Analysts are warning of a potential debt "pinch" for struggling construction giant Fletcher Building [FBU] in the first half of its 2025 financial year.

This follows the sharp downgrade in profit forecast for the 2024 financial year to June issued by the company earlier this week. Fletcher is currently operating without either a permanent chief executive or chairman after the previous incumbents both stood down when the half-year results were announced in February.

Senior analyst Rohan Koreman-Smit and associate analyst Paul Koraua of investment services firm Forsyth Barr say the Fletcher update this week had "few redeeming features".

They and other analysts are pointing to the first part of of the next financial year (which will start in July 2024) as possibly a "pinch point" for Fletcher.

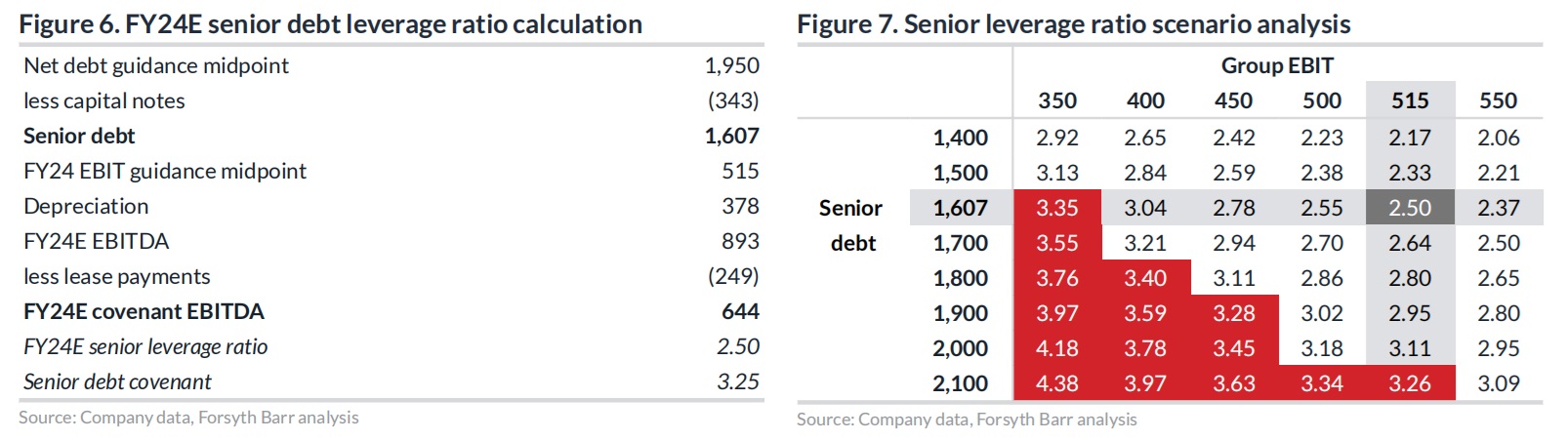

One of the requirements of Fletcher's debt covenants is that is keeps net debt to under 3.25-times its earnings before interest, tax, depreciation and amortisation (EBITDA).

Koreman-Smit and Koraua said that in its update Fletcher had given guidance of net debt of about $1.9 billion to $2.billion at the end of the 2024 financial year - which was about $150 million higher than market consensus expectations.

"At its 1H24 result FBU [Fletcher] had guided to net debt falling from $2 billion over 2H24, with working capital unwind, lower capex, and cut dividends more than offsetting cash outflows from legacy construction projects.

"This is now not the case, with 2H24 cash generation around zero," the analysts said.

"What's more, FBU typically builds working capital in the 1H in Fletcher Living which underpins the seasonally stronger 2H home sales. There is also further legacy project cash outflows and contracted land purchases in FY25.

"As such, the risk is that net debt moves up in 1H25. Compounding this, the FY24 exit run rates suggest 1H25 EBIT [earnings before interest and tax] of c. 210 million (assuming normal seasonality in Fletcher Living and Construction, but all else equal), which would take 12-month rolling EBIT -11% to c. $460 million. Our scenario analysis in Figure 7 suggests this combination could leave little headroom to the senior debt covenant at 1H25."

The sentiment of the Forsyth Barr analysts is mirrored by those at Macquarie Securities, who forecast "close to nil 1HFY25 senior covenant headroom" for Fletcher.

And analysts at Morgan Stanley think "there is now a greater risk of a capital raise" by Fletcher.

Fletcher actually issued a statement to NZX prior to announcing its half-year results in February denying media reports that it was "weighing up an equity raise".

Forsyth Barr's Koreman-Smit and Koraua say they have "further delayed" their expectation of Fletcher's return to paying dividends. It is not paying dividends at the moment.

"We had previously assumed that this would occur in 2H25 after legacy construction projects complete. Given the continued high debt levels, we now assume FBU will prudently prioritise debt reduction, and we expect dividends to return in 2H26 when leverage ratios are improving."

14 Comments

Great analysis by the FB team.

Here Fletchers are, now trading below the float/consolidation price 28 years ago in 1996. 28 Years with a virtual monopoly on building supplies in a rapidly growng nation. What a stain on corporate NZ they are, or maybe they symbolise corporate NZ with the likes of the Fonterra etc etc.

It just goes to show that our talent doesn't rise to the top in NZ. It is either overlooked or has f++++ed off overseas. Someone needs to write an expose on our management class, their backgrounds, their education.

...Koreman-Smit and Koraua said that in its update Fletcher had given guidance of net debt of about $1.9 billion to $2.billion at the end of the 2024 financial year...

The daily cost of circa $2bn in debt is quite extraordinary. This is terminal. Fletchers will collapse under this level of debt.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.