As we approach a year since the Reserve Bank (it was May 24, 2023), somewhat surprisingly, called a halt to its extremely bracing cycle of Official Cash Rate hikes, we can say with every confidence that the forthcoming OCR decision will be another 'hold'.

There's been nothing since the last review in April to change the RBNZ's mind on keeping the OCR unchanged.

But while it is the safest of safe bets that the OCR will remain on 5.5% after the latest review on Wednesday, May 22, there will be much interest and intrigue around what the central bank has to say in its new Monetary Policy Statement (MPS), the first one since February.

The forecasts in it will be crucial.

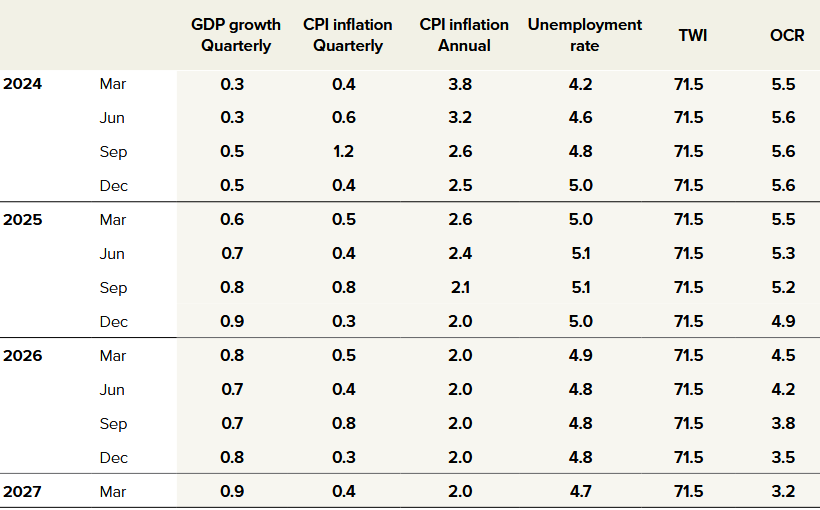

Here is an abridged version of the key forecasts from the RBNZ's February MPS:

The most anticipated figures in the new May MPS will be the OCR forecasts. There will be much interest as to whether or not the RBNZ signals through its new forecasts that it now expects the OCR to be cut for the first time earlier. Interest will also centre on whether it chooses to remove the possibility of of another hike before we get to the cuts.

As per its February forecasts the RBNZ was implying that the first cut to the OCR was likely to happen in the second quarter of next year. But it was also still forecasting about a 40% chance of another RISE of the OCR by the September quarter of this year.

I think the RBNZ could be justified in both removing the implied suggestion of a potential further rate hike and bringing forward the forecast time of the first OCR cut.

But I don't think it will, because that would not be the sort of signal it wants the financial markets to be given.

The markets like to run ahead of themselves - and of the RBNZ. At time of writing wholesale interest rates are pricing in NO chance of another OCR hike, but a very high probability of the first cut by October this year, with a pretty fair chance of TWO cuts by November 2024.

If the RBNZ does either or both of removing the chance of an OCR hike from its forecasts and bringing forward the time of the first forecast cut, the financial markets will run with that and will be quickly pricing in an even earlier start to the cuts. That would be very significant because it could lead to meaningful cuts ahead of time in mortgage rates.

So, the signal from the RBNZ's going to be important. Of course the RBNZ and Governor Adrian Orr are very well aware of how the the markets think and are not averse to wrong footing said markets with pronouncements and forecasts that 'the market' might not have expected. For example, the February media statements and press conference that accompanied the release of the February MPS were far more 'dovish' in their messaging than financial market participants had expected.

The RBNZ folk won't want to see mortgage rates falling significantly from current levels till they are very confident inflation is under control.

So, what of inflation?

Well, if the OCR forecast is the first thing economists and the like will look at in the new MPS, the RBNZ's latest inflation forecast will be a close second.

Importantly, people will want to see if there's any 'slippage' around when the RBNZ thinks inflation - as measured by the Consumers Price Index (CPI) - returns to inside the 1% to 3% targeted range. It's been outside of that target range for nearly three years now.

The past week saw some good news and some slightly less good news for the RBNZ on the inflation front. On the not-so good news front, Statistics NZ's latest new monthly Selected Price Indexes data, which covers about 45% of the things in the quarterly CPI, again pointed to some 'sticky' inflationary pressure - particularly in respect to things such as rents.

But against that, the RBNZ's own Survey of Expectations mostly showed another solid fall in the expectations of future inflation, with all timeframes (one-year, two-year, five-year and 10-year) being under 3% for the first time since the September 2021 survey.

In the February MPS the RBNZ was forecasting that the annual rate of inflation would return to under 3% in the September quarter of this year. It's very unlikely the RBNZ would change that forecast timeframe. It would be a bad look.

But there's no doubt there will be some fingers crossed as the latest forecasts are signed off - assuming that September quarter date for inflation going under 3% is retained.

In terms of the actual inflation figures to date, March quarter CPI rose by 0.6%, which was higher than the RBNZ's 0.4% pick. Annual CPI rose 4.0% (down from 4.7% as of the December quarter) against an RBNZ forecast of 3.8%.

The big 'miss' for the RBNZ forecasting was in domestic (non-tradable) inflation, which was much stronger than the RBNZ was picking. The RBNZ forecast quarterly non-tradable inflation of 1.1%, but it actually came in at 1.6%, while in terms of annual figures, the RBNZ had picked 5.3% but it came in at 5.8%.

Overseas-sourced, or tradable inflation, was -0.8% for the quarter (versus an RBNZ pick of -0.7%) while the annual rate was 1.5% versus the RBNZ's 1.6% pick.

The RBNZ won't want to be depending on continued low inflation or even deflation from offshore, so, it will want to see domestic inflation beginning to drop more quickly.

Other key economic data, however, are perhaps suggesting that more downward pressure is going to start coming for domestic inflation. December quarter GDP showed a 0.1% contraction, while the RBNZ had expected a flat (0.0%) result. Unemployment rose from 4.0% to 4.3% in the March quarter (the RBNZ had picked a rise to just 4.2%).

A contracting economy and a now quite quickly softening labour market would together suggest downward pressure on inflation through fewer wage rises and reduced spending. The soft GDP and labour market figures would therefore probably allow the RBNZ to be 'patient' with inflation for now.

The upshot is, I would be surprised if the RBNZ does change that forecast of inflation going under 3% by the third quarter of the year.

Likewise, I would be fairly surprised if the RBNZ makes much, if any change to its OCR forecasts. It won't want to give the financial markets the opportunity to start pushing down those wholesale rates and thereby, by implication, opening the door for large mortgage rate cuts.

As others have said, the RBNZ won't want to say it's cutting the OCR virtually until the time it does it.

So, for now it's likely we will get a largely unchanged message. But really, you can never exactly tell with the RBNZ. Anybody looking for clear signs of some significant mortgage rate relief coming before the end of the year is, however, likely to be disappointed.

Just as a final thought, however, I've seen some comments asking whether there is any chance of a cut by the RBNZ now? I say no. But the economic news is certainly worth keeping an eye on. There are definitely signs the economy is really starting to roll over. The RBNZ wants to slow the economy. Not break it.

The RBNZ's overwhelming priority is to smash inflation, and to some extent to hell with the consequences for the economy. But yes, I think there is some possibility if the economic news keeps getting darker and darker the RBNZ may yet have to compromise a little on its inflation target. Maybe. But we are not at such a point yet. Watch this space.

I'll finish with a quote from ANZ chief economist Sharon Zollner:

...We don’t see OCR cuts until the RBNZ has more confidence that the downward path for inflation won’t peter out before reaching the desired destination: not only back in the [1% to 3%] band, but also likelier than not to stay there. The timing and specifics of such a ‘confidence’ pivot are very difficult to pinpoint, as it will depend not only a bunch of inflation indicators, but also whether the economy is still going south or recovering. A range of combinations of data could meet the requirements. But the general theme is that the weaker the real economy is looking, the fewer inflation runs on the board the RBNZ is likely to require in order to feel confident about cutting the OCR."

*This article was first published in our email for paying subscribers early on Friday morning. See here for more details and how to subscribe.

106 Comments

Terrible allright. Imagine if the spec crowd had not blown up the largest bubble since tulips and that money had gone into productive businesses. Those people caught now using their house as an atm or caught as last bag holders would have far less debt and mostly be fine.

Thats the real problem.

'Imagine if the spec crowd had not blown up the largest bubble since tulips"

The bigger the party, the bigger the hangover.

House values reached $1.76 TRILLION in NZ at their peak. Remember, residential real estate is the largest asset class in NZ.

Look at other economies which had housing bubbles and the consequences on the economy afterwards - lost jobs, business closures, recession.

Some housing bubbles in history:

1) US 2006

2) Japan 1990's

3) UK 1990's

4) Ireland 2006

5) Spain 2006

6) Hong Kong 1998

7) Singapore 1998

What productive businesses. 95 percent are out of business in 5 years with most failing inside 12 months.

Would you say motels are productive businesses putting rough people in a room at high prices. Would you congratulate someone who went and bought or built a motel to cream it off the govt MSD. Creates some low pay housekeeper jobs who get govt top-ups for Fam support and Accom supp as well

Things that create new goods or provide valuable services. No, landlordship is not a valuable service, it is just the more advanced form of ticket scalpling but instead of an upset tween not being able to go see Taylor Swift it's young families left with no housing stability.

SKF

My business, we were 15% down yoy to the end of March 24, currently 8% up on last year and 1 new staff member. Admittedly it's only 7 weeks in to the fy, hardly anything to get excited about. Import wholesale distribution business. Stacked away a fair war chest in case of trouble.

A lot of people may need to reskill - there is a shift in what skills are needed going forward. An opportunity for those that dont have the right skills - to make themselves more employable in the future.

I do a lot in the software space - and need to continually evolve. AI is shifting the game and so about 20% of working time is now spent learning new skills to stay relevant in a few years. I am not sure standing still is feasible for anyone in their career anymore.

For me - 50's. Always in software/tech in a variety of roles. and everything shifts all the time.

BUT - I am never short of work as I make sure to always be expanding skill sets and adding new ones.

If someone is made redundant and cant find work - the solution is always to look at themselves and their skill sets, and then to make sure next time they are always learning something to add more value.

NZs debt clock clicks over $90,000 / household tonight

"CGT for all sales would be logical"

That would incentivise existing owners to hold on so less inclined to sell - fewer houses for sale in existing house market. Look at pending change of brightline test - many are holding on until zero tax on capital gains. A CGT wouldn't necessarily reduce buying competition from non owner occupier buyers.

Singapore has a stamp duty system which prioritises citizen owner occupier buyers at the top. Whilst other buyers have increased rates of stamp duty (permanent residents, non owner occupier buyers).

Foreign buyers currently have a stamp duty of 60%.

Entities buying residential real estate have a stamp duty of 65% - that would catch most professional property owners renting in the long term rental market, syndicate buyers and trusts.

With those rates of stamp duty, that would be unattractive for many non owner occupier buyers leading to reduced buying competition for owner occupier buyers. Remember how many non owner occupier buyers were effectively borrowing 100% of the purchase price through equity recycling techniques and outbidding owner occupier buyers?

This would make any new purchases for non owner occupiers potentially uneconomic (especially for those focusing on capital gains), thereby reducing buying competition for owner occupier buyers in the existing house market. It would be less financially attractive to use residential real estate as an object of speculation for non owner occupier buyers.

https://www.iras.gov.sg/taxes/stamp-duty/for-property/buying-or-acquiri…-(absd)

Don't know if there would be sufficient income for government tax revenue compared to a CGT, which might be more of a constraint in the government's policy making criteria.

They should have started easing Nov '23. Why? Because the oil shock had passed (less core inflationary pressure) and a cut in Nov '23 would have had six months with less inflationary pressures due to wages catchup to pay for mortgages and businesses needing to pass on the costs of more interest on their working capital. I could go on. But our RB just looks more and more foolish if I do.

"But the general theme is that the weaker the real economy is looking, the fewer inflation runs on the board the RBNZ is likely to require in order to feel confident about cutting the OCR."

Let's hope the RB adheres to this logic. Major consequences if they don't.

This has only held true because NZ use to follow the USA into recession.When the USA went into recession commodities prices collapsed. Commodity prices collapsing caused a fall in inflation. Think 2008 and 1997 Asian financial crisis. However the game has changed NZ no longer follows the USA economy. It is effected by a myriad of factors. So it is plausible our economy can go into recession and inflation and commodity prices will both stay high.

I don't buy an inflation narrative that has the annual inflation returning to under the 2% mid-point this year and that's when I think RBNZ might ease the OCR.

Base effects my friends, last quarter of this year they start to work against you. That's when the conversations about how tough "last mile inflation" is begin.

As ANZ say he will Deny, deny, deny... CUT!

I think cuts August or November if things go the way I think they might... if things are as rosy as some on here think, then no cuts at all are needed... many here think a single cut will set the house market off again... If the RBNZ thinks this way they simply will not cut. Following this logic you Spruikers should keep those opinions to yourselves, least you get a wider following and the RBNZ form your view as well.....

So I would be looking at the economy more then the RBNZ forward track etc. RBNZ forward track GDP look very optimistic to me, not sure how they see twi staying stable, we will see.

I am putting gutters on horse stables, will have most of it done today, water tank is in already.

The horse market is interesting, ponies for younger riders are moving but slowly. Good dressage horses are selling really fast, sometimes the day or one or two days after listing (25k upwards horses) . These appeal to older ladies not wanting to jump. Time waits for no lady it seems.... As you know, these boomers have often done very very well from property and have cash rather then debt, with term rates where they are its good times for them. Bottles of Otago red and pizza from the pizza oven....

This general population is 4 parts

- Older some wealthy, some not

- Struggling middle

- Disillusioned young

- Recent Migrants

The boomers may have to gift there wealth to their children, as the children and others do not have the ability to buy it off them. the children are heading off overseas, increasingly so are young families, being replaced by immigrants.

Interesting times with so many immigrants, so many kiwis leaving, the ethnicity makeup is changing rapidly (most rapid changes in the OECD believe).

What bottle of red will you be opening tonight?

I'm surprised nobody made a sensible comment about the Budget on May 30th.

I think the promise of tax cuts will influence the RBNZ's decision significantly (or at least they'll say so) and will ensure the OCR isn't cut for some time as the RBNZ will want to reassure themselves the tax cuts aren't 'inflationary'.

(They won't be. But the RBNZ hasn't worked this out yet.)

Does it appear odd to anyone else that we supposedly live in a democracy, where the government is supposedly accountable to its citizens, but for some reason we have an unelected body accountable to almost no one but an artificial statistic that that body made up for itself?

And someone, we?, they?, granted that body the right to destroy lives, wealth; waste years of people's live; enrich the wealthier; take from the younger trying to establish themselves in the world; and we accept this as normal? The way it must be?

Are we just slaves to be toyed with by this mysterious body? Are we in fact following a religion? It's not much different. The religious try to define their gods, but they never can because their gods 'act in mysterious ways', and are capricious and unpredictable.

Reading David, Liam's, etc. thoughts above and other media on this subject I am reminded of what I've heard from too many preachers who try to help you understand their gods. They never question if the god should should exist, only that it does, and we must all seek to understand them while remaining completely servile to them.

So now we await the words from the High Priests.

No one knows what they will say.

Nor who will be sacrificed.

But we must accept their edicts.

We have no other choice.

There is a reason they are independent.

Should Lucky Luxon appoint himself head of rbnz, then juice the economy to ramp it to new heights. Poll approval ratings willl shoot up like 1987.

I hear that Trump has said he would appoint himself that role over the fed reserve. IF it happens, the US economy will be the turkey by next thanksgiving.

Some obvious observations to that response:

1. Why does the RBNZ have so few tools to work with?

2. Why do they persist with obviously unjust tools?

3. To whom are they accountable?

4. Who else should be working with the RBNZ so far fewer suffer? Why aren't they?

5. When people a few generations hence look back, will they ask: "What problem were they really trying to solve? Weren't the rich, rich enough already?"

How do high rates increase inequality? To my mind low rates do that far more than high.

https://www.imperial.ac.uk/business-school/ib-knowledge/finance/how-cen…

I have an issue with average people investing instead of saving. Doing so drives up stock prices, and benefits those with the majority share, like Bezos or Gates or Musk etc. So yes they invest the money, because it's earning so little in interest rates in the bank.

I get the feeling most don't have an issue with Bezos earning $2B per quarter, as long as they get their $15,000 .

The recession has already got away from RBNZ and Govt - like it has every single bloody time we have had an imported price shock - 1970s, 1991, 2000 (wobble), 2008, 2021. The pattern is depressingly familiar. The price of a key import like oil spikes upwards, that drives price increases throughout other imports and our economy more widely, RBNZ respond heroically to desperately lagging indicators (rent, wages, etc) and our economy leaps happily off the cliff cheered on by reckonomics ghouls with very little understanding of what is actually going on.

Pull lever this way, ugh, tame inflation, yeh, yeh, pull it dis way, boost economeeee. Idiots.

Imports are $100bn. Our total consumption expenditure is $300bn. So, what happens when imports go up in price by 25%? Yep, pretty soon CPI increase by about $100bn/$300bn x 25% = 7.5%.

Now, what on earth could RBNZ have done about that? How high and quickly would they have had to hike interest rates to stop people filling their cars with petrol, or to stop businesses buying the diesel they needed to ship stuff around, or the fertiliser they needed to grow food? The RBNZ mandate and toolkit means they are incapable of suppressing an imported price shock. In fact, piling $6bn of extra interest cost onto businesses (cos that's what we do) has probably made 'inflation' stickier.

I would prefer it if RBNZ had spent 2020 to 2024 literally standing around pretending to be a tree. In fact we should have given them a bonus to do exactly that.

"Pull lever this way, ugh, tame inflation, yeh, yeh, pull it dis way, boost economeeee. Idiots. "

What I find astounding is that we - most Kiwis - just blindly accept that that is the way it has to be.

We follow what we are told by the High Priests and their army of acolytes without question, never once stopping to ask if there aren't better ways. And we never even question exactly who is benefiting from this system as as we see first hand the middle classes being gutted while the rich grow richer.

Doesn't that make us Kiwis the idiots? By golly. It does!

The point you miss when the current inflation rate is mentioned - and most other commentators (so you're in fine company) - is whether inflation would continue to fall had the RBNZ started easing earlier.

I expect you, like other commentators, will trot out the logic that we must endure an unchanged OCR until inflation is crushed, or slayed, or defeated, or some other words that inspire us to fight and die to the last breath.

I'm fine with that. Just so long as you recognise that you're doing so without evidence that it is required, or necessary, when the early signs that the economy is crumbling were so crystal clear some six months ago.

Interesting with you prediction Yvil,as Rabobank has predicted August & November for OCR cuts- hopefully as an indebted dairy farmer these predictions come true as interest on borrowing is most farmers highest cost,and our annual inflation was running more like 16%, although is dropping with reduced fertilizer & fuel costs.But all is not lost as a Fonterra shareholder,we are in for a so called 300k windfall in 12- 18 months as our board of Directors & CEO convince us to sell Fonterra silverware & step into a more profitable future?🤔

With precision fermentation looming I'm not sure that giving up the value-add products to focus on ingredients (aka milk powder) smart. It's milk powder, for use in chocolate etc, that can be replaced by new technology. But there will always be a market for quality ice cream and cheese, made from fresh milk.

"an indebted dairy farmer these predictions come true as interest on borrowing is most farmers highest cost,"

This is a telling statement and I was unaware that interest on borrowing is the highest cost for most farmers. Is it perhaps they paid too much for the farm so had to borrow a lot?

Be smart buy off the overstretched, .... see this one, he was not smart guys

https://www.trademe.co.nz/a/property/residential/sale/waikato/thames-co…

CLIFF TOP LUXURY - Mortgagee sale.

28 Radar Road, Tairua, Thames-Coromandel, Waikato

I think there is some possibility... the RBNZ may yet have to compromise a little on its inflation target

I can't be bothered searching my previous posts, but I have long been predicting that inflation won't get back to 2% but that the RBNZ will be forced to cut the OCR to resuscitate the economy. (The RB's mandate to focus on inflation won't make a difference)

There is going to be some sort of crash - the only question is what will finally tip it over. The boom was too large for too long and the debt level is absolutely frightening.

i suspect the sharemarket will go first when people realise the 'overhype' of AI and that China has already overtaken the west in Technology and its too late to stop the slide. USA and Europe are now desparately trying to stop China from destoying their economies by selling better products cheaper...

Unfortunately for us - reducing the OCR wont .. anything we do to try to stoke the economy by simply enabling more cheap debt will just make things worse. The only way out is to start to rebuild the western economies properly which requires a long period of pain and being humbled

https://www.waikatotimes.co.nz/nz-news/350275955/military-vets-worked-t…

Boomers who've seen high inflation. But you can't criticise the old or a female or question someone's accountability

I see they're paying $287 per week in subsidized rent, surely they can cut back on a few luxuries. $85 per f/n on Internet/Phone? More than I pay for a 1 gigabit plan with mobile phone. $462 per fortnight on groceries? More than our household of 2 adults 1 children spends, and we're not broke.

He supports people receiving government money when they are sick, old or cannot find a job, but thinks a lot of money is wasted.

Oh I agree, maybe we could find $1b p.a. in savings by income testing Super at $100k p.a., and redistribute the savings to these unfortunate souls.

Long term mortgage interest rates have been around the 7% mark, so they are not high now.

The problem is we took on too much debt at 2.9% so it is now a struggle to service it.

A great time to re adjust and get back to basics, maybe reflect on how our parents managed without all toys such as $2000 mobile phones.

The sky is not falling, it's a storm. It is almost certain that we could remain at this OCR and the economy will eventually grow, after purging the bad debt. That means pain, it means foreclosures, it means business liquidations. The entire outcome is based on stressing everyone and everything until people figure out how to live like this. It might require political change, but the economic pain drives improvements in the efficiency of allocation of resources to satisfy peoples wants.

SKF

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.