Christchurch-based Moola.co.nz is an active player in the "fast cash short term loan market".

The company uses a convenient online method of applying for a loan. It also has a strong advertising presence on radio and TV.

Moola.co.nz says "we tell you all the costs and don't hide fees". However, there is no link to the detail when the company uses that claim on its website. But the link is in the navigation, here.

It is a successful strategy. This is success that is being celebrated in the business world with the company placed second in the recent Deloitte Fast 50 awards, racking up revenue growth of 1013% in three years.

The company is growing quickly and is seeking "indications of interest ... from wholesale investors (as defined in the Financial Markets Conduct Act 2013). Any offer will only be made to wholesale investors who are acceptable to Moola.co.nz, and will be subject to a minimum investment of $50,000."

Moola.co.nz says this offer is for "a debt facility secured by a joint registered first ranking GSA [general security agreement] over the company. Interest is paid at 12% per annum for 3 years, 10% per annum for 2 year and 8% per annum for 1 year."

These are high returns by today's standards for fixed interest 'secured' debt.

But those rates pale in comparison to what Moola charges clients.

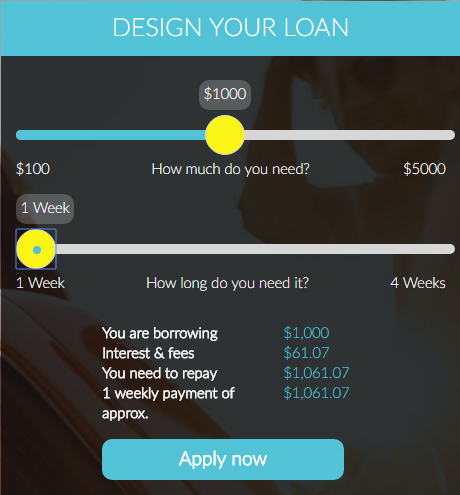

The company's website offers a handy calculator. Here is the default calculator; borrow $1,000 and repay in one week:

Missing is disclosure of the effective cost of credit. In this case it is 309.5% pa.

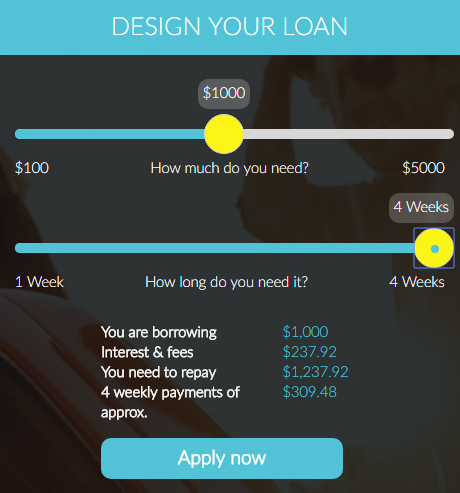

A similar loan paid back in two weekly instalments will incur a 391.8% pa effective cost of credit.

One over four weeks will incur a cost of credit of 456.7% pa.

The online promotion works very well on a responsive browser, especially on a mobile phone. The links to the pesky fees and interest rates are there but are not immediately obvious.

When you get there, this is what they say:

What you see is what you get

We've made our loans clear and fair. At Moola there are no hidden costs, small print or surprises.

We pride ourselves on being a responsible lender. A big part of that is ensuring that all of our customers understand the fees and charges associated with their loan. If there is something you don't understand, just ask our team or check our Q&A.

Short Term (2 - 30 days)

Interest is charged at 1.5% per day on the unpaid balance at the end of the day

547.5% Annualised Interest Rate (AIR)

Establishment Fee: $28.00

Cancelling a direct debit: $20.00

Defaulted Fee: $23.00

Direct Debit Fee: $2.00

Extension Fee: $11.00

Manual Payment Fee: $2.00

Veda Lodgement: $20.00

Wage Deduction Fee: $30.00

Processing Fee: $0.00

Mid Term (63 - 114 days)

Interest is charged at 0.75% per day on the unpaid balance at the end of the day

273.75% Annualised Interest Rate (AIR)

Establishment Fee: $28.00

Cancelling a direct debit: $20.00

Defaulted Fee: $23.00

Direct Debit Fee: $2.00

Extension Fee: $11.00

Manual Payment Fee: $2.00

Veda Lodgement: $20.00

Wage Deduction Fee: $30.00

Processing Fee: $45.00

Long Term (94 - 170 days)

Interest is charged at 0.5% per day on the unpaid balance at the end of the day

182.5% Annualised Interest Rate (AIR)

Establishment Fee: $28.00

Cancelling a direct debit: $20.00

Defaulted Fee: $23.00

Direct Debit Fee: $2.00

Extension Fee: $11.00

Manual Payment Fee: $2.00

Veda Lodgement: $20.00

Wage Deduction Fee: $30.00

Processing Fee: $45.00

The Annual Interest Rate (AIR)

We want you to understand everything about your loan and this is one of the most common means of comparing different loans. But when you see our annual interest rate (AIR) you might have a slight freak out. The problem is that while the AIR is a standard method of comparing various loans, it was not designed with short term loans in mind. Our loans are for a maximum of 186 days and this short duration distorts the AIR in the same way a magnifying glass does.

The full cost of credit

Shining a light on this fee structure is important. As we have pointed out previously, Moola.co.nz is actually at the middle of a very, very high scale in terms of cost of credit. Interest rates are high, but adding in fees to get a full cost of credit bumps the effective rate even higher.

But miss a payment and those fees kick in harder. A minimum $28 establishment fee is just the start as the above lists show. These help build substantial profitability.

And the "interest rate" is only one component in the customer's total cost of credit (ie the total cost for borrowing the original amount).

Sadly, there is demand for these services. After all Moola grew more than 1000% in just three years.

Online convenience is wonderful, except when you miss the common sense big picture. User interfaces, simplified for a small mobile screen are easy to design to gloss over the essential disclosures. Repayment obligations in $ should have the effective cost of credit referenced beside them to help unsophisticated impulse borrowers understand what they are signing up for.

Wholesale investors are being invited to grab some 'high rate' crumbs from this feast.

According to Companies Office records, Moola.co.nz is owned 50/50 by Edward Recordon (who founded and once ran payday loan firm Save My Bacon) and Taurus Investments (Steve Brooks and James Cooney).

5 Comments

Their comment on the annual interest rate is inappropriate. The interest rate is not distorted in any way it is in fact a fantastic way to compare it to other forms of credit.

When people are on low incomes and their expenses exceed their income even a $100 loan would bury them permanently in debt. What you always see is people turning to these loans when they do not address the real problem, then they find themselves in an even worse position. Then when they default they have people repeatedly harassing them to attempt to collect.

Here's a good documentary on the subject.

https://www.youtube.com/watch?v=-yWxTvffbuE

Per https://www.moneyhub.co.nz/moola-review.html, interest rates charged have crept up to 1.7% per day...yet they appear more popular than ever if you hear all the radio ads!

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.