Heartland Bank, which has some of the most competitive home loan rates in the market, has raised all its fixed rates.

The increases are between 10 basis points and 20 bps

However, despite these rises, Heartland still commands the market-leading position - except for its three-year offer, which is bested by SBS Bank's recent 5.99% offer.

(Details of the SBS offer are here.)

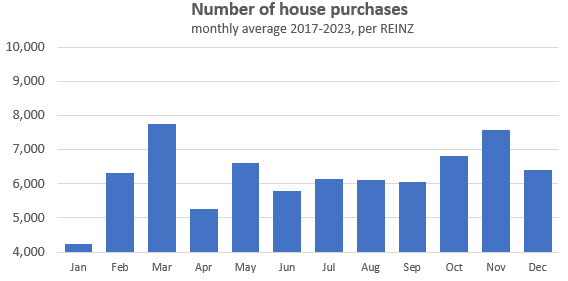

The winter real estate selling season is about to start, but May can deliver outsized volumes after making up for the holiday-affected April. It is the June to September period when real estate sales dip.

The point is, being competitive in May can have rewards for banks, the last chance before higher volumes return in October and November. And this year's 'peak season' in March, at 6521 sales transactions, was a disappointment being 15% lower than the average over the past six years. Banks will see the upcoming May prospects as a way to make some of that back.

Heartland Bank home loans are not for everyone. First you must have at least 20% equity and plan to live in the purchased property. It can only be a standalone, single section house, or a townhouse or terraced house. It cannot be a leasehold property of any type, and it must be located in an urban center. You can't use a trust or company to buy it, and the house must already be built (Heartland won't commit to a new-build project). But if you can meet these conditions, some of the most competitive rates are on offer (which they probably won't negotiate on).

Obviously you should negotiate and shop around. Most other banks will discount their carded home loan rates if you have strong financials. You shouldn't need them but if you are uncomfortable negotiating, a broker can often be helpful. But be aware some brokers won't offer you the best over the whole market, only the banks they have approved connections to in their "lending panel." And clearly bank mobile managers are there to pitch their company's own product.

Heartland doesn't appear to work with mortgage brokers however (other than for its reverse mortgage product, which is a separate issue).

One useful way to make sense of the changed home loan rates is to use our full-function mortgage calculator which is below. (Term deposit rates can be assessed using this calculator).

And if you already have a fixed term mortgage that is not up for renewal at this time, our break fee calculator may help you assess your options. But break fees should be minimal in a rising market. They will become important in a falling market however.

Here is the updated snapshot of the lowest advertised fixed-term mortgage rates on offer from the key retail banks at the moment.

| Fixed, below 80% LVR | 6 mths | 1 yr | 18 mth | 2 yrs | 3 yrs | 4 yrs | 5 yrs |

| as at April 24, 2024 | % | % | % | % | % | % | % |

| ANZ | 7.35 | 7.24 | 6.89 | 6.79 | 6.65 | 7.34 | 7.34 |

|

7.29 | 7.24 | 6.89 | 6.75 | 6.65 | 6.55 | 6.39 |

|

7.29 | 7.24 | 6.89 | 6.79 | 6.65 | 6.55 | 6.55 |

|

7.35 | 7.25 | 6.79 | 6.65 | 6.55 | 6.55 | |

|

7.39 | 7.29 | 6.95 | 6.75 | 6.65 | 6.59 | 6.39 |

| Bank of China | 7.09 | 6.75 | 6.65 | 6.49 | 6.39 | 6.39 | |

| China Construction Bank | 7.19 | 7.09 | 6.89 | 6.75 | 6.49 | 6.40 | 6.40 |

| Co-operative Bank | 7.29 | 7.24 | 6.99 | 6.79 | 6.65 | 6.55 | 6.55 |

| Heartland Bank | 6.89 +0.20 |

6.69 +0.10 |

6.55 +0.10 |

6.35 +0.16 |

|||

| ICBC | 7.19 | 7.05 | 6.95 | 6.85 | 6.59 | 6.49 | 6.49 |

|

7.35 | 7.24 | 6.99 | 6.69 | 5.99 | 6.19 | 6.19 |

|

7.39 | 7.24 | 7.19 | 6.75 | 6.65 | 6.59 | 6.59 |

Fixed mortgage rates

Select chart tabs

Daily swap rates

Select chart tabs

Comprehensive Mortgage Calculator

14 Comments

Banks should just do away with these hidden interest rates. ANZ are offering 6.85% 1yr rates currently when you negotiate with them which beats the Heartland rate.

If they just put the real rate online, articles like these would be pointless (ANZ beats Heartland, if they indeed don't negotiate on rates).

The sharemarket appears to be the only business / investment that when stock is on sale , potential customers leave in droves and that in my opinion is what is happening with Heartland share price and other well manged ,profitable company's on the NZX that are in sectors that over time can sustain substantial growth.

One of the issues facing many investors is they have no or little idea of how to value a business and how to arrive at what is a fair value or undervalued share price.

Many I suggest, see a share price fall say 10- 20 percent or even more and think the share price now must be good buying ...

Market price of a share is not the same as fair value in so many instances.

Many investors maybe don't realise the market is a manic depressant.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.