As we look ahead, we expect that the interplay between market risk and economic growth will drive gold demand in 2020. In particular, we focus our attention to:

In our new gold market outlook, we also explore the performance of gold implied by our innovative Gold Valuation Framework across various hypothetical macroeconomic scenarios.

Gold shone in 2019

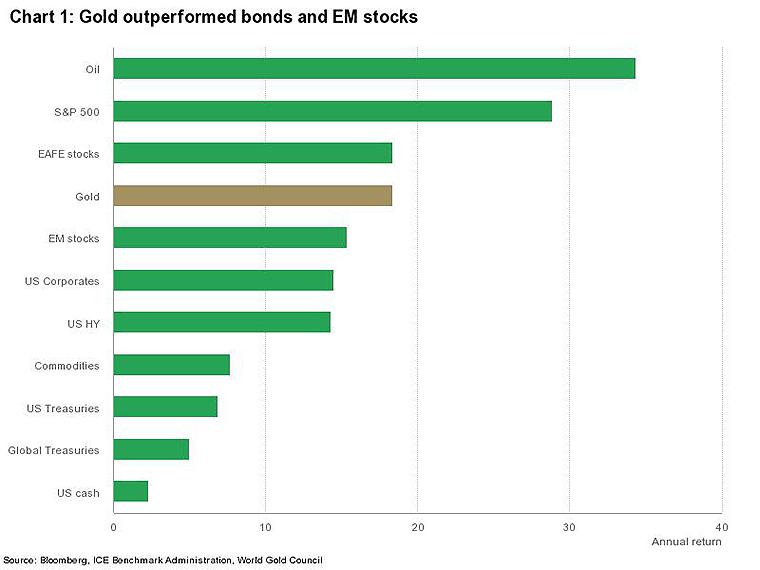

Gold had its best performance since 2010, rising by 18.4% in US dollar terms last year. It also outperformed major global bond and emerging market stock benchmarks in the same period (Chart 1). In addition, gold prices reached record highs in most major currencies except the US dollar and Swiss franc (see Table 2 in the Appendix).

Gold prices rose most between early June and early September as uncertainty increased and interest rates fell. But investors’ appetite for gold was apparent throughout the year, as seen by strong flows into gold-backed ETFs, growing gold reserves from central banks, and an increase in COMEX net longs positioning.

Gold Outlook Chart 1: Gold outperformed bonds and EM stocks

Annual performance of major global assets *

Sources: Bloomberg, ICE Benchmark Administration, World Gold Council; Disclaimer

*As of 31 December 2019. Annual returns based on the LBMA Gold Price, Bloomberg Barclays US Treasury Index and Global Treasury Index ex US, ICE BAML US 3-month Tbill Index, Bloomberg Barclays US Corporate and High Yield Indices, MSCI EM Index, Bloomberg Commodity TR Index, MSCI EAFE Index, S&P 500 Indices, and Bloomberg Oil TR Index.

High risks and low rates on the horizon

We expect that many of the global dynamics seeded over the past few years will remain generally supportive for gold in 2020.

In particular, we believe that:

- Financial and geopolitical uncertainty combined with low interest rates will likely bolster gold investment demand

- Net gold purchases by central banks will likely remain robust even if they are lower than the record highs seen in recent quarters

- Momentum and speculative positioning may keep gold price volatility elevated

- And while gold price volatility and expectations of weaker economic growth may result in softer consumer demand near term, structural economic reforms in India and China will support demand in the long term.

Read the full commentary, analysis, and see hypothetical forecasts for gold performance in 2020 as implied by Qaurum based on a range of maco-economic scenarios developed by Oxford Economics in our new outlook, or try Qaurum to customise your own scenarios.

This article is a re-post from here.

Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

To subscribe to our weekly precious metals email, enter your email address here. It's free.

Comparative pricing

You can find our independent comparative pricing for bullion, coins, and used 'scrap' in both US dollars and New Zealand dollars which are updated on a daily basis here »

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.