers.

If after a few years, you find out that you are highly skilled, you can in fact beat the market, open up a hedge fund and start cashing in. If, like most, you realise within a few months or years that your crystal ball is just as cloudy as everybody else’s, then you can quickly abandon the effort before it dooms you to a lifetime of investing under-performance and join the rest of us at Kernel as index fund investors.

Why even invest in index funds and the capital markets at all?

Well as we outlined last week, so long as you don’t look too closely or regularly (because information causes behaviour) and you leave it alone to grow, bumps and all, the share market will give you the best return over 10+ years.

This is a repost of an article by Kernel, an index investing platform. It is here as part of a range of views.

10 Comments

After being in the Smartshares Top 50 and High Dividend ETFs since their inception, I agree with Stephen. However, let's be real, even a monkey could make money in these markets. That's the reality that Stephen is not really giving any air to. So all this pondering over which is better--passive vs active--needs to balanced against the context of what's going on. And I think that context itself is quite possibly a more important point to think about how you should invest in ETFs.

Current share returns are abnormally good but long run returns are likely to be better than lower risk options if you can

1 weather long troughs, not overreact to them

2 diversify across companies and industries

3 low admin cost

Nz has a Wild West background so we only have a relatively short history to look at Nz market performance over, but long run studies of the more mature US share market indicate an ability to gain a return of 4% before fees and personal taxes while maintaining inflation adjusted capital value.

https://www.visualcapitalist.com/stock-market-returns-time-periods-1872…

Good advice. Even pros can't beat the market (on average, over long term), and they have better information, better tools and lower trading costs. Index funds with minimum management and trading fees are about as good as you can get access to as a small player/individual, though there are sensible long term strategies like investing in faster growing economies and markets (eg big cities in nice climates) - particularly places where smart populations have been held back by bad governments (China, Vietnam)

Not necessarily. As an example, take a look at this ETF of the top 50 stocks on Shanghai Stock Exchange. Down 58% from inception in 2007.

You could invest better than Buffet by doing what Stephen says, then juice the returns by adding a degree of leverage - never more than 30-40% (gotta have nerves of steel for the magnified draw-downs at times). Oh yes, and making sure you own at least one insurance company outright, so you can get the benefit of OPM (Other Peoples Money/Free Capital) to invest, thereby keeping most of the returns after claims...darn, I knew there was a catch, I just need about another $200M so I can buy one.

Even Buffet who is an active manager has advised his missus to plonk all the cash she gets when he dies into index funds and leave it there. There is anyway a strong element of index buying by those NZ mangers who claim to be active, mainly because the NZX is so small that if they don't buy the market darlings they are will lose investor support and perish.

I have no interest in trying to beat 'the market'. I look after my own portfolio of shares and enjoy doing so, but if I didn't, I would certainly go into index funds as a passive investor.

I have long believed in keeping costs to the minimum and in part, that means not over-trading. The best advice I ever received was from a fund manager many decades ago and I have followed it pretty faithfully-run your profits and cut your losses. I have seen countless examples of investors who refuse to sell their loss making holdings on the spurious grounds of-it's only a paper loss. This is a good example of loss aversion, one of the powerful psychological biases identified by Kahneman and Tversky and which led to the emergence of Behavioural Economics.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.