Swap rates

As the prospect of OCR rate cuts fade and global forces and local inflation push up wholesale interest rates, ASB trims its key term deposit rate offers

18th Apr 24, 10:07am

26

As the prospect of OCR rate cuts fade and global forces and local inflation push up wholesale interest rates, ASB trims its key term deposit rate offers

As the real estate selling season tails off, two banks trim a key home loan rate just before the RBNZ does its review, and markets turn sceptical rate cuts are imminent

8th Apr 24, 9:08am

39

As the real estate selling season tails off, two banks trim a key home loan rate just before the RBNZ does its review, and markets turn sceptical rate cuts are imminent

[updated]

Even though they are small and not market-leading, ASB has made a third set of home loan rate reductions to ensure it remains competitive with its main home loan rivals. And it has cut TD rates too

11th Mar 24, 8:32am

25

Even though they are small and not market-leading, ASB has made a third set of home loan rate reductions to ensure it remains competitive with its main home loan rivals. And it has cut TD rates too

Despite another bank trimming home loan rates, the range of rates among all banks is narrowing for the most competitive terms. BNZ matches its latest cut with term deposit reductions

6th Mar 24, 8:58am

13

Despite another bank trimming home loan rates, the range of rates among all banks is narrowing for the most competitive terms. BNZ matches its latest cut with term deposit reductions

Gareth Vaughan on ANZ NZ's erroneous OCR call, a $30t gamble that changed the world, tackling surcharging & more

5th Mar 24, 10:06am

23

Gareth Vaughan on ANZ NZ's erroneous OCR call, a $30t gamble that changed the world, tackling surcharging & more

It looks like this is moving week for both home loan and term deposit rates, following the RBNZ MPS. ANZ the next to cut retail rates although the changes are not major

4th Mar 24, 8:46am

31

It looks like this is moving week for both home loan and term deposit rates, following the RBNZ MPS. ANZ the next to cut retail rates although the changes are not major

[updated]

Soon after its 18 month mortgage rate cut last week, ASB trims its one and two year home loan rates. And tweaks up its 6 month term deposit rate slightly

4th Mar 24, 8:02am

11

Soon after its 18 month mortgage rate cut last week, ASB trims its one and two year home loan rates. And tweaks up its 6 month term deposit rate slightly

ASB cuts 18 month fixed home loan rate by 26 basis points, ahead of the Reserve Bank's OCR decision, and in the face of a stuttering real estate market

27th Feb 24, 7:56am

23

ASB cuts 18 month fixed home loan rate by 26 basis points, ahead of the Reserve Bank's OCR decision, and in the face of a stuttering real estate market

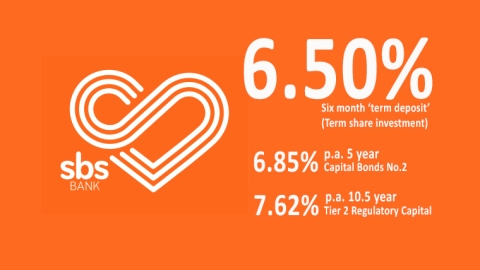

The term deposit rate benefit from a challenger bank just got a sharp boost from a new offer from SBS Bank, part of a recent set of fundraising offers

24th Feb 24, 9:35am

4

The term deposit rate benefit from a challenger bank just got a sharp boost from a new offer from SBS Bank, part of a recent set of fundraising offers

Another major bank tweaks its mortgage rate card lower as doubts spread about an OCR hike next week. Competition is rising as the real estate market hasn't really fired yet in its crucial selling season

22nd Feb 24, 8:06am

72

Another major bank tweaks its mortgage rate card lower as doubts spread about an OCR hike next week. Competition is rising as the real estate market hasn't really fired yet in its crucial selling season

With some economists expecting a higher OCR soon, and financial markets responding with higher wholesale rates, savers might be expecting higher term deposit offers as one consequence

12th Feb 24, 11:08am

31

With some economists expecting a higher OCR soon, and financial markets responding with higher wholesale rates, savers might be expecting higher term deposit offers as one consequence

The Red Bank becomes the first major to break out of the tight range of mortgage rates being offered by the majors, cutting both fixed home loan rates modestly (and term deposit rates by more) even as wholesale rates rise

9th Feb 24, 6:04am

30

The Red Bank becomes the first major to break out of the tight range of mortgage rates being offered by the majors, cutting both fixed home loan rates modestly (and term deposit rates by more) even as wholesale rates rise

Heartland Bank slices its fixed home loan rates with big cuts to all terms, opening up a big differences to main bank rates

8th Feb 24, 8:46am

21

Heartland Bank slices its fixed home loan rates with big cuts to all terms, opening up a big differences to main bank rates

ASB moves both home loan and term deposit rates lower but only for the less popular longer terms. Still, they can claim a competitive three year home loan rate. But they can't claim unique term deposit offers

25th Jan 24, 9:48am

18

ASB moves both home loan and term deposit rates lower but only for the less popular longer terms. Still, they can claim a competitive three year home loan rate. But they can't claim unique term deposit offers

The next bank to trim home loan rates is Westpac. Their adjustments take them into line with their main rivals. But they did make a +10 bps rise to their six month term deposit rate to a somewhat unique level

18th Jan 24, 6:17pm

5

The next bank to trim home loan rates is Westpac. Their adjustments take them into line with their main rivals. But they did make a +10 bps rise to their six month term deposit rate to a somewhat unique level

Both Kiwibank and TSB trim home loan rates to match the big Aussie banks. They also reduce some longer term deposit rates

15th Jan 24, 9:47am

23

Both Kiwibank and TSB trim home loan rates to match the big Aussie banks. They also reduce some longer term deposit rates

The Co-operative Bank becomes the first mover on home loan and term deposit rates in 2024, even if most of its changes mirror those made by the majors at the end of last year

10th Jan 24, 2:49pm

2

The Co-operative Bank becomes the first mover on home loan and term deposit rates in 2024, even if most of its changes mirror those made by the majors at the end of last year

[updated]

BNZ responds to the end of year thin slice to some carded fixed home loan rates by ANZ, making some of its own. But BNZ did not trim its term deposit offers as ANZ did

21st Dec 23, 9:12am

22

BNZ responds to the end of year thin slice to some carded fixed home loan rates by ANZ, making some of its own. But BNZ did not trim its term deposit offers as ANZ did

In a pre-Christmas move, our largest bank trims some key mortgage rates, and some not-so-key term deposit offers. Given where wholesale rates have been trending, this may be the start of a move down across the board

19th Dec 23, 5:55pm

75

In a pre-Christmas move, our largest bank trims some key mortgage rates, and some not-so-key term deposit offers. Given where wholesale rates have been trending, this may be the start of a move down across the board

Wholesale interest rates drop sharply after Statistics NZ reports soft economic data and the US Federal Reserve signals it could cut interest rates soon

15th Dec 23, 12:25pm

43

Wholesale interest rates drop sharply after Statistics NZ reports soft economic data and the US Federal Reserve signals it could cut interest rates soon

Looking at wholesale interest rates, there are signs that we may be at 'peak rate' about now. Savers should watch for signs that lower rate offers may be imminent. Borrowers may get some relief in early 2024

18th Nov 23, 9:46am

46

Looking at wholesale interest rates, there are signs that we may be at 'peak rate' about now. Savers should watch for signs that lower rate offers may be imminent. Borrowers may get some relief in early 2024

Market expectations of Official Cash Rate settings leaning towards cuts after the increase in unemployment this week

2nd Nov 23, 2:11pm

19

Market expectations of Official Cash Rate settings leaning towards cuts after the increase in unemployment this week

Even though rates are now at fifteen year highs, home loan borrowers should be anticipating further fixed rate rises, and quite soon for the next shift up

24th Sep 23, 12:00pm

181

Even though rates are now at fifteen year highs, home loan borrowers should be anticipating further fixed rate rises, and quite soon for the next shift up

Squirrel's David Cunningham explains how interest rates are set and how banks have been able to boost their margins by about 20%

7th Sep 23, 2:14pm

11

Squirrel's David Cunningham explains how interest rates are set and how banks have been able to boost their margins by about 20%

BNZ raises its floating mortgage rate in an out-of-cycle shift, as wholesale rates track marginally higher even though the RBNZ hasn't shifted the OCR

2nd Aug 23, 10:25am

18

BNZ raises its floating mortgage rate in an out-of-cycle shift, as wholesale rates track marginally higher even though the RBNZ hasn't shifted the OCR