Here are my Top 10 links from around the Internet at 10am. I welcome your additions and comments below or please email your suggestions for Monday's Top 10 at 10 to bernard.hickey@interest.co.nz My apologies for the delay today. It's been a tad frantic.  1. Dow near lows - When compared with the gold price, the US stock market remains near record lows, this chart from Rolfe Winkler at Reuters points out. HT Troy Barsten. Not sure what it says, other than more people don't trust the US dollar and that US stocks are in a value-free bubble.

1. Dow near lows - When compared with the gold price, the US stock market remains near record lows, this chart from Rolfe Winkler at Reuters points out. HT Troy Barsten. Not sure what it says, other than more people don't trust the US dollar and that US stocks are in a value-free bubble.  2. Fair enough? - Rob Mackintosh has sent me a useful data series from the Ministry of Social Development on the number of beneficiaries in New Zealand, which shows the number of sickness and invalid beneficiaries is up around 59,000 over the last 10 years, while numbers on the dole are down 84,000. Here's Rob's view, which I share.

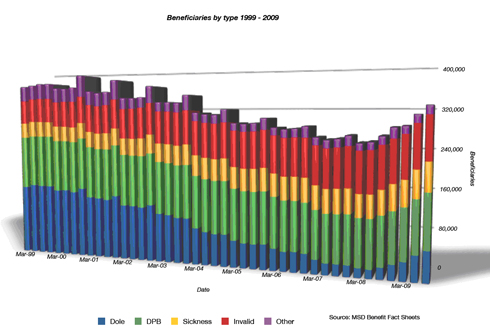

2. Fair enough? - Rob Mackintosh has sent me a useful data series from the Ministry of Social Development on the number of beneficiaries in New Zealand, which shows the number of sickness and invalid beneficiaries is up around 59,000 over the last 10 years, while numbers on the dole are down 84,000. Here's Rob's view, which I share.

It would seem a large chunk of dolers have been shoved onto the sickness or invalids benefit. When all is spent and done we have only 1.7 million full-time workers supporting a population of 4.3 million, including 330 000 working age people on benefits, not to mention the burgeoning Super bill and the legions of unemployed gainfully diverted into training.

3. Titanic problem - Landon Thomas writes in the New York Times about a looming disaster in the banking industry in Europe as shipping lines go bust under the weight of a 25% fall in global trade in the last 18 months. There's US$350 billion of debt in them thar ships apparently.

Banks with large shipping industry portfolios "” among them Royal Bank of Scotland and Lloyds, and HSH Nordbank and Commerzbank in Germany "” could face meaningful write-downs as ship owners confront plummeting charter rates from a 25 percent drop in global trade. "Peak of defaults is generally one year after the trough of the economy," said Scott Bugie, a European bank analyst at Standard & Poor's. "In the U.S., the debt workouts have been faster and the economy also bottomed out before Europe." HSH Nordbank, a leading lender to the shipping industry, set aside close to $800 million in provisions for its shipping-related loans this spring, and it has already received 13 billion euros ($19.4 billion) in support from its owners, the regional German states of Hamburg and Schleswig-Holstein. And while global trade appears to be gradually on the mend, a glut of previously ordered ships due in the coming years is expected to limit the extent of a meaningful price recovery. "The problem is that there will be more bankruptcies and foreclosures if the ship owner can't operate his ship," said Anthony B. Zolotas, a shipping industry banker at Eurofin in Athens. "At that point he will give the keys to the bank and say, "˜Sorry, mate, I just can't do this anymore.' "

4. Yikes - Here's some quotes from a book written in 1997 about a coming crisis in America known as the Fourth Turning. The evocatively named 'BurningPlatform' blog points these quotes out. Hard to know if it's the usual tin hat crackpots or unusually prescient. Good fun to read. HT David George via email.

The known problems of unsustainable debt, civic rot, and global chaos have been festering for decades. They will now coalesce into a violent denouement. Strauss and Howe wrote their book, The Fourth Turning, in 1997. These are their chilling words describing the onset of the next Crisis: "It is unlikely that the catalyst will worsen into a full-fledged catastrophe, since the nation will probably find a way to avert the initial danger and stabilize the situation for awhile. The new mood and its jarring new problems will provide a natural end point for the Unraveling-era decline in civic confidence. As the Crisis catalyzes, these fears will rush to the surface, jagged and exposed. Distrustful of some things, individuals will feel that their survival requires them to distrust more things. This behavior could cascade into a sudden downward spiral, an implosion of societal trust. If so, the implosion will strike the financial markets "“ and, with that, the economy. Aggressive individualism, institutional decay, and long-term pessimism can proceed only so far before a society loses the level of dependability needed to sustain the division of labor and long-term promises on which a market economy must rest. Through the Unraveling, people will have preferred the exciting if bewildering trend toward social complexity. But as the Crisis mood congeals, people will come to the jarring realization that they have grown helplessly dependent on a teetering edifice of anonymous transactions and paper guarantees. Many Americans won't know where their savings are, who their employer is, what their pension is, or how their government works. The era will have left the financial world arbitraged and tentacled; Debtors won't know who holds their notes, homeowners who owns their mortgages, and shareholders who runs their equities "“ and vice versa."

5. China's Ghost City - This is a fascinating documentary piece from Melissa Chan at Al Jazeera about Ordos, a ghost city in China built to make GDP figures look good and help spend US$565 billion of stimulus money. This looks like Japan's 'bridges to nowhere'. HT Gertraud via email and Tyler Durden at Zerohedge

All those who have spent late hours playing SimCity 3000 and never understood why the damn thing would never get any people to move into it, will derive a deranged pleasure from the following clip. In China, where 8% GDP is guaranteed and has to be "goal seeked" by any and every increasingly more deranged economic project, the authorities have taken the game of SimCity and applied it to real life. Alas, they started out on "difficult" level. Ordos is a hyper modern city, full of brand new glass walled residential and commercial buildings, yet devoid of inhabitants. In its attempt to present a "growing" economy, and to "invest" its $585 billion stimulus into anything and everything, courtesy of comparable idiocy on the other side of the Pacific, China's communist party is now ruling over ghost towns. One wonders just how many such "efficient" projects sustain China's magical 8% growth.

6. Lest we forget - Ed Harrison at Credit Writedowns has picked up on a piece by Jim Chanos warning about the 10 things investors should never forget from the global crisis because it seems we're destined to forget quickly.

1. Duration mismatches (borrowing short and lending long) 2. Accounting (Mark-to-market, deferred tax assets and a lot more) 3. Conflicts of interest (no Chinese walls, ratings agencies) 4. Regulation (especially given poor risk controls) 5. Risk management (is Meriwether a leading indicator?) 6. Investment Banking vs. Utility Banking 7. Too big to fail (they must be downsized) 8. Heads I win, tails you lose (socialization of losses is crony capitalism) 9. Quantitative easing (QE has costs) 10. Hedges instead of capital My baseline thinking at the moment is that we are seeing the beginnings of a cyclical recovery built on the back of asset relation more than anything else. The underpinnings of this uptrend are tenuous. So, when this latest burst of reflation hits the wall, all of the aforementioned issues will re-appear and policy makers will again do the who-could-have-known routine we saw in 2001 and again in 2008/ But the broader public is increasingly wise to this song and dance.

7. Oh the irony - Andy Warhol's screen print of 200 one US dollar bills has just sold at auction for US$43.8 million, Bloomberg reported. Now that's inflation caused by money printing...

Five bidders vied for Warhol's 1962 "200 One Dollar Bills" at the Sotheby's sale last night and it went to an unidentified phone buyer. The 7 1/2-foot wide silkscreen canvas comprises repetitive images of one-dollar bills, reproduced in tones of black on grey, with a blue Treasury seal. Karpidas offered the work, according to two people familiar with the situation. She paid $385,000 for the painting at a 1986 Sotheby's sale. "We've seen nothing like this recently," said New York dealer Tony Shafrazi. "This is a masterpiece."

8. Je ne regrette rien - Felix Salmon from Reuters points to some interesting comments on bankers by Andrew Ross Sorkin, who wrote the definitive book this year on those crazy few weeks in September and October last year when the financial world appeared to be ending. It seems the bankers are not sorry.

8. Je ne regrette rien - Felix Salmon from Reuters points to some interesting comments on bankers by Andrew Ross Sorkin, who wrote the definitive book this year on those crazy few weeks in September and October last year when the financial world appeared to be ending. It seems the bankers are not sorry.

One of the key drivers of the crisis was the hubris and general lack of humility of senior bank executives. This is connected to the issue of executive pay: almost everybody thinks he deserves what he's earning. But the only way you can deserve an eight-figure pay package is if you're really on top of what's going on in your bank. Ergo, everybody thought they were on top of what was going on in their banks, even when they weren't; lower pay and more humility would have helped enormously in curtailing some of the most egregious excesses. If bank executives (with the notable exception of John Reed) see no need to apologize for destroying the global financial system, they are still part of the problem and are very unlikely to be part of the solution. Which bodes ill for the future.

9. Dollar doom loop - Simon Johnson and Peter Boone at Baseline Scenario take a good look at the US dollar outlook. They take a longer view and it's not pretty. It's well worth a read.

The 1980s classic, Stephen Marris's "Deficits and the Dollar: The World Economy at Risk," stresses that a rapidly falling dollar would push up United States inflation, resulting in higher interest rates and a deep recession. Writing in the latest edition of Foreign Affairs, Fred Bergsten emphasizes that such outcomes are still possible today. A weakening dollar will cause inflation fears, so yields on long-term government bonds will rise to compensate investors for inflation, and we will need to pay more and more to finance our large debts. The idea that the American dollar might follow emerging markets such as Russia in 1998 and Argentina in 2002, or Britain in the 1970s "” and so depreciate by 50 percent or more in a relatively short time "” is certainly implausible now. But such a "doom scenario" is not unrealistic in the future without change. In this context, the American government needs to control its budget deficit to keep this adjustment on track, and to stop confidence in the dollar from falling further. Our government collects far too little in taxes for what it spends. There is no choice but to raise taxes soon and rein in spending. Short-term rates (controlled by the Fed) will stay low, while long-term rates (market-determined and affected by trust in our Treasury and Fed to keep the value of dollar strong) will rise as people fear their dollar investments will be debased. There is no doubt that both the Fed and the Bank of England know what is happening. The spread between short- and long-term rates (known as the "yield curve") will rise, and banks will benefit; would-be home buyers and people with overdrafts or outstanding credit card balances pay more, while savers get little. This is how the public pays for the past losses of our financial system. We don't have to do this again and again. We could start by changing our financial system from the roots. We need to credibly remove the promise to bail out our large banks each time they fail. This means forcing them to hold more capital, dividing them up so they are smaller, and then letting them fail when they make poor gambles. The Treasury's past and current close connections to Goldman Sachs, Citigroup and other major investment banks illustrate how our own doom machine functions. We need to break up these "banks" so they are small enough to fail, and also ensure that no bank, regardless of its connections, is able to demand that the Fed and the Treasury support its solvency in the future to prevent financial collapse. In this context, a weakening dollar helps the administration to put an unstable financial system back on its feet "” and to crank up our "doom machine."

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| Crash for Clunkers | ||||

|

||||

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.