The Finance Minister Nicola Willis made the first of what is going to be a series of pre-Budget speeches to the Hutt Valley Chamber of Commerce, and in it she dropped a few clues as to the likely contents of the Budget.

In particular, she announced that the Budget’s “tax relief package will increase the take home pay of 83% of New Zealanders over the age of 15 and 94% of households.”

In case you're wondering who is in the unlucky 17%, these are taxpayers with annual income currently below $14,000 or with no income at all. They therefore would not benefit from any increase in tax thresholds. According to Inland Revenue in the year to March 2022, there were over 800,000 taxpayers whose income is been between $1.00 and $14,000. There were another 210,000 or so who had no income at all during the 2022 tax year.

14 long years?

In her speech Nicola Willis noted that New Zealanders have not seen any changes to personal income tax rates and thresholds for 14 years. “Unlike most developed countries, New Zealand has made no adjustments to tax brackets to compensate for rampant inflation.” However, having highlighted this point, there wasn't a commitment in her speech to regular indexation of thresholds, which is how we got 14 years without changes. I’ll have more commentary on that a little later.

The Finance Minister talked about “tax relief aimed at middle and lower-income workers” which is interesting because it hints that maybe threshold adjustments might be focused most on those earning below $70,000. The threshold which I think is most problematic, and Geof Nightingale, Sir Rob McLeod and Robin Oliver all agreed with this, is at $48,000 where the tax rate goes from 17.5% to 30%. There doesn't appear to be any plans to adjust the tax rates there, but whether there is a bigger proportional increase around that threshold relative to the other thresholds, we'll have to wait and see. We know by the way that the $180,0000 threshold at which the 39% tax rate kicks in is not likely to be increased.

The OECD joins the call for a capital gains tax

The Finance Minister’s speech came hot on the heels of the latest Organisation for Economic Cooperation and Development (OECD) Economic Survey on New Zealand, released on Monday. The big headline here from a tax perspective that the OECD joined the IMF in recommending a capital gains tax. What was interesting here is that when the IMF made this suggestion, Nicola Willis, dismissed it with a snippy comment following in the footsteps of her predecessor Sir Michael Cullen. This time around, there was no such snappy dismissal.

The report actually is quite sobering reading, not just around the tax side of it, but just generally about what it has to say about certain aspects of the New Zealand economy. Education was specifically mentioned as a point where attention needs to be focused on improving standards and therefore flowing through to greater productivity across the economy.

The OECD agreed with the Government's proposed fiscal approach trying to squeeze spending and keep it under control. It had some criticisms about how budget operating allowances have been allowed to increase in recent years without any real explanation.

The OECD supports the broad-base, low rate approach, a capital gains tax, and tax reliefs for pension saving

But it also made the point that “any tax cuts should be fully funded by offsetting revenue or expenditure measures”, before going on to add “raising revenues should first be achieved through broadening the tax base and reducing distortions before raising rates of existing taxes.” That very much endorses the broad-base, low-rate approach Sir Rob MacLeod in particular espoused in a recent podcast.

No surprises there, but the report continues:

“There is a need to reduce distortions to household choice of asset allocation. Shares, land and owner-occupied residential property are tax favoured. Most capital gains from shares, owner-occupied residential property and land are not taxed. To ensure the tax system is not overly distorting, saving and supporting broader growth, capital gains taxation reform should be done as part of a wider review of tax settings for saving. New Zealand's tax settings remain an outlier in some respects in international comparison, and notably in offering no tax deduction for contributions and in taxing the returns pensions funds earned while they're invested and prior to withdrawal at progressive rates, this likely distorts saving away from private pension saving.”

Robin Oliver made the point about over-investment in housing, but as mentioned last week Andrew Coleman picked up on how our taxations of savings is unusual by world standards,

There’s a lot to digest in this 150-page report which is only available online. It's probably no surprise that expanding the capital gains tax base is not likely to be very high on the agenda of the Coalition Government at the moment. But there's plenty of food for thought in the report.

One of the other points of interest, and there has been some commentary about this, is the suggestion for an Independent Fiscal Institution, basically, a policy costing unit. The OECD picked up that there had been no independent costings of policies in the run up to last year’s election. This is something that could be done by an Independent Fiscal Institution. Some work was done on this under the last government and Nicola Willis seems open to revisiting the issue.

Following the Irish example?

The OECD survey suggested the Irish Fiscal Advisory Council (IFAC) https://www.fiscalcouncil.ie/as a model that could could be followed. Given Ireland has a similar population this seems a good idea. Personally, I think we ought to look very closely at countries of comparable size to ourselves. The IFAC has been mandated to independently assess the government's fiscal stance and budgetary forecasts and monitor compliance with budgetary rules. As I mentioned earlier the OECD thinks that we need to review our budget rules.

According to the OECD survey about 80% of OECD have some form of Independent Fiscal Institution. The Congressional Budget Office in the United States which has 270 staff is a very well-known example. Over in Australia, the Parliamentary Budget Office, with 45 staff has this role. The Canadians have a similar Parliamentary Budget Office and over in the UK they have the Office for Budget Responsibility. There’s plenty of examples around the world to consider and it would be encouraging if we heard something in the Budget about this.

Small businesses and statistics

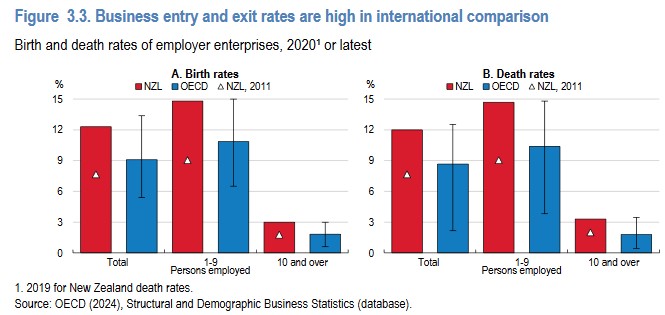

The OECD survey, noted that the business entry and exit rates are higher in international comparison although this means “business dynamism is vibrant” the OECE also noted that the “high share of the population working in micro, small and medium enterprises…hints at a difficulty for these firms to grow into larger businesses.”

One other thing I thought was very interesting was commentary around improving the timeliness of New Zealand’s macroeconomic statistics. I’ve long thought it was a weakness that we don’t see monthly GDP or inflation data, but I wasn’t aware we were, like Australia, very much in the minority within the OECD in not producing a monthly CPI index. As the OECD noted “Older and less frequent statistics increase the risk of costly policy mistakes”. I wonder what the OECD would have made of the news that all Stats NZ staff were offered voluntary redundancy?

Don’t look back in anger? Forty years in tax

This week, it is 40 years since I started working in tax. They say the past is a different country, we did things differently there and that's true, but one thing that hasn't changed over my time in the past 40 years is the behavioural impact of tax. When I started working in the UK, the top rate of income tax was 60% and I saw people very incentivised to make sure that they're claiming all the possible deductions, maximising pension deductions and the like. The top rate in the UK now is 45%, but you still see the same behavioural impact.

For comparison in 1984 the top rate in New Zealand was officially 60% but a further 10% surcharge had been introduced in 1982 by Sir Robert Muldoon, the Prime Minister and Finance Minister at the time. The top rate was therefore 66% which applied to income above $64,000. Based on CPI since then that's the equivalent of roughly $260,000 now. According to the Inland Revenue date for the March 2022 income year, just over 42,400 taxpayers who earned more than $260,000. That's a little bit under 1% of all taxpayers. But they had a substantial amount of income between them, close to $20 billion and therefore paid a sizeable amount of tax nearly $7 billion in total.

The effects of forty years of inflation – how New Zealand taxpayers appear to have lost out compared to their UK counterparts

In terms of inflation, it's quite interesting to look back at the tax rates and the income bands which applied. In 1984 the lowest rate was 20% on the first $6,000 of income. That $6,000 in 1984 dollars would now be $24,350 so in terms of inflation adjustments, even when we see the current 10.5% tax threshold move from $14,000 to maybe $16,000 in the Budget you can see that maybe New Zealanders have been losing out. Consequently, because we aren't adjusting thresholds regularly, fiscal drag means that inflation has affected the ordinary working New Zealanders quite substantially.

That becomes clearer when you swap notes with what's gone on in the UK with the tax thresholds there over the same period. The UK has a tax-free personal allowance which Was £2,005 back in 1984 when I started working. It's now £12,570, but if it had just kept in place in place with inflation, it would be only £6,300. In other words, the value of the tax-free personal allowance has doubled in the past 40 years.

Interestingly, the tax threshold after which the higher tax rates kick in was £15,400 back in 1984. Inflation adjusted that would £48,300 compared with the £50,000 where it actually takes effect. There is an additional rate of 45% in the UK on income over £100,000. Back in 1984 the highest 60% tax rate kicked in at £38,100 inflation adjusted that would be £120,000 now.

What you see looking at these numbers is broadly speaking average earners in the UK have been less affected by fiscal drag and inflation than New Zealand workers have been. And that is something that I think I'd like to see changed here for the better and we should be having regular inflationary adjustments as is required by the UK tax law. I think such a move would tie into the better fiscal discipline suggested by the OECD.

The behavioural impact of no capital gains tax

I've now worked for over 30 years in New Zealand, but I still remember my shock when I realised there wasn't a general capital gains tax here. When I consider the behavioural impact of taxation, that's where you see it apply most where people will be looking to turn something that could be taxable at 39% into a non-taxable gain. And so, there's a distortionary effect there.

And just to circle back to discussions we've had previously on the podcast and what the OECD have just said, there is a tremendous amount of value in the broad-based low-rate approach. It's not perfect, but one of the things it does deal with is this question of behavioural impact and distorting behaviour chasing tax benefits. My personal view is the absence of a general capital gains tax has had an effect on our productivity. If it's better in investment returns to invest in residential property in which the returns are largely tax free, than investing in a business or in shares that are taxed, such as overseas shares under the Foreign Investment Fund regime, then that diverts investment into less productive assets. Whether that's for the benefit of the wider economy as a whole, well, that is a matter for ongoing debate. My view is it’s not.

And on that note, that’s all for this week, I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.

62 Comments

I do think that time has come to introduce a broad based capital gains tax in NZ, that encompasses all properties, including the private home.

You may very well think that...because?

because the tax take from the capital gains will allow to reduce income tax for working people.

There won’t be any now!

no point right now as pooperty is not seeing capital gains....

lets put it in place at the bottom which is looking like a 2027/28 story right now.

That's a short sighted view. Also 7 in 8 properties are selling at a profit, so your statement is just not true.

So you propose to introduce a retrospective capital gains tax? On peoples primary property.......

QUIETLY backing away, shaking head, and thinking this is why tax policy is actually, in the real world set by adults....

You should stick to weather forecasting.... its simpler

If looking for immediate impact then wealth and land value taxes look better over capital gains

SKF

re ... "no point right now as pooperty is not seeing capital gains.... "

Really?

But ignoring your incorrect statement - were it in fact true - then this would be the best time as they'd be little immediate push back.

Agree that if they did do it, it would have to include the family home. But then it would have to be inflation adjusted too. I wonder if it would mean people end up not selling - although I guess other countries have it.

I think a yearly tax is a better option, land tax or similar.

Yes, it will have to be inflation adjusted indeed. You say a "yearly tax", so do you mean on unrealised capital gains? That won't work, imagine the old couple who have finally paid off their mortgage and are on Super, they do not have the funds to pay unrealised capital gains.

Maybe there need to be a means to deduct when they finally sell. But that should be the exception not the norm.

"But then it would have to be inflation adjusted too."

Why?

Are you suggesting we'd need a separate CPI for each asset class? Because simply using the generic CPI would be a nonsense of the highest order, and massively distortionary to boot.

It would be far easier to not adjust the capital gain for inflation and just make the tax rate a bit less, i.e. if the target rate of inflation is 2-3% then the tax is set less by that amount. That might also get some people to focus a bit more on what price increases are appropriate too (i.e. leading to smaller price increases where they could have got away with much larger ones.)

Yes, excluding the family home.

Nope, including the family home ! There is no reason to exclude the family home other than "tax them, not me"

Price is not value.

Its still the same house with the same relative value in the market vs others. Money is simply a medium of exchange (& there are other exchange options). The "price" of money (re/devaluation) & the resulting "price" of houses is driven by a multitude of factors outside the homeowners control.

So, you're essentially proposing to clip the price ticket on a nonexistent value "gain" as people change housing through their lives for a wide range of reasons. An inefficient economic deadweight rort (cf stamp duties).

"I have never understood why it is ‘greed’ to want to keep the money you have earned but not greed to want to take somebody else’s money.” Thomas Sowell

If you are right and houses are still worth the same now as they were 20 years ago, then the CPI must be a terrible measure of inflation. We need higher interest rates ASAP.

I'm sure you understand what I actually said.

I'm not sure you understand it yourself. A lot of words for little meaning.

We had this discussion and concluded that house prices had zero percent real gains/losses over the 1970s despite high inflation. House matched inflation and neither exceeded nor under-performed over the whole decade. IOW houses are inflation proof

As for whether thats also happened over the last 20 years might take a deeper look than a throw away comment by your good self

I buy a home to live in, not as an investment. Any additional home is an investment that needs to have gains taxed, just like many publicly listed shares. The later are easier to tax on unrealised capital gains the as you can obtain the price for any business day. You can't get a house price daily so house would be exceptionally difficult to tax on unrealised capital gains. Taxing additional house would make a more level investment playing field than it is currently.

Most people don't see the reason to tax realised capital gains on additional housing is to try and level the investment playing field. The by-product is to raise additional tax. CGT on housing has never reduced house prices. Australia, UK and Canada as examples. It doesn't stop housing asset bubbles either. Same countries as examples.

"I buy a home to live in, not as an investment. "

That may be what you think - but you can't ignore the fact you get value from doing that.

The 'value' is not having to pay rent for an equivalent home.

Why should you escape a CGT tax when a provider of rental accommodation must pay it?

Excluding the family home from a CGT only has relevance from a political perspective. It has none from an economics perspective and only serves to distort investment decisions as people 'over-capitalize" by investing in their homes to get a tax free advantage.

Phew. I'm glad things are now back to normal & I'm fundamentally disagreeing with CONF.

No problem with that. But be aware that all economists use the 'rent equivalent' when establishing the value to an owner occupier of an owner occupied house.

As an observation - you know that other taxes would go down were a CGT introduced?

So which would you rather have:

- - A drop in PAYE tax over your working life?

- - A drop in GST tax over your entire life?

- - Or a one off CGT tax hit when a property is sold (a bit like Australia's stamp duty)?

Personally - I like 1 and 2 as they both increase my immediate disposable income that I can choose to save, invest or spend as I like.

I think you should include the family home, but have an exclusion up to a certain value (determined in relation to the median house price?). That way it stops people over investing in their primary residence at the expense of other less tax-favoured areas.

Still has a problem. Compare two homes that are purchased for the same value. On is on a small section with a 5 bedroom / 3 bathroom house. The other is on a large section but the house is just 2 bedrooms / 1 bathroom. The latter 'home' will be land banked and not developed just for the tax free capital gain. Removing land from the pool because tax makes it advantageous to do so is distorting the market (yet again).

Yvil - Agreed a capital gains tax that applies to everything including all property types, no exceptions so everyone has skin in the game !

I say again. No to a Capital gains tax. It is just an envy tax. BUT if you insist are you going to allow deductions for annual expenses Rates, Insurance maintenance depreciation etc.

Just like GST, which was introduced to control the need to increase PAYE, It will be increase every time the Politicians run out of Taxpayer money

Calling taxes on capital gains envy taxes is crazy to me. Why do we tax earnings that arise with little to no direct effort and instead heavily burden earnings that arise from you putting in effort into the economy (labour)? As a business owner myself it makes no sense, the 'fair share' should not depend on how much you personally take per year (income), it should depend on how much you have overall (capital).

SKF

You know that other taxes would go down were a CGT introduced?

So which would you rather have:

- - A drop in PAYE tax over your working life?

- - A drop in GST tax over your entire life?

- - Or a one off CGT tax hit when a property is sold (a bit like Australia's stamp duty)?

Personally - I like 1 and 2 as they both increase my immediate disposable income that I can choose to save, invest or spend as I like.

there used to be tax free payments in NZ, all benefits used to be tax free, but RD brought in TAX and the reason he used was, so they feel they are contributing to the running of the country as well, the time has come to reintroduce a tax-free threshold rather than the money go round amongst government agencies that we now have.

"there used to be tax free payments in NZ, For whom ? all benefits used to be tax free, but RD What's RD ? brought in TAX and the reason he used Who is "he" ?

Roger Douglas?

Rod Donald?

I wonder if Rod Donald is any relation to Ged (Gerard) Donald, he was in the new yesterday for his mega dairy farm business going into liquidation

Australia makes us look like a 3rd world country, don't they have tax free income up to AUD$18K ? You can tell people earn way more over there than here from that stat alone. We cannot even offer those on below NZD$14K any tax relief ? People only earning $14K shouldn't be paying any tax, try and live on that in New Zealand.

it would be a benefit to all those small business owners that employ someone for picking, or just need someone for a small amount of time not needing to collect and pay PAYE which gets given back later on by IRD

not really as you do not know who else they work for or passive income....

I would like to see the first 10k tax free

I’d prefer a UBI and a flat tax system.

Removing the tax from the first $14K encourages people to get out and work. UBI just encourages everyone to sit on their bums.

UBI encourages everyone to get out and spend. If we let wealth inequality continue to grow we'll soon run out of people that can buy things, which is quite a poor outcome for an economy. UBI should be just enough to scrape by uncomfortably in my opinion, use it to remove destitution while still relying on the V8 engine that is capitalism to encourage people to get out and work to have a nicer life.

SKF

Land tax is better because it's not triggered on sale. Regular and unavoidable. Include farms and maori land so the sacred cows pay there share as well. Then less income tax burden, a UBI...Oh wait this the the tax policy from TOP.

A policy that was voted down two elections in a row.

Never gonna happen.

The problem with TOP is that the people who would benefit from their policies don’t even know they exist, and the people smart enough to understand their policies are also the ones that would pay more tax so vote for what’s best for them.

So a secret wrapped in a mystery, inside an enigma

Agree land tax is better, not so sure about the never going to happen (since it already did):

a land tax was the very first direct tax ever imposed on New Zealanders, by the Land Tax Act (1878)...The land tax initially provided a major proportion of government revenue. In 1895 it made up 76% of the total land and income tax revenue received by the government. [Taxation in New Zealand - Wikipedia]

TOP could do with slimming down the offering to a few policies so people knew what they stood for. I'm not sure of their current direction since the membership failed to elect a prominent poster, who was the only one that put forward a plan for the future, onto its board.

Don't disagree with land tax but it'll take at least 5 years and a few million to fix the land values. It's actually the Property Valuation Act that needs amending as QV are merely following that. I have concrete examples of the mess.

People would start adjusting what they pay from the minute the legislation is passed. But you're right, it would take time for the full land price impact to filter down. You'll likely know there are lots of other benefits such as the tax base widens to overseas landowners that aren't tax resident here. I would be using the revenue raised to offset income tax which will make working more attractive/financially rewarding.

Neither Australia nor the UK (haven't checked other countries) have CGT on own homes - so why should we?

Because without it, it causes a massive distortion, the lack of it in Assie has created the Super suburbs

Doesn't seem to have affected people being able to buy and sell houses or stopped housing bubbles.

Just yesterday I was talking to my brother and one of his rentals has a tenant moving out, the house has a 400-500k capital gain on purchase price, he's temped to sell, but then said he'd rather move into it (across the road from where he resides) for a couple of years so he doesn't get taxed on it.

It's a loophole, it's exploited and we could do better than Australia in this case. Why should we write better legislation than them?

One of the problems with the Ponzi is that's been exacerbated by tax relief and this has been going on since the mid-90s. Simply slamming on the brakes because there's now something of a realization that the Ponzi has become too big and the negative implications are becoming too poison for the ruling elite to manage is probably just going to make matters worse for socio-economic outcomes. But hey, this was kind of inevitable and external circumstances (excessive money expansion through and post-Covid) have thrown a spanner in the works.

More than a few people have pointed out that the Ponzi is a direct result of credit creation / expansion of the money supply. The evidence is all there and even the Bank of England have openly admitted the reality. I agree with the MMTers that taxation is essentially about controlling the money supply. But it appears that it's too late for that now. Ultimately tax treatment has to be balanced with populist considerations of the ruling elite. You're naive if you can't see that now. Dame Jacinda Kate Laurell Ardern GNZM could see it.

Hate to say it but people have been too self interested to pay attention to what's been happening. Now we only have ourselves to blame.

Boomer rant? Although that term is unfair

The property ponzi and money supply expansion was widely occuring prior to the mid 90s JC. I thought you'd know that

Thought is was pretty funny myself, the guy that's into Bitcoin calls property a Ponzi.

The property ponzi and money supply expansion was widely occuring prior to the mid 90s JC. I thought you'd know that

No. Bank deregulation in the 90s saw a shift in the lowering of risk weighting towards mortgage lending across the Anglosphere. It was the start of the Ponzi. Compare h'hold debt levels to GDP from the early 90s to now for both NZ and Aussie.

Think the first 10k should be no tax. Also think any Iwi or "religious" organisation who runs a commercial operation needs to be taxed like any other company.

Yes, the tax-free ride for charities etc made sense when they mainly got in donations and distributed them, often using voluntary staff. But things have changed.

Maybe a very high proportion of 'total income' needs to be donations for eligibility to continue. Also, a high proportion of donations to be distributed and not gobbled up with staff salaries.

If it walks like a duck and quacks like a duck, it's a duck. Tax (shoot it) it like a duck.

"In case you're wondering who is in the unlucky 17%, these are taxpayers with annual income currently below $14,000 or with no income at all. They therefore would not benefit from any increase in tax thresholds."

+ reindexing of benefits

+ making disability benefits harder to get

+ $3bn in tax cuts for landlords (which will not increase housing supply)

And I'm sure National's tax cuts will favour the rich. It cannot be otherwise unless the top marginal rates are increased or thresholds decreased.

NZ already has a mountain of social problems, this just makes it worse.

"The Finance Minister talked about “tax relief aimed at middle and lower-income workers” which is interesting because it hints that maybe threshold adjustments might be focused most on those earning below $70,000."

Let's be clear here. The 'Finance Minister' - like all before her - is speaking with a forked tongue.

What they are likely to do is reduce that tax rate in one or more middle and lower-income tax band.

Without increasing the tax rate of a higher income tax band - those on higher incomes get the tax cuts as well.

Why shouldn't they? Those within the bands will benefit proportionally more than those that whos incomes extend beyond the bands. So greater benefit to middle income and lesser proportional benefit to high income earners.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.