The financial markets watchdog is warning fund managers not to boast of "phenomenal returns" that have been achieved in the 12-month period to March 2021.

That's because this period does not include the severe Covid-induced global sell-off in markets in February-March last year - but does include all the subsequent strong recovery.

The Financial Markets Authority (FMA) says therefore that any fund managers advertising large investment returns for the 12-month period to March 31, 2021 "could mislead investors".

The FMA notes that many funds subsequent to the February-March 2020 selloff registered "some phenomenal returns... particularly those with large exposures to equities".

The concern for the markets watchdog therefore is that investors being marketed returns for the 12-month period through social media, websites and other channels, without context, "may be misled into thinking they are typical market performance or that particular managers have significant, repeatable skill".

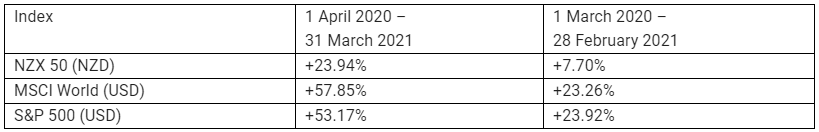

It notes that shifting the performance period back just one month makes a significant difference to the result, as shown in the table below.

"Market index performance for 1 April 2020 to 31 March 2021 (the 12-month period in question) compared with performance for 1 March 2020 to 28 February 2021 (including the March 2020 sell-down) shows the importance of the time-period involved when promoting returns," the FMA says.

It says it has "engaged with industry bodies" on this issue.

FMA Director of Investment Management Paul Gregory said that encouragingly, some fund managers with growth products "share our concerns and have already told us they will not be promoting performance focused exclusively over this 12-month period".

The FMA has asked KiwiSaver providers, other fund managers and financial advisers to:

- avoid advertising performance for the 12-month period to 31 March 2021 (or, where promotion has already happened, withdrawing advertisements and promotions) through any channels, including period-specific promotion on websites; and

- ensure the content and tone of required or otherwise regular investor and customer communications, does not place undue emphasis on, or commentary equating to promotion of, performance over the 12-month period. This includes written or verbal communications.

“Where a provider decides to, or continues to, promote the strong returns seen over the 12 months to March 31, we will be closely monitoring whether doing so potentially breaches the fair dealing provisions contained in the Financial Markets Conduct Act 2013,” Gregory said.

“We will also be concerned for the interests of any members who joined the provider’s scheme or switched into higher-risk funds during the promotion period.

“For investors, the strong performance over the past year is not a reason to chase performance. Rather, it shows the value to investors of staying the course through market ups and downs with the manager and product you have, provided you’ve chosen the right fund for your risk needs and tolerance.”

The FMA has published draft consultation on advertising – soon to be finalised – which expects fund managers "not to overemphasise performance at the expense of other material information" and says past performance information cannot be “cherry picked” to create a more favourable impression.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.