Summary of key points: -

- A balanced Fed and weak jobs data send the US dollar lower

- Reserve Bank of Australia likely to bias to a more hawkish tone

- The Bank of Japan hits the Yen intervention button

A balanced Fed and weak jobs data send the US dollar lower

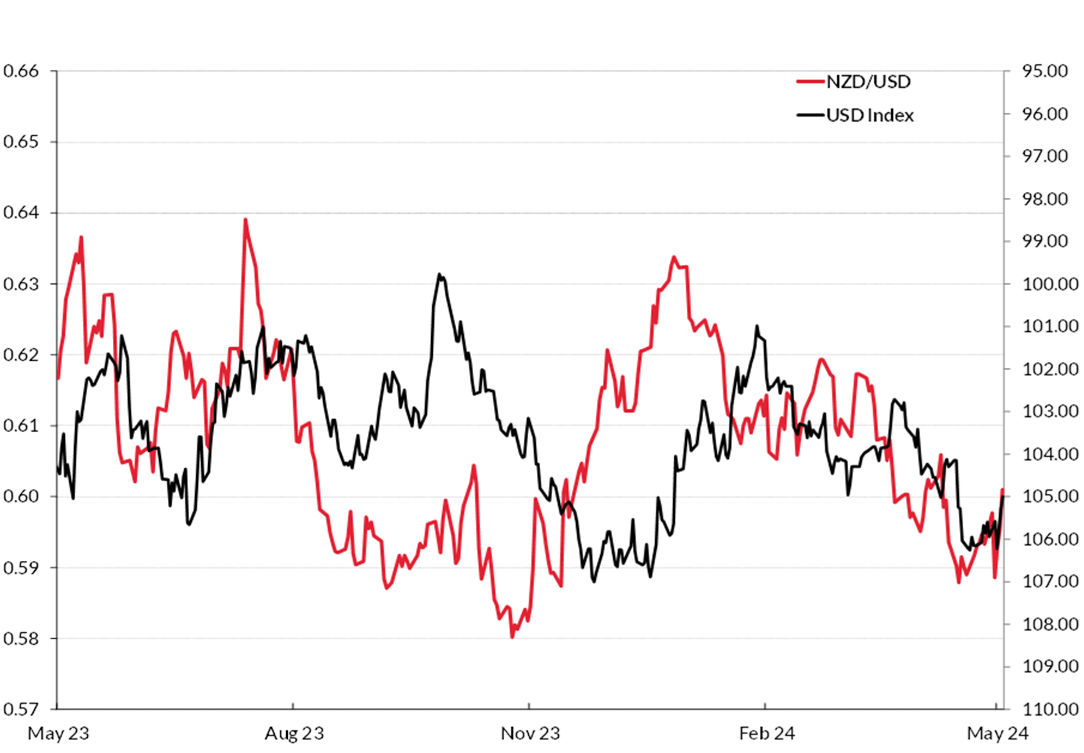

The Kiwi dollar has yet again survived and rebounded back up from an attempted sell-off to rates substantially below 0.6000. And, yet again, the NZ dollar recovery back up to above 0.6000 on Friday 4th May had nothing to do with New Zealand specific currency flow or economic data/conditions.

The US dollar weakened across the board in global currency markets last week due to three separate forces/events: -

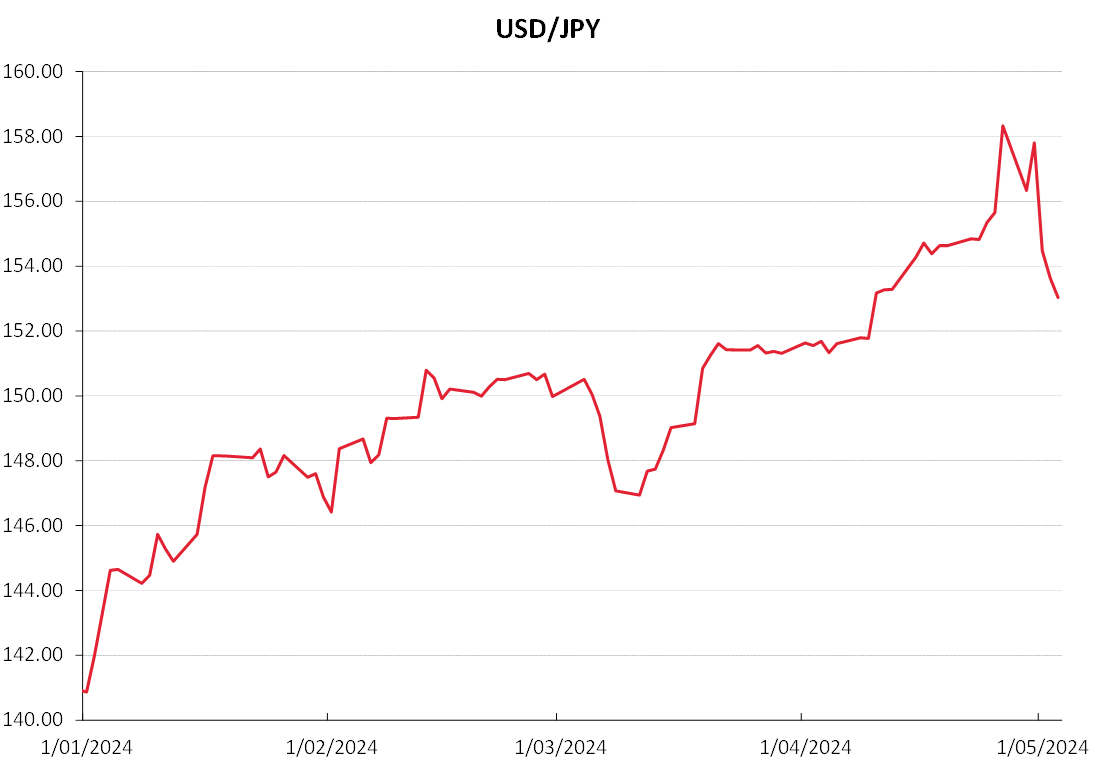

- The Bank of Japan intervened directly into the FX markets on two occasions last week, buying Yen, selling the US dollar. Reported Yen buying amounts were US$32 billion and US$22 billion respectively, slamming the USD/JPY exchange rate down from 160.00 to a low of 152.00.

- The Federal Reserve’s FOMC meeting statement and Chair Jerome Powell’s subsequent media conference was interpreted as less hawkish than what the markets were expecting. Chair Powell ruled out future interest rate increases, and that confirmation was sufficient to cause USD selling.

- After three months of stronger than anticipated US Non-Farm Payroll jobs increases in January, February and March, there was always a good probability that the April number would be on the softer side. The 175,000-employment increase was significantly below prior consensus forecasts of +245,000. The unemployment rate increased from 3.80% to 3.90%, adding to a series of weaker economic data releases over recent weeks in the US. The interest rate markets immediately priced in a higher probability of at least two Fed rate cuts this year, adding to the USD depreciation.

The USD Dixy Index has reversed back downwards from highs of 106.30 on 1st May to a low of 104.60 three days later, allowing the Kiwi dollar to lift from 0.5900 to above 0.6000. US 10-year Treasury Bond yields have also reversed from highs of 4.73% on 24 April to 4.50% at the market close on 4th May. The US interest rate markets have seemingly lost their conviction that inflation is bottoming out at 3.00% and going back up again. Just one month of softer employment outcomes will not be enough for the Fed or the markets to be convinced that interest rates and the USD continue in a straight line down from here. However, a combination of factors now emerging in the US economy following the last three months of stronger inflation and employment numbers, does suggest the balance of risks is now squarely biased towards lower yields and continuing USD depreciation.

Readers will recall that monthly inflation and employment figures over the last six months of 2023 were generally weaker than expected, culminating in the Fed’s pivot on monetary policy in early December (the Kiwi dollar reaching 0.6350 by 31 December 2023). US wholesalers and retailers went through a serious de-stocking period over those months in 2023 to reduce their high inventory levels built up over the shipping/freight disruptions during the Covid years. The run-down in stocks was stimulated by price discounting that produced the lower goods inflation outcomes in late 2023. Examining the inventory cycle more closely, it is now apparent that stocks were run-down too far, resulting in the need to rebuild inventory levels in the first three months of 2024. Hence, the stronger jobs figures and prices moving up instead of down in January, February and March. Looking ahead, inventory levels now appear more evenly balanced, therefore it is fair to expect a continuation of softer jobs figures in May and June. Chair Powell noted the change in the JOLTS (job vacancies) employment data to a weaker tone last month in his media utterances. Our previous analysis on US monthly inflation trends would also strongly suggest monthly increases in the CPI or PCE measures over coming months in the +0.01% and +0.20% range, as compared to +0.30% per month over the first three months. Oil prices tumbling from US$88/barrel (WTI) to US$78/barrel over the last month provides strong support to that view. The financial markets and the Fed members will require more evidence and confirmation that the annual inflation rate is heading lower to 2.00% over coming months, however all the indicators do suggest that this will occur.

Fed Chair Jerome Powell painted two likely scenarios for US interest rate changes over the coming period in his media conference last week. The first scenario is that weaker than expected inflation and employment results over coming months would see the Fed cutting interest rates this year as indicated by the December dot-plot of three 0.25% reductions. The second scenario was that employment and inflation increases do not moderate after the higher levels in the first quarter of 2024 and interest rate cuts are delayed to late 2024 or 2025. The market pricing today is arguably half-way between these two scenarios. As always, the emerging economic data will determine what scenario plays out to be the most accurate against actual outcomes. We have a high conviction that it will be the first scenario.

Therefore, the events of last week add further substance to our long-held view that the USD Index will fall away to the 100.00 area on US interest rates decreasing well ahead of other interest rates around the world. A USD Dixy Index of 100.00 is equivalent to 0.6300 in the NZD/USD exchange rate. The recent bout of USD gains to 106.00 has run out of steam, identical to the May 2023 and November 2023 USD periods of appreciation. The USD bulls will again be reviewing their positions as unsustainable, adding to the general USD selling pressure.

Reserve Bank of Australia likely to bias to a more hawkish tone

Following the stronger than forecast Aussie inflation result for the March quarter 10 days ago, the interest rate markets and economists have taken a decidedly more circumspect approach to when and by how much interest rates can be reduced. The Reserve Bank of Australia (“RBA”) will therefore reflect the changed circumstances of inflation not trending downwards as expected this year, and thus they will deliver a more hawkish bias/tone in their monetary policy statement on Tuesday 7th May. It is somewhat unfortunate that the March quarter wages data does not come out until the week after (Wednesday 15th May) the RBA statement, as continuing high wage increases in the economy add weight to the view that the RBA need to raise interest rates, not cut them.

The RBA will now be forced to increase their 2024 inflation forecast, making the task of achieving the 2.50% inflation target by mid--2026 even harder. The current Labour Government could aid lower inflation and interest rates, ahead of the likely May 2205 general election, by delivering a contractionary budget this month i.e. tighter fiscal policy. They are unlikely to do so, therefore the RBA really need to compensate with a tighter monetary policy stance. Having said all that, there is only a low risk that the RBA will increase interest rates this week. However, that risk has increased over the last two weeks.

The outlook for the Aussie dollar has received a leg up with these recent inflation/RBA developments. However, it needs all the currency speculators who are still holding on to “short-sold” AUD positions to come to the realisation that the AUD is going no lower and the interest rate differential to the USD could be rapidly closing.

Tuesday’s RBA report is standing as a real test of Governor Michele Bullock’s mettle to bring inflation down, following the miscalculations on inflation, the economy and interest rates by her predecessor Philip Lowe.

The Bank of Japan hits the Yen intervention button

Global fund managers, hedge funds and currency traders will all now be much more cautious about continuing their favourite trade of recent years of selling the Yen with 0% interest rates and buying the US dollar with 5.00% interest rates, following the Bank of Japan currency market intervention last week. The Bank of Japan’s own pontification and indecision about changing their monetary policy back to positive interest rates has caused the significant Yen weakness of recent months, which in turn has forced the direct FX market intervention action. Time will tell how successful the intervention buying of Yen has been, however the first objective of any intervention is to make the currency speculators think twice, and the dramatic Yen reversal to 153 indicates that this may have been achieved.

History tells us that the Japanese Yen is a currency that can move a very long way in a very short space in time when the Japanese major banks, fund managers and corporates all follow each other like sheep in bringing funds home to Japan and they buy the Yen in unison at the historically low value against the USD.

If the Bank of Japan want their FX market intervention to be ultimately effective, they also need to follow it up with more significant increases in their official interest rates. The Bank of Japan do not meet until 14th June, their inflation figures for April on 24 May could provide the ammunition they need to justify further interest rate increases.

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.