They were locked up, locked down, and generally put away, but now the credit cards are finding their way out again.

But spending has not quite bounced back to the levels seen a year ago.

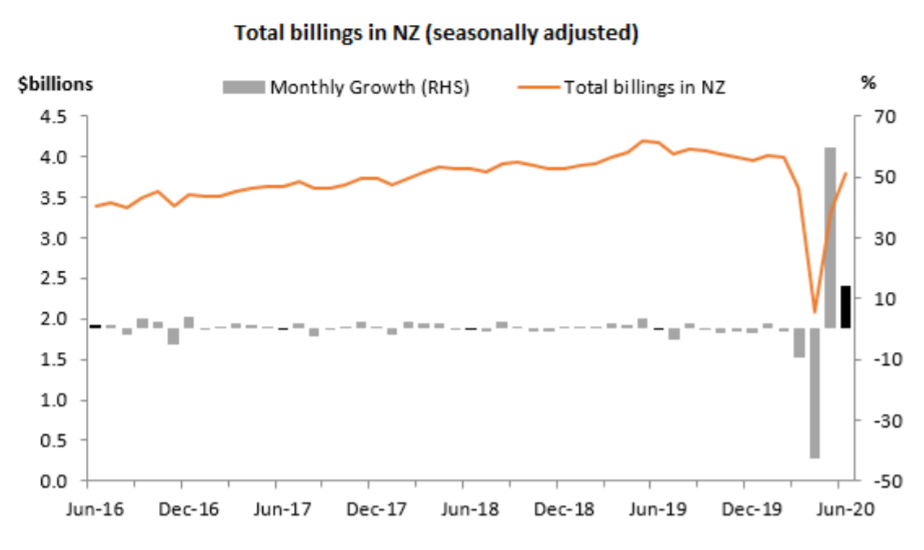

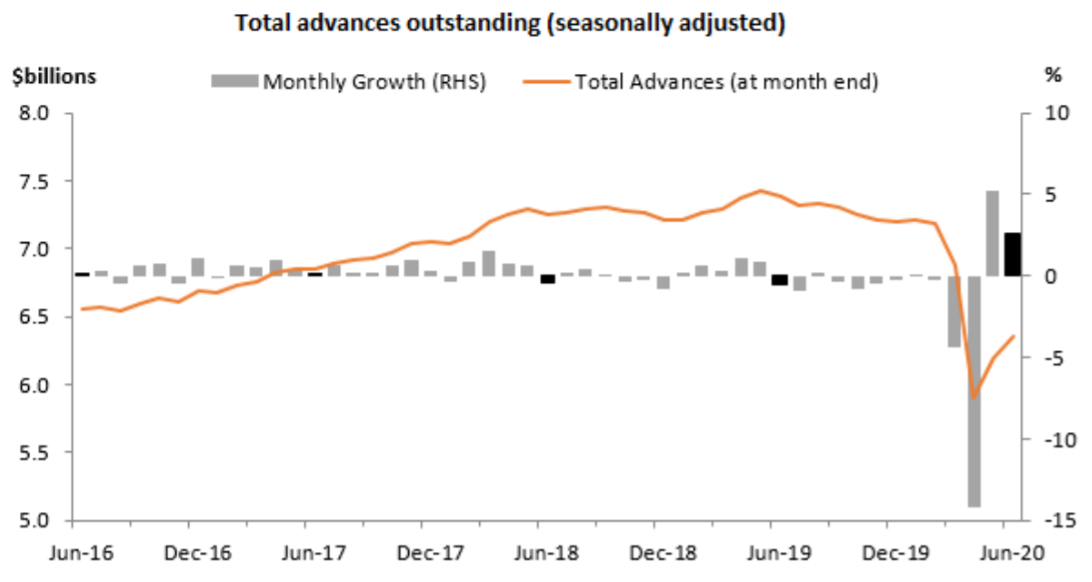

Latest RBNZ figures for both monthly credit card spending and figures for the total amounts outstanding show the rise in spending that was seen in May after we emerged from Level 4 lockdown continued into June. From June 9 we were at Level 1 meaning business was back to near normal, although of course with the notable absenced of travel/tourism.

During the lockdown month of April, the credit card spending and amounts outstanding plunged in spectacular fashion.

Total monthly credit card billings in New Zealand during April fell a whopping 41.3% to $2.1 billion (seasonally adjusted). It was the largest monthly fall on record and took billings back to levels last seen in 2006.

On a seasonally adjusted basis, total advances outstanding fell a staggering 14% to $5.9 billion - the first time the amounts outstanding at month's end had dipped under $6 billion since 2013..

The latest figures for June 2020, while rising, continue to show the hole in monthly spending left by the absence of tourists here.

However, the spending by Kiwis on domestically issued cards last month almost got back to the same level seen a year ago.

The RBNZ issued the following highlighted figures - note that these are all seasonally-adjusted:

Total monthly credit card billings in New Zealand rose 14% to $3.8 billion from May to June, but this is still 9% lower than June 2019.

Billings in New Zealand on domestically-issued cards increased 15% to $3.5 billion which is a similar level of spending to a year ago, just 3% lower than June 2019.

Total advances outstanding rose 2.5% from the month before to $6.4 billion, but this is still 14% lower than June 2019.

Billings in New Zealand on overseas-issued cards increased 9% to $0.32 billion compared with May 2020, but this is still 46% lower than June 2019 reflecting the closure of our borders to tourists.

Overseas billings on New Zealand-issued credit cards decreased 3% to $0.23 billion, and this is still 59% lower than June 2019.

The weighted average interest rate on interest bearing advances fell from 17.3% to 16.7%, reflecting a lower proportion of interest bearing debt.

Credit limit utilisation rate rose from 26.1% to 27.4%.

7 Comments

Good luck in trying to get that back later on without another round of your financial history. A few years back, i think I had retired by then, I reduced my cr limit from $10k to $5k as I didn't need that level of credit. It had been around $10k for years. I then wanted to travel overseas so asked for an increase back to $10k. A bit of a mission. The bank was more than adequately covered by TDs maturing over different time frames. Did get it but had to supply a lot of financial info. It appeared to me the credit card division operate so separately from the banking division that they had no idea of what funds I had available. Further more what ever credit is amassed on the card is fully paid off on due date so I never "borrow" any of it to incur interest charges. No bad debts. Just one more thing I'll never do again is ask for a credit limit reduction.

My main issue now is a complete lack of temptation to buy, a struggle to think of anything on which to spend discretionary money. Not watching public TV helps avoid advertising, as does minimising Facebook and other such channels. Once you stop being part of the most advertised to generations ever the drive to spend isn't quite the same.

Perhaps the odd book, that's about it.

Only tv I watch is sport really. The current economic conditions also provide good reason to be cautious with spending. By nature, I've never really been a big retail addict and other than replacement clothing and some hunting/fishing gear, I don't really buy much. I wouldn't have any debt at all if I could have bought a house freehold.

Banks/lenders no longer care about maintaining relationships with customers/clients Its all about mitigating risk, something most of us are trying to do while keeping hold of what we have if we're in the 50Plus bracket, the young family sector is...I believe looking for growth and opportunity to secure their future, tis the way of The western world, living in the now is considered high risk by many.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.