A new generation of investors will bring new thinking, expectations, and standards says Harbour Asset Management's Andrew Bascand. He explores the trends set to revolutionise the wealth management sector in New Zealand.

New Zealand households are facing a significantly different era in the accumulation of wealth and how they receive advice.

In the last decade total household wealth catapulted to over $2.2 trillion, or around $400,000 per household1, propelled principally higher as house prices lifted at an unsustainable 9.4% pa growth rate.2

In the next decade four trends may collide to produce different a different landscape for wealth accumulation.

KiwiSaver passes the $100bn mark

First, KiwiSaver seems likely to become a significant force in shaping household wealth across a broad spectrum. At over $100bn today, average KiwiSaver balances are about $30,000. Continued growth in contributions, higher wages and salaries and market returns could see KiwiSaver jump to over $260bn over the next decade.

We estimate that more than 110,000 individuals have KiwiSaver balances more than $80,000 today. Projecting those balances forward, the 35-55 age cohort are likely to average more than $500,000 in ten years’ time. Even individuals in those age cohorts with balances above $40,000 today are likely to see balances rise to more than $325,000 on average in a decade.

These figures, representing the older and higher income earners, conceal the unresolved KiwiSaver policy issues - with gender gaps, a relatively low contribution rate and a high number of savers pausing contributions. Despite these concerns, the future of wealth in New Zealand has a much larger proportion of households with KiwiSaver as their principal source of retirement income, and surveys increasingly point to a growing desire for both advice and access to savings choices via a digital platform. According to a recent survey conducted by the Financial Services Council NZ, 19% of respondents are using or have used micro-investing platforms, and an additional 15% are planning to.3

Intergenerational transfers push funds to women and family offices

Second, as in most countries, demographics can shape the most significant trends in how we spend, save and accumulate wealth. In New Zealand we are entering a significant acceleration in the percentage of the population that are over the age of 75, and an even more impressive growth rate in the cohort that is over the age of 85. These demographic changes prescribe a higher probability of a faster pace and larger volume of intergenerational transfers in wealth and, given gender survivorship bias and the evolution of conventional gender roles, a higher proportion of female leadership in the investment decision making processes. Inevitably wealth transfers bring complexity, and often benefit from financial advice. Wealth advice practices that focus on family office creation and female decision makers are likely to see significant growth. New Zealand analysis indicates that already 19% of inheritance financial transfers are focussed on creating legacy assets for grandchildren4 reflecting both emotional and financial values.

Looking at Australian trends, the average value of inheritances was $125,000 in 2019, with A$120bn transferred in 2018, up from $65bn at decade earlier.5 The recipient average age is about 50 years old in Australia, but with a large age distribution. The more interesting trend is the rapid rise in the number of inheritances from about 200k-250kpa to over 400k in the most recent survey year. Based on age cohort progression, the trend of an increase in the number of inheritance payments and the average size both seem likely to continue.

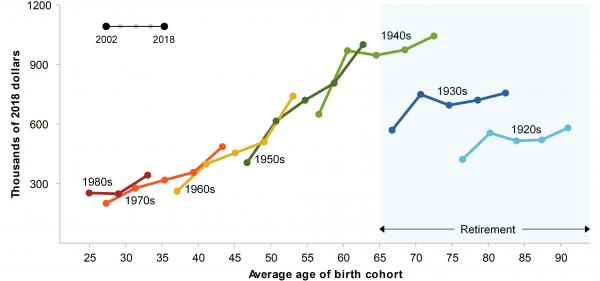

Fig: 1

Age equivalised wealth by birth decade and age

Source: Australian Productivity Commission estimates using HILDA Restricted Release 19 2021.

Integration of wealth and asset management

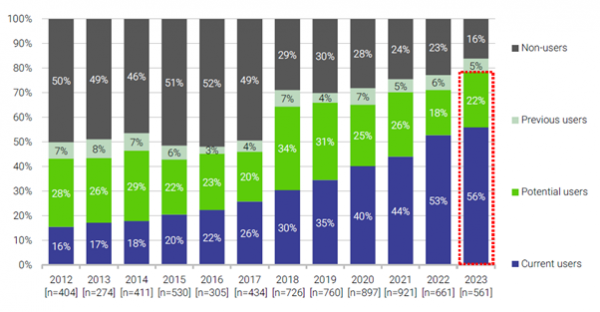

Third, we see a global trend in wealth and asset management coming closer together, principally through digital platforms. The key outcome is a continued fast pace rise in the adoption of managed accounts, often through pooled investment vehicles, or model portfolios led by a professional investment team. In the US, a 2023 survey of financial advice practices1 identified 56% of financial advisers using model portfolios, up from only 17% a decade earlier, with a further 22% noting they were likely to adopt model portfolios or pooled investment funds in their advisory business. This trend reflects synergy benefits from scale, professional investment advice, and merger and acquisition activity drawing large asset management and wealth advisory businesses together. The additional benefit has been the identified efficiency gains in advice practices. The same US survey identifies 17.1 hours a week in time efficiencies, and perceptions of better performance and lower fees.

Fig: 2

The rapid adoption on model portfolios in the US investment advice industry

Source: State Street Global Advisors, Investment Trends January 2023.

The digitisation of advice

Finally, technology (and specifically generative AI (artificial intelligence)), seems likely to further influence the advice industry. Data-driven personalised advice and engagement beyond portfolio management already characterises the largest wealth managers. For instance, Morgan Stanley has implemented their ‘Next Best Action’ system for identifying (with machine learning) personalised investment portfolios, research and ideas, then distributing these directly to clients or to advisers to share. Hybrid models that leverage expert advisers, model portfolios, and a consistency of insights can deliver a competitive advantage.

Recently, at an investment conference in Christchurch, the development of a draft Statement of Advice via a generative AI programme was demonstrated to an audience of advisers. The advice itself was based on an imaginary couple, themselves created by AI, using a set of parameters. The draft advice was tailored to New Zealand’s regulatory framework and the investment philosophy of an advice company. At a glance, the report (produced in less than 210 seconds) seemed to be a great way to embrace a consistent, more effective style.

AI seems likely to improve both acquisition capabilities and reduce churn through providing more timely, customised filters, actionable ideas, and conversation suggestions for client interactions. The capabilities may close the advice gap, helping advisers to profitably serve clients with funds less than $1m and lessen the regulatory burden. Developing investment scope and objectives, consistent reporting and reviews are often still heavily manual processes. In part, the integration of model portfolios and integrated wealth and asset management responses to clients’ needs will likely lead further cases for AI; however, most consultants expect the client front-end applications will significantly enhance both adviser productivity and lift investor engagement.

In summary

KiwiSaver has broken the $100bn mark and is on the way to well over $250bn in the next ten years, meaning the advice opportunity is significant. Second, intergenerational transfers are entering a super cycle. The advice industry needs to get into another gear to support both a greater leadership of women in investment decision roles, and in a providing broader family office advice for intergenerational wealth. Third, we are entering a new phase which combines the strengths of advice and investment management to enhance the solutions brought across the advice spectrum. Finally, integrating these trends is a positive power to improve adviser productivity and client outcomes, in particular, the use of data-driven investment and advice ideas via generative AI.

[1] Statistics New Zealand Household Economic Survey 2023

[2] Based on Real Estate Institute of New Zealand National House Price Index.

[3] Financial Services Council, Money and You – Investing in Volatile Times Survey 2022

[4] The Public Trust: Intergenerational wealth research June 2023

[5] Wealth Transfers and their economic effects, Australian Governments, November 2021

Andrew Bascand is a co-founder of Harbour Asset Management and is the current managing director. This article is here with permission. The original is here.

8 Comments

Yet I hear 'advisors' steering folk away from KiwiSaver, using weasel words and faint praise.

I guess that's because there is little or no commission income for them.

Those brokers charging up to 1.95% like Mlfords have they days numbered.

AI will do all the thinking

There's no justification for a % ticket clipping, once the system is setup there's no incremental cost servicing $1M or $1k

They're parasitic - as is all the 'finance industry'. And a lot of the rest of us.

That worked in times of surplus energy - that era is clearly coming to an end.

Really? Describe your experience and why they are parasitic?

Personally I am grateful for the expertise and input I have had. Advice on FDR, whether I should buy index funds hedged for currency fluctuations, how to purchase Vanguard products that may not be listed in NZ (tricky but doable), does the FTSE return rate include dividends and does this offset its long term under performance, how to purchase blue chip bonds overseas….The list is endless.

At 22 I was a bum albeit well educated. I’m approx 6-8 months out from retirement largely achieved through hard work, sacrifice and good advice.

Worth paying every cent.

You complain a lot.

big numbers but peanutst compared to the aussie scheme where they have doubled the tax on those with over 3 million as they have become significant.you would think that they would be easy on them as they wont be getting an age pension.

Yes, the Aussie super industry is a beast & a half to be sure. We're on the journey, but still have a long way to go/grow. My pick of the next decade is that a transition phase will emerge from the boomers to the rest. How the lower demographics will play out in the west in particular, is yet to be seen. The current play is to import more people. This has its advantages & down sides. We need to be smarter than this, I feel, however, the current educational standards have plummeted to levels not seen before in our life time, so I'm not holding my breath.

DIY Investing seems to be the way forward. I recall a really good list of NZX and ASX in the printed version of the NZ Herald which included many numbers across the 'stock line'. I want to start trading again, where is the best place to find good online info on NZX/ASX?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.