Too Big to Fail

A changing of the guard at a key US Federal Reserve function has opened the door for a US$200+ bln relief from their 'tight' bank capital rules for the largest, globally important banks who are US based

26th Jun 25, 11:40am

4

A changing of the guard at a key US Federal Reserve function has opened the door for a US$200+ bln relief from their 'tight' bank capital rules for the largest, globally important banks who are US based

Gareth Vaughan on Credit Suisse & the trinity, banks as government contractors, an unwanted trifecta, choosing class war over financial stability, and personal bank accounts at the central bank

25th Mar 23, 10:00am

26

Gareth Vaughan on Credit Suisse & the trinity, banks as government contractors, an unwanted trifecta, choosing class war over financial stability, and personal bank accounts at the central bank

Gareth Vaughan wonders whether the only way New Zealand will get a circuit breaker to our housing affordability woes will be if there's a severe housing market downturn

21st Feb 21, 6:02am

198

Gareth Vaughan wonders whether the only way New Zealand will get a circuit breaker to our housing affordability woes will be if there's a severe housing market downturn

Government consultation paper probes the cost & size of deposit insurance fund needed in move from an 'uncertain implicit guarantee' to a 'managed explicit guarantee'

5th Apr 20, 6:02am

87

Government consultation paper probes the cost & size of deposit insurance fund needed in move from an 'uncertain implicit guarantee' to a 'managed explicit guarantee'

In the second part of a series on NZ's retail payment systems, Gareth Vaughan looks at how New Zealand's regulatory oversight of retail payments is behind where Australia was at in 2001

22nd Mar 20, 8:40am

1

In the second part of a series on NZ's retail payment systems, Gareth Vaughan looks at how New Zealand's regulatory oversight of retail payments is behind where Australia was at in 2001

Gareth Vaughan details six key changes proposed by the RBNZ in its bank capital review ahead of the release of the final decisions in its broadest ever review of bank regulatory capital requirements on Thursday

3rd Dec 19, 5:00am

10

Gareth Vaughan details six key changes proposed by the RBNZ in its bank capital review ahead of the release of the final decisions in its broadest ever review of bank regulatory capital requirements on Thursday

Kiwibank economists say one 'perverse' impact of the RBNZ's forthcoming capital proposals could be that banks focus on residential mortgages at the expense of business lending

2nd Dec 19, 12:10pm

8

Kiwibank economists say one 'perverse' impact of the RBNZ's forthcoming capital proposals could be that banks focus on residential mortgages at the expense of business lending

The Reserve Bank will release the final decisions in its biggest ever review of banks' regulatory capital requirements on Thursday, December 5

11th Nov 19, 4:00pm

6

The Reserve Bank will release the final decisions in its biggest ever review of banks' regulatory capital requirements on Thursday, December 5

Gareth Vaughan says the Reserve Bank's efforts to combat the too big to fail problem is a worthy aspect of its proposals to increase NZ banks' regulatory capital requirements

19th Oct 19, 10:02am

34

Gareth Vaughan says the Reserve Bank's efforts to combat the too big to fail problem is a worthy aspect of its proposals to increase NZ banks' regulatory capital requirements

RBNZ's external experts reviewing its bank capital proposals suggest changes to countercyclical capital buffers, retaining Tier 2 capital, and reforms to bank executive compensation schemes

1st Oct 19, 10:00am

3

RBNZ's external experts reviewing its bank capital proposals suggest changes to countercyclical capital buffers, retaining Tier 2 capital, and reforms to bank executive compensation schemes

Kiwibank, Co-op Bank, SBS & TSB welcome proposed RBNZ changes to level the capital playing field, but want access to a wide range of capital sources warning as currently proposed the RBNZ plans are unworkable for small banks

23rd May 19, 5:00am

11

Kiwibank, Co-op Bank, SBS & TSB welcome proposed RBNZ changes to level the capital playing field, but want access to a wide range of capital sources warning as currently proposed the RBNZ plans are unworkable for small banks

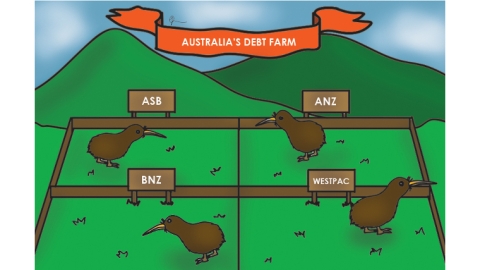

The RBNZ proposes to designate ANZ, ASB, BNZ and Westpac as systemically important banks meaning they'd have capital requirements above and beyond other banks

11th Apr 19, 1:47pm

9

The RBNZ proposes to designate ANZ, ASB, BNZ and Westpac as systemically important banks meaning they'd have capital requirements above and beyond other banks

Against the backdrop of the RBNZ's review of bank capital requirements, Gareth Vaughan details the nitty-gritty of the RBNZ proposals & what they might mean for bank customers

24th Jan 19, 5:00am

28

Against the backdrop of the RBNZ's review of bank capital requirements, Gareth Vaughan details the nitty-gritty of the RBNZ proposals & what they might mean for bank customers

Gareth Vaughan details how the RBNZ's proposals for NZ banks to hold more capital are a victory for the smaller NZ owned banks over their much bigger Aussie owned rivals

17th Dec 18, 5:14pm

34

Gareth Vaughan details how the RBNZ's proposals for NZ banks to hold more capital are a victory for the smaller NZ owned banks over their much bigger Aussie owned rivals

RBNZ proposes significant increase in bank capital requirements that will eat up 70% of the sector's profits over 5 years but only have a 'minor impact' on borrowers

14th Dec 18, 1:26pm

52

RBNZ proposes significant increase in bank capital requirements that will eat up 70% of the sector's profits over 5 years but only have a 'minor impact' on borrowers