Kiwibank is increasing its term deposit rates, including lifting its 100-day rate by 0.70% to a market leading 1.10%.

Head of Borrowing and Savings Chris Greig says Kiwibank "exists to support the financial security of Kiwi by delivering long- term sustainable value and is offering these highly competitive term deposit options while balancing the needs of borrowers who have been benefiting from a low interest rate environment".

“We appreciate customers with savings are looking to maximise their returns, so Kiwibank is making this easier for them. We have a website form so those interested in our special rates can easily sign up. We’ll give them advanced notice of upcoming specials so they have time to arrange their finances or join Kiwibank. They’ll also get a reminder on the day the specials launch so they can take advantage of the offer and use our digital options to seamlessly open and manage their investment.”

Greig said customers needed to "act fast" as the specials were only available for a very limited time.

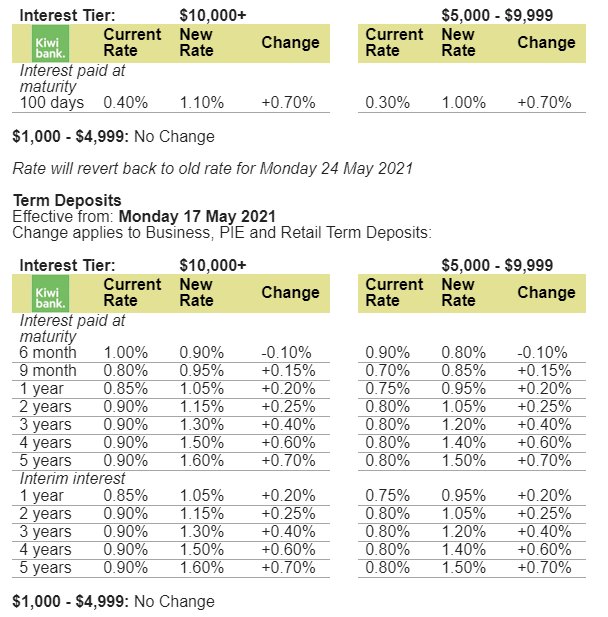

Rate changes are effective from: Wednesday 19 May 2021 – Sunday 23 May 2021

The change applies to Business, PIE and Retail Term Deposits.

There's no change for amounts under $1000.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.