Fonterra's produced a milk price forecast for the new season with a range gap that's big enough to drive a double decker bus through. Fonterra says the range size - a massive $1.50 - reflects "the increased uncertainty we face in the coming season".

For the record the 'forecast' is for a price anywhere between $5.40 and $6.90 per kilogram of milk solids.

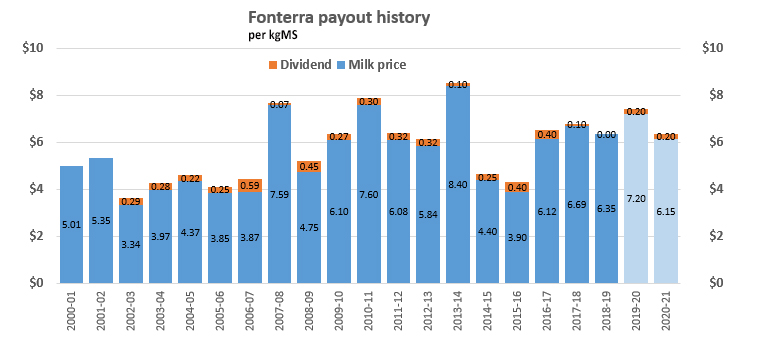

All we can say with any certainty is that even at the top of the range the price will be lower for farmers than that in the season just finishing.

That price now seems likely to be around $7.20 - with Fonterra on Thursday narrowing the range on this forecast from the previous $7-$7.60 to just $7.10-$7.30.

This will see the co-operative contribute about $11 billion to the New Zealand economy through milk price for the year, Fonterra says.

Additionally, Fonterra reaffirmed the full-year 2020 financial year forecast for underlying earnings guidance of 15-25c per share.

Fonterra chairman John Monaghan said of the season just finishing that the co-op has narrowed its price range and reduced the mid-point of the range in response to a softening of demand relative to supply which is pushing down prices.

“One of the main drivers of the softening demand is that many foodservice businesses remain closed. On the supply side, the EU and the US have just been through the peak of their season and that milk is flowing into export markets and increasing competition for sales. As a result, prices are softening across the board.

“This supply and demand imbalance has impacted GlobalDairyTrade (GDT) prices for the products that determine our Farmgate Milk Price. In US dollar terms, GDT prices for Whole Milk Powder are down 17% since late January."

Looking out to next season, he said a global recession will continue to reduce consumers’ purchasing power.

“It is not clear what impact government interventions in the EU and US will have on curbing their milk supply, however, we expect our competitors there to put more of their milk into the product types that determine our Milk Price, as they chase government support programmes and favour longer-life products.

“Covid-19 adds significant uncertainty into the process of forecasting what will happen with global dairy prices over the next 15 months.

“For that reason, we are setting the opening 2020/21 forecast Farmgate Milk Price range at $5.40 - $6.90 per kgMS. The wider range reflects the increased uncertainty we face in the coming season.

“This forecast is based on the information that’s available now. We will regularly update our farmers on changes or events that may impact our milk price as the season progresses.”

Fonterra also provided a third-quarter financial update on Thursday.

This is the summary given by the company:

• Total Group Earnings Before Interest and Tax (EBIT): $1.1 billion, up from $378 million

• Total Group normalised EBIT: $815 million, up from $514 million

• Total Group normalised gross margin: $2.5 billion, up from $2.2 billion

• Normalised Total Group operating expenses: $1,665 million, down $148 million from $1,813 million

• Free cash flow: $698 million, up $1.4 billion

• Net debt: $5.7 billion, down from $7.4 billion

• Normalised Ingredients EBIT: $668 million, up from $615 million

• Normalised Foodservice EBIT: $208 million, up from $135 million

• Normalised Consumer EBIT: $187 million, up from $128 million

• Full year forecast underlying earnings: 15-25 cents per share

• 2019/20 forecast Farmgate Milk Price range: $7.10 - $7.30 per kgMS

• Opening 2020/21 forecast Farmgate Milk Price range: $5.40 - $6.90 per kgMS

• 2020/21 Advance Rate Schedule has been set off the mid-point of $6.15 per kgMS

See here for the full dairy industry payout history and for economists' forecasts.

15 Comments

Nope, but the forecasted price for next year is probably not good news for heavily indebted farmers.

Perhaps their only saving grace will be the lowering interest rates, by the banksters who now find themselves in the same hole.

What concerns me more is the profit margins of these overseas banks rorting this country. How could their profit be so much ($5 billion last count), when Fonterra (NZ's biggest business) can only report $380 million. Something is badly wrong here, and it is likely to have something to do with ex politicians (Jonkey, Simon Power, Don Brash, etc) working for them. Does anyone else see the huge conflict of interest here, because it stands out like dogs balls to me?

Jonkey not only lead Dairy farmers down the path, but got a cushy number for doing this. Farmers need to wake up to the fact past National governments havent worked for them, but rather the overseas banksters. Older farmers will know how their community has changed as a result, and not for the good. Bridges was part of that brigade, and unless National can start working for the people of NZ they can leave the country with their overseas banksters mates.

I think they're oblivious to the matter Goody.

Mentioned y.day on another article about how my 'family in law' farmers would never vote anything other than gnational as they know they get the big payout after x decades of land price increases.

Someone then asked if they had children (as in - do they ever want their kids to own a farm). I think they don't really care tbh, my particular example would prob help fund one of the kids into the farm if they wanted to farm and I'm sure that's a common scenario but really they want the big cash up at the end because land prices have gone through the stratosphere.

So no different to your average Aucklander really I guess.

Talking to a mate the other day who said how his dad went shearing for 7 years and bought a dairy herd (prob circa 150 cows back then so a lot smaller) then sharemilked for 5 years more and bought a farm. As my mate said, go shearing for 7 years now and you'd still be driving around in a shitty old car. (not quite but you're prob not a 50/50 sharemilker either)

Give me a house worth 400k and mtg paid off by 40 anyday over a house worth x gazillion and mtg around your neck for 30 years, banksters are laughing all they way home while a small percentage thing they're rich coz the house went up in value and they can get a shiny white Tiguan for the wife...

Think you're right.

Most have inherited their farms; which doesnt qualify them as smart business people, who are under the illusion land prices will keep rising forever. Brain watched by slick salespeople (like Jonkey) who tell them what they want to hear. If only they could think for themselves.

The only thing we know is the unsustainable dairy growth has seen NZ inc cleaned out by corporate raiders, who are now a large tax on the system and made off with generational assets of Westland and Silver Fern Farms. Real poor governance of Fonterra and successive Governments, seemingly run by plants.

Two aspects for consideration:

Domestic demand is down: "One of the main drivers of the softening demand is that many foodservice businesses remain closed". This may be a permanent/structural change in demand: hospo broadly defined is possibly never going to recover to previous activity levels. And it's not as though a multitude of cafes etc are Essential in any sensible definition of the adjective.

It's worth bearing in mind, when looking at the range of milk prices predicted for the next season, that some large milk operations have sub $5/KgMS break-evens. So it is not all DGM, but will simply exacerbate the gap between suppliers that are marginal and those that are relatively comfortable.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.