By Satish Ranchhod*

Pressures in the housing market are one of the largest challenges that the New Zealand economy is currently confronting. In this edition of Home Truths, we look at the varied housing market conditions in New Zealand’s three main centres. While there are some similarities, each is facing its own challenges that they will be wrestling with for years to come.

– Housing market strains have been most intense in Auckland, where there has been an estimated underbuilding of around 35,000 homes and growing pressures on housing affordability. With population growth expected to remain strong for some time, it will take an extended period - around a decade - of strong building to address the region's housing needs. And it’s likely that tightness in the Auckland housing market will get worse, before it gets better.

– Wellington has had an underbuilding of homes in recent years, and there is growing concern about a shortfall of rental properties. However, building activity in the Capital has been rising.

– After rising strongly in the wake of the 2010 and 2011 earthquakes, home building in Canterbury has been pulling back, and we expect a further moderation over the coming years. With construction a key driver of regional economic activity in recent years, this signals some drag on the Canterbury economy more generally.

Auckland’s a nice place to visit, but can you afford to live here?

Auckland has around 35,000 too few homes

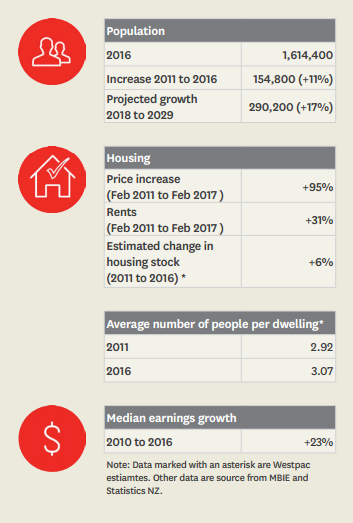

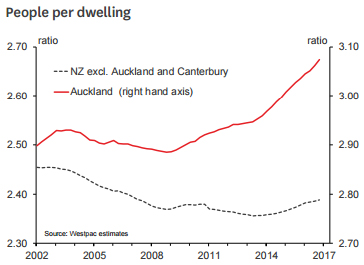

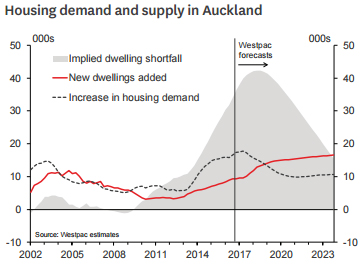

We estimate that Auckland currently has around 35,000 too few homes - equivalent to around 7% of the housing stock. And even that estimate may be on the low side. This has seen the average number of people per home rising rapidly in recent years, up from 2.92 in 2011 to an estimated 3.07 in 2016. In contrast, in most other parts of the country the average number of people per home has been relatively stable. (To put those numbers in context, in a city the size of Auckland each 0.01 change in the average number of people per dwelling is equal to around 1,500 homes.)

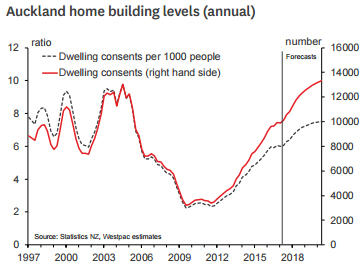

Home building in Auckland fell to low levels in the mid to late-2000s, weighed down by factors that included high interest rates, weak economic activity during the financial crisis, and building regulations that were less permissive than our current Unitary Plan.

While we have seen home building rising in recent years, we estimate that between 2011 and 2016 the housing stock only increased by around 6%. Over this same period Auckland’s population grew by around 150,000 people – an increase of 11%.

Since 2011, Auckland’s population has grown twice as fast as the rest of the country. Around a third of this was due to natural increase. The remainder was mainly due to New Zealand citizens returning from abroad and new arrivals from offshore, both of which have risen strongly. Auckland also attracts people from elsewhere in the country, however this tends to be more than offset by outflows of people to surrounding regions.

Auckland’s population is expected to grow by around 290,000 people over the coming decade, an increase of around 17% (vs. 7% in the rest of the country).¹ This is being encouraged by the strong employment, education and social opportunities in the region.

On top of the existing housing shortfall of around 35,000 homes, strong population growth means that Auckland will need to build around 100,000 additional new homes over the coming decade. And even that would only bring the average number of people per home back to the level seen in 2009 (prior to this people per dwelling was trending down).

There needs to be around a decade of strong home building activity

To address its existing housing shortfall Auckland currently needs to be building around 11,000 new homes per year. And with strong growth in the region’s population expected, that the required rate of building will creep up over time, with building levels needing to remain elevated for around a decade.

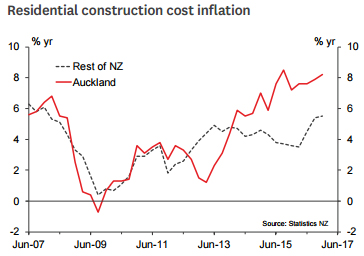

Building 11,000 new homes a year would be a rapid pace of home building, requiring a more than 20% increase from current levels that is maintained for an extended period.² The last time Auckland achieved the sort of building levels that it now requires was in the late 1990s / early 2000s. Despite being a much shorter construction cycle than we now require, that earlier period was associated with large increases in building costs. During that time, we also saw a number of significant issues arising in relation to build quality, including ‘leaky buildings’ and ‘shoe box’ apartments.

This highlights the challenging balancing act that Auckland now faces: it needs a faster pace of home building, while still ensuring a combination of build quality and affordability. Achieving this will be a tough ask. Although building levels in the region are currently lower than required, construction firms are already highlighting challenges with sourcing the required labour. At the same time, inflation in the building sector has picked up, with the price of newly-built homes in Auckland rising by 8.2% over the past year.

Housing market tightness will get worse before it gets better

We expect home building in Auckland will rise over the coming years. The Unitary Plan has now cleared many of the legal hurdles to its implementation. And with strong economic incentives to build, consent issuance has picked up again in early 2017, including a rise in multi-unit consents. However, it will still take some time before building levels rise to the required pace. This means that Auckland’s housing shortfall will get worse before it gets better.

Population pressures are adding to property prices…

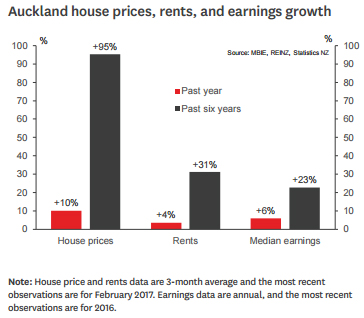

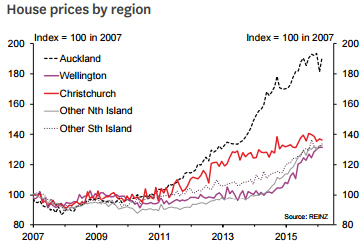

The demands of a growing population have contributed to strong increases in property prices and rents in Auckland, especially in areas close to the central city and major amenities likes schools. Since 2011, house prices in Auckland have essentially doubled (compared with a still strong 44% rise in the country more broadly), while rents are up around 30%. Over this same period, average earnings in Auckland have increased by around 20%.

But it’s not just the price of houses that’s increasing, it’s the price of land. Traditionally, New Zealand homes have been single units with relatively large sections. The ability to purchase an existing home and section, and then build and on-sell several new homes at a profit, is very attractive for developers. This has boosted the demand for sections, and consequently prices for existing houses on those sections.

Over time, increases in the housing supply will help to reduce the upside pressure on Auckland house prices and rents. In that sense, the economic incentives to build that are reflected in rising house prices are very rational. In fact, rising house prices are actually a key factor that is encouraging building.

However, in the meantime, housing affordability has become very stretched for many Aucklanders. In February, the median price for a home in Auckland was $800,000, while the median annual household income was around $90,500. That gives a very high price-to-income ratio of 8.8, a level that makes houses in Auckland some of the least affordable in the world.³

Affordability is a particular challenge for many first home buyers (as well as those looking to upgrade), who find themselves competing to purchase homes against developers who have a different set of financial constraints and incentives.

…but low interest rates have really added fuel to the fire

While there’s a lot of attention on supply side pressures, in isolation they do not explain the extent of the house price increases we’ve seen in in Auckland. The missing piece of the puzzle is interest rates. As we discussed in a previous edition of Home Truths,⁴ low interest rates have made the capital gains on housing assets and relatively high returns from home building very attractive to many investors and developers. They also help to explain why strong house price increases have not been limited to Auckland, with prices also rising rapidly in areas that do not have the same degree of housing market tightness.

Mortgage rates have risen in recent months. Combined with a tightening in lending restrictions and pressure on housing affordability, this has sapped some of the momentum out of the housing market. However, giving the physical demandsupply imbalance in Auckland, significant or sustained falls in prices seem unlikely in the near-term.

What other adjustments could we see in the housing market?

While we expect that housing supply in Auckland will increase over time, this will be a gradual process. And in the meantime, pressures in Auckland’s housing market are likely to become more pronounced. But the housing stock is not the only area where we may see changes over the coming years.

Concerns around housing supply and low affordability may prompt a reduction in the number of people moving into Auckland, or encourage a shift to other regions. We continue to hear reports about high living costs in Auckland making it harder to attract and retain staff in the region, especially with wage growth failing to keep pace with house prices.

Another factor that could affect population growth and housing market pressures in Auckland is migration policy. Much of the increase in Auckland’s population in recent years has been due to high levels of net migration. This is an area that is drawing increasing political attention in the run up to the election, and where we could see changes as part of post-election coalition negotiations. In contrast to housing supply which can take an extended period to address, changes to migration policy can be pushed through relatively quickly.

Another way that conditions in the housing market may adjust is a permanent shift upwards in the average number of people per home. In part this is may be prompted by economic factors, with low housing affordability encouraging people to live with non-family members for longer. Similarly, with both an aging population and low housing affordability, we may see the increasing prevalence of inter-generational households (i.e. parents living with adult children).

Wellington’s housing and rental markets have tightened, but building levels have picked up also

Wellington’s housing market has tightened, with increased pressure on prices and rents

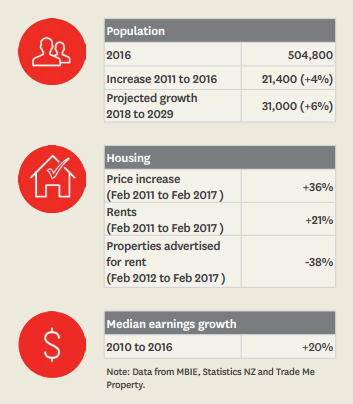

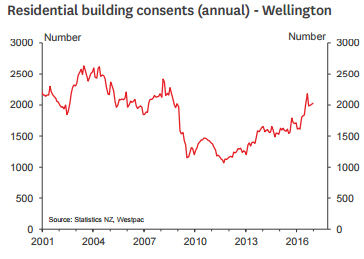

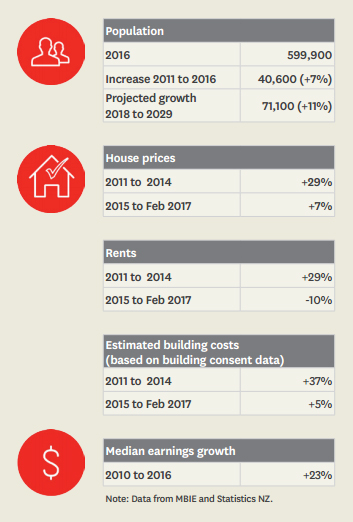

Wellington has had an underbuilding of homes in recent years.⁵ Between 2011 and 2016 the region’s population grew by around 21,000 people.⁶ To house that sort of increase in the population would roughly require an additional 8,300 homes. However, between June 2011 and June 2016, there were only around 7,600 new homes consented, and at least some of these will relate to replacement housing (rather than additions to the housing stock).

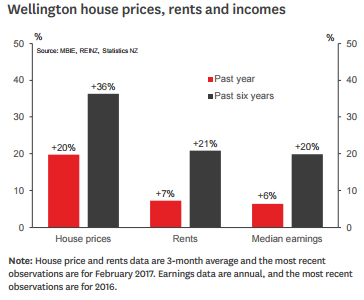

Looking at longer term trends in the region, we estimate that relative to its population Wellington currently has around 3,000 too few homes. Media reports suggest that it could be even higher. Combined with low interest rates and high average income levels, this increase in population pressures saw house prices in Wellington rise by around 20% over the past year.

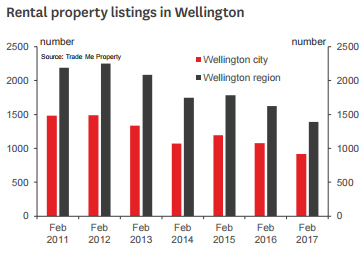

There is also growing concern about a shortfall of rental properties in the region. The combination of educational, social and career opportunities (especially in the public sector) make Wellington a great place to live. These factors encourage an influx of people into the region each year, many of whom go into rented accommodation. But while the region’s population has continued to grow, data from Trade Me Property point to an almost 40% reduction in the number of homes being advertised as available to rent since 2012. Similarly, a recent report from the Wellington Council’s City Strategy Committee noted that reduced rental turnover “is limiting rental opportunities and anecdotally is reflected in increased competition for rental properties.”⁷

Unsurprisingly, these conditions have seen rents in the region rising, with bond data showing to a 21% rise in rents since 2011. There are reports of particularly strong competition for rental properties in areas close to the central city. The challenges for renters have been reinforced by relatively low levels of housing affordability, which has meant that many people are renting for longer than in the past.

Absolutely positively not Auckland, but there are still challenges in Wellington’s housing market

There is concern that like Auckland, Wellington could find itself wrestling with a severe shortage of housing over the coming years, especially in the rental market. But although there are some similarities, conditions in the Wellington and Auckland property markets are quite different. Since 2011, population growth in Wellington has been more moderate than in Auckland (averaging +0.9% and +2.1% per annum respectively). In addition, the extent of underbuilding in Wellington, which we estimate is less than 2% of the housing stock, is much less pronounced than the 7% shortfall in Auckland.

But while housing market pressures in Wellington may not be as intense as in Auckland, they have nonetheless been increasing. In addition, Wellington’s population is expected to grow by around 31,000 people over the coming decade.

To address its existing housing shortfall and meet the additional needs of its growing population, we estimate that Wellington will need to build around 1,500 new homes per year for the next decade.⁸ We think this a challenge that Wellington is certainly up to. In fact, building consent levels have already picked up. Furthermore, house price gains are adding to the incentives for developers.

On top of the aforementioned factors, local government has been active in trying to limit the pressures in the housing market. The Council’s draft City Housing Strategic Investment Plan includes plans to build around 750 new social and affordable homes, at least half of which will be new stock. In addition, rating schemes have been structured to encourage consenting and building, with further changes being looked at.

Nevertheless, the region will face some challenges in addressing its housing shortfall. For a start, the pace of building described above would see the current housing shortage whittled away quite gradually. This means that pressure on rents and housing affordability would likely persist for some time. Faster building could see these pressures alleviated more rapidly. However, that would risk reinforcing the existing pressure on building costs. Building costs have already been rising in recent years, and the coming years will see increased competition for construction labour with Auckland.

There is also the question of where new building can occur. Historically, Wellington has been more of a ‘compact city’ than Auckland, with housing located relative closely to centres of employment and education. However while there is still scope for intensification in the central city, Wellington’s geographic features, including the harbour and steep hills surrounding the city, naturally impose some limitations on building. In addition, in many areas close to the central city, there is already a relatively high concentration of building and prices are high.

Home building in Canterbury is in a period of transition

Reconstruction continuing, but it’s now in a different phase

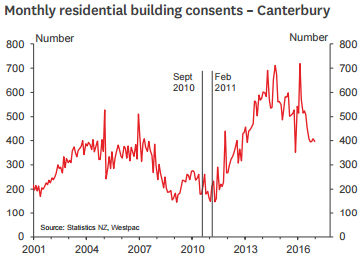

Canterbury’s housing cycle continues to be shaped by reconstruction following the devastating earthquakes in 2010 and 2011. The earthquakes caused massive damage to Canterbury's housing stock, with around 24,000 homes requiring significant rebuilding work or complete reconstruction. There were also more than 60,000 other homes that required some form of repair work. To put those numbers in context, prior to the earthquakes, there were around 230,000 homes in Canterbury. Reduced housing supply as a result of the earthquakes prompted large increases in rents and house prices, both of which rose by around 30% between 2011 and 2014.

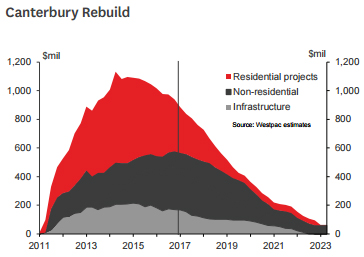

Six years on from the initial quakes, and reconstruction is now well advanced, with around two-thirds of planned work complete. There’s still a lot to do on the rebuild, and construction activity in the region will remain strong from sometime yet. However, we are seeing changes in the make-up of activity. Reconstruction work has been rotating towards commercial activity. At the same time, residential reconstruction, which drove much of the initial lift in spending, has been winding back. Dwelling consent issuance has fallen sharply over the past year, and we expect it will continue to trend down for some time yet. The question is how far will home building levels fall?

A period of more moderate home building is on the cards

In the wake of the rebuild, we’re likely to see a period of relatively soft home building activity. The housing stock has been refreshed, meaning less need for regular replacement and maintenance work in the near term.

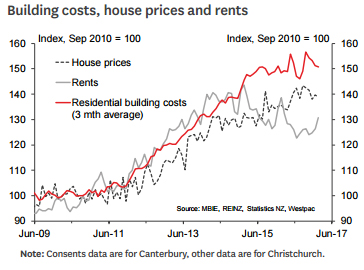

On top of this, the economics of home building in the region have changed. In the early stages of the rebuild, costs rose rapidly as building activity increased. However, this was in line with the increases in house prices and rents that occurred at the same time.

More recently, as the housing stock has been replenished, house prices have levelled off, and rents have fallen 10% since 2015. In contrast, construction costs have continued to rise, albeit at a more moderate pace than in recent years.

For investors, the reduced opportunity for capital gains and lower rental yields mean that there is less incentive to build.

Similarly, for those looking for their own home, building will now be looking less attractive compared with either renting or purchasing an existing home.

Looking further ahead, the next decade is likely to see a period of moderate home building activity. Canterbury’s population is expected to grow by around 71,000 people between 2018 and 2028. That signals the need for around 2,800 new homes a year. As a comparison, in the decade before the earthquakes, annual dwelling consent numbers ranged between 2,200 and 4,500, (compared to a peak of around 7,300 during the rebuild).

Past the peak, still going strong for now

Reconstruction spending in Canterbury has provided a massive boost to the economy, with planned spending estimated to cost around $32 billion (in 2012 dollars, excluding cost increases). That’s equivalent to around 15% of New Zealand's annual GDP spread over several years. As well as increases in construction work, this spending provided a boost to activity and employment in a range of associated industries like engineering, finance and retail. And that boost to activity was not limited to Canterbury. For instance, architectural work related to the rebuild was spread across the country.

In the early stages of the rebuild, increases in spending saw regional GDP growth in Canterbury rising to around 5% per annum – well above what we saw in the country more generally.

Now, although activity levels in Canterbury remain strong, growth has eased back and unemployment has lifted from its earlier lows. Importantly, we’re no longer seeing the big increases in spending that we did in previous years despite continuing population growth. Just as the ramp up in building was a boon for growth, over time the gradual wind down in the rebuild will be drag on growth in the region and economy more generally. The highly planned nature of the rebuild and its wind down does offer the chance to plan for changes in the economic landscape over the coming years. But as we saw in Australia during the wind-down of their mining investment boom, this doesn’t guarantee a smooth transition.

At least for now there is a very positive vibe among many businesses in the region. The number of commercial buildings completed has been rising, and businesses are moving back into the central city. At same time, the drivers of activity in the region are shifting from reconstruction work, and towards demand in other areas like services and tourism. Improved dairy prices are also supporting confidence in the region. Together these conditions have given the region a sense of vibrancy, with workers reporting improved job prospects.

1. Based on Statistics NZ’s population estimates.

2. We discuss the required pace of building in more depth here: http://www.westpac.co.nz/assets/Business/Economic-Updates/2015/Bulletins-2015/Outlook-for-Aucklandresidential-construction-August-2015.pdf

3. Based on data from interest.co.nz (https://www.interest.co.nz/property/house-price-income-multiples). While price-to-income multiples provide some information on housing affordability, they omit some key factors affecting affordability, most notably interest rates. However, even accounting for interest rates, housing affordability in Auckland is low.

4. Available here: http://www.westpac.co.nz/assets/Business/Economic-Updates/2015/Monthly-Files-2015/NZ-Home-Truths-Special-Edition-14-May-2015.pdf

5. For our estimates, we’ve assumed a desired average number of people per dwelling of 2.53 (the level that prevailed just before the financial crisis).

6. Based on estimates from Statistics NZ.

7. Noted in the minutes of the “Ordinary Meeting of City Strategy Committee” 2 March 2017.

8. This assumes that the desired average number of people per home is around 2.53. However, it could be lower. Prior to the financial crisis, the average number of people per house

was trending down. A lower desired number of people per home would suggest some upside risk to our estimate of how much building is needed.

9. TGP Planning “Wellington City housing and residential growth study: Final planning assessments and recommendation” September 2014.

Satish Ranchhod is a senior economist at Westpac. This article is a re-post of a Westpac publication in their Home Truths series. It is here with permission.

11 Comments

Great article, thanks.

It's a shame though that there is real confusion between Christchurch & Canterbury. In the title it states a comparison between the 3 main centres but the data is NOT for Christchurch, it's for Canterbury which is a very vast area with many rural towns. This matters because most these areas were not negatively affected by the earthquake and actually benefitted from some exodus from Chch into the Canterbury region. Likewise, the "Canterbury rebuild" doesn't exist, it's only Chch that is being rebuilt. The situation between Chch & the rest of Canterbury between 2011 & 2016 is very different and should not be amalgamated into one.

Wellington at a population of 500,000 means the 'province' of Wellington and includes places like Masterton. So this also seems like a very broad measure of city population. https://en.wikipedia.org/wiki/Wellington_Region

I think both the Canterbury and Wellington figures could be reduced by 100,000 to 50,000 to get true Greater Christchurch and Greater Wellington figures. The other figures -building rates, predicted population growth etc are 90% urban phenomena -even if they occur in 'rural' districts -they are satellite towns + life style blocks of the respective cities.

My take is that Christchurch is gradually pulling away from Wellington and if Christchurch was resourced with public infrastructure in a manner reflective of this second city status then Christchurch's long term growth rate (in percentage terms) could start catching up with Auckland.

The Westpac senior economist, uses a 'desired' average number of occupants per household of 2.53, and by using this number a housing shortage exists. . Where are the facts to clarify the meaning of desired, as the last time I looked , most individuals count as one, the absurdity of numbers .

After a weekend riding the motorways and rail,I would say Auckland is a failed experiment.

Motorways are poorly planned , at their worst around Spaggetti Junction, like nothing I have seen in Australia or Europe.

Rail is a legacy of a main trunk system and years before the rail loop will be completed, passengers are consigned to a forty minute trip each way which is the outer limit of acceptability, cancellations are common.

Reasonable travel is driving the network of suburban roads within 15 minutes of work and a local shopping center, in other words Greater Auckland is a planning failure.

No solutions in sight.

... yes ... having lived in Adelaide ( SA ) for many years , a similar sized city to Auckland ... when I came back to our Queen City it was 'like stepping into the third world of public transport ...

Even the ubiquitous Jeepneys of my second home ( Philippines ) offer a cheaper and more effective & efficient transport system than the buses and trains of Auckland ...

... tisk tisk ! .... we've been overtaken , surpassed by a genuine 3'rd world country ...

Recognising it is a transport failure, throw no more more money at it and revert to the old city structures, Manakau etc, maybe one can develop a low price structure like Christchurch.

It appears the old CBD never had an adequate infrastructure, stormwater etc, leave them to fund the cleanup.

Guess is is like the EU, a misunderstanding.

So everyone recognizes there are massive issues with Auckland & the National government poor responses

to these rising problems ? Correct

Prime Minister Key who forced the SuperCity onto Aucklanders has now abandoned his post ? Correct

So why anyone would vote National defies common sense based on the above

National have simply underperformed for the people of Auckland

Marooning Aucklands citizens amongst an unchecked sea of migrants most of which cannot even speak or write English properly creating strains on communities

I was a born and bred Aucklander and sadly am dismayed that nothing appears to be changing for the betterment of Auckland people

Good article but the building consent data on Canterbury and its conclusions could be improved. Back before the earthquake Canterbury was building around 4000 per year. (YE March 07 - 4435 dwellings and YE March 08- 4109 dwellings). The number of dwelling consents is falling but not dramatically as the article suggests. YE March 16 - 6251, YE Sept 16 - 6270, YE Feb 17 -5798. Clearly the industry has as much trouble winding down as it does winding up. There is a serious oversupply of properties for sale and properties to let. We have not seen anything yet on business failures and mortgagee sales. The Kaikoura earthquake has saved Wellington CBD office rental market and may help save the local residential construction industry.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.