A week ago, Westpac made a big move lower with its three year fixed home loan rate, taking it down to 6.39%, a -26 bps drop from the 6.65% rate universally adopted by all their main rivals.

Today, ASB has made the same move, matching Westpac at 6.39% for all terms three to five years.

6.39% is low for a main bank, but not as low as SBS Bank's 5.99% three year 'special'.

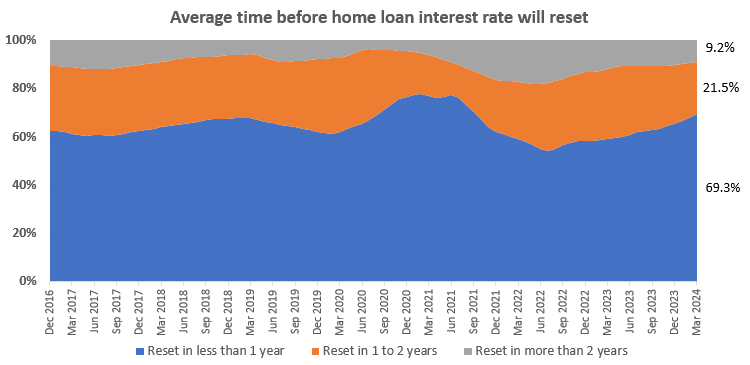

However, borrowers are not keen on longer term fixed rates. But perhaps they should be.

The likely reason borrowers are choosing a six or 12 month fixed rate contract is the expectation that rates will fall soon. In fact, financial markets are currently pricing in two -25 bps OCR cuts from the RBNZ in 2024, and another three in 2025.

That could take the OCR down from 5.50% to 4.25%. Any move like that would be influential on the six and 12 month fixed rates.

But those current 1 year fixed rates are currently running in the 6.99% to 7.24% with most at 7.14%. A -125 bps cut by the end of 2025 would take them down to ~5.9%.

At that level, the three year 6.39% carded home loan rate makes sense for borrowers to consider. And that is because the math shows taking the lower three year rate now, you would be no worse off than taking 7.14% now for one year, 6.50% in one year, and 5.90% in a another one year contract in two years.

But taking the 6.39% three years now locks in the certainty of these assumptions. Holding out for the expected rate cuts is very uncertain.

By our figuring, taking 6.39% for three years now instead of the 7.14% offered by the other big Aussie banks for one year, and trusting rates will be much lower after May 2025 and 2026, means for a $450,000 mortgage that will require repayments at $2,812/month now versus the $3,036/month by taking the one year option. That is a saving per month of $224. Over the first year, that builds to a $2,688 saving by taking the three year rate now. You are guessing that rates in May 2025 will be lower.

What's the chance? Worth taking the gamble?

Two additional points are worth making. First carded rates are less relevant these days. Bank apps offer good discounts to existing borrowers who are ready to roll over their interest rate contract. A few simple clicks and you are done, probably with a lower-than-carded rate. That 'simplicity' discourages competition, especially when you feel you got a 'good deal' from a 'lower rate'. Please note the current discount offers from these apps in the comment section below if you know them.

And secondly, the shift short is raising the power and influence of the RBNZ's monetary policy to affect household budgets. The rush short means far more loans will be affected by RBNZ rate revisions when they come. OCR cuts could turbocharge spending quite quickly.

ASB has also dropped its longer-term term deposit rates by between -10 and -20 basis points each. The more popular shorter term deposit rates are unchanged.

One useful way to make sense of the changed home loan rates is to use our full-function mortgage calculator which is below. Term deposit rates can be assessed using this calculator.

And if you already have a fixed term mortgage that is not up for renewal at this time, our break fee calculator may help you assess your options. Break fees will be minimal in a rising market. But they become important in a falling market however.

Here is the updated snapshot of the lowest advertised fixed-term mortgage rates on offer from the key retail banks at the moment.

| Fixed, below 80% LVR | 6 mths | 1 yr | 18 mth | 2 yrs | 3 yrs | 4 yrs | 5 yrs |

| as at May 16, 2024 | % | % | % | % | % | % | % |

| ANZ | 7.25 | 7.14 | 6.89 | 6.79 | 6.65 | 7.34 | 7.34 |

|

7.24 | 7.14 | 6.89 | 6.75 | 6.39 -0.26 |

6.39 -0.10 |

6.39 |

|

7.24 | 7.14 | 6.89 | 6.79 | 6.65 | 6.55 | 6.55 |

|

7.25 | 6.99 | 6.79 | 6.65 | 6.55 | 6.55 | |

|

7.29 | 7.24 | 6.95 | 6.75 | 6.39 | 6.39 | 6.39 |

| Bank of China | 7.09 | 6.99 | 6.75 | 6.65 | 6.49 | 6.39 | 6.39 |

| China Construction Bank | 7.19 | 7.09 | 6.89 | 6.75 | 6.49 | 6.40 | 6.40 |

| Co-operative Bank | 7.29 | 7.14 | 6.99 | 6.79 | 6.65 | 6.55 | 6.55 |

| Heartland Bank | 6.89 | 6.69 | 6.55 | 6.35 | |||

| ICBC | 7.19 | 7.05 | 6.79 | 6.75 | 6.59 | 6.49 | 6.49 |

|

7.35 | 7.14 | 6.99 | 6.69 | 5.99 | 6.19 | 6.19 |

|

7.39 | 6.99 | 7.19 | 6.75 | 6.65 | 6.59 | 6.59 |

Fixed mortgage rates

Select chart tabs

Daily swap rates

Select chart tabs

Comprehensive Mortgage Calculator

11 Comments

You do need to factor in cash back. That is where the 5.99% from SBS falls over a bit because from my understanding they (and heartland) don't give much if anything.

It's why also the 4 and 5 year rates may give you pause if your loan is big enough that it changes your effective rate.

Just don't waste it and instead pay use it to pay down the equity or have it sitting in an offsetting account.

Im pretty sure the 6.39% from ASB here now matches what they were actually offering customers on those terms. Question is whether they will now offer lower rates.

"At that level, the three year 6.39% carded home loan rate makes sense for borrowers to consider. And that is because the math shows taking the lower three year rate now, you would be no worse off than taking 7.14% now for one year, 6.50% in one year, and 5.90% in a another one year contract in two years."

Perhaps David could rework the maths based on your numbers and adjust your numbers by the projected OCR declines?

So what are banks up to?

Simple. They're trying to lock people into longer mortgages with rates that will look pretty damn expensive once people figure out the RBNZ (with some assistance from poor government policy!) has created the 'mother of all recessions' and the RBNZ is forced to change tack at greater speed than most bank economists are telling us.

Is being in a recession a big enough event for you? (And we've basically had near zero growth and/or recessions for the last 2 years!)

Sorry. You said, "next big global event".

Global Recessions usually follow global interest rate inversions. My current guess is we'll see terror and fear showing up in the faces and statements of central bankers as the northern hemisphere enters winter. So whatever you expect - rates will come down more quickly, and further, than many expect. Central banker are nothing if not predictable.

Not really affecting me sorry, put money aside for a rainy day. Honestly I'm having trouble making a prediction from this point onwards, cannot see rates going up or down significantly at this point in time. The RBNZ may virtue signal some drops later in the year, possibly early next year, they have a nasty habit of sticking to their guns no matter what to kind of prove "We were right".

Everyone is looking the wrong way at these interest rate reductions.

There is one reason and only one, why banks cut rates in the current market, and that is to attract more borrowers.

The slump in real estate, car sales, HP, and borrowing in general leaves banks in the desperate position of having too much cash on hand- and on which they are paying top dollar to depositors.

There is nothing generous by these over bloated and profit grabbing leviathans.

It's the only their way to ensure that their gains are kept to the maximum, so that we, the suckers are bled white in the process.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.