home loan rates

In granular analysis, we show the rate offer moves lower for savers have been faster than for borrowers. But the size of the shift might surprise you, with at least 3 interesting out-takes from this analysis

31st Oct 25, 9:10am

6

In granular analysis, we show the rate offer moves lower for savers have been faster than for borrowers. But the size of the shift might surprise you, with at least 3 interesting out-takes from this analysis

SBS Bank cuts its first home buyer 'Combo' rate to 3.99%, its lowest rate since May 2022

15th Aug 25, 3:00pm

5

SBS Bank cuts its first home buyer 'Combo' rate to 3.99%, its lowest rate since May 2022

Infometric's Gareth Kiernan takes a look at where mortgage interest rates are headed in light of the recent changed signals from the RBNZ

31st May 23, 1:10pm

78

Infometric's Gareth Kiernan takes a look at where mortgage interest rates are headed in light of the recent changed signals from the RBNZ

[updated]

NZ's largest bank raises fixed and floating home loan rates, savings account rates, and term deposit rates in a broad response to the recent RBNZ OCR rises

12th Apr 23, 4:34pm

42

NZ's largest bank raises fixed and floating home loan rates, savings account rates, and term deposit rates in a broad response to the recent RBNZ OCR rises

At least $1 billion in 'excess' interest cost is being left on the table by home owners who don't negotiate hard enough for the best mortgage rate available, sure to rise as policy makers create the conditions for higher rates

26th Sep 21, 4:55pm

8

At least $1 billion in 'excess' interest cost is being left on the table by home owners who don't negotiate hard enough for the best mortgage rate available, sure to rise as policy makers create the conditions for higher rates

In a surprise move, Heartland Bank has sharply cut its floating and one year fixed home loan rates to levels that will cause its rivals to have a double-take

12th May 21, 2:18pm

21

In a surprise move, Heartland Bank has sharply cut its floating and one year fixed home loan rates to levels that will cause its rivals to have a double-take

SBS Bank's new very low one year fixed rate offer is available for first home buyers with only a 10%+ deposit. Others need 20%. Investors need 40%.

7th May 21, 4:50pm

9

SBS Bank's new very low one year fixed rate offer is available for first home buyers with only a 10%+ deposit. Others need 20%. Investors need 40%.

A set of home loan rate changes are now in place from all main banks, repricing to reflect a steeper rate curve. A slower real estate market means fewer transactions to compete for

5th May 21, 1:01pm

19

A set of home loan rate changes are now in place from all main banks, repricing to reflect a steeper rate curve. A slower real estate market means fewer transactions to compete for

New Zealand's largest mortgage lender chimes in with home loan rate cuts of its own, nabbing the lowest rate for an 18 month term of any main bank. But it has raised its three year rate

28th Apr 21, 6:49pm

14

New Zealand's largest mortgage lender chimes in with home loan rate cuts of its own, nabbing the lowest rate for an 18 month term of any main bank. But it has raised its three year rate

Home loan heavyweight ASB trims some short-term fixed rates and raises some longer-term fixed mortgage rates as background wholesale rates shift under varying influences. Westpac follows

23rd Apr 21, 9:49am

36

Home loan heavyweight ASB trims some short-term fixed rates and raises some longer-term fixed mortgage rates as background wholesale rates shift under varying influences. Westpac follows

HSBC ends its 1.99% fixed home loan offers, raising them to 2.25% after a two month run at the unusually low level. All eyes are on how the RBNZ will react to rising international benchmark rates

6th Apr 21, 3:55pm

6

HSBC ends its 1.99% fixed home loan offers, raising them to 2.25% after a two month run at the unusually low level. All eyes are on how the RBNZ will react to rising international benchmark rates

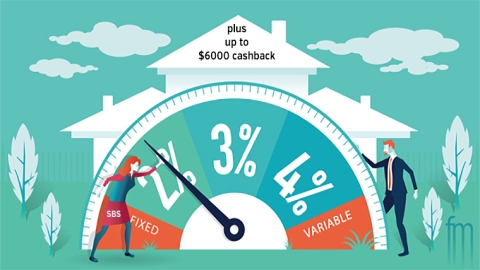

SBS Bank extends its 2.29% home loan rate out to terms of 18 months and two years fixed, making the two year offer the lowest in the market. It is also offering up to $6000 as a cash incentive

12th Feb 21, 4:02pm

15

SBS Bank extends its 2.29% home loan rate out to terms of 18 months and two years fixed, making the two year offer the lowest in the market. It is also offering up to $6000 as a cash incentive

Another challenger bank goes below 2% for mortgages, as the 2021 home loan market swells on sharply rising demand. These challenger banks have opened up a 30 bps rate advantage over the main banks

10th Feb 21, 10:10am

5

Another challenger bank goes below 2% for mortgages, as the 2021 home loan market swells on sharply rising demand. These challenger banks have opened up a 30 bps rate advantage over the main banks

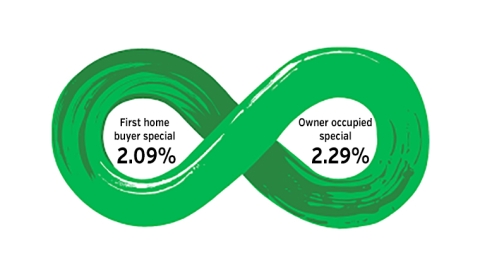

A challenger bank offers first home buyers a one year fixed rate well below the main banks, raises two term deposit rates to well above the main banks as well

27th Jan 21, 3:30pm

6

A challenger bank offers first home buyers a one year fixed rate well below the main banks, raises two term deposit rates to well above the main banks as well

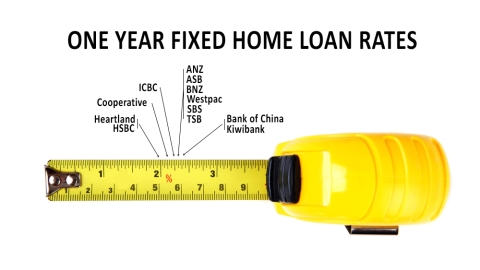

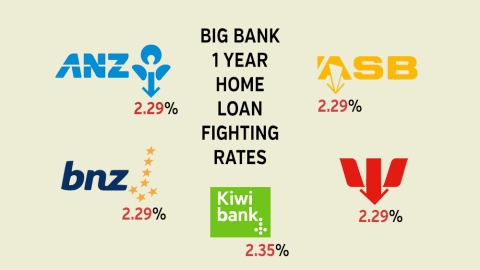

More big banks slip into line with lower one year fixed rate home loan offers. BNZ is the latest, then ASB. But challenger banks still have lower rates on the table

22nd Jan 21, 8:37am

42

More big banks slip into line with lower one year fixed rate home loan offers. BNZ is the latest, then ASB. But challenger banks still have lower rates on the table