RBNZ

Latest Reserve Bank figures show that in two months after the RBNZ effectively declared there would be no more interest rate cuts, the amount of money on fixed mortgage rates for longer than a two year duration increased by over $10 bln

4th Mar 26, 12:39pm

1

Latest Reserve Bank figures show that in two months after the RBNZ effectively declared there would be no more interest rate cuts, the amount of money on fixed mortgage rates for longer than a two year duration increased by over $10 bln

Economists are beginning to flirt with a revolutionary idea - that the New Zealand economy might be able to grow and prosper without the traditional leg-up from the housing market

4th Mar 26, 8:55am

34

Economists are beginning to flirt with a revolutionary idea - that the New Zealand economy might be able to grow and prosper without the traditional leg-up from the housing market

[updated]

There's a simple solution to banks baulking at the RBNZ's proposal for them to provide nationwide cash services for free, but a compromise is the likelier outcome

4th Mar 26, 5:00am

9

There's a simple solution to banks baulking at the RBNZ's proposal for them to provide nationwide cash services for free, but a compromise is the likelier outcome

[updated]

Labour finance spokesperson Barbara Edmonds says the Government’s removal of the Reserve Bank’s employment mandate ‘not in the best interest of Kiwis given the unemployment rate we’re seeing now’

3rd Mar 26, 12:58pm

6

Labour finance spokesperson Barbara Edmonds says the Government’s removal of the Reserve Bank’s employment mandate ‘not in the best interest of Kiwis given the unemployment rate we’re seeing now’

New Zealand Debt Market to take one for the team, as Reserve Bank financial stability settings override public bank bond issuance

2nd Mar 26, 9:37am

New Zealand Debt Market to take one for the team, as Reserve Bank financial stability settings override public bank bond issuance

Roger J Kerr says both the passive and active forces determining the NZ dollar value appear much more positive than negative as we move further into 2026

2nd Mar 26, 9:09am

Roger J Kerr says both the passive and active forces determining the NZ dollar value appear much more positive than negative as we move further into 2026

Low equity lending to first home buyers surged to a record high in January

Bank lobby group says RBNZ cash plans will increase the cost of banking for all New Zealanders

26th Feb 26, 7:30am

12

Bank lobby group says RBNZ cash plans will increase the cost of banking for all New Zealanders

Reserve Bank opens public consultation on a proposal that would require banks to provide a minimum level of cash services, including withdrawal, deposits and cash exchanging at a cost potentially of about $104 million a year

25th Feb 26, 11:00am

30

Reserve Bank opens public consultation on a proposal that would require banks to provide a minimum level of cash services, including withdrawal, deposits and cash exchanging at a cost potentially of about $104 million a year

RBNZ chief economist Paul Conway says it’s not optimism to think inflation will fall to 2%, it’s New Zealand’s economic fundamentals

23rd Feb 26, 9:33am

19

RBNZ chief economist Paul Conway says it’s not optimism to think inflation will fall to 2%, it’s New Zealand’s economic fundamentals

Roger J Kerr says there have to be major question marks over expected further decreases in both non-tradable inflation and tradable inflation this year

23rd Feb 26, 8:44am

4

Roger J Kerr says there have to be major question marks over expected further decreases in both non-tradable inflation and tradable inflation this year

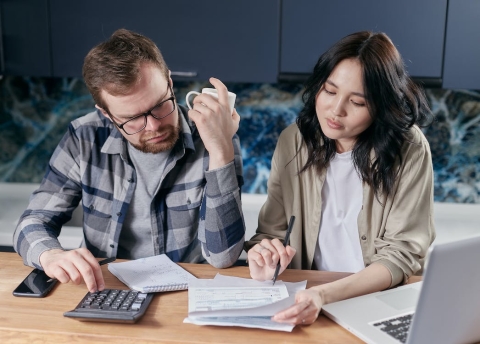

RBNZ Governor explains why they expect declining tradables inflation to bring inflation rate back within target range, providing the economy with room to recover without a lift-off in inflation

22nd Feb 26, 10:11am

9

RBNZ Governor explains why they expect declining tradables inflation to bring inflation rate back within target range, providing the economy with room to recover without a lift-off in inflation

In order not to kill our fragile economic recovery, the Reserve Bank's taken something of a calculated gamble that inflation will behave itself

20th Feb 26, 10:30am

20

In order not to kill our fragile economic recovery, the Reserve Bank's taken something of a calculated gamble that inflation will behave itself

Governor Anna Breman says Reserve Bank Monetary Policy Committee isn’t planning on hiking the Official Cash Rate ‘until we see more inflationary pressures and a stronger economy’

18th Feb 26, 7:23pm

16

Governor Anna Breman says Reserve Bank Monetary Policy Committee isn’t planning on hiking the Official Cash Rate ‘until we see more inflationary pressures and a stronger economy’

Live-stream of the February 2026 RBNZ Monetary Policy Statement press conference with Governor Anna Breman

18th Feb 26, 2:50pm

Live-stream of the February 2026 RBNZ Monetary Policy Statement press conference with Governor Anna Breman