tax avoidance

While public officials argue and delay adopting global tax reforms, multinational companies continue to rort the variances in rates and arbitrage jurisdictions. More than US$2.4 tln of profits avoid minimum acceptable levels

22nd Nov 23, 12:09pm

3

While public officials argue and delay adopting global tax reforms, multinational companies continue to rort the variances in rates and arbitrage jurisdictions. More than US$2.4 tln of profits avoid minimum acceptable levels

Reforms coming in Australia in a big crackdown on tax adviser misconduct. Tax promoter penalty laws will be expanded 'so they’re easier for the ATO to apply to advisers and firms who promote tax avoidance'

19th Aug 23, 9:00am

5

Reforms coming in Australia in a big crackdown on tax adviser misconduct. Tax promoter penalty laws will be expanded 'so they’re easier for the ATO to apply to advisers and firms who promote tax avoidance'

Carl Rhodes says Australia's PwC scandal shows consultants, like church officials, are best kept out of state affairs

18th May 23, 1:27pm

6

Carl Rhodes says Australia's PwC scandal shows consultants, like church officials, are best kept out of state affairs

US$1 trillion in the shade – the annual profits multinational corporations shift to tax havens continues to climb and climb

7th Mar 23, 9:24am

8

US$1 trillion in the shade – the annual profits multinational corporations shift to tax havens continues to climb and climb

Economist Brian Easton says the informed discussion on the next steps in tax policy is about improving the income tax base, not about taxing wealth directly

23rd May 22, 8:47am

7

Economist Brian Easton says the informed discussion on the next steps in tax policy is about improving the income tax base, not about taxing wealth directly

Te wiki o te tāke; comparing New Zealand’s taxation of property with other countries; OECD heralds a clampdown on crypto-assets; and another warning from Inland Revenue about attempts to manipulate income to avoid the 39% tax rate

10th Apr 22, 2:05pm

9

Te wiki o te tāke; comparing New Zealand’s taxation of property with other countries; OECD heralds a clampdown on crypto-assets; and another warning from Inland Revenue about attempts to manipulate income to avoid the 39% tax rate

Te wiki o te tāke; Interest limitation and bright-line test changes now enacted, guidance to help find your way through the maze of the financial arrangements rules, and the Australian Budget might give the IRD ideas

3rd Apr 22, 9:44am

18

Te wiki o te tāke; Interest limitation and bright-line test changes now enacted, guidance to help find your way through the maze of the financial arrangements rules, and the Australian Budget might give the IRD ideas

Terry Baucher assesses the IRD's proposal for a big stick to counter top tax rate avoidance, potential tax changes make a difference to the cost of living, and what you should do to get ready for tax year end

27th Mar 22, 9:52am

18

Terry Baucher assesses the IRD's proposal for a big stick to counter top tax rate avoidance, potential tax changes make a difference to the cost of living, and what you should do to get ready for tax year end

Government investigating ways of preventing high-income earners from using trusts and companies to lower their personal tax bills

19th Mar 22, 9:30am

14

Government investigating ways of preventing high-income earners from using trusts and companies to lower their personal tax bills

Terry Baucher and Professor Craig Elliffe assess the recent global agreements on international taxation, some big changes and some messy compromises

29th Nov 21, 7:34am

1

Terry Baucher and Professor Craig Elliffe assess the recent global agreements on international taxation, some big changes and some messy compromises

It's time New Zealand's bureaucrats and politicians took responsibility for enabling car crashes caused by their issuing of financial services drivers licences for use anywhere in the world except NZ

19th Oct 21, 6:01pm

15

It's time New Zealand's bureaucrats and politicians took responsibility for enabling car crashes caused by their issuing of financial services drivers licences for use anywhere in the world except NZ

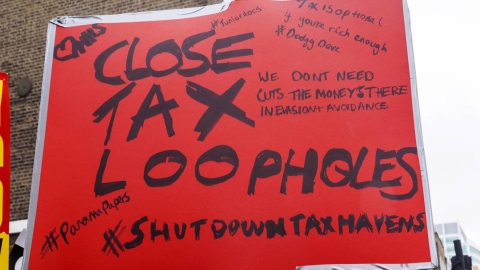

Transparency International calls for an end to the ability for the ultimate owners of NZ foreign trusts to avoid tax and financial transparency obligations in their home countries

14th Oct 21, 7:43am

4

Transparency International calls for an end to the ability for the ultimate owners of NZ foreign trusts to avoid tax and financial transparency obligations in their home countries

Josep Borrell & Paolo Gentiloni hail the recent international deal on corporate taxation as an example of successful multilateralism

30th Jul 21, 6:00am

2

Josep Borrell & Paolo Gentiloni hail the recent international deal on corporate taxation as an example of successful multilateralism

Inland Revenue says it'll 'take the necessary action' against high income earners trying to avoid the new 39% tax rate

12th Mar 21, 11:26am

19

Inland Revenue says it'll 'take the necessary action' against high income earners trying to avoid the new 39% tax rate

Yu Yongding shows how illicit financial flows undermine development - and suggests several ways to stop them

2nd Mar 21, 4:27pm

5

Yu Yongding shows how illicit financial flows undermine development - and suggests several ways to stop them

Inland Revenue raises 'significant' concerns over people using trusts to avoid the new 39% income tax rate; Suggests the trustee rate be hiked; Grant Robertson open to the idea

2nd Dec 20, 5:51pm

36

Inland Revenue raises 'significant' concerns over people using trusts to avoid the new 39% income tax rate; Suggests the trustee rate be hiked; Grant Robertson open to the idea

Revenue Minister David Parker says the 33% tax rate on trusts could be hiked if high-income earners avoid the new 39% tax rate

1st Dec 20, 3:17pm

18

Revenue Minister David Parker says the 33% tax rate on trusts could be hiked if high-income earners avoid the new 39% tax rate

The Week in Tax: International reviews into the dominance of GAFA and their tax engineering is getting renewed attention, as is the tax treatment of cryptos. The pressures are building

18th Oct 20, 6:59pm

7

The Week in Tax: International reviews into the dominance of GAFA and their tax engineering is getting renewed attention, as is the tax treatment of cryptos. The pressures are building

The Week in Tax An expensive and too common GST mistake, reporting overseas income, and more on Labour’s higher income tax proposal

20th Sep 20, 9:29am

10

The Week in Tax An expensive and too common GST mistake, reporting overseas income, and more on Labour’s higher income tax proposal

The Week in Tax: Inland Revenue’s sweet taste of victory over Frucor, updated Inland Revenue guidance on cryptoassets, and Labour's tax and small business policy

13th Sep 20, 1:52pm

11

The Week in Tax: Inland Revenue’s sweet taste of victory over Frucor, updated Inland Revenue guidance on cryptoassets, and Labour's tax and small business policy

In the fifth and final part of a series on New Zealand's retail payment systems Gareth Vaughan lays out a roadmap for regulating the retail payments sector and outlines why this should be done

16th Apr 20, 5:00am

8

In the fifth and final part of a series on New Zealand's retail payment systems Gareth Vaughan lays out a roadmap for regulating the retail payments sector and outlines why this should be done

Terry Baucher has a deep dive through history at some of the great tax adventures and misadventures involving musicians, entertainers and sports stars and the lessons we can learn from them

22nd Nov 19, 10:02am

9

Terry Baucher has a deep dive through history at some of the great tax adventures and misadventures involving musicians, entertainers and sports stars and the lessons we can learn from them

IRD launches hidden economy campaign targeting the hospitality sector saying it will 'track down and prosecute businesses deliberately hiding cash sales'

4th Oct 19, 12:04pm

16

IRD launches hidden economy campaign targeting the hospitality sector saying it will 'track down and prosecute businesses deliberately hiding cash sales'

Will a new digital services tax backfire? Is it an 'ugly tax' that will bite some local companies hard, despite being aimed at tax-avoiding FAANGS? Should we worry about potential US retaliation? LawNews investigates

29th Jul 19, 11:56am

1

Will a new digital services tax backfire? Is it an 'ugly tax' that will bite some local companies hard, despite being aimed at tax-avoiding FAANGS? Should we worry about potential US retaliation? LawNews investigates

Will Fitzgibbon of the International Consortium of Investigative Journalists says NZ is 'being harmed reputationally as a country' through its role in the world of offshore finance

27th Mar 19, 10:46am

8

Will Fitzgibbon of the International Consortium of Investigative Journalists says NZ is 'being harmed reputationally as a country' through its role in the world of offshore finance