Here are my Top 10 links from around the Internet at 10am. I welcome your additions and comments below or please email your suggestions for Wednesday's Top 10 at 10 to bernard.hickey@interest.co.nz. We love our shareholders at interest.co.nz  1. Intergenerational injustice - Brian Fallow at NZHerald unleashes both barrels on the amended Emissions Trading Act going through parliament this week, accusing the government of passing on the cost to future generations. This debate over the massive intergenerational transfer of wealth from Generations X and Y to the Babyboomers is not going to go away in a hurry. It will go away slowly as Generations X and Y buy one way tickets outta here.

1. Intergenerational injustice - Brian Fallow at NZHerald unleashes both barrels on the amended Emissions Trading Act going through parliament this week, accusing the government of passing on the cost to future generations. This debate over the massive intergenerational transfer of wealth from Generations X and Y to the Babyboomers is not going to go away in a hurry. It will go away slowly as Generations X and Y buy one way tickets outta here.

The focus in recent days on whether some forest-owning iwi are getting a sweetheart deal, or whether it is a pragmatic resolution of genuine grievance, has distracted attention from the larger intergenerational injustice inherent in the emissions trading scheme amendments about to be trundled into law. What those amendments essentially do is give this message to the sectors - mainly agriculture and heavy industry - which are responsible for about two-thirds of the country's carbon emissions but which face competition from competitors that will not face a cost on emissions: "Go for your life, ramp up your production of milk, or methanol, or cement, or urea or whatever. The country needs the money you earn. Don't worry about the cost of those emissions. Someone else will pay for almost all of it."

2. Hell No! - Janet Tavakoli captures the increasingly angry mood in the United States about the way investment bankers are benefiting personally from taxpayer bailouts while the taxpayers on Main St are still suffering. The mood is even beginning to filter through to Washington where the Fed may now be audited and Fed Chairman Ben Bernanke's reappointment is now no sure thing. Here's Tavakoli with the core problem and a discussion of the apparent hypocrisy (or at least cynicism) of Warren Buffett. HT Roelof via email

Government debt, like your credit card, is a type of money. It must be paid off with our future taxes generated from our production (unless you wish to destroy the economy by printing excess money). The fruits of your labors should be used in the way you see fit. We must stop subsidizing speculators with cheap funding and tax breaks. We have to hold people accountable for malfeasance, break up large financial institutions, and allow them to fail instead of bailing them out. As for high pay and tax breaks for speculators, even Warren Buffett says: "Hell no!" But he won't help us make changes. U.S. taxpayers will have to figure it out, or we will pay.

3. It's dawning on them now - Edmund Andrews at The New York Times has done the maths and worked out that US government borrowing of US$1 trillion a year will create interest payments of US$700 billion a year by 2019, more than triple what it was last year. So when will foreign investors stop pumping more money into US Treasuries?

In concrete terms, an additional $500 billion a year in interest expense would total more than the combined federal budgets this year for education, energy, homeland security and the wars in Iraq and Afghanistan. The potential for rapidly escalating interest payouts is just one of the wrenching challenges facing the United States after decades of living beyond its means. The surge in borrowing over the last year or two is widely judged to have been a necessary response to the financial crisis and the deep recession, and there is still a raging debate over how aggressively to bring down deficits over the next few years. But there is little doubt that the United States' long-term budget crisis is becoming too big to postpone. Americans now have to climb out of two deep holes: as debt-loaded consumers, whose personal wealth sank along with housing and stock prices; and as taxpayers, whose government debt has almost doubled in the last two years alone, just as costs tied to benefits for retiring baby boomers are set to explode. The competing demands could deepen political battles over the size and role of the government, the trade-offs between taxes and spending, the choices between helping older generations versus younger ones, and the bottom-line questions about who should ultimately shoulder the burden.

4. The other point of view - Paul Krugman at the NYTimes has written a detailed post explaining why he thinks deficits don't matter, interest rates can stay low and why the Americans need to worry more about high unemployment than anything else. He's arguing hard for a second bailout package. HT Felix Salmon, who points to the chart below.

On the face of it, there's no reason to be worried about interest rates on US debt. Despite large deficits, the Federal government is able to borrow cheaply, at rates that are up from the early post-Lehman period, when market were pricing in a substantial probability of a second Great Depression, but well below the pre-crisis levels. Bear in mind that the whole problem right now is that the private sector is hurting, it's spooked, and it's looking for safety. So it's piling into "cash", which really means short-term debt. (Treasury bill rates briefly went negative yesterday). Meanwhile, the public sector is sustaining demand with deficit spending, financed by long-term debt. So someone has to be bridging the gap between the short-term assets the public wants to hold and the long-term debt the government wants to issue; call it a carry trade if you like, but it's a normal and necessary thing. Now, you could and should be worried if this thing looked like a great bubble "” if long-term rates looked unreasonably low given the fundamentals. But do they? Long rates fluctuated between 4.5 and 5 percent in the mid-2000s, when the economy was driven by an unsustainable housing boom. Now we face the prospect of a prolonged period of near-zero short-term rates "” I don't see any reason for the Fed funds rate to rise for at least a year, and probably two "” which should mean substantially lower long rates even if you expect yields eventually to rise back to 2005 levels. And if we're facing a Japanese-type lost decade, which seems all too possible, long rates are in fact still unreasonably high.

5. No worries, be happy - Felix Salmon at Reuters references both the Andrews article and Krugman's piece in this post. He points out that the debt servicing costs remain relatively low, as in the chart above. It all comes down to how long these low US rates can stay low. Your view?

Most developed countries can cope quite happily with net interest payments around 3% of GDP. According to the OECD, Belgium is already at 3.8%, and Italy's at 5.2%; the average for the euro area is 2.7%. So while there might be a big rise in this metric, it would be a big rise from a low level and to a number very much within the bounds of precedent. None of which is to say that Andrews doesn't raise an important question. But fiscal prudence is the kind of thing which get rich financiers like Pete Peterson and Bill Gross very excited; it doesn't have nearly as much effect on the populace as a whole. Just ask the Japanese: if they're having problems right now, it's not because of their massive government debt.

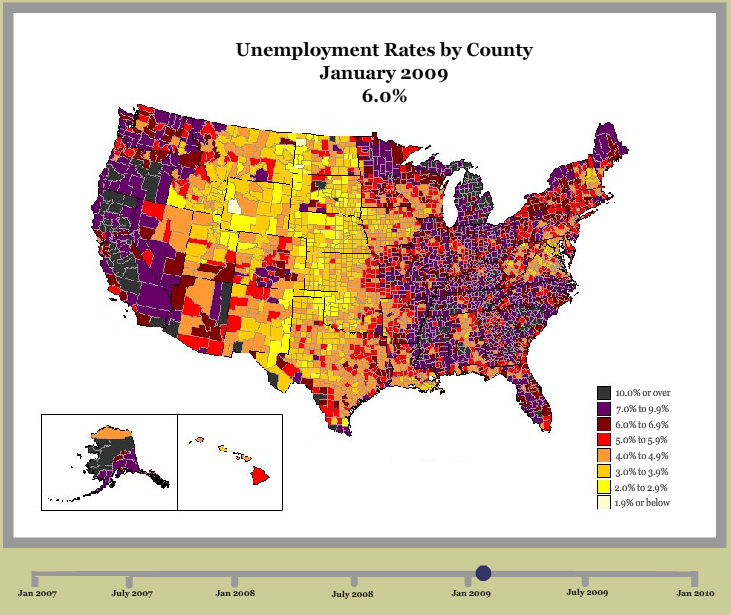

6. Turning purple - This interactive graphic of a map of the United States and how unemployment has changed county by county is useful. It is by Latoya Egwuekwe. HT Gertraud and Barry Ritholz at The Big Picture

7. Cautionary tale - This joke is doing the rounds of email at the moment. It's sort of funny in a black (sea) sort of way. HT Alex via IM from Unmesh Patil.

It is the month of August, on the shores of the Black Sea . It is raining, and the little town looks totally deserted. It is tough times, everybody is in debt, and everybody lives on credit. Suddenly, a rich tourist comes to town. He enters the only hotel, lays a 100 Euro note on the reception counter, and goes to inspect the rooms upstairs in order to choose one. The hotel proprietor takes the 100 Euro note and runs to pay his debt to the butcher. The butcher takes the 100 Euro note, and runs to pay his debt to the pig grower. The pig grower takes the 100 Euro note, and runs to pay his debt to the supplier of his feed and fuel. The supplier of feed and fuel takes the 100 Euro note and runs to pay his debt to the town's prostitute that in these hard times, gave her "services" on credit. The hooker runs to the hotel, and pays off her debt with the 100 Euro note to the hotel proprietor to pay for the rooms that she rented when she brought her clients there. The hotel proprietor then lays the 100 Euro note back on the counter so that the rich tourist will not suspect anything. At that moment, the tourist comes down after inspecting the rooms, and takes his 100 Euro note, after saying that he did not like any of the rooms, and leaves town. No one earned anything. However, the whole town is now without debt, and looks to the future with a lot of optimism.... . And that, ladies and gentlemen, this is how the United States is doing business today.

8. Real demand - Demand for gasoline in America is running way down, FTAlphaville points out and there's even signs that demand for metals in China is cooling off, Reuters reported. Is this the beginning of the double dip? HT Troy Barsten.

Last Friday, what many in the energy market had long suspected might happen, happened. Valero, the largest independent refiner in the US, was forced to close another 200,000-plus barrel-per-day refinery "” this time, its Delaware City unit "” due to a lack of demand. The closure comes just three months after Valero shuttered its 235,000 barrel-per-day Aruba refinery in the Caribbean. Rival Sunoco, meanwhile, shut down a 150,000 barrel per day facility at Eagle Point in New Jersey in October. These closures reflect just how badly the sector is doing, a fact which has also shown through in (falling) share prices.

9. Oh my god they killed Benny! - There's now a free iPhone app called Bailout Ben which is a game where you have to fly a helicopter and dump money (Ben Bernanke style) on companies and banks to bail them out.

The names of the companies to be bailed out are shown on the bottom of the screen, in stock ticker format. For example, C for Citigroup, GM for General Motors. The debt of each company is denoted by the blue and green bars. The taller the bar, the greater the toxic debt. Tap the screen to drop a bundle of dollars and help bail out a company. Only one wad of cash can be dropped at a time, so manage your bailouts carefully. Land the helicopter and see Benny dance to the funky beat*. Or be trampled by a herd of piggy banks, angry at the lack of money flowing their way. Sometimes they get really mad and then it's "Oh my gosh they killed Benny!"

10. Somewhat relevant funny video - Here is an economics lecture that made some people laugh. Greg Mankiw's textbook gets a trashing.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.