Treasury has released Budget 2011 advice it gave to Ministers, including comments that foreign investors will play an important role in the partial sell down of four State Owned Assets, as they will put upward pressure on share prices, helping the government with its fiscal goal of raising money from the sales.

But Cabinet also agreed to consider the use of 'hard foreign ownership restrictions', such as individual or total ownership caps, or separate domestic shares.

The full release of advice can be found here.

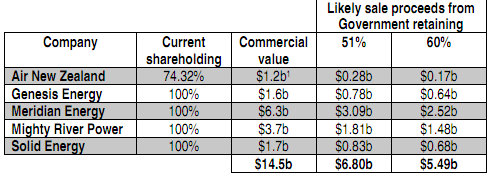

A paper to Cabinet from Finance Minister Bill English said New Zealanders would be at the forefront of the queue to purchase shares in the partial floats of Meridian Energy, Genesis Energy, Mighty River Power and Solid Energy. The government is also proposing to sell down its 76% 74% stake in Air New Zealand. It is proposing to sell down its stakes in each SOE to as low as 51% government ownership.

The Labour Party Opposition have come out strongly against the proposed action, saying there was no guarantees shares would not be bought by foreigners, meaning dividends and sale proceeds could flow offshore.

Labour argues the SOEs should not be sold at all.

However if the sales were to go ahead, Labour has called for New Zealand investors to be at the front of the queue for purchasing shares, and has said government should consider incentives to get and keep shares in Kiwi investors’ hands.

In the Cabinet paper, English said Treasury recommended not to initially use incentives to encourage local purchases of shares.

“Experience from previous government initial public offerings (e.g. Contact Energy and Auckland International Airport) suggests that we can achieve widespread and substantial New Zealand ownership across the five companies,” it says in the paper.

“There are also a range of options for incentivising New Zealand participation should it become clear that these measures are required (e.g. price discounts, loyalty shares). Incentives to encourage domestic participation typically range from 5 to 10% of total value (NZ$250m to NZ$500m based on a NZ$5 billion programme),” it says.

“However, past experience suggests that significant incentives may not be required and their use should be kept in reserve given the tradeoff with the Government’s fiscal objective that their use involves. We propose that the use and form of any participation incentives be examined through the detailed scoping study process.”

'Foreigners will put upward pressure on prices'

Foreign investors would play a role in helping government achieve maximum prices for the shares it sells.

“New Zealanders will be at the front of the queue for any offers arising from the extension of the Mixed Ownership Model, but overseas investors have an important part to play in providing pricing tension to support the Government’s fiscal objectives,” it says in the paper.

A large section is then blanked out in the advice, which was released under the Official Information Act, due to commercial sensitivities.

“It is also worth noting that maintaining majority Crown ownership removes the possibility of foreign control and associated perception issues. However, we intend to maintain flexibility on the potential use of foreign ownership restrictions and will further examine their desirability and scope as part of the proposed detailed scoping studies process,” it continues in the paper.

Further down it asks Cabinet agree "to consider the use of hard foreign ownership restrictions, such as individual or total ownership caps, or separate domestic shares".

Questions over what the SOEs are worth

In its May 19 Budget 2011 documents, the government booked proceedes from the half-sale of the four SOEs, as well as a sell-down of Air New Zealand shares, of between NZ$5-7 billion over a period of three to five years. The chart below breaks down possible proceeds:

However a flow-chart provided by Treasury to the Minister of Finance in February stated the combined book value of the four power and energy companies was NZ$9 billion - half of which would be NZ$4.5 billion.

Treasury looked at temporary quake taxes

Meanwhile, included in the advice was a document showing Treasury considered multiple options for temporarily raising funds from the public to help pay for costs stemming from the Christchurch earthquakes.

In a paper dated March 2011, Treasury outlined a range of temporary tax measures that could be implemented to raise up to NZ$1 billion a year. However, Treasury told Finance Minister Bill English it strongly believed temporary taxes were not a good idea, saying it would need to hear some strong opposing arguments to change its position.

The measures included temporarily raising GST, an income levy surcharge, a payroll levy similar to the ACC levy, additional rates payments, and raising/introducing excise taxes or import duties.

The idea of temporary taxes to help with quake costs was raised by Green Party co-leader Russel Norman, who outlined a plan to raise up to NZ$1 billion a year by keeping the company tax rate at 30% (instead of dropping it to 28.5%), and placing surcharges on income taxes on incomes above NZ$48,000.

However English and PM John Key repeatedly refused the idea in Parliament, saying the government's books were in a good enough position to take the hit of the quake costs on its balance sheet, opting to borrow funds through government bond issues to pay for the immediate costs of the quakes.

Treasury today released Budget 2011 advice to Ministers, including advice on KiwiSaver, Working for Families and the sell-down of state owned enterprises.

The full release of advice can be found here.

More soon.

(Updates with Treasury saying foreign investors important in SOE sell-downs, discussion of temporary earthquake levy)

6 Comments

The Government would have had to borrow the money anyway - it's a simple question of timescales. The money was needed immediately and your "bit extra" wouldn't have delivered the kinds of resources needed immediately.

The question is therefore how to repay the loan. Are you really saying that if the Government has a choice between whether to repay the loan with taxing you or without taxing you, you;d prefer the former?

Brownlee was worried we weren't going to be massaging the international media during RWC (doc from November):

...In addition, the Rugby World Cup 2011 Office has identified that no allocation of resources has been made for an international media hosting programme. New Zealand will be in the spotlight of the international media through this period and it will be important to ensure that they are well supported while in New Zealand. Further to this, provision also needs to be made for additional sector showcasing as specified by Ministers.

http://www.treasury.govt.nz/downloads/pdfs/b11-2082610.pdfThe higher the price the Hydro Dams sell for the more our electricity will cost us. It is really very simple. We are buying dams we already own with our own money. The money go round only exists to make sure that plenty sticks to the sides for those on the inside, senior management, Bankers, Advisors, sharebrokers etc.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.