It appears high LVR lending isn't to borrowers trying to get on to the property ladder; rather it is being used by borrowers who are wanting to stretch themselves into properties they couldn't otherwise afford.

That is one interpretation from the RBNZ March data released this week in both their C31 and C33 series.

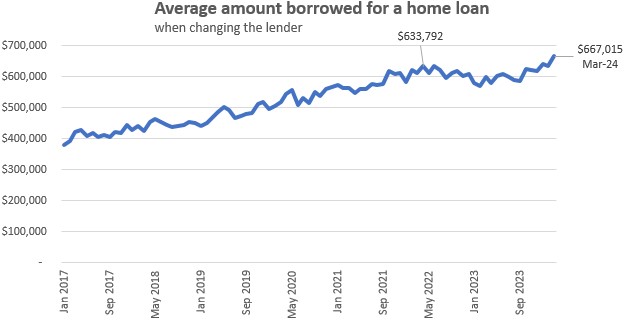

And home loan borrowers who change lenders are borrowing a record $667,000 on average. That new record came in March 2024.

But those same borrowers who borrow on a high LVR basis are committing to $700,000 on average.

High LVR borrowers are, it seems, not afraid to commit. You might have thought that high LVR lending was for low-income borrowers wanting to get on to the property ladder in modest purchases suited to their stage in life. But rather it seems to be for those who choose to stretch.

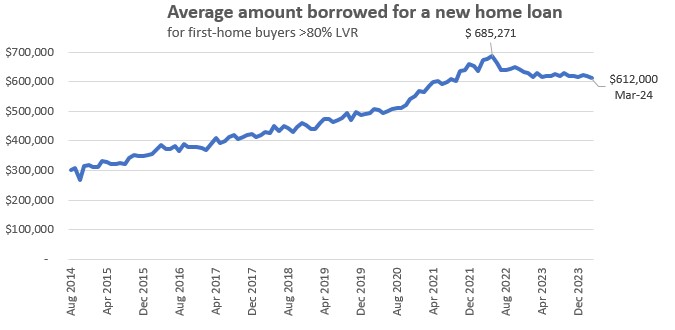

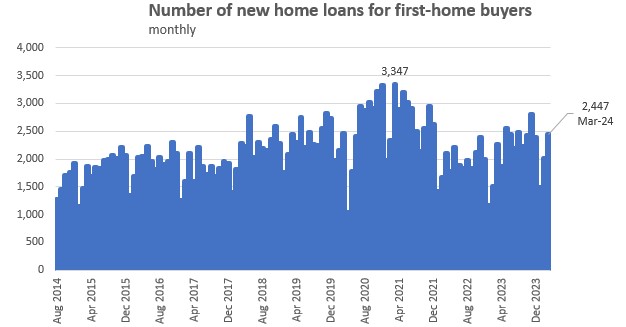

First home buyers commit on average to $548,000, but high-LVR FHBs commit to $612,000. These are the borrowed amounts. But how much are they paying for the house? you can find that estimate here.

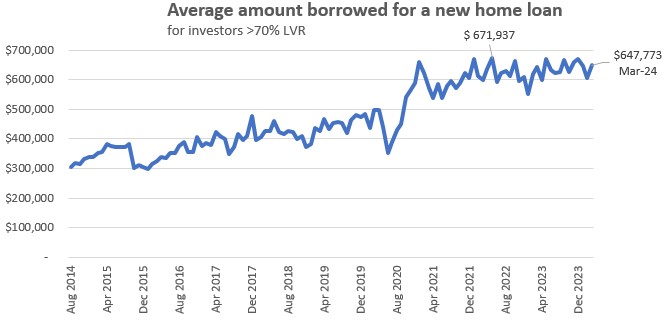

And the high-LVR story extends to investors too. On average residential property investors borrow $515,000 while high LVR borrowers are stretching to +25% more at almost $648,000.

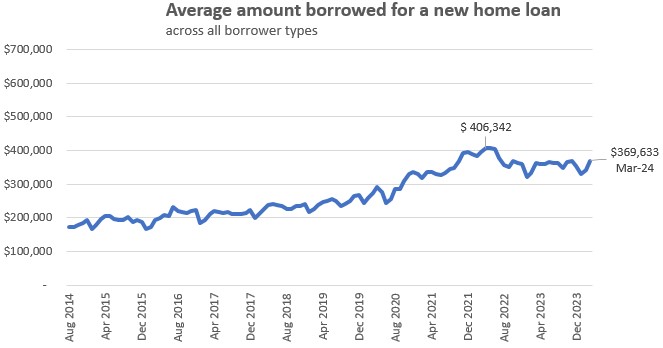

Over all home loans, the average home loan size in March 2024 was just under $370,00, and a key reason that average seems low is because of top-up loans.

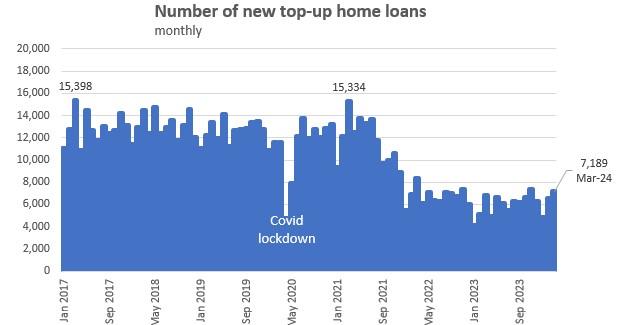

The average top-up amount borrowed was $103,000 in March 2024, and that is down -17% from the early 2022 peak. There were 7189 top-up loans made in March 2024. But that was down a massive -53% from the 15,300 level in March 2021.

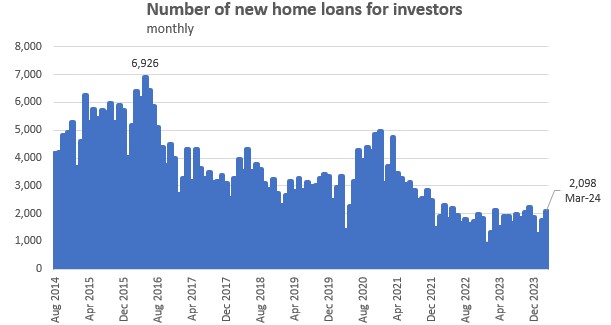

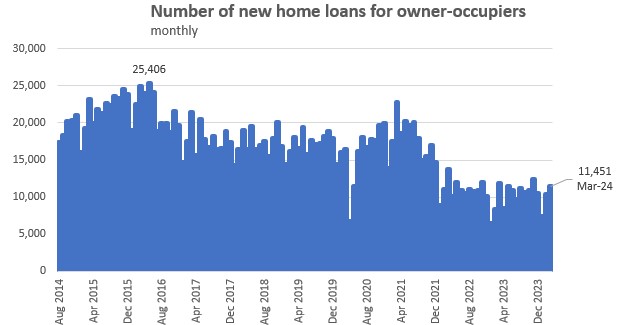

The story is similar for most types of home loan - the March 2024 volumes are far less than their peak levels.

Overall, loans to investors fell a startling -70% from 6926 in March 2016 to only 2098 in March 2024.

Loans to owner-occupiers are -55% lower from their March 2016 level of 25,406, now only 11,451 in March 2024.

So that makes the -27% fall in FHB loans the least-affected sector and it raises the relative level of FHB activity overall in a shrinking-volume market.

Falling home loan volumes and easing home loan values paint a picture of a mortgage market that has fallen into a funk. None of these charts describe the rollover / refinancing market which is the largest part of the bank home loan business, but they do shine a spotlight on a sector that is in its quietest period over the past decade.

Real estate agents might be able to survive this quietish period by selling fewer higher priced homes, keeping the "median prices" reported at similar levels, and mortgage brokers can survive as the bulk of the refinance/rollover market churns. But it is clear this is not currently a growing market for either. Market share matters more to everyone, including the banks, when they are all in a no- or low-growth sector.

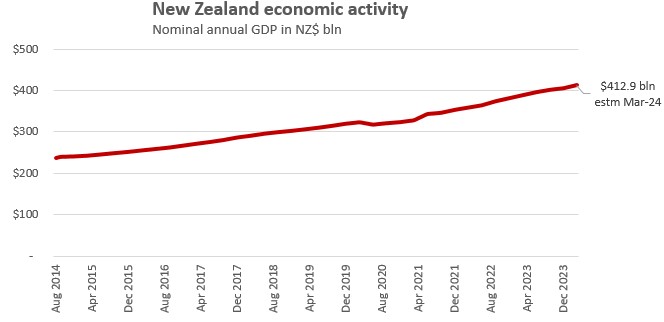

In contrast, overall economic activity has not missed a beat yet, still expanding in nominal terms (and the nominal world is where the real estate and mortgage market lives). So perhaps we are pushing the excessive fascination with 'property' down in our collective relative priorities.

5 Comments

"It appears high LVR lending isn't to borrowers trying to get on to the property ladder; rather it is being used by borrowers who are wanting to stretch themselves into properties they couldn't otherwise afford."

"And the high-LVR story extends to investors too. On average residential property investors borrow $515,000 while high LVR borrowers are stretching to +25% more at almost $648,000"

Can't see this, in a housing market where prices are falling and stock is increasing, ending badly at all..........

"And home loan borrowers who change lenders are borrowing a record $667,000 on average. That new record came in March 2024."

That's odd. Anyone got any ideas why?

Because someone like J Bolton from Squirrel will get you $6,000 for refinancing !

Possibly because HSBC's loan book was taken over by Pepper Money and as I understand it most of those that were happy with HSBC were not happy with Pepper and ended up refinancing with another bank. HSBC had a number of high value loans through its premier lending team. So if it drops back in the coming quarters that could be the reason.

Yes, almost guaranteed to be influencing current numbers. We were very happy with HSBC for many years (great rates, no hassles), was handed off to Pepper who are not in any way interested in competitive rates for good payers. Mortgage moving to ANZ later this week, significant discount on advertised rates and some cash my way. Same thing for a couple of friends.

HSBC required mortgages over $500k, so not surprised the numbers are above that.

Side grumble . . . can't believe the hassle of applying for a mortgage now, 10x the paperwork compared to when we bought our first house 16 years ago, even though we now have a ton of equity, far better incomes and significant liquid savings and investments.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.