By Westpac chief economist Dominick Stephens*

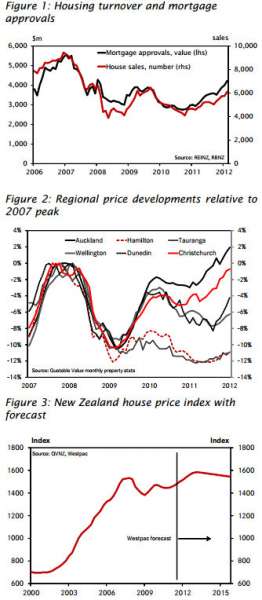

New Zealand's housing market has strengthened noticeably over the past six months or so. House sales are up, people have been seeking more approvals for new mortgages, and house prices are rising.

New Zealand's housing market has strengthened noticeably over the past six months or so. House sales are up, people have been seeking more approvals for new mortgages, and house prices are rising.

The Real Estate Institute's measure of national house prices rose 4.3% in 2011, which is very close to the forecast we issued early last year.

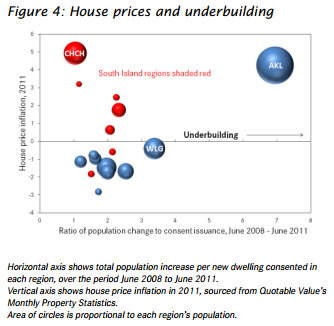

The most remarkable feature of the market has been variation between regions. Prices have been rising rapidly in Auckland and Christchurch for some time now. Elsewhere, prices were falling for most of 2011, but began rising modestly towards the end of the year. New Zealand hasn't seen anything like this degree of regional divergence since the 1990s.

From 2000 to 2010 New Zealand's regions experienced housing booms, busts, and blips in more-or-less equal measure, along more-or-less similar timelines.

So what is going on? Are Auckland and Christchurch the vanguard of what is going to become a nationwide burst of house price inflation? Or are we experiencing something more like the mid-1990s, when prices in some regions took off while others languished? And how long will this period of rising prices last?

A local shortage for local prices

Our analysis suggests that prices have been rising more quickly in Canterbury and Auckland because both regions are experiencing local housing shortages. The implication is that other regions will not necessarily follow where Auckland and Canterbury have led. Auckland and Canterbury house prices have built up a premium over other regions in the past year. This premium can be expected to persist until builders correct the local housing shortages.

The genesis of Canterbury's shortage is obvious. The decline in population has been smaller than the decline in housing supply since the earthquakes, leading to a sudden shortage of housing.

Auckland's shortage has arisen after an extended period of low building activity and high population growth. Over a three-year period to June 2011, Auckland's population increased by seven people for each new dwelling consent issued.

Auckland is actually the only region in New Zealand that experienced significant underbuilding over that three year period. The average number of people per dwelling in New Zealand is 2.5. Roughly speaking, if there are more than 2.5 people for each new house built then a region is underbuilding.

But every region except Wellington and Auckland gained fewer than 2.5 new residents for each new dwelling consent issued over a three-year period. None of those regions underbuilt.

Wellington's population increased by 3.5 people for each new dwelling, so there may have been slight underbuilding. Auckland's population increase of seven people per new house is in a league of its own.

Figure 4 suggests that regional house price performance in 2011 was associated with the degree of underbuilding over recent years, at least for the North Island.

The South Island does not fit the correlation, probably because of the Canterbury earthquakes. In Canterbury's case houses are in short supply because of stock destruction – and Canterbury has the strongest prices on the island.

Meanwhile, other regions of the South Island experienced an unusual surge in population growth soon after the earthquakes, which may account for their slightly stronger prices compared to similar North Island regions.

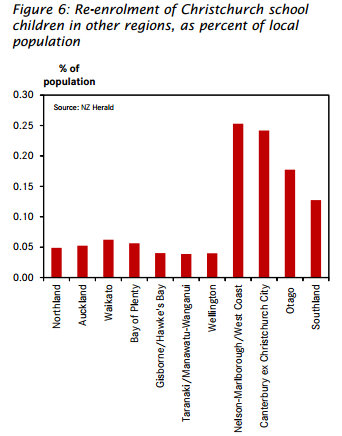

Figures 5 and 6 illustrate that post-earthquake population movements have been much more important for the South Island than for the North Island.

A little something for everyone

Housing shortages cannot explain the more recent market upturn across all regions in New Zealand, including the North Island ex Auckland. Most regions have no shortage of houses. We suspect prices across the country have received a shot in the arm from low interest rates.

Housing shortages cannot explain the more recent market upturn across all regions in New Zealand, including the North Island ex Auckland. Most regions have no shortage of houses. We suspect prices across the country have received a shot in the arm from low interest rates.

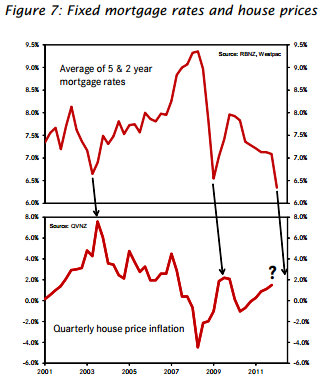

Figure 7 illustrates the very strong relationship between interest rates and house prices in New Zealand. A recent Reserve Bank Discussion Paper found that interest rates were one of the most important factors in predicting house prices.

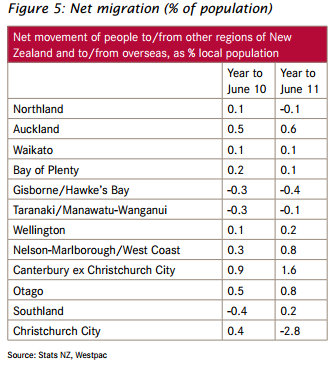

We expect low interest rates to continue stimulating the market for the whole of 2012 – the small rise in rates we do anticipate would not be enough to stymie house price increases. Consequently, we are now forecasting 5% house price inflation in 2012.

Don't get too excited

We suspect the current burst of house price inflation will prove temporary, for two reasons.

We suspect the current burst of house price inflation will prove temporary, for two reasons.

First, interest rates will not stay this low forever. We expect rates to rise substantially over the 2013 – 2015 period, as the Reserve Bank struggles to contain inflationary pressures arising from the Canterbury rebuild. Higher interest rates would put the brakes on the housing market in short order.

And second, house prices in New Zealand remain stretched relative to incomes.

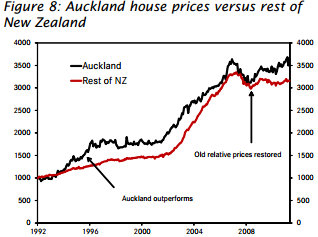

Those regions experiencing outsized gains at present should be wary of local prices underperforming once the shortage is alleviated. Auckland house prices surged in the early-1990s, but subsequently rose more slowly than other regions of New Zealand. By 2009 the old relativity between Auckland and the rest of New Zealand had been restored.

One hopes that if pre-existing relative prices are restored, the adjustment will take the form of slightly slower price gains in Canterbury and Auckland over a decade or more.

One hopes that if pre-existing relative prices are restored, the adjustment will take the form of slightly slower price gains in Canterbury and Auckland over a decade or more.

But for Canterbury in particular, there is a clear danger of prices overshooting in the short run, only to fall sharply at some later date.

Boiling the available evidence down, we have settled on a forecast of 5% house price inflation for 2012, zero in 2013, and -1% in each of 2014 and 2015.

Our fear is that prices could rise more than 5% this year, particularly if the Reserve Bank dallies on hiking the OCR. And we do use the word "fear", because the further prices rise in the short run, the further there could be to fall over a longer horizon.

22 Comments

not sustainable for banks continue to gauge profits at record rates, and you being from a bank i shouldn't tell you this but "interest rates most important factor" - i don't think so

BNZ-REINZ Residential Market Survey indicates 0.5% of buyers do so because they think the interest rates are currently good - most people are buying due to re-locating, or are buying down or up, though divorce (if ever married), or thinking now is the best time to buy or because they are new immigrants or moving for schooling in that particular order sliding from 16.3% to 6.2% of respondents - so a paltry 0.5% of respondents to that survey indicates to me "interest rates most important factor" is nothing short of b*llsh*t... rates are going to go sideways for a long time yet, people are buying as they want or need a house - quite a simple answer really - want more action then lower the rates and see if that then tickles their fancy, but right now they are not all that appealing given the recovery stage we are in... President of Property...

Nowhere does Dominick say that interest rates are a factor in the decision to buy a house. What he does say is that interest rates and house prices are correlated. This makes some sense, people think they can afford to pay more for a house because their mortgage payments are smaller. What he neglects to mention is that if interest rates go up then the borrower's equity in the house is reduced.

All good - only forgot to factor in the big question of income/employment.

As seen in the US, if jobs go in large proportion, no matter how low the rate of interest (even at zero), many folks can't make their mortgage payments, setting off a spate of foreclosures and a correlated dramatic reduction in real estate values overall.

The effect of such here would be made worse by the fact that we do not have non-recourse loans. Therefore, if/when employment improves and people start earning again - they will still be paying off the asset they have been dispossessed of.

It's now very difficult to get into a rest home, as there are very few places, and you have to be assessed as needing that care. The other option is to buy a license to occupy in one of the villages, which is where the money is for them. Or move in with the kids which is becoming more common, and is perhaps a good thing for families.

I still feel one of the biggest factors influencing Auckland is the large number of people sitting in their leaky homes not moving/selling affecting the overall supply in some of these parts of Auckland where prices have risen the most.Couple this with the drift to cities nowadays in larger numbers for the modern lifestyle and whammo.Out in the provinces things are still very ordinary at far more affordable values,in my area theres plenty of work and young ones have little problem getting into a home if desired.

Eventhough I am going to list my house shortly so this is like good news. But I don't think the burst will last like 2002. There is some poplulation growth in Auckland but bugger all (good) jobs, also it's not as easy to get a mortgage these days..

So I am making hay while the sun is shining!

"inexact science" is pretty much and oxymoron, but I agree. Ask two economists the same question; get three different answes. The only iron clad economic law is "I am the only one whio is right."

Measuring the fuel economy of a car is done in liters per 100km, how do you measure the economic economy, of the economy?

I sold my house, as I believe the house price rally is short term, The media is pretty bullish when it comes to the global economy, particulalry the US. I dont agree. There are many many structual problems across most western countries that have been hidden by stimulis and QE, these will rise to the surface at some stage. The debts of so many countries are truly unsustainable. Any rise in interest rates on bond markets will result in more QE, this will push down currencies and raise inflation. There is on other way, the EU, UK, USA and soon NZ cannot pay their debts even at today's interest rates. Consumers are deleveraging so growth will be slim.

Take advantage of the high NZ dollar, invest outside the country in a global trend that long term, will continue regardless of the incompetitance of goverments. http://j.mp/zT1bHA

The rise of house prices is driven more by the rise of rents and the realisation by renters that the "Golden Years" of cheap rents is rapidly coming to an end.

For every dollar rents rise, another swarm of buyers hits the market .

By the time rents double, ( not that far off now) todays' house prices will look like screaming bargains.

If that were true buying (incl. maint, rates) would have to be cheaper than renting (incl. revenue from saved capital). You'd also expect a healthy 6%+ ROI from being a landlord. There are parts of the country where this is the case but it is often not. I'd suggest that in the past property investment had more to do with speculation on untaxed future capital gains. Good luck with that.

Until New Zealand as a whole increases its building numbers back over 20 000 residential units per anum demand will be thicker than the thin vineer of supply.

for the past 3 years NZ has barely cracked 13 000 homes per year , this year will be no different.

there is currently no robust funding available for large residential development? so you have sustainable demand for a product in an industry with notable supply constraints with a huge time lag to effectively remedy. Seems like a very solid business proposition to me.

Why do you think Banks dont want to fund NEW resdiential developments?

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.