New figures produced by the Reserve Bank in conjunction with its latest Financial Stability Report (FSR) reveal the extent to which investors have been gearing themselves up largely to buy extra properties.

The RBNZ has for a few years now been publishing debt to income (DTI) information on house buyers every quarter (though the data is monthly).

What it hasn't published till now though is separate information for investors.

Now it has and it's pretty spectacular. Large numbers of investors are taking out mortgages way in excess of what their annual income is.

It also shows very clearly the impact of the decision by the RBNZ to remove loan to value ratio restrictions as of May 1 last year, and the resulting mad scramble by investors to grab houses.

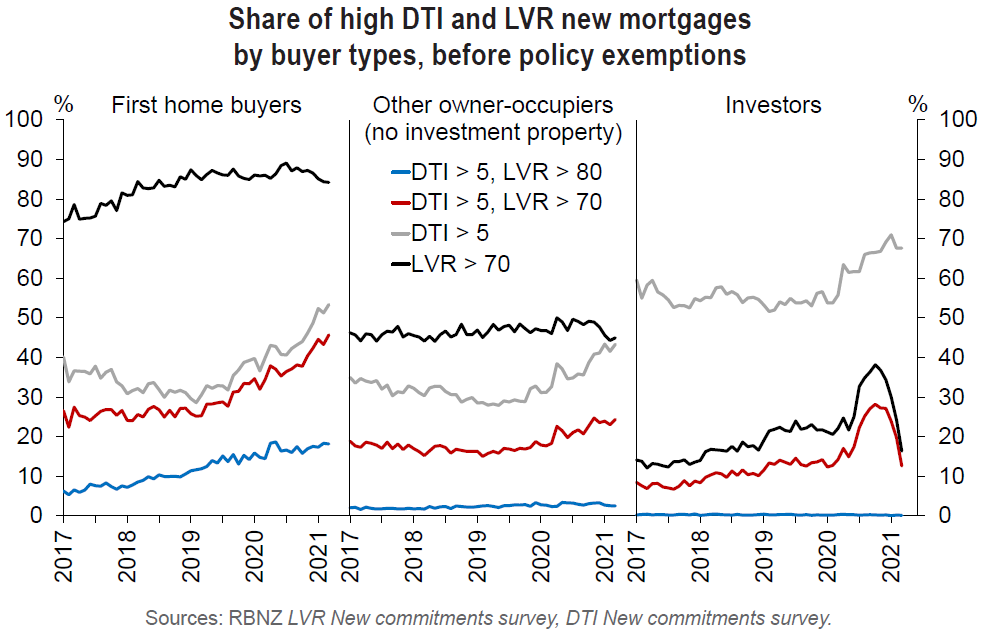

The RBNZ closely monitors lending where the mortgage size is more than five times the size of the income of those taking out the mortgage - IE the DTI is over five.

Its latest figures show that as of March last year, prior to the removal of the LVR limits, some 55.8% of the mortgage money advanced to investors was done on a DTI of over five.

By December this figure had blown out to 69.1% of DTIs of over five for investors.

Then in January (possibly as investors rushed to get in before LVR restrictions were reintroduced) this ratio of high DTI mortgage money blew out even further to 71%. Then for both February and March, it slipped back a little to be 67.6% for both months.

Remember also, these figures are nationwide figures. With Auckland having much higher house prices it can be reasonably assumed that the DTIs of Auckland investors are even higher than the national figure is showing.

(The RBNZ does normally publish an Auckland break-out of the DTI figures in its quarterly releases, but it hasn't included such a breakout with this latest set of figures.)

In its latest FSR document the RBNZ says it has reinstated LVR restrictions to "reduce the risk that large declines in house prices amplify a wider economic downturn".

"By limiting borrowers’ leverage, LVR restrictions lean against high-risk lending during an upswing, and reduce the negative feedback effects of falling housing wealth on household spending during a downswing.

"The LVR policy has been reinstated at a more restrictive calibration for investors, reflecting the greater potential for investors to amplify the housing market cycle."

The revelation of the very high level of high DTI borrowing by investors comes at a time when the RBNZ is due (at the end of this month) to report back to Finance Minister Grant Robertson on the potential introduction of a DTI-limiting macro-prudential tool.

Robertson has shown a clear inclination to want DTIs applied against investors - but not first home buyers.

Meanwhile though, the latest figures show that the FHBs have continued their recent pattern of rising DTI levels too.

The latest RBNZ figures show that for the month of March, 2021 some 53.3% of mortgage money borrowed by FHBs nationwide was at a DTI of over five. That's up from 48.7% as at the end of December 2020. A year earlier in December 2019 under 40% of FHB mortgage money was borrowed at DTIs over five.

Remember again, the Auckland-only figures will be higher.

Owner-occupiers are coming off a much lower base, but they too are starting to blow out their DTI ratios.

According to the RBNZ data some 43.3% of owner-occupier mortgage money was on an over-five DTI at of March 2021. That was up from 41.1% in December 2020, and up from 32.8% in December 2019.

62 Comments

They don't need either of those things.

Just stop banks lending against equity held in property. That's what's driving it all.

Other than those that have a spare mil floating in the bank it makes 90% of the population a first home buyer all over again and everyone is on equal footing.

End of problem.

Yes, it's all very well to say that's what should be done, but how do you actually accomplish it?

A person owns an investment property with bank A. It has 25% mortgage with a value of $200,000 and the remaining equity in the property is $600,000 for a total value of $800,000. With 60% LVR restrictions they can take the lending up to $480,000 on this property, or in other words they have another $280,000 in equity they can use to secure another property. However due to your rule, they aren't allowed to use equity to secure a second investment property.

So this person arranges to sell their property to a company that they control with a sale and purchase price of $800,000, and they go to bank B to organise a loan for the property - bank B gives them a $480,000 mortgage, at 60% LVR of the purchase price. They take the $480,000 in money from bank B, pay back the outstanding $200,000 mortgage from bank A and keep the other $280,000 cash in bank B's chequeing account, ready to use as "cash" for a deposit on another house. The other $320,000 of the purchase price is a debt that the owner owes to their company, which the company writes off as a gift (or whatever other accounting tricks you want to use).

In other words if all you've done is say "you can't use equity as a deposit on another house", all you've done is force people to 'sell' assets between entities they control in order to unlock equity. You've just made everything less efficient and haven't really achieved what you set out to do - stop people leveraging the capital value of property they own to buy other properties.

I think the banks, in requiring personal guarantees from the trustees or direct owners would be able to see through such schemes (if they are required to by RBNZ) and look at the consolidated position i.e. the sale to another related entity would be eliminated in the consolidation to use an accounting analogy. But as good an idea as excluding (or at least heavily discounting) housing equity value from LVRs is, it's clearly not on the agenda.

Applying DTI ratio to investors is wrong. It should be applied to FHBs and owner occupiers instead.

Investors' properties generates income and that income justifies the debt whereas FHBs and owner occupiers' properties do not generate income and therefore theirs are non-income generating debt.

RBNZ and Gruntry got it wrong again and that might be the torpedo to the economy that they just earnestly tried to avoid during COVID lockdowns.

If you want to dissuade investors stop pretending DTI or no interest only loans are needed for financial stability. Labour has made a good start with denying interest deductibility which given the debt frenzy by investors is going to hurt. Other options would be limiting house ownership to 2 houses per person/couple and state set rent limits.

I agree, but the idea that the investor class should be able to spike prices with uncapped-lending while FHBs should be subject to DTIs smacks of self-interest and should be called out for what it is: Attempting to ensure it's as hard to break out of the renting cycle as possible.

DTI should be ring-fenced to the rental income on the rental house only. Which is really just another LVR control in practice, if a house has a rental income of $40,000 PA and you make a rule that DTI is ring-fenced for the rent only with a max loan of 7x, then it means the maximum mortgage a bank could give you would be $280,000. If the house is 'worth' $750k according to the market, then the max LVR on that property would be 280/750 = 37.3%.

Witnessing first hand this week the absolute speculative frenzy that the housing market has now entered. This is a full-blown mania, I am sure of it. 'Cooling'? I know it isn't true. We will look back in years to come and will be able to say we lived through something extraordinary - this is where a speculative frenzy, ultra-low interest rates, and a tsunami of credit all meet and something unique in our history occurs. There is no thought of affordability, or risk, or consequence - just buy, buy, buy.

Does one have to be a Rocket Scientist or Economist or...to know that investors can multiple their borrowing by opting for INTEREST ONLY LOAN but Mr Orr Ego prevents him from stopping IO Loan though all data / information is screaming to ban IO.

Shameless creature. Sorry but truth is bitter.

Richard, being the critic I am of Mr.Orr, the human side of me cares enough to notice all this criticism is taking a toll in his mental health enough for him to skip this week and the press conference. I am not sure what pressure he is under or who is pressing him under the thumb but I sincerely hope he wakes up and does the job he is paid to do. After his absence today I get the feeling that he might want to get rid of IO, but for some reason is unable to.

Hi Passerby, What about the mental health of thousands of average Kiwi and FHB...anguish by his inaction.

If conscious is clear nothing to worry otherwise remember Karma is a Bitch.

Why is he so rigid when all data and information justify action on Interest only loan - tool used by most, if not all Speculators to fund their activity.

IO should be stopped and should be allowed in case of emergency for a short period and not to buy houses - ponzi or no ponzi as should also be stopped to remove unfair advantage that Investors (who already have a home of their own) have over FHB.

Please visit auction room and see the pain and tears on the face of FHB and let your human side decide ...

House = Home = Safe = Memories = Dream

But this creatures have turned

House = Casino Chip = Speculative Stock = Nightmare for FHB.

Richard, if you have seen my comments in this site before, you would notice how much I have discussed the mental toll house prices has directly had on the mental health of my young family as well as other FHBs I work with. I have written to Orr, Robertson and Ardern on my absolute disgust re inaction (in some strong words) from the government and RBNZ and have been a broken record on removing IO loans, yet I can still see when it impacts the mental health on others including Orr. Compared to him, I am bloody poor, but I can see this taking a toll on him as well, just like it is on thousands and thousands of others. Something has to be done to break this toxic cycle. I just don’t feel good about beating a broken man. There seems to be more to this story and I really really want to know what it is. It doesn’t smell like corruption but there is something there, removing IO is an an absolute no brainer. I cannot believe we are still talking about this and why this hasn’t been removed already. What is it that is stopping them???

What happens to existing IO mortgages if they disallow them?

Would there be a cooling off period of 4 years, like they have with the tax deducibility of interest payments on investment properties? If that were the case, landlords (and we have to remember, the majority of MP's are landlords too), would have to find $1000's / month extra to make the capital repayments.

This would force the majority of them to sell up a portion of their portfolio. Who's going to buy those properties? Certainly not other investors, and, as I suspect it'll be the higher value properties being sold to pay down the capital on a larger number of the cheaper ones, not many FHB's would be able to afford them either.

So they would have to say that only new mortgages can't be Interest Only. Pretty much expect a slew of invested people to shout "Unfair!" at that. How would this affect commercial property investments?

Seems to me that the reason they haven't done it yet is because it's just not simple. Either that, or they haven't wasted enough time and money on expert workgroups, just to ignore the outcomes and do their own thing.

It'll end up in the "too hard basket", along with CGT, pay equality, and a first-world train network.

Maybe Orr knows that the Ponzi is unsustainable, knows that inflation driven by ‘cost push’ is coming, and the full horror of what will unfold is keeping him awake at night. Must be an awful position to be in having to keep the train on the track while the speed keeps increasing and the bridge is out up ahead.

IO loans are not a large risk to the economy, especially given LVR restrictions on investors. Furthermore, they allow more funds for consumption which is consistent with increasing inflation which is currently below target. You and many others think Orr's mandate is to destroy landlords, it is not hence his actions not living up to your expectations.

RBNZ forcing banks to retain earnings until July '22 has likely meant commercial banks have went heavily risk-on. Banks where ready for a sever market event prior to Covid-19 so, with the additional RBNZ restrictions, they now have a lot of retained earnings looking for a home. In reality it's easier to scale the mortgage portfolio over any other portfolio currently which is why you're seeing loans to businesses wither while home lending booms. You can also see this with ANZ Bank trying to deploy capital into M&A with Citi assets.

The net lesson for RBNZ should be that of unintended consequences. Trying to excessively de-risk banks with a blunt tool like retained earnings actually pushed them into higher risk lending.

Actual high DTI exposure of banks may be considerably more. More than a few 'investors' project income based on letting individual rooms, thus placing the proposition in an acceptable DTI risk category. The actual rental return in C19 times when demand for bedsits is likely to be 'dynamic', may look rather different.

Can somebody explain DTI’s me how they work. Ie if they are set at 5 does that mean someone on $150k a year could borrow $750k assuming they have no debt is it that simple. What about credit cards even if they are paid off each month do the credit card limits still count as debt

Agree. We had a credit card we only used when travelling overseas, and the bank included the limit as part of our debt when arranging the mortgage, so we cancelled it. We also reduced the limit on our emergency card and paid off a retail personal loan early. Put us in a stronger position.

So correct me if I’m wrong again the reason ths affects investors is if they have a 200k income and a750k mortgage on a house valued at $1.5m. They want a rental which gives income of 30k a year they would only be able to borrow then 400k for that rental and this is why it makes it harder for investors. Have I understood that correctly. I assume it would also make it difficult for retirees to borrow

That's the way I see it yes. Although the bank may apply a multiplier to the rental income. I'm not completely sure but I believe currently when a a bank assesses your ability to buy a rental they use 75% of the rental income to account for when the rental is empty.

It would affect investors and FHBs, unless Orr targeted it at investors only. The main reason it may have a bigger impact of FHBs is the lack secondary rental income.

Example. Investor and FHB want to buy $1m dollar home and DTI is 4. FHB and investor have salary of $200k and investor has rental with $50k income. FHB is locked out.

Straight from the horses mouth, yes its as simple as that: https://www.rbnz.govt.nz/-/media/reservebank/files/publications/policy-…

In the 1970's and 80's the level of subsidy being poured into the agricultural sector was supporting the incomes and asset values of farmers. It also created a level of malinvestment from so called Queen St Farmers. Looking to get their hands on some of the subsidy income and tax benefits. The Lange government removed those subsidies at the stroke of a pen. Over leveraged farmers lost their farms. But we would argue now that NZ is better off having done what was necessary. Even if it wasn't kind. Now we subsidise property investors through Accommodation Supplements and Working For Families. Without those transfer payments. The tenants could not afford the rent. So rents and house prices (supported by rental income) would have to fall. Just like the farmers of the 80's. The property investors of the 2020's pay bugger all tax. Releasing tax free capital gain on a periodic basis to fund their existence.

I read some of the comments in here, blaming anyone is not doing anyone justice. the current environment is conducive to folks parking their money in property. money printing , cheap money, ultra low interest rates.

Blaming one group and the other isn't going to help.

There are some property investors here who have no qualms in passing their wisdoms, in the same token there are others who portray tall poppy syndrome.

In ten years time, latter would still be cursing.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.