By Amanda Morrall

1) Four savings mistakes

A colleague who shall remain nameless joked that he spent his weekend participating in the retail Olympics. He prides himself on being a savvy shopper because he has an eye for goods on sale. (Eds: Definitely not me then) Actually, while we might rationalise our consumption and congratulate ourselves when we buy on sale, it's still spending (that for the majority of us) eats into savings.

Age writer Nicole Pedersen-McKinnon includes discount spending as one of the top four savings mistakes along with paying unnecessary bank fees, (i.e. using ATM's other than your banks and skipped payments), leaving money languishing in low interest rate savings accounts and paying the prescribed minimum balance on your credit card. All common sense stuff really but we know how uncommon sense is when it comes to prudent personal finance choices. Here's our minimum repayment calculator if you want to shock yourself into rapid debt repayment.

2) Know thyself thru others

This blog from the Harvard Business Review says if you want to reflect on your success or lack therefore you shouldn't look in the mirror. Limitations of the conscious mind mean that we can't see the truth about ourselves even if it's staring us in the face. Those first impressions others have of us may not be right but overall their perception are probably better than our own. You think therefore I am?

3) Personal money trainer

Personal finance trainer and coach Hannah McQueen subscribes to the same motto as sports apparel mogul Nike. She says the key to success, financial or otherwise, is "Just do it.''

In this profile of the Kiwi entrepreneur, who advises accountants and even CEOs, McQueen talks about her foray into the world of personal financial coaching and shares her strategies at EnableMe for helping people to sort their financial affairs efficiently and effectively. While McQueen helped to develop a mathematical formula to fast track debt repayment, she says real control lies in understanding one's personality and behaviours.

4) A higher education at what cost?

A little learning can be a dangerous thing but a lot of learning? This first person story published in Forbes Money explains why a US$50K Master's degree turned out to be a liability for one prospective job hunter. Taking time out of the workforce to upgrade one's education used to be considered an investment, but the returns aren't what they used to be.

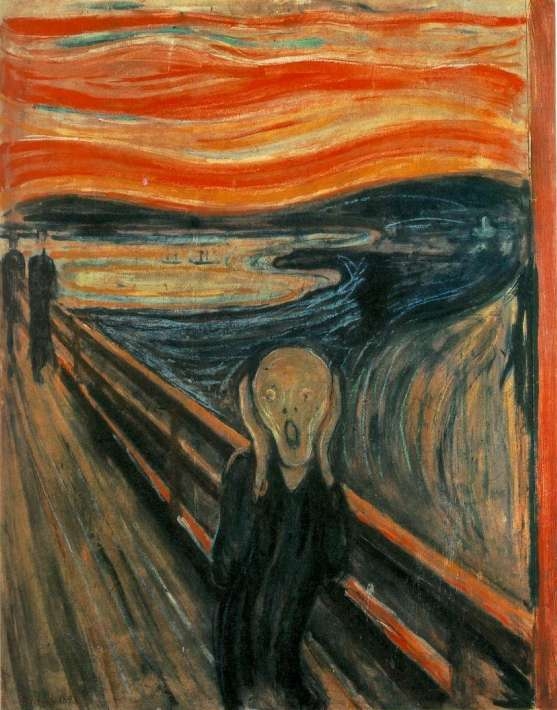

5) Art as investment

With financial markets continuing to disappoint, many high rollers are turning to alternative investments like art and vintage wine for juicier returns. The Telegraph reports how Christie's and Sotheby's have seen a 12% increase on its profits from auctions in the past 12 months.

Steven P Murphy, Christie's CEO said the steady increase in sales is threefold: "growing worldwide demand for art, the quality and curation of important consignments and our consistency in offering the best service and broadest choice to our clients.”

Murphy said an increase in wealthy Asian bidders and also a growing on-line presence were also driving up bids and bidders.Earlier this year, Edvard Munch’s The Scream – one of the world’s most famous paintings – sold for a record US$119.9 million, making it the most expensive artwork ever to sell at auction, the Telegraph reports.

To read other Take Fives by Amanda Morrall click here. You can also follow Amanda on Twitter @amandamorrall

2 Comments

1: Another big mistake,

"Thinking or assuming governments want or actively encourage you to save?"

RWT?

Same with banks, They only let you have a savings account to feed off you to fund the next sucker who wants or a home loan , which in many cases is that very individual.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.